Legal Entity Identifier-Introduction

History of the LEI: Following the 2008 market crash, issue with transparency in the markets caused a litany of issues with regard to identifying counter parties in transactions. When the stock market crashed, thousands of funds and trusts were unidentifiable and the fall resulted in mass confusion. The lack of transparency put financial institutions and banks in a vulnerable position. This was addressed at the G20 Summit of June 2011, who created the concept of the LEI. The idea was to create a digital database, of all legal entities which was easily accessible, reliable and up to date. LEI Codes are simply used to identify legal entities on a global scale. This allows for great transparency in financial markets, standardization, and greater risk control. According to LEI ROC, the LEI number was conceived to be used by the private sector to support improved risk management, increased operational efficiency, more accurate calculation of exposures, and other needs. One centralized source of information that contains vast amounts of attainable, high quality data.

A Legal Entity Identifier (LEI) is a code that is unique to a legal entity such as a Limited Company, Fund or trust or any organization. The LEI code consists of a combination of 20 letters and numbers. This code allows each entity to be identified on a global database of entities searchable by number instead of by name, as many entities may have similar or the same name. The LEI is an ISO standard, which is now a legal requirement for many companies within the global financial system.

The LEI is a way of identifying market participants on a single, standardized database. This offers accurate data about a company which is accessible and completely free of charge to use.

A companies LEI record will contain public data such as their name, address, where they are registered, and whether they are a branch, or owned by another 'parent' company. Till date, there have been over 1.8 million LEIs created globally, and it is quickly being adopted as a global standard in business transactions.

Previously, it was very difficult to find out about the counterparty if they had no digital presence. This became problematic in the global financial crisis a decade ago. The lack of transparency put financial institutions in a vulnerable position as vast numbers of entities and funds were unidentifiable. Also, this created complications relating to risk assessment and transparency. The G20 (Group of 20) launched the LEI system in 2011 in order to ensure this would not happen again. The idea was to create a digital database, of all legal entities which was easily accessible, accurate and up to date. One centralized source of information that contains vast amounts of attainable, high quality data. You can access this freely accessible database by using the LEI Search Tool.

After the G20 formed the concept of the Legal Entity Identifier (LEI) Code, the Financial Stability Board (FSB) appointed a new overseeing body to implement it. This organization is known as the Global Legal Entity Identifier Foundation (GLEIF). GLEIF were given the role of accrediting and monitoring financial institutions with the ability to issue Legal Entity Identifiers. These institutions, known as Local Operating Units (LOUs) and are the only institutions with the ability to issue LEIs. LOUs may issue LEIs themselves or partner with various Registration Agents such as LEI Worldwide who help facilitate mass adoption to the LEI by providing channels through which legal entities can easily obtain an LEI code. This makes the LEI very easy to obtain, and promotes healthy competition between service providers.

LEIs are required by any legal entity which is involved with financial transactions or operating within today’s global financial ecosystem. There are a number of mandates currently in existence which state "no LEI, no trade" meaning both reporting parties and traders require an LEI. The LEI is mandated by a number of EU directives such as EMIR, MiFIR & MIFID II. The US also has similar requirements such as the Dodd Frank Act, the OFR, the Federal Reserve and the Securities & Exchange commission (SEC).

LEI requirements vary depending on the country, legal jurisdiction or industry. It is the prerogative of the authorities acting in individual jurisdictions to mandate the use of LEIs. The use of the Legal Entity Identifier is mandatory for some companies, but others that may still apply for LEI when not required are charities, government bodies, associations, and branches. This is quite popular as there are plenty of benefits associated with getting an LEI Number. If you fall under the LEI regulation requirement, but have not yet obtained an LEI, you may be at risk of complications with your regulators, financial intermediary or bank and could face a "no LEI no trade" ruling or a blocked/delayed transaction. However it is up to the individual market participants to obtain their own LEI and ensure it is up to date and renewed annually.

