Concept of Angel Tax & Taxability under Income Tax Act, 1961- An Introduction

Ever since the government started with the plan of Startup India, Indian companies have seen incredible investments. The investor community across the world has come up with serious investments in the Indian market because of the sheer size of the market that is up for grabs in the second most populous country in the world. High net worth individuals, foreign funds, angel investors, venture capitalists, almost every possible individual or a company that is capable of investing has played a role in investing in various Indian startups.

However, while the government promotes the development of startups in India, the government has continued to impose the angel tax on startups. The tax was introduced in 2012, but the government had promised to exempt companies from it. This finally happened in February 2019, when the Indian government made some amendments to the angel tax, giving a much-needed breather to startups.

Under SEBI (Alternative Investment Funds) Regulations, 2012 ("AIF Regulations"), AIF means any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

AIF does not include funds covered under the SEBI (Mutual Funds) Regulations, 1996, SEBI (Collective Investment Schemes) Regulations, 1999 or any other regulations of the Board to regulate fund management activities. Further, certain exemptions from registration are provided under the AIF Regulations to family trusts set up for the benefit of 'relatives‘ as defined under Companies Act, 1956,employee welfare trusts or gratuity trusts set up for the benefit of employees, 'holding companies‘ within the meaning of Section 4 of the Companies Act, 1956 etc.

Section 3 (1) of the SEBI (AIF) Regulations, 2012 provides for mandatory registration of the AIF for any entity or individual to operate.

Applicants can seek registration as an AIF in one of the following categories, and in sub-categories thereof, as may be applicable:

Category I AIFs- AIFs which invest in start-up or early stage ventures or social ventures or SMEs or infrastructure or other sectors or areas which the government or regulators consider as socially or economically desirable and shall include venture capital funds, SME Funds, social venture funds, infrastructure funds and such other Alternative Investment Funds as may be specified.

Category II AIFs- AIFs which do not fall in Category I and III and which do not undertake leverage or borrowing other than to meet day-to-day operational requirements and as permitted in the SEBI (Alternative Investment Funds) Regulations, 2012. Various types of funds such as real estate funds, private equity funds (PE funds), funds for distressed assets, debt fund etc. are registered as Category II AIFs. In this regard, it is clarified that, since Alternative Investment Fund is a privately pooled investment vehicle, the amount contributed by the investors shall not be utilized for purpose of giving loans.

Category III AIFs- AIFs which employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives. Various types of funds such as hedge funds; PIPE Funds, etc. are registered as Category III AIFs.

What is 'Angel Fund'?

“Angel fund” is a sub-category of Venture Capital Fund under Category I Alternative Investment Fund that raises funds from angel investors and invests in accordance with the provisions of Chapter III-A of AIF Regulations. In case of an angel fund, it shall only raise funds by way of issue of units to angel investors.

Angel investor

An angel investor (also known as a private investor, seed investor or angel funder) is a high-net-worth individual who provides financial backing for small start-ups or entrepreneurs, typically in exchange for ownership equity in the company. Often, angel investors are found among an entrepreneur’s family and friends. The funds that angel investors provide may be a one-time investment to help the business get off the ground or an ongoing injection to support and carry the company through its difficult early stages.

- An angel investor is usually a high-net-worth individual who funds start-ups at the early stages, often with their own money.

- Angel investing is often the primary source of funding for many start-ups who find it more appealing than other, more predatory, forms of funding.

- The support that angel investors provide start-ups fosters innovation which translates into economic growth.

- These types of investments are risky and usually do not represent more than 10% of the angel investor’s portfolio.

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or ownership equity. Angel investors usually give support to start-ups at the initial moments (where risks of the start-ups failing are relatively high) and when most investors are not prepared to back them.

As per Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012

"Angel investor" means any person who proposes to invest in an angel fund and satisfies one of the following conditions, namely,

(a). an individual investor who has net tangible assets of at least two crore rupees excluding value of his principal residence, and who:

- has early stage investment experience, or

- has experience as a serial entrepreneur, or

- is a senior management professional with at least ten years of experience;

('Early stage investment experience' shall mean prior experience in investing in start-up or emerging or early-stage ventures and 'serial entrepreneur' shall mean a person who has promoted or co-promoted more than one start-up venture.)

(b). a body corporate with a net worth of at least ten crore rupees; or

(c). an AIF registered under these regulations or a VCF registered under the SEBI (Venture Capital Funds) Regulations, 1996. Angel funds shall accept, up to a maximum period of 3 years, an investment of not less than 25 lakh from an angel investor.

Thus, “ Angel Investor” is informal investor, angel funder, private investor who is a Wealthy Individual or HNIs or retired employees of multinational companies having huge wealth and provide capital to start-ups in exchange of equity ownership or debt instruments. These investors generally provide seeding capital or initial capital to a start-up entity to earn health profit or capital appreciation of investment once start-ups come into operations and exist from the start-ups

Essentially these individuals both have the finances and desire to provide funding for start-ups. This is welcomed by cash-hungry start-ups who find angel investors to be far more appealing than other, more predatory, forms of funding.

Importance of Angel Investors

- Small businesses are financed through angel investors.

- They give funding at a time when traditional sources of finance, such as banks and financial institutions, are proving difficult to come by.

- They foster entrepreneurship in the country in this way.

- Such investors provide guidance to entrepreneurs and offer them access to their own business networks.

- As a result, they bring to new ventures both experience and cap

Difference between Venture Capitalists and Angel Investors

| Venture Capitalists | Angel Investors |

| They often invest more money. | They invest comparatively less. |

| They invest other people’s money in businesses. | They invest their own money. |

| They are professional investors who make money by investing. | Angel Investors are not in it for money. |

| VCs would like a proof of concept in hand | An angel investor is more likely to provide capital for an idea |

| They are always motivated by return on investment (ROI). | They may do it out of love for the company or idea. |

Angel Investment

Investment, which is made by angel investors, is called Angel Investment. Angel investors generally make an investment in startup companies or new companies establish by entrepreneurs. The main intension behind the investment is not to make a profit but to boost startup growth and new ideas by youngsters. To boost the confidence of startups, angel investors provide lucrative terms as compared to other investors. Recently many startup companies in India have received abundant investment across the globe, which has secured not only startups growth but also economic growth in India.Angel investors who are also referred to as informal investors are individuals having good net worth and are willing to make an investment in the country. These investors include private investors, fundraisers, and business angels, etc. who make investments or inject funds for startups by securing equity in the company.

Regulation 19D: Investment in angel funds

- Angel funds shall only raise funds by way of issue of units to angel investors.

- An angel fund shall have a corpus of at least ten crore rupees.

- Angel funds shall accept, up to a maximum period of three years, an investment of not less than twenty-five lakh rupees from an angel investor.

- Angel fund shall raise funds through private placement by the issue of information memorandum or placement memorandum, by whatever name called.

Regulation 19E: Schemes

- The angel fund may launch schemes subject to the filing of a scheme memorandum at least ten working days prior to the launch of the scheme with the Board: Provided that payment of scheme fees shall not apply to schemes launched by angel funds.

- Such scheme memorandum shall contain all material information about the investments proposed under such a scheme.

- The Board may communicate its comments, if any, to the applicant prior to the launch of the Scheme and the applicant shall incorporate the comments in the scheme memorandum prior to the launch of the scheme.

- No scheme of the angel fund shall have more than 49 angel investors.

Regulation 19F: Investment by Angel Funds

- Angel funds shall invest in venture capital undertakings which:

- complies with the criteria regarding the age of the venture capital undertaking/startup issued by the Department of Industrial Policy and Promotion under the Ministry of Commerce and Industry, Government of India vide notification no. G.S.R. 180(E) dated February 17, 2016, or such other policy made in this regard which may be in force;]

- have a turnover of less than 100 crore rupees;

- are not promoted or sponsored by or related to an industrial group whose group turnover exceeds three hundred crore rupees; and

Explanation I: For the purpose of this clause, “industrial group” shall include a group of body corporates with the same promoter(s)/promoter group, a parent company and its subsidiaries, a group of body corporates in which the same person/ group of persons exercise control and a group of body corporates comprised of associates/subsidiaries/holding companies.Explanation II: For the purpose of this clause, “group turnover” shall mean combined total revenue of the industrial group.

- are not companies with family connection with any of the angel investors who are investing in the company.

- Investment by an angel fund in any venture capital undertaking shall not be less than25[twenty-five] lakh rupees and shall not exceed five crore rupees.

- Investment by an angel fund in the venture capital undertaking shall be locked-in for a period of26[one year].

- Angel funds shall not invest in associates

- Angel funds shall not invest more than twenty-five per cent of the total investments under all its schemes in one venture capital undertaking: Provided that the compliance to this sub-regulation shall be ensured by the Angel Fund at the end of its tenure.

- An angel fund may also invest in the securities of companies incorporated outside India subject to such conditions or guidelines that may be stipulated or issued by the Reserve Bank of India and the Board from time to time.

Can public be invited to subscribe to AIF?

AIFs are privately pooled investment vehicles. AIFs shall raise funds through private placement by the issue of information memorandum or placement memorandum, by whatever name called. As an eligibility criterion for registration as an AIF, the applicant is required to be prohibited by its memorandum and articles of association/ trust deed/ partnership deed from making an invitation or solicitation to the public to subscribe to its securities.

What does an investor look for while funding?

In the context of AIFs, a Fund of Fund is an AIF which invest in another AIF.An AIF under the SEBI (Alternative Investment Funds) Regulations, 2012 can be established or incorporated in the form of a trust or a company or a limited liability partnership or a body corporate. Most of the AIFs registered with SEBI are in trust form.

