E-Invoicing - An Introduction

The Central Board of Indirect Taxes & Custom had published a new notification about the E-Invoice Under GST, which contains the new rules of electronic invoicing.

Who should comply with e-Invoicing and Roadmap Notified?The government mandated e-invoicing to avoid GST tax evasion. The first Committee was set up in May 2019 to discuss the usability of e-invoicing and its implementation plan in India, considering global implementations. Since then, several to be mandatory from 1st April 2020 but was later pushed by the GST Council, and finally, it became live drafts were issued, and finally, the e-invoice scheme was introduced in January 2020. E-invoicing was supposed from 1st October 2020 in a phased manner.

In the first phase, companies with turnover higher than 500 crore had to issue e-invoices from 1st October 2020. In the second phase, companies with turnover greater than 100 crore had to issue e-invoices from 1st January 2021. In the third phase, companies with turnover higher than 50 crore must issue e-invoices from 1st April 2021.

The Central Board of Direct taxes and Customs (CBIC) has made the e-invoicing system amndatory for taxpayers with a turnover higher than 20 crore from 1st April 2022 vide Notification No. 01/2022 – Central issued on 24th February, 2022.

E-Invoice stands for the electronic invoice which is issued by the Business and Corporate regarding the buying and purchasing of the products. It prescribes the standard format creating an invoice; E-invoice system basically authenticates the Business-to-business invoices, which makes the system more and more user-friendly. The invoices which are created between two corporations or businesses are authenticated electronically by the Goods & Services Tax Network.

Invoice Registration Portal which is managed by Goods & Services Tax Network issues an identification number for every single generated invoice. E-invoice under GST has various advantages, it helps in auto reporting Goods and Service Tax returns and it also helps to generate e-way bills or invoices when required. Out of these, two advantages are first to simplify the transaction methods and second is that it helps in reduction of billing process cost.

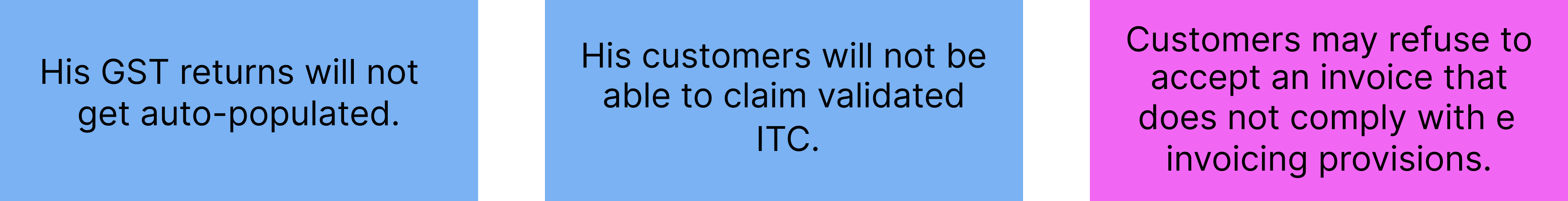

What happens if an e-invoice is not generated?Non-generation of e-invoice is an offence and attracts penal provisions. It attracts heavy penal provisions of up to 10,000 per invoice. Further, incorrect invoicing can lead to a penalty of 25,000 per invoice.Other than penal provisions, if a taxpayer delays in generation of e-invoice-

What is E-Invoicing?

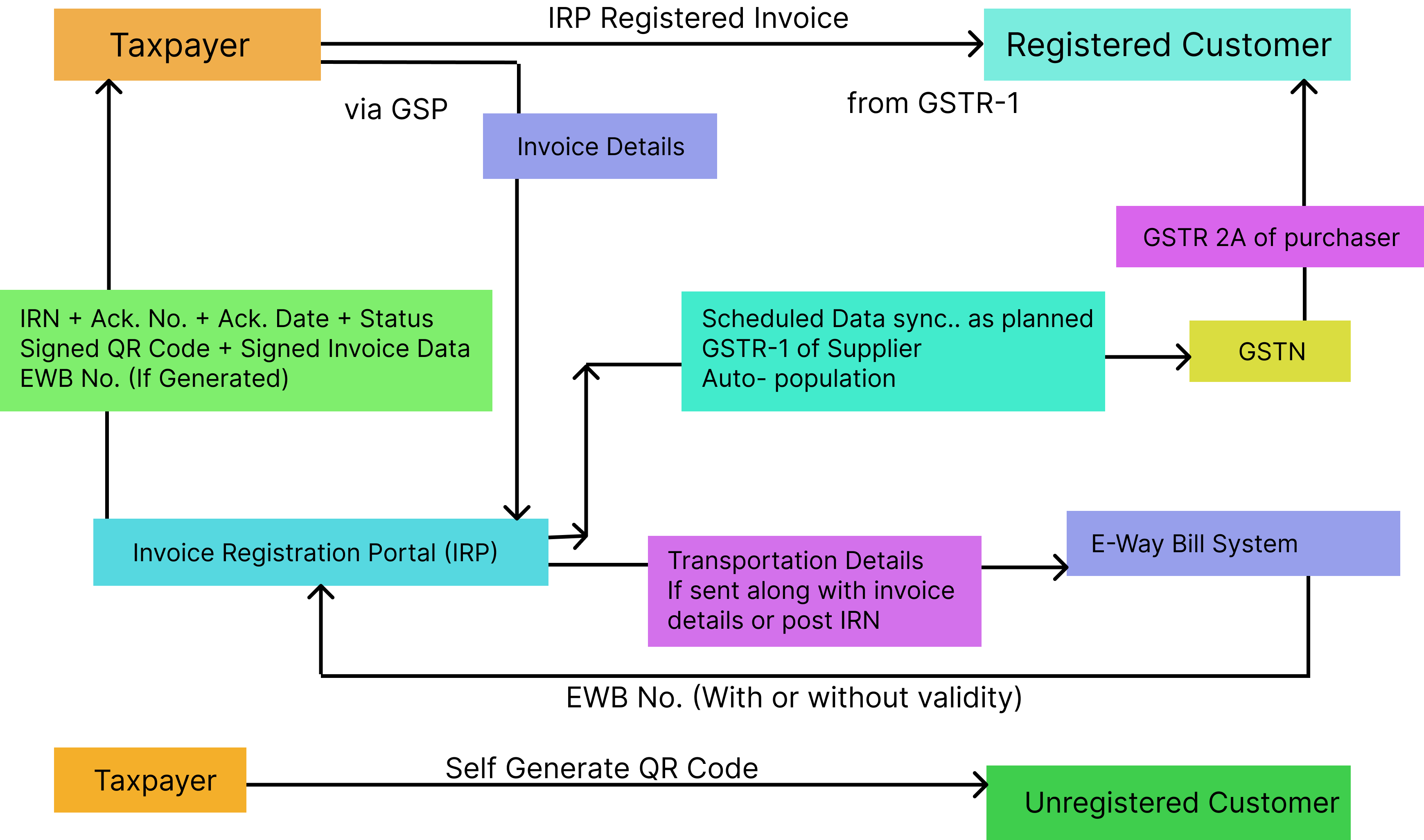

‘E-invoicing’ or ‘electronic invoicing’ is a system where in the tax payer will upload his invoice details and register his supply transaction on the Government Invoice Registration Portal (IRP)and get the Invoice Reference Number (IRN) generated by the IRP system. That is, the tax payer will first prepare and generate his invoice using his ERP/accounting system or manual system and then upload these invoice details to IRP and get the unique reference number, known as IRN. It is clarified again that the e-invoice does not mean preparation or generation of tax payer’s invoice on government portal but it is only intimating the government portal that invoice has been issued to the buyer, by registering that invoice on the government portal.

The basic aim behind adoption of e-invoice system is to reduce the submission of multiple statements and details by the tax payers and help the purchaser to get the Input tax credit easily.Registration of e-invoice of generation of IRN is the responsibility of the supplier, who will be required to report the invoice details to e-invoice system, which in turn will generate a unique Invoice Reference Number (IRN).

The taxpayers having aggregate turnover of 20 crore and above have to register at e-invoice system and generate IRN.

The taxpayers need to report the following documents to the e-invoice system.

- Invoice by Supplier

- Credit Note by Supplier

- Debit Note by Supplier

The ‘Invoice Status of Taxpayer’ under Search can be used to know the status of enablement of your GSTIN for generation of IRN.

All the registered users under GST who wish to generate IRN need to register on E-invoice system using his GSTIN. Once GSTIN is entered, the system sends an OTP to his registered mobile number registered with GST Portal and after authenticating the same, the system enables him to generate his/her username and password for the E-invoice system. After generation of username and password of his/her choice, he/she may proceed to make entries to generate IRN. Users who are already registered on the e-way bill portal need not to again register on the e-invoice system. User can use EWB login credentials to login at e-invoice system.

The Invoice Reference Number (IRN) is a unique number (also known as hash) generated by the e-invoice system using a hash generation algorithm. For every document such as an invoice or debit or credit note to be submitted on the e-invoice system, a unique 64 characters Invoice Reference Number (IRN) shall be generated which is based on the computation of hash of GSTIN of supplier of document (invoice or credit note etc.), Year and Document type and Document number like invoice number. This shall be unique to each invoice and hence be the unique identity for each invoice for the entire financial year in the entire GST System for a taxpayer.

Once the e-invoice system has validated and registered an IRN, it will be made available to the taxpayer for reference on e-invoice system for only 24 hours. The IRP after registering the invoice will share a digitally signed e-invoice for record of the supplier. You can download the invoice for further use and action. The digitally signed invoice is one which has been digitally or electronically signed by the IRP after receiving the invoice upload from the supplier. That is, the government is authenticating the genuineness of the invoice submitted/registered by the tax payer.