Global LEI System

The ROC oversees the Global LEI System (GLEIS), which is composed of the ROC itself, the Global LEI Foundation (GLEIF), and LEI issuers known as Local Operating Units (LOUs).

The LEI (Legal Identity Identifiers)The LEI is a 20-character reference code to uniquely identify legally distinct entities that engage in financial transactions and associated reference data. Two fundamental principles of the LEI code are:

Uniqueness:LEI is assigned to a unique entity. Once assigned to an entity, and even if this entity has for instance ceased to exist, a code should never be assigned to another entity.

Exclusivity:a legal entity that has obtained LEI cannot obtain another one. Entities may port the maintenance of their LEI from one operator to another. The LEI remains unchanged in the process.

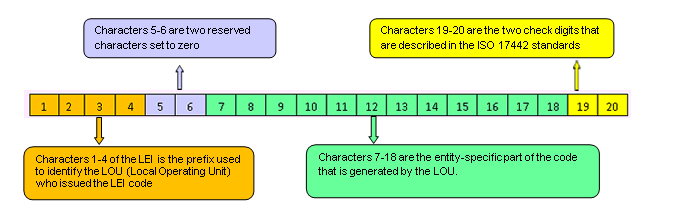

The LEI definition currently relies on a standard published by the International Organization for Standardization (ISO) on 30 May 2012 (ISO 17442:2012, Financial Services - Legal Entity Identifier (LEI)).The LEI Code is structured as follows:

- Characters 1-4: A four character prefix allocated uniquely to each Local Operating Unit (LOU) issuing LEIs. This prefix identifies (except for LEIs issued before 30 November 2012) the LOU that first issued the LEI and contributes to avoiding that different LOUs would assign the same LEI. However, the entity might have subsequently ported the maintenance of its LEI to a different LOU. Use the GLEIF search function to check which LOU is maintaining LEI ("Managing LOU" field) and go to this LOU's website to update the reference data of the entity or certify that it is still up-to-date

- Characters 5-6: Two reserved characters set to zero

- Characters 7-18: Entity-specific part of the code generated and assigned by LOUs according to transparent, sound and robust allocation policies.

- Characters 19-20: Two check digits as described in the ISO 17442 standards. The check digit scheme follows ISO/IEC 7064 (MOD 97-10) and contributes to avoiding typing errors.

The reference data stored in the LEI data base for each entity includes

- The official name of the legal entity;

- The address of the headquarters of the legal entity;

- The address of legal formation;

- The date of the first LEI assignment;

- The date of last update of the LEI;

- The date of expiry, if applicable;

- For entities with a date of expiry, the reason for the expiry should be recorded, and if applicable, the LEI of the entity that acquired the expired entity;

- The official business registry where the foundation of the legal entity is mandated to be recorded on formation of the entity, where applicable;

- The reference in the official business registry to the registered entity, where applicable.

The Global LEI Foundation

The Global LEI FoundationThe Global LEI Foundation (GLEIF) was established in June 2014 as a not-for-profit organization overseen by the ROC to act as the operational arm of the GLEIS. The foundation provides on their website a centralized database of LEIs and corresponding reference data. A search function was added in October 2015, where one can check if an entity has an LEI, or access the reference data associated with an LEI, including verifying whether the LEI is current and can be used in regulatory reporting (registration status: "issued" or "pending transfer"). From 7 October 2015, new institutions that wish to become LEI issuers need to be accredited by the GLEIF, which monitors their compliance with the standards of the GLEIS. As of this date, the GLEIF also assumed the tasks of defining and maintaining the operational and technical standards of the system. The GLEIF also publishes the list of authorized LEI issuers.

Local Operating UnitsLEIs are issued by "Local Operating Units" (LOUs) of the Global LEI System.

LOUs are the utilities accredited by the GLEIF under ROC oversight, to provide LEIs and other services to registrants.

LOUs make the LEIs and associated reference data available to the public and regulators free of charge and on a continuous basis.