“Corpus’’ is the total amount of funds committed by investors to the AIF by way of a written contract or any such document as on a particular date.

No scheme of an AIF (other than angel fund) shall have more than 1000 investors. (Please note that the provisions of the Companies Act, 2013 shall apply to the AIF if it is formed as a company). In case of an angel fund, no scheme shall have more than forty-nine angel investors. However, an AIF cannot make invitation to the public at large to subscribe its units and can raise funds from the sophisticated investors only through private placement.

‘’Sponsor’’ is any person(s) who set up the AIF and includes promoter in case of a company and designated partner in case of a limited liability partnership.

An AIF may launch schemes subject to filing of placement memorandum with SEBI. Further, it may be noted that prior to launch of scheme, an AIF is required to pay 1 lakh as scheme fees to SEBI while filing the placement memorandum. Such fee shall be paid atleast 30 days prior to launch of scheme. However, payment of scheme fees shall not apply in case of launch of first scheme by the AIF (other than angel fund) and to angel funds.

The certificate of registration of an AIF shall be valid till the AIF is wound up

Venture Capital Funds (VCFs) registered under the repealed SEBI (Venture Capital Funds) Regulations, 1996 ("VCF Regulations") may seek re-registration under SEBI (Alternative Investment Funds) Regulations, 2012 subject to approval of two-third of their investors by value of their investment.As against other applications for registration as Category I- VCFs who have to pay 5 lakhs as registration fees, VCFs registered under the VCF Regulations are required to pay 1,00,000 only as re-registration fees. Venture Capital Funds registered under SEBI (Venture Capital Funds) Regulations, 1996 shall continue to be regulated by the said regulations till the existing fund or scheme managed by the fund is wound up and such funds shall not launch any new scheme after notification of the AIF Regulations. Further, the existing fund or scheme shall not increase the targeted corpus of the fund or scheme after notification of AIF Regulations. However, VCFs may seek re-registration under these regulations subject to approval of two-thirds of their investors by value of their investment.

AIFs are privately pooled investment vehicles. AIFs shall raise funds through private placement by issue of information memorandum or placement memorandum, by whatever name called. As an eligibility criterion for registration as an AIF, the applicant is required to be prohibited by its memorandum and articles of association/ trust deed/ partnership deed from making an invitation or solicitation to the public to subscribe to its securities.

Only AIFs who have not made any investments under the category in which they were registered earlier shall be allowed to make application for change in category. Such AIFs are required to make an application in Form A along with necessary supporting documents. Application fees of 1,00,000/-must be paid along with the application to SEBI. AIFs are not required to pay registration fees for such applications. If the AIF has received commitments/ raised funds prior to application for change in category, the AIF shall be required to send letters/emails to all its investors providing them the option to withdraw their commitments/ funds raised without any penalties/charges. Any fees collected from investors seeking to withdraw commitments/ funds shall be returned to them. Partial withdrawal may be allowed subject to compliance with the minimum investment amount required under the AIF Regulations.

The AIF shall not make any investments till deployment of fund as per the scheme other than in liquid funds/ banks deposits until approval for change in category is granted by SEBI.

On approval of the request from SEBI, the AIF is required to send a copy of the revised placement memorandum and other relevant information to all its investors.

At end of financial year, the manager of an AIF shall prepare a Compliance Test Report (CTR) on compliance with AIF Regulations and circulars issued thereunder in the specified format.

In case the AIF is a trust, the CTR shall be submitted to the trustee and sponsor within 30 days from the end of the financial year.

In case of other AIFs, the CTR shall be submitted to the sponsor within 30 days from the end of the financial year.

In case of any observations/comments on the CTR, the trustee/sponsor shall intimate the same to the manager within 30 days from the receipt of the CTR. Within 15 days from the date of receipt of such observations/comments, the manager shall make necessary changes in the CTR, as may be required, and submit its reply to the trustee/sponsor.

In case any violation of AIF Regulations or circulars issued thereunder is observed by the trustee/ sponsor, the same shall be intimated to SEBI as soon as possible.

Overseas investments by AIFs investments shall not exceed 25% of the investible funds of the scheme of the AIF subject to overall limit of USD 500 million (combined limit for AIFs and Venture Capital Funds registered under the SEBI (Venture Capital Funds) Regulations, 1996).

The AIF shall have a time limit of 6 months from the date of approval from SEBI for making allocated investments in offshore venture capital undertakings. In case the applicant does not utilize the limits allocated within the stipulated period, SEBI may allocate such unutilized limit to other applicants.

Procedure of obtaining registration as an AIF from SEBI

The applicant shall make an application in Form A as provided in the SEBI (Alternative Investment Funds) Regulations, 2012 along with necessary supporting documents. Application fees of 1,00,000/-must be paid along with the application to SEBI. On receipt of approval from SEBI, Registration/re registration fee /scheme fee as applicable may be paid. Registration fee to be paid by an AIF is as under:

| Category I Alternative Investment Funds | 5,00,000 |

| Category II Alternative Investment Funds | 10,00,000 |

| Category III Alternative Investment Funds | 15,00,000 |

| Angel Funds | 2,00,000 |

Procedure for winding up of AIF

In terms of Regulation 11(2), information memorandum or placement memorandum issued by an AIF shall inter alia include information on manner of winding up of the Alternative Investment Fund or the scheme. In terms of Regulation 29 of AIF Regulations, an Alternative Investment Fund shall be wound up:

- when the tenure of the Alternative Investment Fund or all schemes launched by the Alternative Investment Fund, as mentioned in the placement memorandum is over; or

- if seventy five percent of the investors by value of their investment in the Alternative Investment Fund pass a resolution at a meeting of unit-holders that the Alternative Investment Fund be wound up; or

- In case of a trust, if it is the opinion of the trustees or the trustee company, as the case may be, that the Alternative Investment Fund be wound up in the interests of investors in the units; or

- if the Board so directs in the interests of investors.

The trustees or trustee company or the Board of Directors or designated partners of the Alternative Investment Fund, as the case maybe, shall intimate the Board and investors of the circumstances leading to the winding up of the Alternative Investment Fund. On and from the date of such intimation, no further investments shall be made on behalf of the Alternative Investment Fund so wound up.

The assets shall be liquidated, and the proceeds accruing to investors in the Alternative Investment Fund shall be distributed to them after satisfying all liabilities, within one year from the date of aforesaid intimation.

Investors’ redress of complaints against AIFs

SEBI has a web based centralized grievance redress system called SEBI Complaint Redress System (SCORES) at http://scores.gov.in where investors can lodge their complaints against AIFs. Further, in terms of the AIF Regulations, for dispute resolution, the AIF by itself or through the Manager or Sponsor is required to lay down procedure for resolution of disputes between the investors, AIF, Manager or Sponsor through arbitration or any such mechanism as mutually decided between the investors and the AIF.

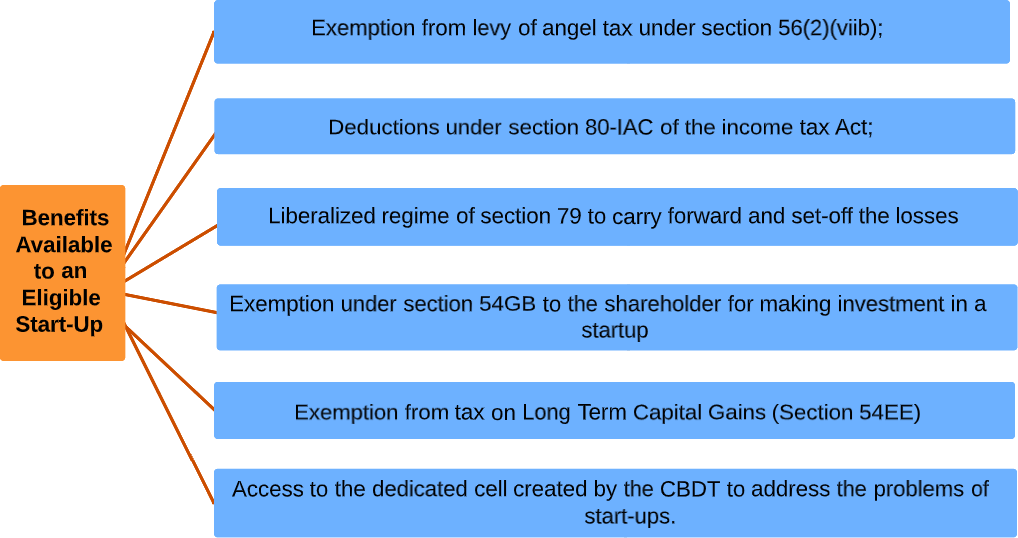

With government initiative to build up Startup India, several leverages are given to startups such as tax exemption, etc. Due to this reason, there is a surge in the development of many startups. Many investors across the world have made significant investments in the country due to the large market size. Angel tax is one of the initiatives taken by the government that was however introduced in 2012, but final execution was made in February 2019 only when certain tax exemptions were given to startup industries.

Actual Investment Process of Angel Investor

Angel investors come in after the original funding is in place but typically before a company requires a more sizable investment from a venture capital company. Their investment is needed to grow a company at a critical (and usually early) stage of development; after the initial funding threatens to run out and before venture capital groups show interest in partnering with a promising business.

Angel investors connect with young, developing companies through word of mouth, through business and industry seminars or conventions, through referrals from professional investment organizations, from online business forums or via local events like chamber of commerce meetings.