Anyone can verify the authenticity or the correctness of e-invoice by uploading the signed JSON file or Signed QR Code into e-invoice system. The option ‘Verify Signed Invoice’ under Search option can be selected and the signed JSON file can be uploaded and verified. Similarly, the QR Code Verify app may be downloaded and used to verify the QR Code printed on the Invoice.

The pre-requisite for generation of e-invoice is that the person who generates e-invoice should be a registered person on GST portal and e-invoice system or e-way bill system. The documents such as tax invoice or Debit Note or credit Note must be available with the person who is generating the e-invoice. If a user is generating Bulk invoices, then he/she should have a valid JSON file as per the e-invoice schema to upload on the e-invoice system or he/she has to integrated with API interface and generate the IRN.

The different supply types that can be reported are

- B2B: Business to Business,

- SEZWP: To SEZ with Payment ,

- SEZWOP: To SEZ without Payment,

- EXPWP: Export with Payment,

- EXPWOP: Export without Payment,

- DEXP: Deemed Export

Many of the businesses have multiple places of business or head office and branch at different locations or work remotely from the principal place of business. Generating IRN with a single login may be a challenge for them. To overcome this challenge business can create multiple sub-users. A sub-user can use the same login credentials created originally and perform the actions as per the access that is given to them. For example, a sub-user may be allowed to generate IRN and restricted to accept IRN.

Most of the times, the tax payer or authorized person himself cannot operate and generate IRN’s. He will be dependent upon his staff or operator to do that. He would not like to avoid sharing his user credentials to them. In some firms, the business activities will be operational 24/7 and some firms will have multiple branches. Under these circumstances, the main user can create sub-users and assign the roles to them. He can assign generation of IRN or report generation activities based on requirements. This facility helps him to monitor the activities done by sub-users. However, the main user should ensure that whenever employee is transferred or resigned, the sub-user account is frozen / blocked to avoid mis-utilization.

For every principal/additional place of business, user can create maximum of 10 sub-users. That is, if tax payer has only (one) principal business place (and no additional place of business), he can create 10 sub-users. If tax payer has 3 additional places and one principal place of business (i.e. 4 places), then he can create 40 (4 X 10) sub users.

The e-invoice system gives an option to the taxpayer to freeze the sub-user i.e. Disable the sub-user from using facilities on the e-invoice system.

- Step 1: Click ‘Freeze Sub-user’ under the option ‘User Management’ on the left-hand side of the dashboard

- Step 2: Select the sub-user you want to Freeze, the below screen opens up. Now click on ‘Freeze’ button appearing at the bottom of the screen. On clicking the ‘Freeze’ button, the sub-user will no longer be able to access any facilities on the e-invoice system.

The registered person can generate the IRN from his account from any registered business place. However, he/she needs to enter the address accordingly in the e-invoice form. He/she can also create multiple sub-users and assigned to these places and generate the IRN accordingly.

The user is allowed to generate report on daily basis. Because of criticality of the system for performance for 24/7 operation, the reports are limited to be generated for a day. The user can change date and generate the report for that date. Hence, the user is advised to generate report daily and save in his system.

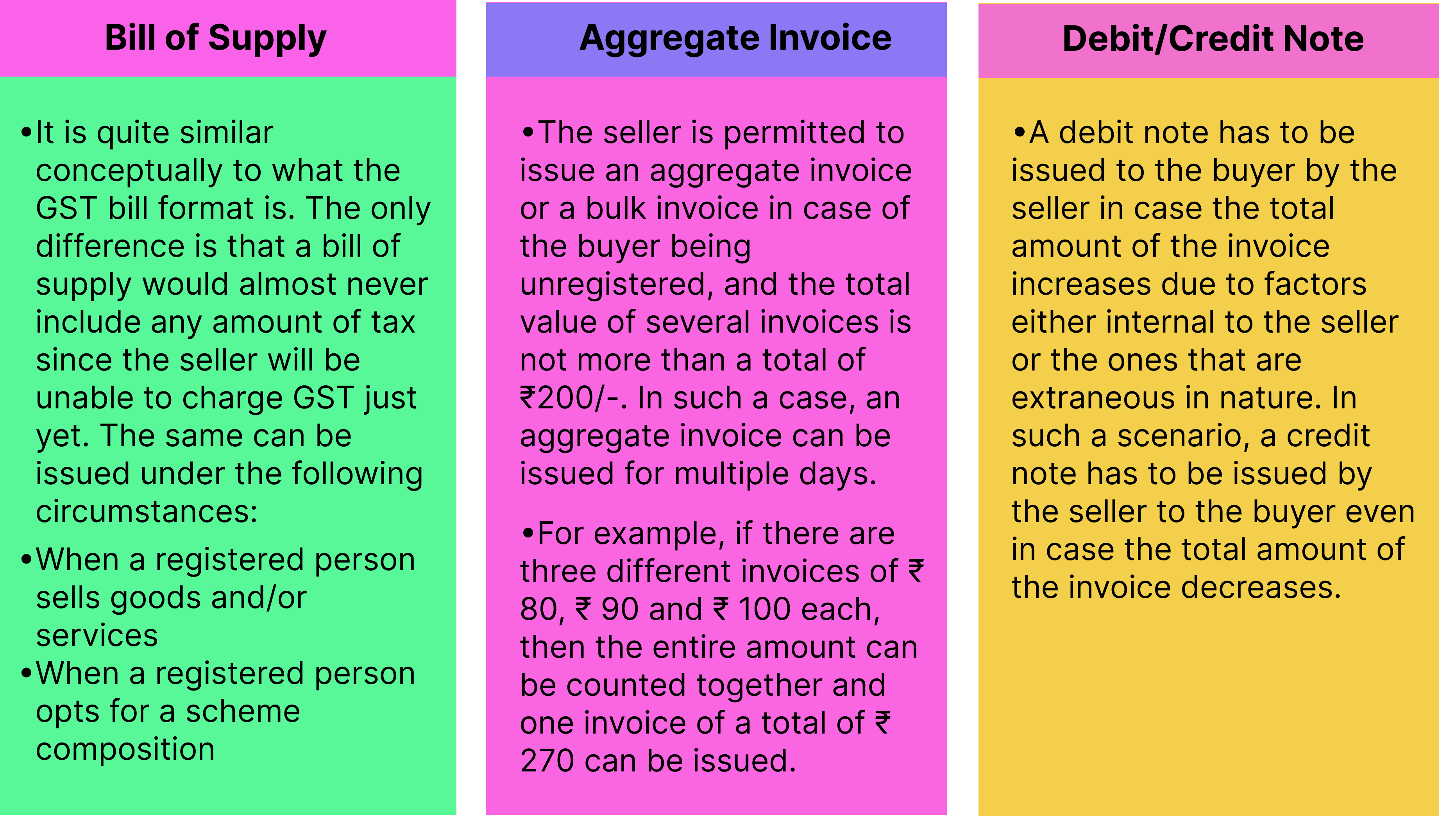

Types of GST Invoices

GST Invoices are issued by businesses that are GST registered. The sellers must maintain a particular GST invoice format while sending GST-complaint bills to the clients. Vendors registered with the GST council and have their own GST Identification Number (GSTIN) tend to provide the bills of purchase in the GST invoice format. GST invoice format has to be maintained mandatorily for every GST bill sent to the buyer from the seller. A GST bill format includes the likes of the following:

- The customer’s name

- The invoice date and the GST Invoice number

- The customer’s address, along with their GSTIN number,

- The place where the product is to reach

- The relevant SAC/HSN codes

- Applicable discounts

- Payable commissions and;

- Rates of Tax

Additionally, a GST invoice includes information such as the item's description in terms of physical dimensions, number of units, supplier's signature, and the monetary value attached. However, if the customer does not have a GSTIN number and the amount of the product exceeds 50,000, then the GST bill should carry the name of the recipient, their address, delivery address, and the name of the state along with its code.

There are particular and definite limitations on time limits that are to be kept in mind while issuing a GST invoice, as per the rules laid out for issuing GST invoices.

- In any normal case of goods, invoicing under GST should be issued on or before the delivery date.

- In cases of continuous supply of goods, invoicing under GST has to be issued on or before the day when the account statement is issued.

- In case of any general case of services, invoicing under GST should be issued within 30 days of the supply being made.

- In cases of services associated with banks or NBFCs, invoicing under GST has to be issued within 45 days of the supply being made.In cases such as that of banking and passenger transportation, certain relaxations are provided by the government in terms of GST invoicing and/or following the GST invoice format. It must be noted that you must generate your GST invoice format in an Excel sheet while keeping in mind the rules mentioned to ensure the smooth functioning of your business operations.

Can Invoices be revised?

Yes, invoices that are issued for the purpose of GST calculations can be revised. Every individual or business entity that is registered with the GST council will need to apply for a provisional registration prior to obtaining a certificate for a permanent one.

How many invoice copies are supposed to be issued per case?

- Three copies of the invoice must be issued in the case of goods.

- Two copies of the invoice must be issued in the event a service is being sold/ rendered.

From April 1, 2022, all companies registered under GST will be required to use e-invoice for B2B transactions, according to the Finance Secretary. E-invoicing was made available to the registered taxpayers with a turnover of more than 20 Crores in any previous financial year and because of this, there have been few changes made to the existing GST system to simplify and reduce the burden ofcompliance on the taxpayers.

The main advantage of e-invoicing is that it allows for a completely integrated flow from one company's ERP system to another, resulting in less invoice mismatches during reconciliation.

- Existing taxpayers who have their E-Way Bill (EWB) login credentials can use the same to log in to the E-Invoicing system.

- Section 12 of the e-Invoice schema asks for EWB details.