The list of LOUs accredited by the GLEIF can be found on the GLEIF website.

Some of these registries serve a given country while others offer services to entities worldwide. They may be differences as well in the languages available, facilities to register many entities in bulk, and price, among others.

These websites also provide information on the process for obtaining LEI, which complies with general principles set by the ROC, in particular:

- Self-registration: Only an entity eligible to receive an LEI or its authorized representative may obtain a LEI code. The permission of the LEI registrant to perform an LEI registration on its behalf by a third party is considered to satisfy the requirements of self-registration only if the registrant has provided explicit permission for such a registration to be performed.

- The LOU will collect a minimum set of reference data on the entity (e.g. name of the entity and address).

- This reference data has to be confirmed or certified by the entity seeking LEI. Entities are requested to periodically verify the continued accuracy of their reference data (e.g., at least through yearly certification)

The Global LEI Foundation

- The LOU is required to check each entry against reliable sources (public official sources such as a business registry, private legal documents) prior to publishing the LEI and associated reference data. This explains a delay between the request for an LEI and the publication of the LEI.

- LOUs generally charge a fee for issuing the LEI as well as for validating the reference data upon issuance and after each yearly certification.

The Regulatory Oversight Committee (ROC) is an international body that promotes the broad public interests to improve the quality of data used in financial data reporting, improving the ability to monitor financial risk, and lowering regulatory reporting costs through the harmonization of these standards across jurisdictions.

Mandate of the ROCThe primary objective of the ROC is to oversee the Global LEI System (GLEIS), the Unique Transaction Identifier (UTI), Unique Product Identifier (UPI) System, and the Critical Data Elements (CDE), in accordance with the High Level Principles set out in the ROC Charter. More specifically, the objectives for each of the identifiers are as follows.

Global LEI System

open and free access to publicly available data from the GLEIS, including

- data should be non-proprietary, with no bundling of services, or restrictions on access, usage, or redistribution;

- all public data should be readily available on a continuous basis, easily and widely accessible using modern technology, and free of charge;

- confidential data should be safeguarded and with due regard for any applicable data protection legislation;

- data and operating processes should not be subject to any type of intellectual property restrictions, except those judged necessary by the ROC for protecting the broad public interest;

- restrictions should not be placed on a registrant on the use of its own LEI.

open access to obtaining an LEI, including:

- by providing that any entities required, or eligible, to obtain an LEI are able to acquire one under open and non-discriminatory terms;

- by providing that fees, where and when imposed by the LEI Central Operating Unit (LEI COU, the GLEIF), are set on a non-profit cost-recovery basis under the premise that the operational model of the LEI COU is efficient and avoids excessive costs and, that where possible, a parallel arrangement holds for the LOUs;

- by providing that the intellectual property necessary for or associated with the operation of the GLEIS is held in a way that facilitates achievement of the High Level Principles.

that the GLEIS meets broad public and private sector requirements, including:

It is mandatory as a post incorportion compliance for Public Limited Company to maintain statutory registers like :

- ensuring the uniqueness, consistency, exclusivity, accuracy, reliability, timeliness of access, portability, and persistence of the LEI codes and reference data;

- promoting the use and scope of the GLEIS to expand the collective benefit from widespread adoption; and

- allowing use of local languages and character sets in registration, as well as allowing access to the GLEIS in a common language and character set

With regard to the UTI:

- unrestricted and free access to and use of the UTI for national or regional authorities, trade repositories acting in their capacity as trade repositories, and all other stakeholders and those involved in the lifecycle of a derivative contract;

- unrestricted access to the UTI data standard on a cost-recovery basis;

- that the UTI and UTI data standard adhere to the characteristics as defined in the UTI Technical Guidance; and, (4) use of and access to the UTI and UTI data standards is free of licensing restrictions, not tied or bundled with any other service offered by a service provider, and that intellectual property necessary for or associated with the operation of the UTI is held in a way that facilitates achievement of the relevant High Level Principles.