If there’s mutual interest, the angel investor will conduct due diligence on the young company by talking to the founders, reviewing business investment documents and gauging the industry the company is targeting.

Once a verbal agreement between an angel is in place, a term sheet or contract is drawn up, with agreements on the investment terms, payouts or equity percentages, investor rights and protections, governance and control parameters and an eventual exit strategy for the angel investor.

Once the contract is finalized an actual legal agreement is created and signed, the deal is officially closed and the investment funds are released for the company’s use. Some angel investors group together as a syndicate and can provide funding up to $1 million for select companies.

Angel investors don’t usually acquire more than a 25% stake in a company. Veteran angel funders know that the company founders need to hold the highest stake in their own companies as they then also have the highest incentive to make their companies successful.

Valuations and Equity Dilutions for Indian Start-ups

A product company with a good traction (according to the industry) would be valued at 4-6 crores pre-money.

Angel investors in India typically take up 20-30% of equity for investment worth 1-3 crores.

Angels are the first people who put in the money and take the highest risk. Depending on a lot of factors, angles can take as less as 10% as well.

The next step for most angel-funded or accelerated startups is raise money from a VC. It is best to have at least 60% of the company with the founders (after removing the options pool and initial investors) to make your company attractive to a VC. And a VC round is not always the next round after an angel round as there may be a seed round or a bridge round before reaching a Series A. This makes it necessary for entrepreneurs to be very careful with their equity.

Then there are incubators like AngelPrime which work very closely with the companies and also act as a co-founder. The incubators also take up a significant amount of equity (sometimes more than 50%) which is justified by the degree of involvement.

Advantages and Disadvantages of Angel Investing

There are several reasons why emerging startup companies might partner with an angel investor.

Angel Investor Advantages

No obligations

- Since the start-ups haven’t applied for a new line of credit and most Angel investing involves equity deals, business owners don’t have to pay the angel funder back if the company doesn’t grow.

An angel investor is usually an entrepreneur, too

- Angel investors often have an abundance of business knowledge and experience.

Less administrative work

- Organizations that raise financing from angels are free from onerous investment filings with the National Stock Exchange of India (NSE) and state regulators that they might have to if they decided to hold, for example, an IPO to raise money.

More cash down the line

- When angels fund a company, they’re often in for the long haul. They often make another cash injection later on

Rationale behind Introducing Angel Tax

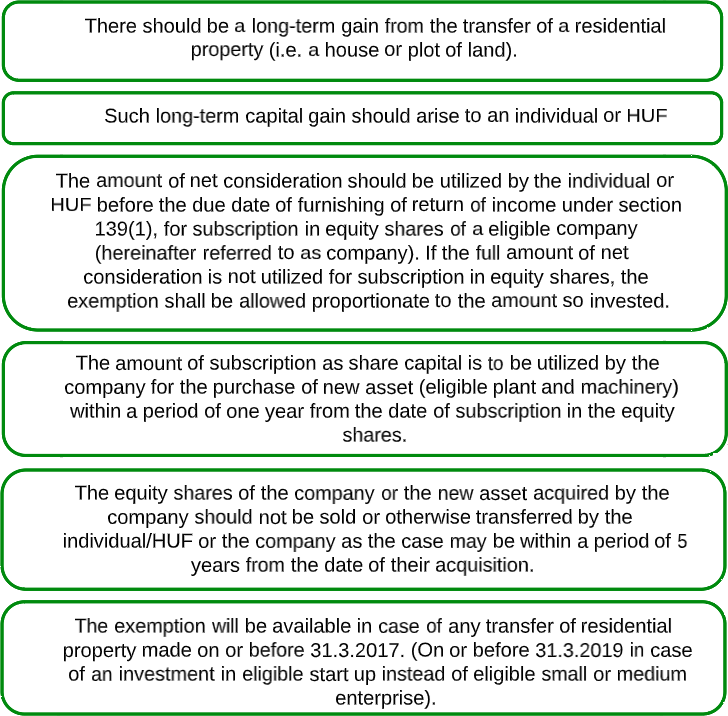

Angel tax is levied under Section 56(2)(viib) of the Income Tax Act 1961 (“the Act”), on the capital raised by privately held companies via the issue of shares to a resident, the consideration for which exceeds the face value and the Fair Market Value (FMV) of the shares issued. Angel tax gets its name from the wealthy individuals (“angels”) who invest heavily in risky, unproven business ventures and start-ups, in the initial stages when they are yet to be recognized widely.

The whole thrust for such taxation is to bring measures to tax the excessive share premium received over and above the FMV by private companies, which was extensively being used as a mechanism for accounting for hitherto unaccounted money and to receive corporate kickbacks. In essence, this is one of the anti-abuse provisions introduced to prevent money laundering.

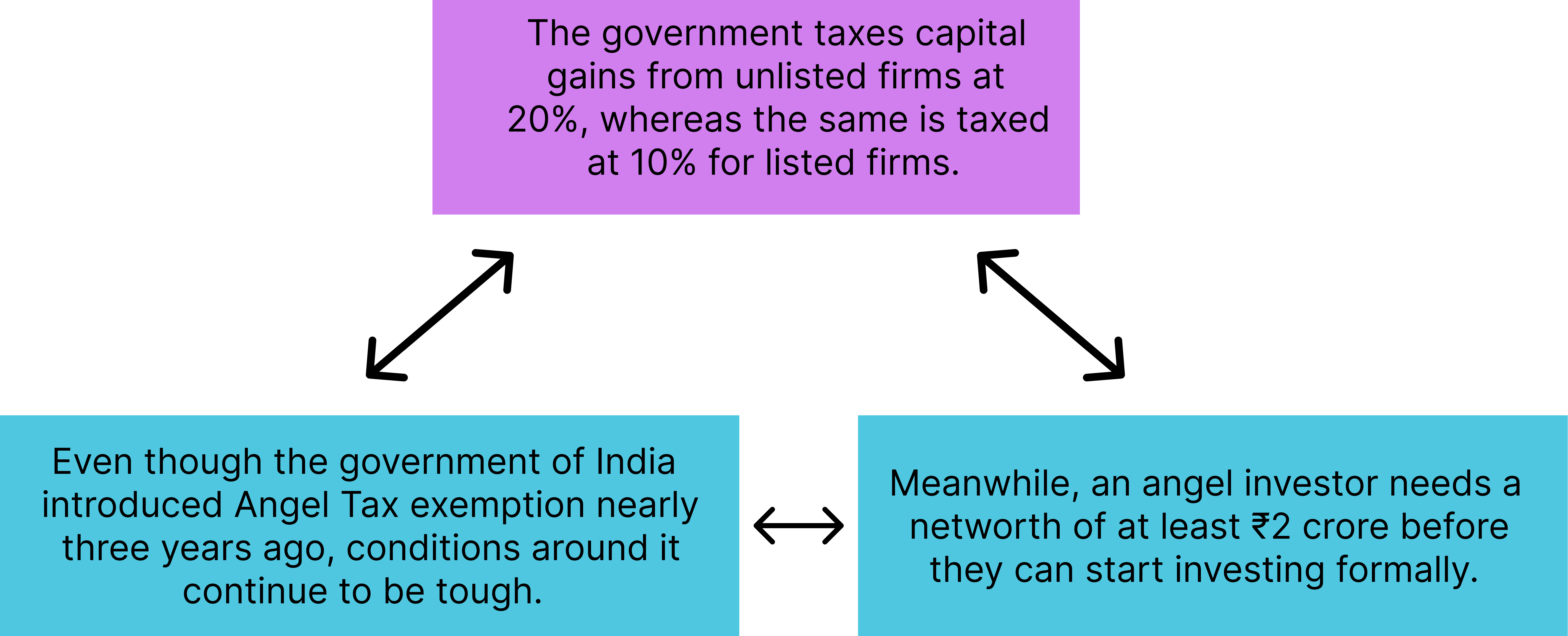

According to a joint survey by Local Circles and the Indian Venture Capital Association, nearly 73 % of the start-ups received one or more Angel Tax notices. Later, based on representations and because in the startup ecosystem shares are issued at a premium and value the long term potential of the company which may not be captured under the valuation methodology specified (Net Asset Value –NAV) under this section, an exemption was provided to start-ups recognized by the Department for Promotion of Industry and Internal Trade. However, the exemption was provided subject to the following specified conditions:-

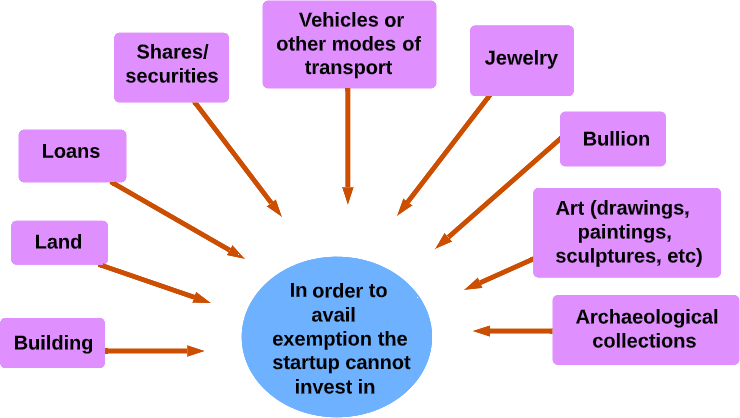

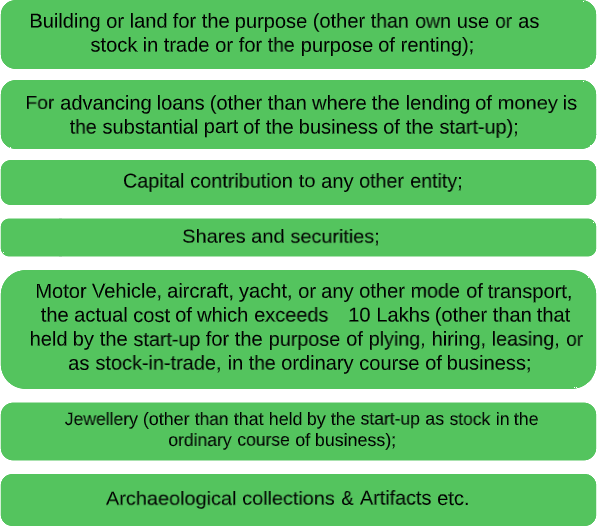

- Start-ups should not invest, within 7 years from the end of the latest financial year in which the shares are issued at a premium, in

(i). Land or buildings (except for own use),

(ii). Shares and securities,

(iii). Capital of other entities,

(iv). Jewellery and artifacts, - Any mode of transport where the actual cost exceeds 10 lakh, other than in a normal, ordinary course of business.