- Currently, the E-Way Bill and Invoice Reference Number (IRN) systems are running independently. This is expected to integrate in a phased manner.

- Through the e-Invoicing portal, taxpayers can:

- Generate E-Way Bills through IRN

- Generate EWB in bulk

- Print E-Way Bills

- E-Way Bill can be generated only for invoices and not for credit and debit notes.

- There may be certain types of transactions like job work, sales return, etc., which requires an E-Way Bill. E-Invoicing does not cover these transactions yet. Hence, the EWB will have to be generated under the existing system with other supporting documents.

- The regular E-Way Bill generation process will continue along with the additional facility of generating E-Way Bills through IRN.

- The validity of the E-Way Bill can be extended if the consignment has not reached the destination within the validity period due to exceptional circumstances like natural calamity, law and order issues, shipment delay, accident of conveyance, etc. The transporter has to explain the reason in detail while requesting for an extension.

Various domains under GST such as e-Way Bill System, Reverse Charge, Reporting of Invoices, availing Tax Credits, etc. are going to be impacted by e-Invoicing. Widely, the supplier creates the e-Way Bill but for exceptional cases, the transporter & the recipient can also create e-Way Bills, given that the creator must be registered under GST.

An e-Way Bill generation is an excellent compliance tool that helps keep the transportation process on track with the GST Rules, hence reducing the chances of Tax Evasion. Non-Compliance with the e-Way Bill Rule attracts penalties (minimum of 10,000), seizure, detention & confiscation of goods, leading to monetary losses for Businesses.

Working of E-Invoicing System

For example Mr. Arvind creates a B2B Sales Invoice against a purchase that he made for his Business.Under e-Invoicing, he needs to upload this Invoice to the unified Invoice Registration Portal.The Portal will verify if all the mandatory fields & values in the Invoice & correct.Upon successful validation, the IRP will generate a unique code- Invoice Reference Number & a Bar Code for the Invoice, turning it into an e-Invoice.

Note- In case of errors, the IRP will notify you & highlight the errors for your reference; you can rectify them & re-upload the Invoice.From here the e-Invoice data will be transferred to the e-Way Bill Portal, GST Portal & to the recipient if their e-mail ID is mentioned.After the successful creation of e-Invoice, the data will be available on the IRP for the next 24 hours. In case of any errors, the e-Invoice cannot be rectified, you must cancel it.

This too you need to do within 24 hours from the time of IRN generation.This simplifies work up to a large extent by automating most of the process. This also reduces the chance of errors & enhances accuracy.But the major function of the e-Invoicing System is increased transparency & accuracy in invoice management to reduce Tax Evasion.

Note - contrary to what its name suggests, e-Invoicing is in fact applicable to other important documents such as Credit Notes, Debit Notes, B2G (Business to Government) Invoices, Export Invoices & Reverse Charge Invoices as well.

The idea of e-invoicing is not new. Electronic invoices have been around for 30 years, using electronic data interchange (EDI) and XML formats. More recently, the main driver behind e-invoicing adoption has come from a government level.In Europe – the world’s most active region with regard to e-invoicing – a series of legislation has been created to promote the uptake of e-invoicing across the European Union. In fact, as of April 2020, EU countries are required to transpose the European Union’s e-Invoicing Directive into their national laws and comply with its associated standards.The concept of the online e-way bill under GST was to abolish the Border Commercial Tax Post to avoid tax evasion in India. Hence, it is crucial to know every aspect related to the e-way bill system under GST. The E-Way bill system is important for both the government as well as the business industry. Modern-day businesses are complex, complicated and maze-like structures. The latest developments in technology have created more challenges for a business owner, and simultaneously made some of the associated processes simpler.

The motive behind bringing these changes to the system is to ease up compliance & bring the Way Bill System further inside the GST Regime. To feed this agenda, the Government has also linked e-Way to GST Return Filing. Apparently, generation of way bills will be blocked for the taxpayers who have two or more consecutive GST Returns Pending to be filed.The Government is also considering to reconcile the e-Way Bill data with the data of GSTR-1 to cross verify if there were proper Way Bills against Invoices & vice versa.And now, there is the linking of e-Way Bill with the e-Invoicing system to make the process more thorough & revised. As automation will reduce manual entry & the errors, that follow the process, making the process more accurate.

As a result of all the system modification, there are going to be a few effects-

- Ease of Compliance for taxpayers

- Automation of the process to ensure accuracy &

- Reduced Tax Evasion.

These effects are for the benefit of the Businesses as well as for the Government.

How will e-invoicing impact or change business processes?

E-Invoice is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. Under the electronic invoicing system, an identification number will be issued against every invoice by the Invoice Registration Portal (IRP) to be managed by the GST Network (GSTN).

On uploading the invoice, a unique Invoice Reference Number (IRN) will be issued against each invoice.Non-generation of e-invoice will imply non-intimation of supply transactions to the government. Any invoice issued by the applicable taxpayer without the IRN is considered invalid invoice under the GST law.

Businesses will now have to get their systems integrated with the government’s invoice registration portal for a seamless generation of Invoice Reference Number (IRN) for every B2B invoice. They will also have to make changes in their accounting software to comply with the e-invoice scheme. Generating e-invoices will impact the business processes as follows-

The business will now have to identify transactions to which e-invoicing may apply and segregate them accordingly for compliance.

Businesses will have to maintain a vendor and customer master to incorporate additional information for invoices like bank details and payee details.

Businesses will have to make changes in the GST return preparation process since the B2B supplies can be auto-populated in the returns, and B2C supplies are manually updated.

Businesses will have to decide whether they want to comply with e-invoicing via API integration, offline utilities like GePP, or integrate via GSP (GST Suvidha Provider)

The biggest challenge that the businesses will face is to engage themselves in the continuous generation and capturing of IRNs. Big retailers generate thousands of B2B invoices in a day. They cannot make the customers wait till the time e-invoice is generated. Such businesses need to utilize the services of GSP for smooth implementation.

Therefore, ‘e-Invoicing’ or ‘electronic invoicing’ is a system in which B2B invoices is authenticated electronically by GSTN for further use on the common GST portal. Under the electronic invoicing system, an identification number will be issued against every invoice by the Invoice Registration Portal (IRP), managed by the GST Network (GSTN). The National Informatics Centre launched the first IRP at einvoice1.gst.gov.in.All invoice information will be transferred from this portal to both the GST portal and e-way bill portal in real-time. Therefore, it will eliminate the need for manual data entry while filing GSTR-1 returns and generation of part-A of the e-way bills, as the information is passed directly by the IRP to the GST portal.

Why e-Invoices are required?

Earlier when invoices were generated, many people used fake invoices to avoid tax and commit fraud, which was a major issue for the government. Mechanism of e-Invoicing was proposed in order to put an end to these practices by mandating the e-Invoices from government portal.

Key benefits of e-Invoicing:- All the invoicing details for GST filing required only once.

- Elimination of invoice mismatching during reconciliation.

- Standard invoices faced issue of interoperability due to multiple software.

- Invoices can be tracked in real-time.

Invoice can be created by proper accounting or billing software which should be according to the format of e-Invoicing. Using standard hash-generation algorithm, unique invoice number which is Invoice Reference Number can be generated by supplier. The Invoice Registration Portal will validate the Invoice Reference Number and authenticate the file against central registry of GST to avoid any duplication. After successful verification, the invoice will be updated with IRP’s digital signature and QR code will be added on JSON file. Furthermore, the uploaded data will be shared with E-way bill and GST system.

The E-Invoicing API specifications were released on 5th August on sandbox for testing and the production begins from 15th August 2020. Also, from now on E-invoicing and E-way Bill generation can take place simultaneously as well.

Under the e-invoicing mandate, invoices that the taxpayers generate need to be registered on the official e-invoicing portal set up by the Government called as Invoice Registration Portal (IRP) in response of which an Invoice Registration number (IRN) is generated unique to every invoice. As a step ahead, the Government has streamlined the generation of E-way Bill with E-Invoicing. And IRP can be used to generate not only IRN but also E-way bills, for the documents which qualify. Thus, depending on the data sent, the IRP system will return IRN or E-way Bill Number or both.