With regard to the UPI:

- unrestricted access to, and use of, UPI Codes and UPI data standard; and that such access should not be tied or bundled with any other services offered by a service provider;

- unrestricted and free access to, and use of, the UPI Reference Data Library and of the UPI system itself for national or regional authorities;

- that the UPI code and reference data adhere to the Technical Principles as defined in the UPI Technical Guidance;

- access to, and use of, the UPI Reference Data Library for all entities with reporting obligations and trade repositories in a manner that is sufficient to allow them to associate a specific derivative product to its UPI Code in a timely manner to facilitate the discharge of reporting obligations for derivative transactions;

- that any fees, when and where imposed by the UPI service provider(s), are set on a cost-recovery basis and allocated fairly among stakeholders (excepting authorities, for which use of the UPI system will be free);

- that the UPI Data Standard is not subject to any intellectual property/licensing restrictions and intellectual property necessary for or associated with the operation of the UPI Reference Data Library is held in a way that facilitates achievement of the relevant High Level Principles;

- that the UPI service provider has policies and procedures that are reasonably designed to detect and effectively manage any potential conflict of interest, and that access to the UPI is not tied or bundled with any other services offered by the UPI service provider(s); and

- the operational viability and continuity of UPI service provider operations in accordance with the relevant High-Level Principles.

With regard to the CDE:

- unrestricted and free access to, and use of, CDE (including definitions, formats, and allowable values), and that the CDE Technical Guidance and the CDE Data Standards remain open source and freely available;

- that use of the CDE (including their definitions, formats, and allowable values) should not be subject to any intellectual property restrictions;

- that CDE Data Standards are agnostic to existing communication protocols and should be implementable in any existing syntax; and,

- Compatibility of CDE data standards with the relevant High-Level Principles.

The Framework

The ROC's sole decision-making body is the ROC Plenary, comprising more than 65 financial markets regulators and other public authorities from more than 50 jurisdictions. The ROC's work is also taken forward by a regionally balanced Executive Committee, supported by two standing Committees and a Secretariat

- Committee on Evaluation and Standards (CES):The primary responsibility of the CES is to evaluate the adequacy of existing standards and protocols for GLEIS in the light of the High Level Principles (ROC Charter, Annex A) and other principles adopted by the ROC and that serve the broad public interest, and to propose to the ROC Plenary revised or additional standards / protocols as necessary.

- Committee on Derivatives Identifiers and Data Elements (CDIDE): ): The primary responsibility of the CDIDE is to evaluate the adequacy of existing standards and protocols for the UPI, UTI, and CDE in the light of the High Level Principles (ROC Charter, Annex C) and other principles adopted by the ROC and that serve the broad public interest, and to propose to the ROC Plenary revised or additional standards / protocols as necessary.

International Governance Body for derivatives data elements

The UTI is a reference code up to maximum 52 characters to uniquely identify individual OTC derivatives transactions on reports to Trade Repositories (TRs). In particular, a UTI will help to ensure the consistent aggregation of OTC derivatives transactions by minimizing the likelihood that the same transaction will be counted more than once.

The key characteristics of UTI codes are:

Neutrality:: The UTI is globally applicable and the generation of the UTI should not reflect jurisdictional differences. While reporting is reflective of jurisdictional variations (e.g. dual sided or single sided reporting), the generation of the UTI should be flexible enough to meet the vast majority of generation needs.

Uniqueness:Every reportable transaction should have a unique UTI. Different reportable transactions should each have their own UTIs. No UTIs should be reused even if the previous use was on a transaction that is no longer open.

Consistency: Any individual transaction should have the same UTI even if such transaction is reported more than once to facilitate transactions' matching while contributing to the avoidance of double-counting.

Persistence:: A transaction should keep the same UTI throughout its lifetime. This continuity facilitates the handling of amendments and updates to a report. Some life cycle events affecting existing OTC derivative transactions create one or more new reportable transactions, which such reportable transactions would then each require a new UTI.