- No loans and advances should be extended, unless lending is in ordinary course of business, within the aforesaid 7 years.

- Further, the aggregate amount of paid-up share capital and share premium of the start-up post issue of shares, excluding such amount, as raised from non-residents, Venture Capital Company (“VCC”) or Venture Capital Fund (“VCF”), or a specified listed company with net worth of at least 100 crore as on last day of preceding financial year or with a turnover of at least 250 crore for the preceding financial year, shall not exceed 25 crore(now 100crore),up to 10 years from the year of incorporation (being the number of years for which an entity can be recognized as a start-up).

Reasons for Ineffective growth rate of start-ups despite of exemptions

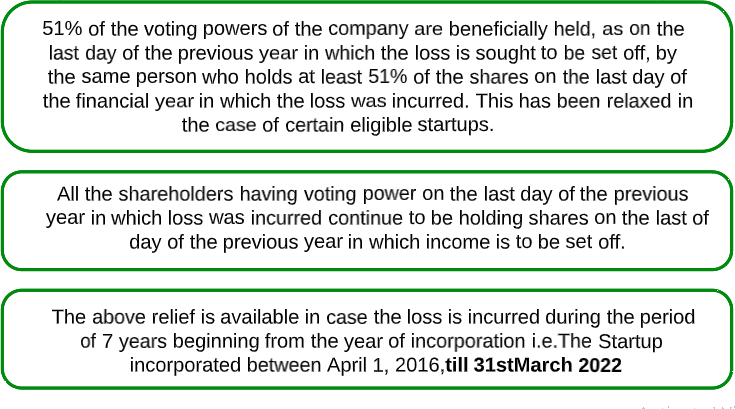

The number of start-ups eligible for the exemption from angel tax saw an increase from 1867 as of December 31, 2019, to 3,612 start-ups as of February 3, 2021. Despite the 93.4 % jump, this exemption which was intended as a breather to start-ups, turned out to be a dampener due to the following reasons:-

Start-ups invest the surplus funds raised in debt mutual funds to multiply their funds. A blanket restriction on investment in shares and securities hampers the investment and growth opportunities of start-ups.

Start-ups give salary advances or loans to employees and these start-ups are now not eligible for the exemption from angel tax. This embargo on loans and advances, without any threshold limit, is far too constraining.

Start-ups are barred from making a capital contribution to any other entity. This again creates obstacles for companies, looking to expand their operations through mergers and acquisitions or setting up subsidiaries. Further, those start-ups that operate in sectors that require liaisons (fintech, e-commerce) with other firms to sustain long-term growth are also burdened. It is now the new normal among start-ups to merge and/or acquire, as is evident from the cases of Zomato and Uber Eats & Byju’s and White Hat Jr, amongst other acquisitions.

As per a Nasscom-Zinnov report, Indian start-ups take an average of 6-8 years, to reach a $1 billion valuation. Start-ups like Ola, Udaan, and Glance have attained unicorn status in about 2.4 years. Given the need to fast-pace the growth of Indian start-ups, a 7-year restriction on down-stream investments seems unaccommodating.

Most importantly, the restrictions on the deployment of funds are not limited only to the money raised from the angel tax investors but a blanket restriction on all these activities for 7 years. In other words, start-ups are prohibited from such investments/ deployment even out of the capital raised subsequently from VCCs, VCFs or any other nonresidents for 7 years, which are excluded from the threshold of 25 crore mentioned supra.

Article 68 adds a huge tax liability for startups if they cannot disclose the source of funding.The unexplained fund receipts push young entities into various financial troubles. Young entrepreneurs go through many pains to get funding, and the least the government can do is not add more hindrances to their growth by adding more taxes on their funds.

The failure to satisfy any of the conditions for 7 years would result in the excess consideration (share premium less FMV) being treated as income of start-ups. The consequential penalty of a whopping 200 % penalty on such an amount under Section 270A of the Act seems draconian for exploring further developmental opportunities and effectively, a penalty on growth.

Over the last five years, India has seen an inflow of $250 billion of foreign direct investment. Out of the total, almost 75 per cent of this FDI, i.e. $184 billion, has come in through venture capital and private equity funding, which invests in the unlisted companies, start-ups, and growth companies, leading to the creation of unicorns. While this unprecedented surge in FDI can partly be viewed as a means to avoid any implication of angel tax (because of the restrictive covenants), it can additionally be attributed to the liberalized regulatory environment for foreign investments in start-ups and the promising business models of young Indian entrepreneurs. The impact of the investment by the non-resident investors is that the majority of these start-ups are forced to have their holding company outside India, to limit the exposure to the Indian laws.

Way Forward

As of May 2021, there were over 50 unicorn start-ups in India, with valuations exceeding $1 billion (approx. 7200 crore). The success story of some of the startup unicorns of fund-raising might overshadow the issue but in the initial stages of the startups, it’s the resident investors who invest in and help them in graduating to the next level, where after, the Venture Capital investors and private equity investors, storm into the limelight with their big bang investments.

Even though the intent of the government to prevent misuse and abuse of the provisions is understandable, relaxation of certain conditions and bringing the timeline down would go a long way in ensuring that the genuine start-ups are not affected by the regulations and could lead to many more success stories. The following relaxations may be considered:

- Restriction on end-use to be restricted only to the funds ra

- Reduction of the time limit from 7 years to 3 years especially for certain conditions like that of investment in the capital of other entities

-The monetary limit of 25 crore can be extended to 50 crore or 75 crore

- Valuation method based on future earnings such as DCF instead of NAV for recognized start-ups

These steps would help the start-ups in a big way and resident angel tax investors, which are currently subject to angel tax, can also enjoy a pie out of the success of the Indian start-ups with more investment opportunities.

Angel tax

Angel tax was introduced in the year 2012, which can be defined as income tax that is to be paid by angel investors on the amount of capital raised in companies by issuing shares. These investors basically make an investment in unlisted companies by issuing shares in the company. The main motive of introducing angel tax was to restrain money laundering by inhibiting buying of shares at a higher price.

Angel investors get benefits in the form of taxation as the entire investment made by investors in not taxed. The amount which is regarded as the above fair value during the valuation of a company is taxable. This tax is chargeable at the maximum rate of 30% that affects both investors as well receivers.

In other words, there may be some companies that are doing extremely well operationally, and investors wait with bated breath to buy the shares of such companies when first shares are issued. In such a situation, the company, knowing its brand value and market expectations, may issue shares at a price way higher or over what a comparable stock may be granted at in the market. In a scenario like that, unlisted companies have to pay income tax on the money raised through such an issue. The excess of funds raised at prices above fair value is treated as income, on which tax is levied.

What is angel tax today, came into being after a financial amendment was introduced in 2012 in the form of Section 56 (2) (viib) of the Income Tax Act to plug money laundering practices. Here any unlisted company (usually startup enterprises) in receipt of investment which is above the fair value will have to treat the extraneous capital as ‘income from other sources’ which would be identified and taxed. Given that the tax implication majorly rested with angel investors, meaning ones who put their money behind startups, it came to be called an angel tax.

Angel tax essentially derives its genesis from section 56(2) (viib) of the Income Tax Act, 1961. The finance act, 2012 introduced section 56(2)(viib) in the IT act which taxes any investment, received by any unlisted Indian company, valued above the fair market value by treating it as income. The investment in excess of fair value is characterized as ‘Income from other sources’ and the tax imposed on it is known as Angel Tax since it largely affects angel investors investing in startups.

Angel tax is imposed only on investments made by a resident investor. It should be noted that angel tax is not applicable in case the investments are made by any non-resident or venture capital funds.

What is the rate at which angel tax computed?

Angel Tax is levied at a hefty rate of 30.9% on net investments in excess of the fair market value. So for example, if a startup receives 50 crore of investment by issuing 1 lakh shares at 5000 each to an Indian investor and the fair market value is 2000 per share i.e 20 crore only, then the startup will have to pay angel tax on the amount in excess of the fair market value i.e 30 crore. Therefore Angel Tax payable in this transaction will be 9.27 crore (30.9% on 30 crore).

Purpose behind Angel taxation

The main intention behind angel taxation was to curb money laundering. Only a minor percentage of the population does comply with taxation requirements, which comprise only 2% of the total population. Due to the reason if India supports angel investment, then it may lead to the creation of black money in India, which may further lead to money laundering. Most of the startups don’t maintain proper books of account and show or their assets legibly. Due to this flaw, the income tax department of India is of view that the valuation of companies needs to be done by special officers based on prescribed guidelines and formulas. This will help the department to do the proper valuation of assets of the company, which shall further lead to higher tax payment.