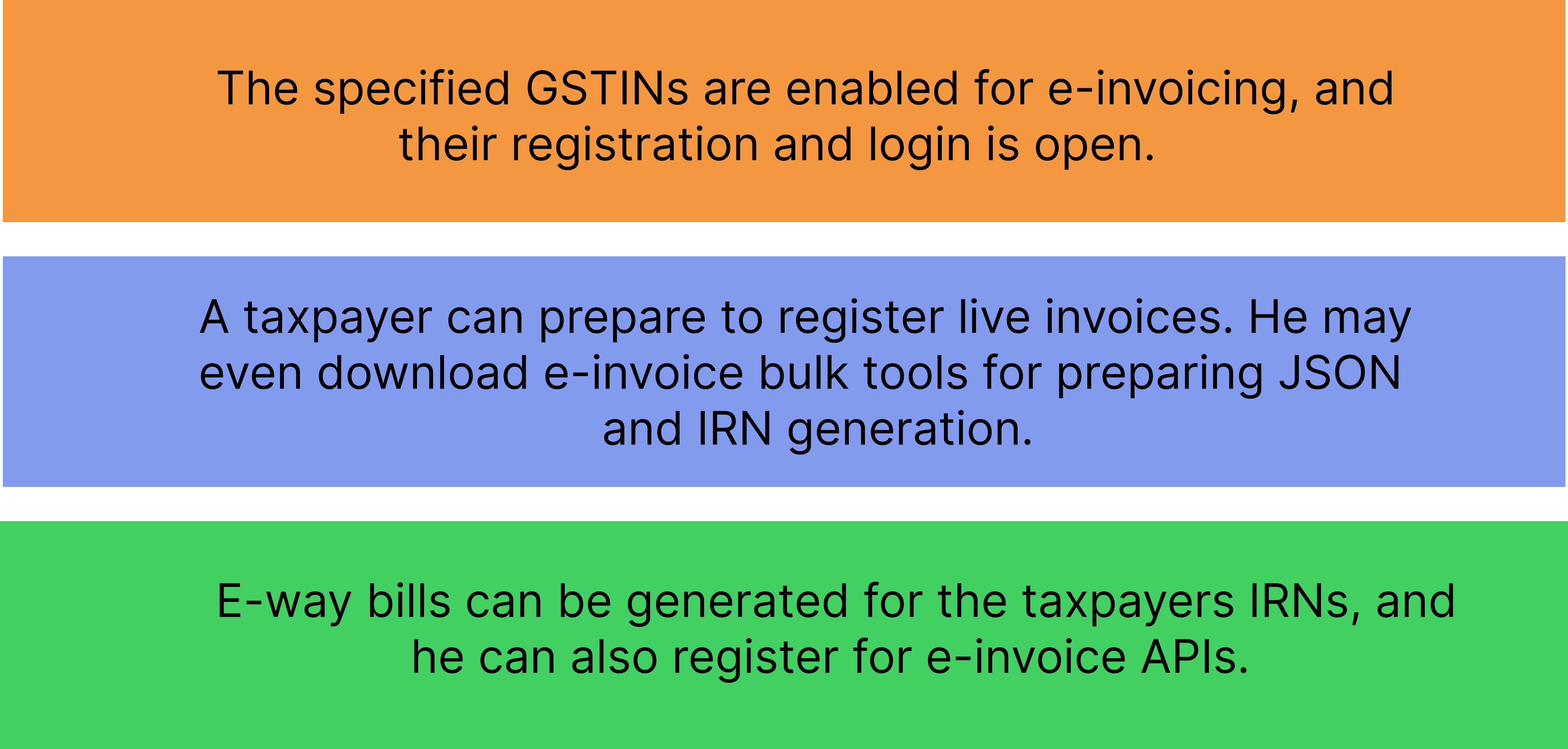

National Informatics Centre (NIC) - Guidelines

NIC has issued the below guidelines for the taxpayers whose turnover exceeds 20 crore:

The e-invoice system requires intimation of all the B2B supply transactions to the government by way of uploading invoice on the IRP (invoice registration portal). A taxpayer can first generate an invoice or the debit or credit note on his accounting software/ERP.

Thereafter, he/she must upload the invoice on the IRP. On uploading the invoice, a unique Invoice Reference Number (IRN) will be issued against each invoice. Non-generation of e-invoice will imply non-intimation of supply transactions to the government. Any invoice issued by the applicable taxpayer without the IRN is considered invalid invoice under the GST law. In other words, it is regarded as a non-issue of invoice and thus attracts various penalties as listed in the next section.

The most significant benefit of e-Invoicing for taxpayers related to SEZs’, Exports and Deemed Exports is the automated refund of GST Input Tax Credit (ITC), and GST already paid on exports. The GST and ICEGATE systems are expected to share the information between them electronically, and this will result in lesser compliance. Claiming of refunds is currently one of the challenges faced by the businesses.

The e-Invoice API (Application Programming Interface) access mechanismThere are several ways in which the taxpayer’s system can interact with the IRP for IRN generation:

- Companies have direct access to APIs- In this case, a taxpayer can generate his username and password and access API through client ID and client secret of the company that has access to the API.

- Taxpayers having access to e-way bill APIs- If the taxpayer already has access to the e-way bills API, then he can use the same credentials to access the e-invoice system.

- Through GSPs (Generalized System of Preferences), the taxpayer can generate his username and password and tie-up with GSPs to access API using the Client ID and Client Secret of the GSPs.

- Through ERPs (Enterprise Resource Planning), the taxpayer can generate his username and password and tie-up with ERPs to access API using the Client Id and Client Secret of the ERPs.

Disbursement of Demand Incentives

All invoice information is transferred from e-nvoice1.gst.gov.in portal to both the GST portal and e-way bill portal in real-time. Therefore, it eliminates the need for manual data entry while filing GSTR-1 return as well as generation of part-A of the e-way bills, as the information is passed directly by the IRP to GST portal.

Businesses will have the following benefits by using e-invoice initiated by GSTN:

- E-Invoice resolves and plugs a major gap in data reconciliation under GST to reduce mismatch errors i.e. elimination of invoice mismatching during reconciliation.

- All the invoicing details for GST filing required only once.

- E-Invoices that are created on one software which can be read by another, allowing interoperability and help reduce data entry errors.

- Real-time tracking of invoices prepared by the supplier is enabled by e-invoice.

- Backward integration and automation of the tax return filing process – the relevant details of the invoices would be auto-populated in the various returns, especially for generating the part-A of e-way bills.

- Faster availability of genuine input tax credit.

- Lesser possibility of audits/surveys by the tax authorities since the information they require is available at a transaction level.

It will help in curbing tax evasion in the following ways:

- Tax authorities will have access to transactions as they take place in real-time since the e-invoice will have to be compulsorily generated through the GST portal.

- There will be less scope for manipulating invoices since the invoice gets generated before carrying out a transaction.

- It will reduce the chances of fake GST invoices, and the only genuine input tax credit can be claimed as all invoices need to be generated through the GST portal. Since the input credit can be matched with output tax details, it becomes easier for GSTN to track fake tax credit claims.

E-Invoicing does not imply the generation of invoices on the GST portal. Instead, e-invoicing involves the submission of an already generated standard invoice on a common e-invoice portal. Thus, it automates multi-purpose reporting with a one-time input of invoice details.

Advantages of e-invoicing

Documents become tax compliant on real time basis

Single source of truth for fiscal purposes

Compliance becomes part of natural business process and supply chain system

Real time auto-population of invoice details into return

Simultaneous generation of e-way Bill, where required

E-invoicing can mitigate fraudulent practices in GST, especially the menace of fake invoices.

Gives fillip to initiatives like ‘invoice financing’ by enabling use of invoice as collateral, especially by small and medium businesses (e.g. TReDS)

Paves way for inter-operability among businesses, i.e. by allowing direct transmission of invoices in structured digital format from one finance system to another

Eliminates data entry errors

Reconciliation issues get reduced

Disputes among transacting parties get reduced

Faster payment cycles

Processing cost gets reduced

Better Internal Controls

Enhances overall efficiency of businesses

Advantages of e-invoicing for various parties

The key benefits for buyers, suppliers and managers include:

Significant cost and time savings can be achieved by removing paper and manual processing from your invoicing. But the real benefits of e-invoicing come with the level of integration you can achieve, not only with your trading partners but also between your invoicing software and other business systems. For accounts payable (AP) in particular, integrating e-invoices directly into the AP automation solution further drives touch less invoice processing - which frees up time and resources for more value-adding and strategic tasks.

Starting to send and receive e-invoices can be an excellent first step of your organization’s digital transformation journey, and a critical step in ensuring that your business operations are efficient and scalable to support future growth.

What is the current system in place for issuing invoices?Currently, businesses generate invoices through various software and the details of these invoices are manually uploaded in the GSTR-1 return. Once the respective suppliers file the GSTR-1, the invoice information is reflected in GSTR-2A for the recipients for viewing only. On the other hand, the consignor or transporters must generate e-way bills by again importing the invoices in excel or JSON manually.

Under the e-invoicing system (to be implemented from 1st October 2020), the process of generating and uploading invoice details will remain the same. It will be done by importing using the excel tool/JSON or via API integration, either directly or through a GST Suvidha Provider (GSP). The data will seamlessly flow to GSTR-1 preparation and for the e-way bill generation too. The e-invoicing system will be the key tool to enable this.

E-invoicing – Legal Provisions

As per Rule 48(4) of CGST Rules,

- notified class of registered persons

- to prepare invoice

- by uploading specified particulars in FORM GST INV-01

- on Invoice Registration Portal (IRP) and

- obtain Invoice Reference Number (IRN)

After following above ‘e-invoicing’ process, the invoice copy (with QR Code containing inter alia, IRN) issued by the notified supplier to buyer is commonly referred to as ‘e-invoice’.Invoice issued by the notified person in any other manner shall not be treated as an invoice. (Rule 48(5))Where e-invoicing is applicable, issuing of invoice in duplicate/triplicate is not required (Rule 48(6))

Implications for Taxpayers

Taxpayers continue to create their GST invoices on their own Accounting/Billing/ERP Systems

Necessary changes on account of e-invoicing requirement (i.e. to enable reporting of invoices to IRP and obtain IRN), will be made by ERP/Accounting and Billing Software providers in their respective software.

Not voluntary; only those above specified turnover are enabled to report invoices on IRP

How to know a particular supplier is supposed to issue e-invoice (i.e. invoice along with IRN/QR Code)?

On fulfillment of prescribed conditions, the obligation to issue e-invoice in terms of Rule 48(4) (i.e. reporting invoice details to IRP, obtaining IRN and issuing invoice with QR Code) lies with concerned taxpayer.However, as a facilitation measure, taxpayers who had crossed the prescribed turnover from 2017-18 onwards were enabled to report invoices to IRP. Note that the listing is based on the turnover of GSTR-3B as available in GST System.One can search the status of enablement of a GSTIN on e-invoice portal: https://einvoice1.gst.gov.in/ Search > e-invoice status of taxpayer

This listing is based on the turnover of GSTR-3B as reported to GST System. So, it has to be noted that enablement status on e-invoice portal doesn’t mean that the taxpayer is supposed to do e-invoicing. If e-invoicing is not applicable to a taxpayer, they need not be concerned about the enablement status and may ignore it.In case any registered person, is required to do e-invoicing but not enabled on the portal, he/she may request for enablement on portal: ‘Registration -> e-Invoice Enablement’.