What benefits does angel investor gets in India?

Angel investors frequently choose to keep their investments hidden.

In many countries, in order to promote angel investments, many exemptions, such as tax breaks are given to investors. For instance, in the United States, reinvestment profit is being generated from one to another startup. However, in India, this is not the scenario as any such special tax break is given to angel investors. Further, 30% of the funding needs to be paid in the form of tax as ‘other source of income’ that imposes a much higher rate of taxation. Many startups and investors are against this and fighting for this, as this creates unnecessary pressure on them.

Certified innovative startup: The Company which is not older than five years and having turnover not exceeding 25 million can get certified innovative startup certification. But the company must engage in the production of innovative services or products. These companies don’t fall under the ambit of angel taxation and get relief from the same. But it is difficult to get this certification as only 5% of the companies are able to get the same due to strict parameters.

The legal stance of angel taxation is defined under Section 56(2)(vii b) of the Income Tax act of 1961, which is applicable for startup companies. As per the said section, when equity shares are held by the closely held company, and further such shares are taken by investors, such investors shall pay such value of shares, which is higher than fair share value to be considered as income from other sources. Such companies need to pay the taxation amount at the rate of 30%, and cess levied.

Why is the startup community opposing Angel Tax?

The imposition of angel tax hinges on the fair market valuation of the company and this has been a bone of contention between startups and the income tax department. The tax department goes by the rule book and calculates market value based on the net assets of the company. However, estimated growth prospects of the startup and future projections based on these growth prospects are major factors in determining the fair market valuation of the startup. The methodology difference in calculation of the market value of the startup makes it pay a hefty price in terms of angel tax at a whopping 30%. Angel tax in a way wipes away a major part of the investible surplus of the startup hurting its growth prospects and hitting hard on the viability of the business.

However, after facing a sustained backlash from the startup ecosystem against the imposition of angel tax, the government has finally assured the startups that no coercive action will be taken to collect angel tax and also appointed a committee to look into this issue.

Problems with the Angel Tax

Angel Tax is a tax levied by the government on start-ups who are funded by angel investment. As mentioned earlier, Angel Investment is the investment made by an Angel Investor. They recognize crude talent and if it fits their demands, Angel investors agree to invest in them. According to the laws of India, all start-ups who receive investment from an angel investor have to pay a certain percentage of the investment to the government.

The law under which Angel Tax comes states that the start-up needs to pay a certain part of the investment to them if the total investment value is greater than the Fair Market Value (FMV). The basis of Angel tax is that the extra investment that the start-up receives is seen as an income. And thus, according to the Income Tax rules of India, a start-up is liable to pay the Angel tax as a part of Income Tax.

- Only payments made by Indian Residents are liable for Angel tax. This means that if a start-up is funded by a resident Indian, then the start-up has to pay a certain share of this investment in the form of angel tax.

- Since Angel tax demands start-ups to share a piece of their investment, some of their money is being lost in the form of tax. Most start-ups need a strong financial basis, to begin with, and Angel Tax seems to take a huge toll on start-ups while Investments made by non-resident investors and venture capitalists are not liable for Angel Tax deduction.

- Since Angel tax has caused a lot of problems to start-ups as they were losing a huge sum of their investment in the form of tax. This activity not only affects to start-up but also affects the investor. Seeing the unhealthy effects of Angel tax, people were trying to find grounds for exemptions. The government has finally notified the start-ups that there are conditions under which exemption is possible. This comes under Section 56 of Income Tax Law, 1961.

Hence, as an investor, you are losing one third of the value of your investment immediately. This is the story that has been playing out in the last few months in the tax department, with the tax authorities levying income tax on various capital infusions by investors into companies.

There are two provisions under which such additions are being made.

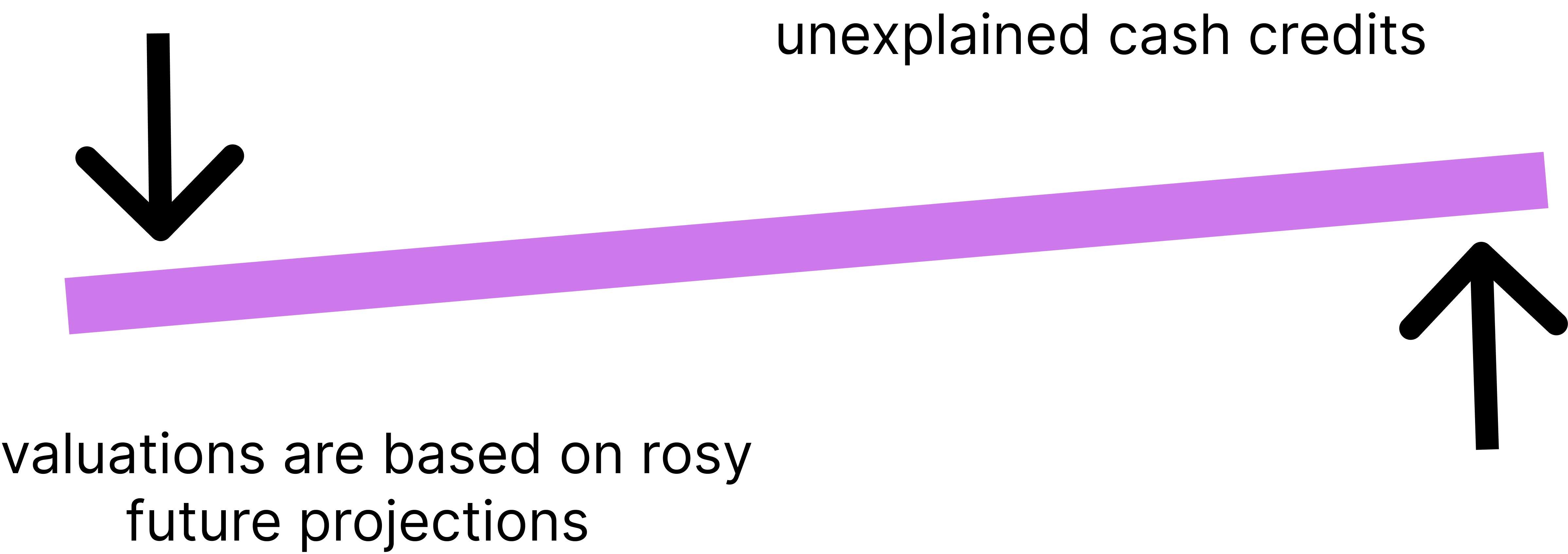

The first provision is in relation to unexplained cash credits, a provision which has been in the law for many years, but which has recently been amended to provide that besides having to prove the genuineness of the transaction and the identity and capacity of the investor, the recipient is also required to prove the source of the funds in the hands of the investor. Tax authorities are now insisting on not just the confirmation of the investor, but for a copy of the balance sheet and bank account of the investor to prove from where the investor got the funds.

Most foreign investors are obviously wary when a request is made by the investee company for such information, and obviously do not want to share it. Thus a law is needed, which requires a company to prove something which is not within its control, or else penalizes the company. The law certainly needs drastic changes, or else adequate controls need to be built in so that genuine investors are not scared away.

The second provision (commonly referred to as “angel tax") under which additions are made is a provision under which a company is taxed if it charges a premium for its shares, where the amount received for allotment of the shares exceeds the fair market value of the shares. As is well known, many loss making companies, including e-commerce companies, tech start-ups, etc have high valuations, though they are currently incurring losses. These valuations are based on rosy future projections, assuming that the idea underlying the business will succeed. By the time the tax assessment comes up, in 9 out of 10 cases, the projections are not met. The tax officer, on the basis of hindsight, then refuses to accept the valuation, and values the company based on figures actually achieved. This results in large amounts of share premium being treated as income of the investee company

There is a provision for registration of start-ups with the Inter-Ministerial Board of Certification of the government. Registered start-ups are exempt from the provision taxing excessive share issue price. However, such registration is restricted only to small companies with investments up to 10 crore, and for investors meeting certain criteria. Investors would need to share their income and net worth with the investee companies for this purpose. Further, this exemption is available only from the current year, and does not apply to the past 3 years, for which this provision is currently being invoked. Therefore, a large number of companies, which are generally loss-making, are facing litigation on this account, effectively destroying what is left of such businesses.

In the meanwhile, the Central Board of Direct Taxes has clarified that no coercive action will be taken to recover tax demanded on account of rejection of valuation. But, this is not sufficient, as the tax demands have to be challenged in appeal. Further, the central government has promised to do something to address the situation.

Besides losing a huge chunk of investment to the government, there are many factors which come into play. These factors adversely affect the true potential of a start-up. Some of these factors are:

The difference in calculation of Market Value

It has been observed that there is a significant difference in the methods of calculation of true market value. The approach that the government takes when calculating the market value of a start-up is way different from the approach taken by the start-up.

Many factors are considered when a company calculates its market value. The same factors are not considered when the government calculates the net worth of a start-up. Many factors which elevate the market value of a start-up are ignored by the government and this in an unbelievably low market value.

On the other hand, Angel investors who make an investment consider the true potential of the company while making an investment. They know, if nurtured properly, a start-up can yield a lot. Hence, they invest a lot. This extra investment is seen in the form of income and is charged for tax, whereas this sum of money can be used by the company.

Impact on start-ups and Investors

- A start-up loses a humongous chunk of its investment in the form of tax. This costs a lot and most start-ups cannot afford to lose such kind of money, that too at the very beginning. This puts a lot of pressure on the company.

- For a start-up, it is not at all easy to gather funding. They come across a handful of willing investors after going through a lot of futile meetings and attempts. Once they nail a hot-shot investor, they want to put all their efforts and resources into building their company and making their product better. But instead, they lose a huge part of their investment to the government in the form of tax.

- Angel tax also discourages many big investors from investing in small start-ups. Investors may see potential in the company, but they may not be willing to invest because they know a lot of it would be lost in the form of tax. Angel tax has instilled a sense of fear in the minds of investors. This has made it all the more difficult for start-ups to find proper funding.

Discouragement

- The very purpose of “Make in India” was to promote start-ups and encourage the production and sale of goods made in India. But the application of Angel tax has proven to be big discouragement for start-ups. Start-ups are young, struggling companies. They do not have a lot of funding options. Also, they cannot afford to lose a large sum of their investment in the form of tax. Angel tax has made the survival of start-ups more difficult.

- The adverse effect of Angel tax on investors has also proven to be a major drawback for start-ups. With a lack of investors, there is barely any chance that a start-up would live to see the day.

Therefore, ever since its introduction, the tax came under criticism by investors, industry analysts and entrepreneurs for being cumbersome and startup unfriendly. They said that calculating a startup’s fair market value had subjective aspects to it which could not be standardized since a startup’s valuation may be based on something as simple as projected returns at a given point and are subject to negotiations between the startup and investor. Another problem was, assessing officer, a key tax official who scrutinizes the books, would choose cash discounted flow to determine the fair market value, which was not a very favorable practice for startups. In December 2018, more than 2000 startups received tax notices to pay up dues on the angel tax, including penalty charges.

There are many reasons due to which startups are opposing this concept of angel taxation along with investors as investors are reluctant to invest in Indian startups due to this concept, which impose higher tax amount on them. Certain reasons are as mentioned below:

- There is a difference in the method of calculation of market value shares as used by companies from the concept as used by government authorities. Government authorities don’t use many factors while calculating the market value as include by many startups, which results in a much lower value. This calculation result done by startups results in higher price value, which leads them to make a huge investment in the companies. But this difference in calculation later leads to payment of a large amount of tax amount.

- Due to large amount of taxation to be paid, many investors are avoiding making an investment in the market which has a huge impact on Indian industries as many large investors are avoiding funding due to the reason

- Angel taxation has halted the development and growth of startups, leaving them disheartened.

After huge opposition by startups and many investors, finally Indian government has come up with certain changes that have further a positive hope in this direction.

Anomalies that need to be fixed in India’s startup regulations

What are initiatives taken by the government in this regard?

In order to promote the startup industry, the government has taken certain steps in regards to angel taxation as mentioned:

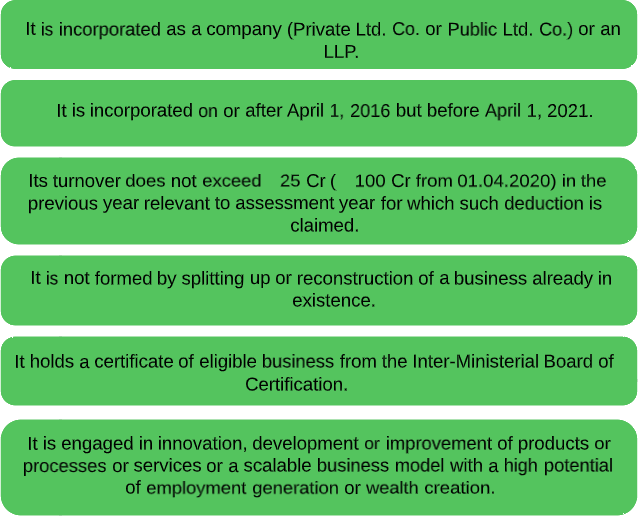

- Earlier, a company was regarded as a startup for a period of 7 years from the date of its incorporation. But now it has been increased to 10 years in order to provide benefits in terms of income tax for a further three years.

- Further, a company shall be regarded as a startup if it has not attained a turnover of more than 100 crores for the said financial year. This limit was 25 crores before, which has now been increased.

- In the case said entities meet the criteria as defined by the government, then exemption from angel taxation shall be given.

Companies to be regarded as start-ups till 10 years

Turnover of company increased to 100 crores

Meet the criteria as defined by the government authority

New rules for Angel Tax

Previously, angel tax exemption was limited to enterprises with a revenue of up to 25 crores; however, under new guidelines, the exemption limit has been increased to companies with a turnover of less than 100 crores and that are less than ten years old.

Furthermore, investments made by listed firms with a net worth of at least $100 million or a total turnover of at least $250 million, as well as investments made by non-resident Indians, will be tax-free.

A qualified start-up is one that is registered with the government, has been in operation for less than 10 years, and has generated less than $100 million in revenue during that time.

In addition, the Finance Minister stated that an e-verification mechanism will be implemented to address the issue of verifying the identity of the investor and the source of his cash. As a result, monies raised by startups will not be scrutinized by the Income Tax department.

Startups would not be required to present the fair market value of their shares granted to certain investors, such as Category-I Alternative Investment Funds (AIF).

New Procedure for Pending Angel Tax Cases

In a move to ease scrutiny of startups over the capital they have received from angel investors, Central Board of Direct Taxes (CBDT) has recently laid out a procedure to address pending angel tax assessments.

The procedure has followed the announcement made by the Finance Minister in Budget 2019-20. The Finance Minister proposed a host of incentives, including a special arrangement for resolution of pending assessments of income tax cases, with a view to encouraging startups.

New Procedure

- No verification will be done by an assessing officer if a startup has been recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) and the case is selected under limited scrutiny.

(1). In case the startup has not received DPIIT approval, officers are only allowed to carry out any inquiry or verification only after obtaining approval of his/her supervisory officer.

(2). In the event that a startup is recognized by DPIIT, but the assessing officers are scrutinizing it for multiple issues, the officials cannot pursue scrutiny under an anti-evasion provision of the Income Tax Act, 1961, in its assessment proceedings. - Section 56(2) (vii)(b) of the Income Tax Act,1961 deals with the taxation of share premiums received in excess of the fair market value and has been used in the past to serve demand notices to startups over the angel capital they have raised.

- The applicability of angel tax would not be pursued during the assessment proceedings and inquiry or verification with regard to other issues in such cases shall be carried out by the assessing officer only after obtaining approval of his/her supervisory officer.

SEBI notifies rules for angel investors

The new norms would help in encouraging entrepreneurship in India by financing small start-ups at a stage where they find it difficult to obtain funds from traditional sources of funding such as banks or financial institutions. SEBI would frame guidelines for angel investor pools by which they can be registered under AIF venture capital funds (VCF).Market regulator Securities and Exchange Board of India (SEBI) notified new norms for angel investors, who provide funding to companies at their initial stages. With the new norms, SEBI aims to encourage entrepreneurship in the country by financing small start-ups.

In view of the high-risk investments of such funds, certain conditions have been imposed on investors. For instance, individual angel investors shall be required to have early stage investment experience/ experience as a serial entrepreneur/ be a senior management professional with 10 years’ experience. They shall also be required to have net tangible assets of at least 2 crore. Corporate angel investors shall be required to have 10 crore net worth or be a registered AIF/VCF.Angel Funds shall have a corpus of at least 10 crore (as against 20 crore for other AIFs) and minimum investment by an investor shall be 25 lakhs (may be accepted over a period of maximum three years) as against 1 crore for other AIFs. Further, the continuing interest by sponsor/manager in the Angel Fund shall be not less than 2.5% of the corpus or 50 lakhs, whichever is lesser.

For ensuring investments are genuine angel investments, angel funds shall invest only in venture capital undertakings which are not more than three years old, have a turnover not exceeding 25 crore, are not promoted, sponsored or related to an Industrial Group whose group turnover is in excess of 300 crore, and have no family connection with the investors proposing to invest in the company.Further, investment in an investee company by an angel fund shall be not less than 50 lakhs and more than 5 crore and shall be required to be held for a period of at least three years.

Angel investors are allowed to be registered as alternative investment funds (AIFs) — a newly created class of pooled-in investment vehicles for real estate, private equity and hedge funds, a gazette notification said.

In order to ensure investment by angel funds is genuine, the SEBI has restricted investment by such funds between 50 lakhs and 5 crore.

Among other norms included, angel funds can make investments only in those companies which are incorporated in India. These funds needs to be invested in a firm for at least three years, can invest in companies not older than 3 years

Further, investee company needs to be unlisted and with a maximum turnover of 25 crore and this firm may not be related to a group with a revenue of more than 300 crore.

Angel funds are required to have a corpus of at least 10 crore and minimum investment by an investor should be 25 lakhs.

As per SEBI, the manager or sponsor shall have a continuing interest in the angel fund of not less than 2.5% of the corpus or 50 lakhs, whichever is lesser, and such interest shall not be through the waiver of management fees

SEBI also stipulated that the fund must not have any family connection with the investee company and that no angel fund scheme have more than 49 investors.

Under SEBI guidelines, AIFs already have sub-categories such as Venture Capital Funds, Social Funds and SME Funds. Angel fund is likely to be a separate sub-category. Angel Funds have been included in the definition of 'Venture Capital Funds' and a separate Chapter has been inserted specific to such funds. Angel funds shall raise funds only from angel investors.

Regarding raising of funds by an individual investor, the person need to have an experience of 10 years and should possess assets of at least 2 crore.