GST-E-Invoicing IRN System-Schema / Format

- E-invoice schema is notified as ‘INV-1’

- ‘Schema’ simply means a structured template or format

- ‘e-invoice’ schema is the standard format for electronic invoice

- Invoice details in prescribed schema to be reported to IRP in JSON format (JavaScript Object Notation)

- ‘JSON’ can be thought of as a common language for systems/machines to communicate between each other and exchange data

- Businesses are already preparing/generating invoices in their ERPs/Accounting/Billing Software; the same to continue without any change

- ‘Schema’ acts as uniform standard for ERP/ Billing/ Accounting software providers to build utility in their solution/package to prepare e-invoice, for reporting to IRP

- Schema ensures e-invoice is ‘machine-readable’ and ‘inter-operable’, i.e. the invoice/format can be readily ‘picked up’, ‘read’, ‘understood’ and further processed by different systems like Tally, SAP etc.

- Schema facilitates ‘machine-to-machine’ exchange of invoice data

- Schema has got only 29 mandatory fields. All other fields are optional.

- Digital signature (DSC) of supplier not required while reporting e-invoice to IRP

- Maximum number of line items which can be reported in a single invoice is 1000 at present. It will be enhanced based on requirement in future.

- Schema caters to only items chargeable to GST. For items outside GST levy, separate invoice may be given by businesses.

- In case of Credit Note and Debit Note, no linkage with invoice is built.

- Taxpayer needs a system/utility to report e-invoice details in JSON format to IRP and receive signed e-invoice in JSON format.

- Modes for reporting e-invoice: Multiple modes available so that taxpayer can use one based on his/her need:

Invoice Registration Portal (IRP) is the website for uploading/reporting of invoices by the notified persons. Vide notification no. 69/2019-Central Tax dated 13.12.2019, ten portals were notified for the purpose of preparation of the invoice in terms of Rule 48(4). The first Invoice Registration Portal (IRP) is already active and can be accessed at: https://einvoice1.gst.gov.in/

Multiple Invoice Registration Portals (IRPs) will be established to ensure uninterrupted availability. IRP will only be a pass-through portal. It will not store or archive e-invoice data.

- Specified validations will be performed by IRP on invoice data

- IRN will be generated in sub-200 milliseconds duration

- Facility available for bulk-upload of invoices (bulk generation tool)

- The uploaded invoice data will be digitally signed by IRP

- In case of breakdown of internet connectivity in certain areas, a localized mechanism to provide relaxation by Commissioner is provided.

- IRN is a unique 64-character hash/string: 35054cc24d97033afc24f49ec4444dbab81f542c555f9d30359dc75794 e06bbe

- A GST invoice will be valid only with a valid IRN

- IRN Need not be printed on e-invoice (It’s already embedded in QR Code)

- An invoice/document number which was reported and obtained IRN, can’t be used again

IRN Cancellation & Amendments

Reporting: No prescribed time window for reporting to IRP

Cancellation:- IRN can be cancelled within 24 hours (from the time of generation of IRN).

- However, if the connected e-way bill is active or verified by officer during transit, cancellation of IRN will not be permitted

- In case of cancellation of IRN, GSTR-1 also will be updated with such ‘cancelled’ status.

- Amendments are not possible on IRP.

- Any changes in the invoice details reported to IRP can be carried out on GST portal (while filing GSTR-1).

- However, these changes will be flagged to proper officer for information.

Along with signed invoice, IRP will also give a QR code (QR code will enable Offline verification of invoices using Mobile App) containing the unique IRN and below key particulars:

- GSTIN of supplier

- GSTIN of Recipient

- Invoice number as given by Supplier

- Date of generation of invoice

- Invoice value (taxable value and gross tax)

- Number of line items.

- HSN Code of main item (the line item having highest taxable value)

- Invoice Reference Number (IRN)

- Date of generation of IRN

- The QR code which comes as part of signed JSON from IRP shall be extracted and placed on the invoice.

- However, printing of QR code on separate paper is not allowed.

- While the printed QR code shall be clear enough to be readable by a QR Code reader, the size and its placing on invoice is upto the preference of the businesses.

- Acknowledgement No.” and “Date” given by IRP are only for reference. They need not be printed on e-invoice

- Being a 15-digit number, the acknowledgement number will also come handy for printing e-invoice or for generating e-way bill (instead of keying in the 64- character long IRN).

- One can verify the authenticity or correctness of e-invoice:

- By uploading the signed JSON file or Signed QR Code into e-invoice system: einvoice1.gst.gov.in > Search > ‘Verify Signed Invoice’

- Alternatively, with “Verify QR Code” mobile app which may be downloaded from einvoice1.gst.gov.in > Help > Tools > Verify QR Code App

Notification No. 14/2020-Central Tax dated 21st March, 2020 mandates entities with aggregate turnover > 500 crores (now aggregate turnover > 20 crores) in a FY to include QR code on their B2C invoices. It is also specified that a Dynamic Quick Response (QR) code made available to buyer through digital display (with payment cross-reference) shall be deemed to be having QR code. The purpose of this Notification is to enable and encourage digital payments. It has no relevance or applicability to the e-invoicing in respect of B2B Supplies by notified class of taxpayers.

GSTR-1 Auto-Population

The IRP will push the relevant invoice data (payload) to GST System. The GST system will auto-populate them into GSTR-1 of the supplier.

For all the taxpayers, who are generating e-invoice, their GSTR-1 (Sections B2B, CDN, EXP, Table12) will be auto-populated with e-invoice data.

| GSTR-1 Table no. | GSTR-1 Table description |

| 4A,4B,4C,6B,6C | B2B Invoices |

| 6A | Export Invoices |

| 9B | Credit/Debit Notes |

| 12 | HSN-wise summary of outward supplies |

- GST system will do mapping of E-invoice fields with GSTR1 fields, aggregate items on rate and populate GSTR-1.

- In case the e-invoice is cancelled, the auto-populated details will be removed from GSTR-1, automatically. The status also will be updated accordingly.

- Taxpayer will be able to edit auto-populated e-invoice data in GSTR-1.

- Invoice uploaded by Taxpayer will take precedence i.e. if a taxpayer has reported invoices first in e-invoice system and uploaded the same again in GSTR-1, then invoice uploaded by Taxpayer will prevail;

- GST system will provide G2B API to get complete e-invoice data.

- GST System will enhance GSTR1, GSTR2A, GSTR2B, GSTR6A APIs and offline tool to include IRN and IRN date. (In second phase)

- To start with, data from e-invoice will be pulled once every night, so data uploaded in e-invoice system on ‘T’ will be available on ‘T+1’ basis, in GSTR-1 and GSTR-2A/GSTR-6A. After stabilization,this will be made available in near real-time basis.

| S No | E-invoice Field name | GSTR1 field name |

| 1 | Supply_Type_Code | Invoice type (This Field will be used for mapping invoice to different sections of GSTR1 like B2B/SEZWOP/SEZWP/DEXP invoices will be mapped to B2B section of GSTR1) |

| 2 | Document_type_code | It will be used to decide CDN or other sections |

| 3 | Document_Num | Supplier Invoice number |

| 4 | Document_Date | Supplier Invoice Date |

| 5 | Reverse_charge | Reverse Charge |

| 6 | Supplier_Legal_Name | Supplier Legal Name |

| 7 | Supplier_trading_name | Trade Name of Supplier |

| 8 | Supplier_GSTIN | Supplier GSTN |

| 9 | Recipient_Trade_Name | Buyer Trade name |

| 10 | Recipient_ GSTIN | Receiver GSTIN |

| 11 | Place_Of_Supply_State_ Code | Place of Supply (POS) |

| 12 | Total_Invoice_Value_INR | Supplier Invoice Value |

| 13 | HSN code | HSN code (Table-12) |

| 14 | Quantity | Quantity (Table 12) |

| 15 | UQC (UOM) | UQC (Unit of Measure) of goods sold (Table 12) |

| 16 | GST Rate | Rate |

| 17 | Taxable Value | Taxable value of Goods or Service as per invoice |

| 18 | IGST_amt | IGST Amount as per item |

| 19 | CGST_amt | CGST Amount as per item |

| 20 | SGST_UTGST Amt | SGST/ UTGST Amount as per item |

| 21 | Comp_Cess_Amt_ Ad_Valorem | CESS Amount as per item |

| 22 | Shipping_Bill_Number | Shipping Bill Number |

| 23 | Shipping_Bill_Date | Shipping Bill Date |

| 24 | Port_Code | Port Code |

Process of e-invoicing fl

| B2G API | |||

| G2G API | |||

| Supplier | Invoice Registration Portal | GST System | Buyer |

|

|

|

|

|

|

|

|

Diagrammatic presentation of the e-invoicing process

What is the process of getting an e-invoice?

The following are the stages involved in generating or raising an e-invoice.

- The taxpayer has to ensure to use the reconfigured ERP system as per PEPPOL (Pan-European Public Procurement) standards. He could coordinate with the software service provider to incorporate the standard set for e-invoicing, i.e. e-invoice scheme (standards) and must have the mandatory parameters notified by the CBIC (Central Board of Indirect taxes and customs), at least.

- Any taxpayer has got primarily two options for IRN generation:

The taxpayer must thereafter raise a regular invoice on that software. He must give all the necessary details like billing name and address, GSTN of the supplier, transaction value, item rate, GST rate applicable, tax amount, etc.