In case an investor is a corporate entity, it need to either have a net worth of 10 crore or registered as AIF/ VCF with SEBI.

Condition set forward to apply for Angel Tax exemption

| Restrictions/Conditions | Timeline | Demand |

| Startups cannot invest in land or buildings, shares and securities, capital of other entities, mode of transportation over 10 lakh. | Seven years from latest fiscal year | No restricted end-use for assets |

| No loans or advances should be extending, unless lending is ordinary course of business (Includes advance salary to employees) | Seven years from latest fiscal year | Lending could be an option. |

| Paid up capital should not exceed 25 crore | Up to 10 years from the year of incorporation. | The monetary limit could be extended to 50 crore or 75 crore |

| Startup valuation is determined by net asset value (NAV) method, which is the next value of an entity. | N/A | Valuation should be determined by future earnings through the Discounted Cash Flow (DCF) method. |

However, SEBI may be getting a bit too demanding with its angel investors. An Angel investor must have a net tangible asset of at least 2 crore, excluding the value of their principal residence. An early stage investment experience, serial entrepreneurship and 10 years of work experience as a senior executive may come in handy too. The said investor, in case investing through an angel fund, needs to commit 25 lakh rupees over a period of three years.

“Now if I [as an angel investor] want to invest in four startups of four different funds [Angel Funds], I need to commit 25 lakh to each of these funds. I have to commit 1 crore to four startups whereas I will be only investing 3-5 lakh in each startup. hence that interchangeability is required.

| Requirement | Demand | Why change is needed |

| Minimum net worth of 2 crore | Reduction of net-worth | Young working professional will not be able to fulfill this requirement |

| Need to commit 25 lakh to an angel fund | The commitment should be reduced to 10 lakh and one should be able to commit this amount across angel funds, instead of focusing on one | Investing 25 lakh is capital intensive and it becomes an issue if one has to commit at least 25 lakh in multiple funds to grab deals they prefer. |

Startup would mean any innovative entity that uses technology and is less than 10 years of age. This entity should not have clocked 100 crore in turnovers for any year.

If a startup has 25 crore in each year, it would still be a startup but if a startup has 100 crore in even one year, it would not be considered a startup.

Exemption:

- Whatever money you raise, will be exempt till total Share capital plus share premium touches 25 crore. This means that the total amount of capital issued, should be below 25 crore.

- This means an exempt startup will not have to pay any angel tax for upto 25 crore of capital raised. This can be in multiple tranches. A startup can raise 10 crore and then 5 crore and then 6 crore and all of it would be free from angel tax.

- However if a startup already has paid up share capital of 20 crore, even if a startup raises 8 crore, it shall not be eligible for the exemption.

Inclusion:

In order to calculate the above mentioned 25 Crore, the amount of money received from the following will not be included

Category 1 AIF:

AIF stands for Alternative Investment Fund. Currently only one category of AIFs are exempt from this calculation. All funds that invest in startups are in category one

Venture Funds:

All venture capital funds are exempt from this calculation

Non-Residents:

Any money coming from outside India is exempt from this calculation. This include Foreign Venture Funds, Non-Residents, International bodies

Listed company:

Listed company that has a net-worth of 100 crore or turnover of 250 crore for the previous year. Also, the shares of this company should be frequently traded

A startup with 30 crore paid up capital where 10 crore is from a Category 1 AIF would be eligible.

A startup receiving any amount of funding from a foreign national would be exempt.

A startup receiving money from an Indian venture fund would also be exempt.

Prohibition:

In order to check that the company that has received investment is not a shell company, the startup cannot invest in any of the following assets

Positive Point

You are allowed to buy these things for business. This means if you are in the business of plying taxis, then you can buy vehicles. If you are in the business of online jewelry, then you can buy those. If you are a co-working space, you can buy building. These purchases have to be for the purpose of business only.

Negative Point

You cannot buy these at all (for non-business purposes). You can make other money but still not buy any of these for seven years. You cannot buy these in the name of the company even to give to a company executive.

Also, you cannot create a subsidiary company as that would entail capital contribution or investment in shares of a company which is prohibited.

Process:

You need to sign a declaration form that says neither have you invested in those asset nor shall you do so and if you do then your exemption would stand cancelled and you will have to pay the amount.

Declaration Filing

A Startup shall be eligible for exemption subject to the following conditions

- It has been recognized by DPIIT as an eligible Startup

- Aggregate amount of paid-up share capital and share premium of the startup after issue or proposed issue of a share, if any, does not exceed, 25 Crore rupees:

In computing the aggregate amount of paid-up share capital, the amount of paid-up share capital and share premium of twenty-five crore rupees in respect of shares issued to any of the following persons shall not be included

- a non-resident

- a venture capital company or a venture capital fund

- a specified company” means a company whose shares are frequently traded within the meaning of Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 and whose net worth on the last date of the financial year preceding the year in which shares are issued exceeds one hundred crore rupees or turnover for the financial year preceding the year in which shares are issued exceeds two hundred fifty crore rupees.

- Startup shall not invest in any of the assets given below for the period of seven years from the end of the latest financial year in which shares are issued at a premium

- a building or land appurtenant thereto, being a residential house, other than that used by the Startup for the purposes of renting or held by it as stock-in-trade, in the ordinary course of business

- land or building, or both, not being a residential house, other than that occupied by the Startup for its business or used by it for purposes of renting or held by it as stock-in-trade, in the ordinary course of business;

- loans and advances, other than loans or advances extended in the ordinary course of business by the Startup where the lending of money is a substantial part of its business

- the capital contribution made to any other entity;

- shares and securities;

- a motor vehicle, aircraft, yacht, or any other mode of transport, the actual cost of which exceeds ten lakh rupees, other than that held by the Startup for the purpose of plying, hiring, leasing, or as stock-in-trade, in the ordinary course of business

- jewelry other than that held by the Startup as stock-in-trade in the ordinary course of business;

- any other asset, whether in the nature of the capital asset or otherwise, or of the nature specified in section 56 of the Income Tax Act.

Compliance to claim exemption:

A startup fulfilling above mentioned conditions shall file a duly signed declaration in Form 2 to DIPP that it fulfills the conditions. On receipt of such declaration, the DPIIT shall forward the same to the CBDT.

- Form 2 is to be filed

- It is a self-declaration form

- Submitted to DPIIT (department of production industry and internal trade)

- Then DPIIT forwards it to the CBDT.

Revocation of Exemption

In case it is found that any certificate has been obtained on the basis of false information, the DIPP Board reserves the right to revoke such certificate or approval.The effect of the revocation is that any consideration received before failure by such start-up which is in excess of the fair market value of shares will be deemed to be the income of the start-up for the financial year in which exemption is revoked.Further, it shall be deemed that the start-up has under-reported its income and shall be liable for consequences u/s 270A i.e. penalty equal to 200% of the amount of tax payable on under-reported income.

Fair Market Value (FMV)

For the purpose of this Section 56(2)(viib)-

Fair Market Value shall be the value, Higher of the following:

- as may be determined in accordance with such methods as may be prescribed( Methods prescribed under Rule 11UA are Book value Method (NAV) and Discounted Cash flow method); or

- as may be substantiated by the company to the satisfaction of the Assessing Officer, based on the value, on the date of issue of shares, of its assets, including intangible assets being goodwill, know-how, patents, copyrights, trademarks, licenses, franchises or any other business or commercial rights of similar nature, In Rule 11UA (2) (b) the fair market value of the unquoted equity shares shall be determined by a merchant banker or an accountant as per the Discounted Free Cash Flow method.

An eligible start-up would be one that is registered with the government, has been incorporated for less than 10 years, and has a turnover that has not exceeded 100 crore over that period.

Also, the Finance Minister announced that a mechanism of e-verification will be put in place to resolve the issue of establishing the identity of the investor and source of his funds. With this, funds raised by startups will not require any kind of scrutiny from the Income Tax Department.

Also announced that startups will not be required to present the fair market value of their shares issued to certain investors including Category-I Alternative Investment Funds (AIF).

What are the concerns with it?

- The share issued to an investor has to be valued to decide whether the price is in excess of fair value.

- The valuation of a startup is usually based on a commercial negotiation between the company and the investor.

- It is based on the company’s 'projected earnings' at that point in time.

- However, as startups operate in a highly uncertain environment, many are not always able to perform as per their financial projection.

- Equally, some companies exceed the projection if they are doing well.

- Resultantly, startups are often valued subjectively and it causes differing interpretations of “fair value”.

- Startups are thus vulnerable to unduly high taxes because the taxman feels the investment is too high over their valuation.

How will angel tax exemption benefit?

- Stringent rules on angel tax have had an adverse effect on investor confidence in startups.

- So the relaxations will help the start-ups which are in desperate need for capital to fund their growth and other business requirements.

- Further, the new rules are set to be applied retrospectively.

- So many young companies that have received notices from the IT Department in the last few years will be relieved by the change in rules.

Income Tax Exemption for Angel Investors in Startups

Indian government acknowledged a long-standing demand of the startup community in the country,announcing that the angel investors would receive a total exemption on the investments in the startups. Angel investors were taxed heavily, even when the foreign investors and venture capital firms were exempt from it.

Angel Investor is one who invests his money in a startup while it is still finding its feet and still struggling to establish itself in the marketplace. Up until now, an angel tax of more than 30% was levied on the funds invested by the individuals in an unlisted firm at the share price above the fair market value.

Usually, around 300-400 of the start-ups fund themselves with the angel funding in a year. The Income Tax Department has exempted the Angel investors, subject to specific conditions that are laid down by the Indian Department of Industrial Policy and Promotion (DIPP), which has offered substantial relief to early-stage investors.