Once either of the above options is chosen, raise the invoice on the respective ERP software or billing software. Thereafter, upload the details of the invoice, especially mandatory fields, onto the IRP using the JSON file or via an application service provider (app or through GSP) or through direct API. The IRP will act as the central registrar for e-invoicing and its authentication. There are several other modes of interacting with IRP, such as SMS-based and mobile app-based.IRP will validate the key details of the B2B invoice, check for any duplications and generate an invoice reference number (hash) for reference. There are four parameters based on which IRN is generated:

- Seller GSTIN,

- invoice number,

- FY in YYYY-YY, and

- Document type (INV/DN/CN).

IRP generates the invoice reference number (IRN), digitally signs the invoice and creates a QR code in Output JSON for the supplier. On the other hand, the seller of the supply will get intimated of the e-invoice generation through email (if provided in the invoice).

IRP will send the authenticated payload to the GST portal for GST returns. Additionally, details will be forwarded to the e-way bill portal, if applicable. The GSTR-1 of the seller gets auto-filled for the relevant tax period. In turn, it determines the tax liability.

A taxpayer can continue to print his invoice as being done presently with a logo. The e-invoicing system only mandates all taxpayers to report invoices on IRP in electronic format.

Steps to prepare for e-invoicing implementation

E-invoice is a new concept in India. Thus, businesses will have to take certain steps for the smooth implementation of e-invoicing:

- Changes in the accounting software- Businesses will have to re-configure their ERP/accounting system to communicate with the IRP portal for IRN generation. Also, the printing infrastructure will have to be re-configured to incorporate additional fields such as QR code. Such changes will require a significant amount of investment.

- Providing educational sessions to the employees- Before e-invoicing, businesses used to generate invoices using common formats. But, e-invoicing requires organizations to follow standard formats. This format is divided into three parts-e-invoice schema, masters and e-invoice template. Thus, to familiarize the employees with the new compliances, they will have to impart training to its employees.

- Choosing the best ERP integration- The most common integrations for e-invoice generation are API based and SFTP based. An organization may choose the integration based on its budget and specific business requirements.

- Data security- Ensuring data security is most important as the e-invoices will mostly be directly generated from the organizations ERP/accounting software. This accounting software contains vital information about its business. Also, if a taxpayer is planning to use ASP/GSP services, use two-factor authentication enabled and ISO 27001 certified.

Web-based

- A taxpayer can enter the invoice details through the website of IRP for IRN generation.

API-based

- Through this mode, the taxpayers accounting system can interact with IRP and generate IRN. IRN can be generated either one at a time or in bulk.

SMS-based

- This method involves entering invoice details in a specified format and sending it to the IRP through SMS for further processing.

Mobile app-based

- GSTIN has also made mobile apps available for taxpayers for e-invoicing compliances.

Offline tool-based

- The invoice details can be updated through the offline tool available on the IRP portal.

GSP-based

- Taxpayers can take services of GSP for IRN generation.

Documents/Supplies Covered

| Documents covered | Supplies Covered |

| Invoices | Supplies to registered persons (B2B) |

| Credit Notes | Supplies to SEZs (with/without payment) |

| Debit Notes | Exports (with/without payment) |

| Deemed Exports |

| Where Applicable | Where Not Applicable |

| For Registered persons whose aggregate turnover (based on PAN) in any preceding financial year from 2017-18 onwards, is more than prescribed limit (as per relevant notification) i.e. Has a turnover of 20 crore or more (based on PAN) in the previous financial year. | Supplies to Govt. department having a GSTIN (as entity supplying goods/services/ deducting TDS) |

| Invoices between two different GSTINs under same PAN | Supplies to Government Departments where they don’t have any registration under GST |

| Invoices issued by notified person for supplies made by him but attracting reverse charge under Section 9(3) | When notified persons receive supplies:

|

| Issues B2B invoices. | B2C invoices issued by notified persons are not under the purview of e-Invoicing currently. |

| Supplies goods or services or both to a registered person (recipient or transporter of supplies cannot generate e-Invoices). | NIL-rated or wholly-exempt supplies |

| Taxpayers undertaking Exports (with/without payment) and Deemed Exports are liable to generate e-Invoices. | E-Invoicing is not applicable for import Bills of Entry. |

| Supplies to SEZs (with/without payment) are covered under e-Invoicing. | Entities exempt from e-invoicing:

|

| SEZ Developers who have the specified turnover (while fulfilling the other conditions) are required to generate e invoicing under GST. | Invoices issued by Input Service Distributors (ISD) are not covered under e-Invoicing. |

| DTA units are required to issue e invoice under GST applicability if other guidelines are met. | Non-GST Supplies (alcoholic liquor, Petrol, Diesel etc.) |

| Persons registered in terms of Rule 14 of CGST Rules (OIDAR | |

| Financial/commercial credit notes | |

| High sea sales and bonded warehouse sales |

Salient Features of Invoice Registration Portal (IRP)

- IRP is only a pass through validation portal. Certain key fields will be validated on IRP. So, IRN will be generated instantaneously, in sub-200 millisecond duration. The server capacity is robust enough to handle simultaneous uploads.

- Further, multiple IRPs will be made available to distribute the load of invoice registration.

- Signature (DSC) of supplier not required while reporting e-invoice to IRP In e-invoice schema, only 29 fields are mandatory. All others are optional.

- Where e-invoicing is applicable, there is no need of issuing invoice copies in triplicate/duplicate (Rule 48(6)).

- Where e-invoicing is applicable, carrying e-invoice print during transportation of goods is not mandatory.

- As per Rule 138A(2) of CGST Rules, where e-invoicing is applicable, “the Quick Reference (QR) code having an embedded Invoice Reference Number (IRN) in it, may be produced electronically, for verification by the proper officer, in lieu of the physical copy of such tax invoice.

One can verify the authenticity or correctness of e-invoice by uploading the signed JSON file or Signed QR Code (string) on e-invoice portal:

- There is no validation to the effect that the ‘document date’ (in the payload to IRP) has to be within a specified time window, for reporting to IRP/generation of IRN.

- 1000 is the maximum number of line items which can be reported in a single invoice. This will be enhanced based on requirement in future.

- Penal provisions for not issuing invoice in accordance with GST Law/rules are provided in Section 122 of CGST/SGST Act, read with CGST/SGST Rules.

It is the taxpayer’s obligation to:

- Report the invoice details to the IRP,

- Obtain IRN and

- Issue the final invoice with QR code.

However, as a facilitation measure, the Government has enabled the invoice reporting on IRP for taxpayers who have had an annual turnover more than 500 crores in any financial year from 2017-18. This enablement has been made based on the turnover reported in the GSTR-3B of the taxpayer.Taxpayers can view the status of enablement of a GSTIN on the e-invoice portal.

Auto-population of GSTR-1/2A and generation of e-way bill

On successful reporting of invoice details to IRP, the GST system will auto-populate them into GSTR-1 of the supplier and GSTR-2A of respective receivers.

With source marked as ‘e-invoice’, IRN and IRN date will also be shown in GSTR-1 and GSTR-2A. -population of details from e-invoices into GSTR-1 is only a facility extended to taxpayers.

The Scheme is expected to contribute significantly to achieving a USD 1 trillion digital economy and a USD 5 trillion GDP by 2025.

In self-assessment, the statutory obligation to file GSTR-1 with accurate details as per documents raised during the relevant tax period lies with taxpayer.

Where the details auto-populated into GSTR-1 from e-invoices are edited/deleted or re-uploaded afresh by the supplier, the ‘Source’, ‘IRN’ and ‘IRN date’ will be reset to blank in respective tables of GSTR- 1 and also won’t get reflected in GSTR-2A also.

So, non-appearance of IRN details in GSTR-1/2A alone shouldn’t be as used to mean that such invoices were not reported to IRP.

In case both Part-A and Part-B of e-way bill are provided while reporting invoice details to IRP, they will be used to generate e-way bill.

In case Part-B details are not provided at the time of reporting invoice to IRP, the same will have to be provided by the user through ‘e-way bill’ tab in IRP log in or e-Way Bill Portal, so as to generate e-way bill.

After generation of IRN, presently, there is no time limit for generation of e-way bill using that IRN (where applicable/desired).

- Step 1: Visit https://einvoice1.gst.gov.in/

- Step 2: Under ‘Search’, select ‘e-Invoice Status of Taxpayer’.

- Step 3: Enter ‘GSTIN’ and ‘Captcha’ and click on ‘Go’.

- Step 4: View details

- Note: In case any registered person is required to follow the e-Invoicing guidelines, but is not enabled on this portal, he/she will have to register on the portal.

- Step 1: Visit https://einvoice1.gst.gov.in/

- Step 2: Under Registration, select ‘e-Invoice Enablement’.

- Step 3: Add the required details and proceed.

However, in case any registered person, who doesn’t have the requirement to report invoices, is enabled on this portal, the same may be brought to the notice of the Government by writing an email to support.einv.api@gov.in.

State Incentives

The e-invoice system will generate the IRN, and then digitally sign the e-invoice and the QR code (quick response code). The QR code will enable a quick view, and validation and access of the invoices from handheld devices. The QR code will consist of the following parameters: The GSTIN of supplier.

Step 1 – Creation of the invoice on the taxpayer’s ERPThe taxpayer will continue to generate invoices in the normal course of business. However, the reporting of these invoices electronically has criteria. It needs to be done as per the e-invoice scheme along with mandatory parameters. The mandatory fields of an invoice for the supply of goods are listed below:

| S. No. | Name of the field | List of Choices/ Specifications/Sample Inputs | Remarks |

|---|---|---|---|

| 1. | Document Type Code | Enumerated List such as INV/CRN/DBN | Type of document must be specified |

| 2. | Supplier_Legal Name | String Max length: 100 | Legal name of the supplier must be as per the PAN card |

| 3. | Supplier_GSTIN | Max length: 15 Must be alphanumeric | GSTIN of the supplier raising the e-invoice |

| 4. | Supplier_Address | Max length: 100 | Building/Flat no., Road/Street, Locality, etc. of the supplier raising the e-invoice |

| 5. | Supplier_Place | Max length: 50 | Supplier’s location such as city/town/village must be mentioned |

| 6. | Supplier_State_Code | Enumerated list of states | The state must be selected from the latest list given by GSTN |

| 7. | Supplier Pincode | Six digit code | The place (locality/district/state) of the supplier’s locality |

| 8. | Document Number | Max length: 16 Sample can be Sa/1/2019 | For unique identification of the invoice, a sequential number is required within the business context, time-frame, operating systems and records of the supplier. No identification scheme is to be used |

| 9. | Preceeding_Invoice_Reference and date | Max length:16 Sample input is Sa/1/2019” and “16/11/2020 | Detail of original invoice which is being amended by a subsequent document such as a debit and credit note. It is required to keep future expansion of e-versions of credit notes, debit notes and other documents required under GST |

| 10. | Document Date | String (DD/MM/YYYY) as per the technical field specification | The date when the invoice was issued. However, the format under |

| S. No. | Name of the field | List of Choices/ Specifications/Sample Inputs | Remarks |

|---|---|---|---|

| explanatory notes refers to ‘YYYY-MM-DD’. Further clarity will be required. Document period start and end date must also be specified if selected. | |||

| 11. | Recipient_ Legal Name | Max length: 100 | The name of the buyer as per the PAN |

| 12. | Recipient’s GSTIN | Max length: 15 | The GSTIN of the buyer to be declared here |

| 13. | Recipient’s Address | Max length: 100 | Building/Flat no., Road/Street, Locality, etc. of the supplier raising the e-invoice |

| 14. | Recipient’s State Code | Enumerated list | The place of supply state code to be selected here |

| 15. | Place_Of_Supply_State_ Code | Enumerated list of states | The state must be selected from the latest list given by GSTN |

| 16. | Pincode | Six digit code | The place (locality/district/state) of the buyer on whom the invoice is raised/ billed to must be declared here if any |

| 17. | Recipient Place | Max length: 100 | Recipient’s location (City/Town/Village) |

| 18. | IRN- Invoice Reference Number | Max length: 64 Sample is ‘a5c12dca8 0e7433217…ba4013 750f2046f229’ | At the time of registration request, this field is left empty by the supplier. Later on, a unique number will be generated by GSTN after uploading of the e-invoice on the GSTN portal. An acknowledgement will be sent back to the supplier after the successful acceptance of the e-invoice by the portal. IRN should then be displayed on e-invoice before use. |

| 19. | ShippingTo_GSTIN | Max length: 15 | GSTIN of the buyer himself or the person to whom the particular item is being delivered to |

| 20. | Shipping To_State, Pincode and State code | Max length: 100 for state, 6 digit pincode and enumerated list for code | State pertaining to the place to which the goods and services invoiced were or are delivered |

| 21. | Dispatch From_ Name, Address, Place and Pincode | Max length: 100 each and 6 digit for pincode | Entity’s details (name, and city/town/village) from where goods are dispatched |

| 22. | Is_Service | String (Length: 1) by selecting Y/N | Whether or not supply of service must be mentioned |

| 23. | Supply Type Code | Enumerated list of codes Sample values can be either of B2B/B2C/ SEZWP/S EZWOP/E XP WP/EXP WOP/DE XP | Code will be used to identify type of supply such as business to business, business to consumer, supply to SEZ/Exports with or without payment, and deemed export. |

| 24. | Item Description | Max length: 300 The sample value is ‘Mobile’ The schema document refers to this as the ‘identification scheme identifier of the Item classification identifier’ | Simply put, the relevant description generally used for the item in the trade. However, more clarity is needed on how it needs to be described for every two or more items belonging to the same HSN code |

| S. No. | Name of the field | List of Choices/ Specifications/Sample Inputs | Remarks |

|---|---|---|---|

| 25. | HSN Code | Max length: 8 | The applicable HSN code for particular goods/service must be entered |

| 26. | Item_Price | Decimal (12,3) Sample value is ‘50’ | The unit price, exclusive of GST, before subtracting item price discount, cannot be negative |

| 27. | Assessable Value | Decimal (13,2) Sample value is 5000 | The price of an item, exclusive of GST, after subtracting item price discount. Hence, Gross price (-) Discount = Net price item, if any cash discount is provided at the time of sale |

| 28. | GST Rate | Decimal (3,2) Sample value is ‘5’ | The GST rate represented as a percentage that is applicable to the item being invoiced |

| 29. | IGST Value, CGST Value and SGST Value Separately | Decimal (11,2) Sample value is ‘650.00’ | For each individual item, IGST, CGST and SGST amounts have to be specified |

| 30. | Total Invoice Value | Decimal (11,2) | The total amount of the Invoice with GST. Must be rounded to a maximum of 2 decimals |

The seller has to ensure that his accounting/billing software is capable of generating a JSON file of the final invoice. The seller can create a JSON file following the e-invoice schema and mandatory parameters by using the following modes:

- An accounting and billing system that offers this service

- A utility to interact with the accounting/billing system, or ERP, such as an excel/word document or a mobile app

- An offline Tool to generate e-invoices by keying-in invoice data

The IRN (also known as hash) is a unique number which is generated by the e-invoice system using a hash generation algorithm. For every document submitted, a unique 64 character IRN will be generated. At present, the e-invoice system provides the two modes to generate the IRN (Invoice Reference Number), i.e. offline and API. Notified taxpayers, who need to generate e-invoices, can generate them using these options:

Using the offline tool

- The invoices can be uploaded in the standard format and the IRN can be generated in one go. User can visit the e-invoice portal, and view the procedure for preparing a bulk upload request for IRNs at Help -> Tools -> Bulk Generation tools. Once the bulk upload request file has been prepared, the same needs to be uploaded in order to generate the IRNs. Once generated, the IRN form will all the details can be downloaded.

Using API (Through GSPs integration

- Using API through GSP integration, system integration can be done through the help of registered GSPs (GST Suvidha Providers). Before using this mode, the API integration with the identified GSP will need to be tested in a sand-box environment. After the test, the GSP will need to submit the test summary report on the sand-box portal. The GSP will need to be registered on the e-invoice portal if not already registered. If the same GSP is being used as on the e-way bill portal, there is no need to register again, and the same login credentials can be used. An API user will need to be created by entering a username and password. Using these credentials, a token and request for the IRN can be generated.

Using API (Through direct integration)

- Using API through direct integration, the taxpayers’ systems can be directly integrated. The API integration will need to be tested in a sand-box environment. After the test, the taxpayer will need to submit the test summary report on the sand-box portal. The taxpayer will need to get registered on the e-invoice portal if not already registered. If registered on the e-way bill portal, the same login credentials can be used. If the taxpayer is already integrated with API on the e-way bill system, the same API credentials can be used. If not, he will need to get API registration done using IP whitelisting. If a sister concern having the same PAN has already registered for API and has had IP whitelisting done, the same client-ID credentials can be used. However, the new API user will need to be registered.

Using API (Through an enabled sister concern’s GSTIN)

- Systems can be integrated using API, through the sister company of the taxpayer having the same PAN, if the same has been enabled for API. The API integration will need to be tested in a sand-box environment. After the test, the taxpayer will need to submit the test summary report on the sand-box portal. The IP used by the sister concern and the concerned taxpayer should be the same when accessing the e-way bill and e-invoice production APIs. The taxpayer will need to get registered on the e-invoice portal if not already registered on the e-way bill portal. If registered on the e-way bill portal, the same login credentials can be used. If the taxpayer is already integrated with API on the e-way bill system, the same API credentials can be used. If not, he will need to create a new API user.

E-way Bill API-enabled Taxpayers

- System integration using API can be done for e-way bill-enabled taxpayers. The taxpayer will need to test the API integration in a sand-box environment. After the test, the taxpayer will need to submit the test summary report on the sand-box portal. If the taxpayer is already API-enabled on the e-way bill system, the same credentials can be used. There is no need for any further steps.

The e-invoice system will generate the IRN, and then digitally sign the e-invoice and the QR code (quick response code). The QR code will enable a quick view, and validation and access of the invoices from handheld devices. The QR code will consist of the following parameters:

- The GSTIN of supplier

- The GSTIN of recipient

- The invoice number as given by supplier

- The date of generation of the invoice

- The invoice value (taxable value and gross tax amount)

- The number of line items

- The HSN code of the main items (the line item having the highest taxable values)

- The unique IRN (hash)

The digitally signed QR code will have the unique IRN (hash) which can be verified on the central portal, as well as by offline apps. This will be helpful for tax officers who need to check invoices in places where internet connection may not be available, such as on highways.

Back-end processing of a valid e-invoiceThe signed e-invoice data will be sent to the GST system where GSTR-1 of the supplier and GSTR-2B/2A of the buyer will be updated based on the details entered in the invoice. Wherever applicable, details of invoices will be used to update ‘Part A’ of the E-Way Bill. As a result, only vehicle number needs to be entered in ‘Part B’ of the E-Way Bill system to create an E-Way bill.

To report any issues or for support on integration of E Invoice system, following options are available.Before reporting the issue, users are encouraged to go through the following web sites to acquaint themselves with all the related and relevant information.

- https://einv-apisandbox.nic.in (For API Integration and Testing)

- https://einvoice1.gst.gov.in (For Registration, Login and Bulk generation)

- https://www.gstn.org.in/e-invoicing (Queries on Legal and procedures)

(1). For quick resolutions of issues related to API integration, may provide all the relevant details at once such as

- NIC Environment: Sandbox / Production

- API name or NIC end point

- Request header attribute values

- Request payload in plain text (encrypted payload in case of authentication related issues)

- Actual response from NIC API etc.