Hence, allaying the concerns of the startup community, the government has exempted investments made by the domestic investors in companies approved by an inter-ministerial panel from Angel Tax.Section 56(2) (viib) of the Income Tax Act 1961 would not be applicable to the startups registered under DPIIT.

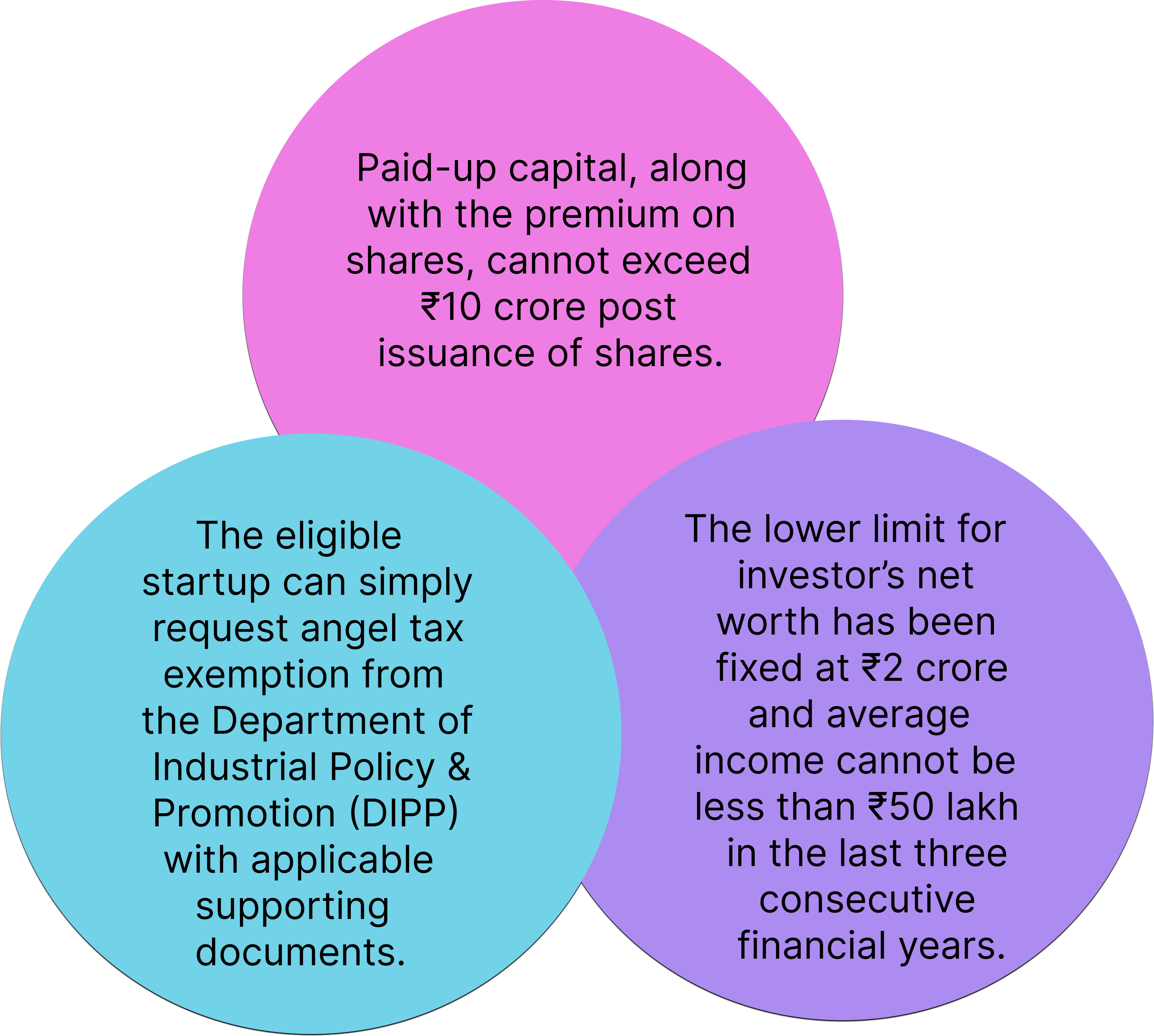

- The income tax relief impacts the startups which are approved by the inter-ministerial panel, where the paid-up capital and share premium of the beneficiary company doesn’t exceed 10 crore after the issuing of shares. This notification is effective retrospectively from 11th April 2018.

- Angel investors planning to subscribe shares in a startup would require fulfilling specified criteria and the start-ups would need to procure the report from the merchant banker which would specify the fair market value of such shares as per the income tax rules.

- As per the income tax notification, angel investors with the minimum net worth of 2 crore or the average returned the income of more than 25 lakhs in the previous 3 financial years will be eligible for 100 % tax exemption on the investments that are made in the start-ups above the fair market value.

- Many startups have raised their concerns over taxation of the angel funds under the provisions laid down under Section 56 of the Income Tax Act, 1961. This section required taxing the funds received by an entity. Around 18 start-ups received the notices from income tax authorities. Start-ups that are incorporated on or before April 2016 could seek the exemptions from this section.

- However, the 3-year income tax concession is available to the startups that have been incorporated after 1st April 2016. Start-ups enjoy the income tax benefit for 3 out of 7 successive AYs (assessment years) under the Income Tax Act. The Indian government so far has extended the tax benefits to only 88 startups which have been recognized by Department of Industrial Policy and Promotion since January 2016. For availing both the concessions i.e. exemption from tax on funds and exemption of tax from 3 years, start-ups need to approach the inter-ministerial board of certification.

- The notification is considered a welcome move in dispelling fears of the start-ups with respect to angel tax and providing much-required clarity in relation to non-applicability of the angel tax. Further, this decision to provide an exemption to investors in start-ups from the income tax was intended to address a major issue that was faced by the angel investors who were investing their money during the early times of gestation and growth. This exemption will provide a level playing field for the investors.

- The other key takeaway was the amendment with respect to the issue of valuations reports by Chartered accountants for angel tax purposes. The Central Board of Direct Taxes (CBDT) has amended the Rule 11 UA (2)(b) of the Income Tax Act, 1961, thus making the valuation by merchant bankers compulsory for determining the fair market value of the unquoted equity shares

However, in order to qualify for angel tax exemption, the startup should meet certain criteria which are as follows:

- The paid-up capital and share premium of the startup should not exceed 10 crore after issuing shares.

- The startup should procure the fair market value certified by a merchant banker.

- The investor should have a minimum net worth of 2 crores and the average income in the last 3 financial years should not be less than 50 lakh.

- The startup should have received approval from an 8 member inter-ministerial board for angel tax exemption.

- In order to simplify the compliance procedure, the government in a recent notification has done away with the requirements fair market value certificate issued by a merchant banker and approval from an inter-ministerial board. The eligible startup can simply request angel tax exemption from the Department of Industrial Policy & Promotion (DIPP) with applicable supporting documents. The application of DIPP-recognized startups will be forwarded to CBDT (Central Board of Direct Taxes) along with the attached documents. CBDT has been mandated to accept or decline such an application within 45 days from the day of receipt.

Exemption for angel tax

Exemption from angel tax will not be available if the procured money is used to buy assets like land, building, vehicles, aircraft and other modes of transports, jewellery etc. Similarly, it should not be used to give loans and advances or to buy shares and securities.

At present, the start-up funding exemption has been given to angel funds that are regulated as Category I alternative investment funds. Category I Alternative Investment Funds are mainly venture capital funds including angel investors. The industry demands that exemptions to be extended to Category II investors including Private Equities and other type of Investors.

The angel tax could not be scrapped as money laundering is a major problem. There is a network of 200 shell companies and they have been under control since 2012, so it cannot be scrapped.However, concessions are under consideration with the size of the start-up, the duration of its operation, and the income of the angel investor.

Steps Taken by Indian Government against Tax terrorismIn order to reduce the long pending grievances of taxpayers and to minimize litigations pertaining to tax matters, the Government of India in July 2018 has decided to increase the threshold monetary limits for filing Departmental Appeals at various levels.

- Goods and Services Tax has been introduced.

- Insolvency and Bankruptcy Code has been implemented.

- “Kardaata e-Sahyog Abhiyaan” has been launched by CBDT etc.

What are the continuing concerns?

- Companies need to be registered with the government as start-ups to make use of the latest exemption. To start with, only DPIIT-recognized startups have been spared from the Angel Tax, but MSMEs and SMEs operating from rural areas may not have the means to complete the documentation process and are still facing challenges.

- Secondly, eligibility for tax exemption is not applicable for startups that invest the capital received from investments in immovable properties like lands and buildings, and loans and advances, contribution made to other entities, jewellery, artefacts, or any mode of transport where the actual cost exceeds 10 lakh (aircraft, car etc.) – if purchased or traded for any purpose other than that regarding the ordinary course of business. This means early-stage and bootstrapped startups in sectors such as deep tech may face difficulties while raising funds.To be classified as a startup, a company has to prove certain conditions such as that it hasn’t invested in vehicles worth more than 10 lakh, in land unrelated to the business, or in jewellery.

- Startups that invest in shares and securities are also not eligible for Angle Tax exemption. Since most new ventures tend to invest in debt mutual funds to multiply their fund, this hinders their growth. Moreover, startups with overseas ties or foreign subsidiaries are barred from making a capital contribution to any entity. This again creates obstacles for companies that operate in certain sectors and require liaisons with other firms to sustain long-term growth.