- Password should not be shared with anybody

(2). For quick resolution of issues related to generation of IRN in Bulk mode using offline tool, following details may be provided

- Last updated date of the offline tool

Steps to be followed for resolving issue withe-invoices

- Visit the site https://selfservice.gstsystem.in in the browser.

- Click on button "Report Issue

- Click on button "Advance Search" check box

- Select "E-Invoice" under "Category" dropdown list and the relevant sub category under "Sub Category

- The system provides links to relevant information available for the selected issue type. May use the link and get the information and resolve the issue on own to save time, else, click on "NO, I WANT TO LODGE MY COMPLAINT

- Provide all the relevant details and can attach the screenshots and other supporting material using the "Attachment" option

The Self-help portal also has other provisions such as check the progress / status of the issue raised, links to relevant information etc.

Cancellation of e-invoice

An e-invoice cannot be cancelled partially but can be cancelled wholly. On cancellation, it must be reported to the IRN within 24 hours. Any attempt to cancel thereafter cannot be done on the IRN and must be manually cancelled on the GST portal before the returns are filed.If you want to cancel the invoice after 24 hours, then you can do it in the GSTN system or you can do it by issuing a credit note. It is always better to issue a credit note and nullify it because if you delete this from GST system alone, the invoice will still be active in the IRP system.

Re-generation of EWB on the same document is possible but not for IRN as per policy.

Amendment/Cancellation of e-invoice:An invoice/IRN can’t be cancelled partially. It has to be cancelled in total. Cancellation of invoices is governed by Accounting Standards and other applicable rules/regulations. An IRN/invoice reported to IRP can be cancelled within 24 hours. In case of cancellation of IRN, GSTR-LI also will be updated with such ‘cancelled’ status.

However, if the connected e-way bill is active or verified by officer during transit, cancellation of IRN is not After expiry of cancellation window, any changes in the invoice details reported to IRP can be carried out on GST portal (while filing GSTR-1).

In case GSTR-1 has already been filed, then using the mechanism of amendment as provided under GST. However, these changes will be flagged to proper officer for information. IRN is a unique string based on Supplier’s GSTIN, Document Number, Type of Document & Financial Year.

So, once an IRN is cancelled, the concerned invoice number cannot be used again to generate another e-invoice/IRN (even within the permitted cancellation window). If it is used again, then the same will be rejected when it is uploaded on IRP

IRP does not allow amendment in e-invoices. However, amendment needed, if any, can be done as usual on the e-filing portal while filing GSTR-1. However such changes will be flagged to proper officer for information.

Impact of E-Invoicing On SEZ, Exports and Deemed Exports

SEZ stands for a Special Economic Zone. This is a separate area within the territorial boundaries of India notified by the Central Government as a duty-free territory and is deemed to be foreign territory for trade operations, duties and tariffs. Furthermore, EXPWP meaning in GST is Export with Payment. When the term SEZ is used, it can mean one of these two distinct entities: SEZ Developer orSEZ Unit.

An SEZ Developer is generally a private sector entity who is granted permission by the Central Government to set up an SEZ area to carry out various business activities (eg. Mangalore SEZ Limited). An SEZ Unit is a business set up within the SEZ (eg. Cardolite Specialty Chemicals India, LLP).

Export means the sale of goods or services or both outside India. Exports can be done without paying GST (using a bond) or by paying GST and claiming a refund later. The Government may notify certain supplies of goods as Deemed Exports. Here, the goods supplied do not leave India, and the payment for such supplies is received either in Indian rupees or in convertible foreign exchange if they are manufactured in India (Section 147 of CGST Act 2017). The Central Government has notified the following supplies as deemed exports through Notification No. 48-2017 Central Tax dated 18th October 2017:

- Supply of goods by a registered person against Advance Authorization issued by Director General for Foreign Trade

- Supply of capital goods by a registered person against Export Promotion Capital Goods Authorization (EPCG)

- Supply of goods by a registered person to Export Oriented Unit

- Supply of gold by a bank or Public Sector Undertaking specified in the notification No. 50/2017-Customs, dated 30th June 2017 (as amended) against Advance Authorization.

Every exporter is required to register on the E-Invoicing portal - Invoice Registration Portal (IRP). At the time of registration on the IRP, as an exporter, the taxpayer has to select the type of exports (such as regular export, deemed export, supplies from SEZ unit or SEZ developer).

Applicability of E-InvoicingE-Invoicing applies to all B2B supplies made to registered persons. Supplies to SEZs (with/without payment of GST), Exports (with/without payment of GST), Deemed Exports, by the notified class of taxpayers are also covered under e-Invoicing. Presently, e-Invoicing applies to taxpayers having an annual turnover of over 20 crores. However, a recent notification expressly excludes SEZ units.

E-Invoice Schema - Additional Requirements

| S. No. | Description of the field | Whether Mandatory or Optional | Explanation in brief |

|---|---|---|---|

| 1.2 | Code for Supply Type | Mandatory | Fill in the code to identify the type of supply. B2B: Business to Business B2C: Business to Consumer SEZWP: To SEZ with Payment SEZWOP: To SEZ without Payment EXPWP: Export with Payment EXPWOP: Export without Payment DEXP: Deemed Export |

| 5.3 | Recipient’s GSTIN | Mandatory | Fill in the GSTIN of the Recipient, if available. In case of exports or if supplies are made to unregistered persons, fill in as URP (Unregistered Person) |

| 5.9 | Recipient PIN Code | Optional | Fill in the PIN code of the Recipient’s locality. However, in the case of export, Pin code need not be mentioned |

| 5.10 | Country Code of Export | Optional | Fill in the code of the country of export as per the EDI system. The list published and updated from time to time at https://www.icegate.gov.in |

| 10.3 | Port Code | Optional | In case of export/supply to SEZ, fill in the port code as per the Indian Customs EDI System (ICES), where applicable, at the time of reporting the e-invoice. Non-EDI Port Codes are also listed. The lists are published and updated from time to time at https://www.icegate.gov.in |

| 10.4 | Shipping Bill Number | Optional | In case of export/supply to SEZ, fill in the shipping bill number as per Indian Customs EDI System (ICES), if applicable, at the time of reporting e-invoice. |

| 10.6 | Export Duty Amount | Optional | Fill in the amount of Export Duty in INR in case of invoices for export |

| 10.7 | Supplier Can Opt Refund | Optional | In the case of deemed export supplies, this field is for mentioning whether the supplier can exercise the option of claiming refund or not. |

As stated in the notification-Notification No. 60/2020 – Central Tax dated 30th July 2020.

Major challenges in implementing an e-Invoicing solution

Implementing an e-Invoicing solution can be a complex process. It will involve a number of people in different parts of your business and potentially will extend to include your supplier/customer community. It will also require the integration of different business systems. Some of the major issues you should consider before commencing your e-Invoicing project.

- Forward planning

The key element, however, in building a successful business case, is to ensure that you have an agreed method for calculating your current average invoice processing cost. Without this, you will never know whether your e-invoicing project has delivered the financial benefits you desired.Managing the transition period is another issue that needs proper planning. - Internal capabilities

You will require tax experts to ensure that your e-invoicing solution remains compliant with tax laws in the territories where you operate and fulfils the requirements of the relevant tax authorities.Data translation and mapping will require internal IT staff with the right levels of EDI skills.Successful e-invoicing implementation means planning the right level of internal resources with the right set of knowledge and skills to deliver an effective, integrated solution. - Technology readiness

At a minimum, your e-invoicing solution is required to:

- Facilitate the exchange of documents between buyers and suppliers, regardless of the data standards used by the respective accounting systems

- Enable buyers and suppliers to make independent communications and technology decisions by providing multiple, secure networking options to accommodate each company’s security policies and IT infrastructures

- Support any or all of the invoice-related documents, such as purchase orders, debit notes, credit notes and remittance advices, that you may need to store together for audit purposes

- Be globally available regardless of the location of buyers or suppliers

- Enable all type and size of trading partner to participate, regardless of their technical capabilities

- Be capable of structured data exchange with other business systems for accurate forecasting and planning

- Supplier/customer acceptanceFor any e-invoicing project to be successful, it is important for you to consider the capabilities of your trading partners. The less number of changes you ask them to make, the more likely it is that you will gain their acceptance. It is good practice to examine their current invoicing process and identify how your e-invoicing project can fit within these processes at an early stage.Below are some of the considerations that you need to plan into your overall electronic invoicing programme for success.

- Electronic and web invoicing formats

- Web-based forms

- Excel and accounting package integration

- ERP system integration

- Supplier/customer integration

Below are just some of the steps that you will need to take in order to integrate your trading partner community, including:

- Compile an accurate and up-to-date trading partner contact list

- Identify and then communicate the key benefits of participation for trading partners

- Select some of your key partners to pilot the e-invoicing system with (not just the largest)

- Gain an understanding of their technical capabilities and the format in which they would like to receive data

- Define the communications and end-to-end document testing processing

- Provide education and training where required

- Provide on-going support through testing, implementation and roll-out

- Data storage and archivingEvery tax authority has its own stipulations on how long a document has to be stored and which documents are required. If you consider that a large company may be dealing with over 100,000 invoices every year, data storage and archiving becomes a major issue.Effective data storage of electronic invoices is essential. You need to be able to quickly retrieve historical documents during tax audits, when dealing with payment disputes, negotiating new vendor contracts or conducting a cash performance analysis. In addition, all supporting documentation must be stored with the original invoice.

- Managing change