Traceability:If one transaction is replaced by another transaction with a different UTI, then there should be a means of relating the transactions before and after such a change of UTI. Traceability assists in understanding the evolution of transactions and provides an audit trail.

The UTI Code is structured as follows:

- Character length: Consist of up to maximum 52 alphanumeric characters.

- Character representations: Upper case alphanumeric characters (A-Z and 0–9 only).

- Characters 1-20: The legal entity identifier of the generating entity, as represented in ISO 17442.

- Characters 21-52: Characters of a unique identifier assigned to the transaction by the generating entity without separators.

The globally harmonized UTI has been published by the International Organization for Standardization (ISO) as International Data Standard on 4 August 2020

ITechnical Guidance for the UTI

The UTI Technical Guidance was published by CPMI and IOSCO on 28 February 2017 as technical guidance to authorities. The UTI Technical Guidance covers not only the UTI Data Standard (including the UTI's structure and format, its length, which characters should be used in its construction, see section The Unique Transaction Identifier) but also:

- The circumstances in which a UTI should be used, i.e. for reportable transactions that have not previously been allocated a UTI.

- The impact of lifecycle events on the UTI, through setting out principles that provide guidance on when a lifecycle event should or should not cause a new UTI to be used.

- Which entity (or entities) should be responsible for generating UTIs, with the aim of ensuring that there is a well-defined entity responsible for UTI generation for every transaction while respecting the different nature of transactions and providing flexibility.

- When UTIs should be generated, considering the reporting time scales imposed by different jurisdictions.

The ROC, in its capacity of International Governance Body (IGB), is now in charge of a number of responsibilities spelled out in the UTI Governance Arrangements (FSB, December 2017) and now included in the ROC Charter (see also Mandate of the ROC), including updates or changes to the UTI Technical Guidance as necessary.

The Unique Product Identifier (UPI) and the UPI System

The UPI is a 12-character reference code to uniquely identify any OTC derivative reported to trade repositories. Each UPI code is mapped to a set of data (the so called reference data elements) with specific values that together describe the product (e.g. the data element "Asset class" may contain values representing "Credit", "Rates", "Commodities", "Equities" or "Foreign Exchange"). The combination of the UPI code, UPI reference data and the process of assigning a UPI code to a particular set of reference data represent the UPI System. UPI service provider(s) provide for timely issuance of UPI codes and maintain their associated reference data.The key characteristics of the UPI are:

- Jurisdiction neutrality: It helps ensure that the UPI System is globally applicable and therefore facilitates aggregation. All values that are included in an OTC derivative product's reference data should be standardized to the fullest extent practicable.

- Uniqueness: Every reportable OTC derivative product should be identified by one UPI code and by a distinct set of UPI reference data elements and their values. Different reportable OTC derivative products should have different sets of UPI reference data elements and their values and hence different UPI codes.

- Consistency: The UPI reference data should describe each OTC derivative product using a consistent set of UPI reference data elements. Different asset classes may utilize different sets of UPI reference data elements to represent different instrument and underlie characteristics specific to an asset class.

- Persistence: An OTC derivative product, once described using the UPI reference data elements and assigned a particular UPI code, should keep the same UPI reference data element values and UPI code, as far as practicable.

- Adaptability: The UPI reference data element values should be capable of adapting swiftly to market changes and innovations, including the introduction of new OTC derivative products as well as to the evolving aggregation needs of authorities in response to those changes. The allowable values for each UPI reference data element should be capable of readily incorporating required changes.

The UPI code is structured as follows:

The globally harmonized UPI is currently being set by ISO as International Data Standard (ISO 4914 Financial services – Unique Product Identifier (UPI)).

UPI Reference Data Library

It refers to the collection of reference data elements and their values for each product reside in a UPI reference data library. The UPIs are maintained in a reference data library accessible to authorities and market participants that store the UPI codes and their related UPI reference data. Authorities and market participants may find any UPI code within the reference data library, to discover the UPI reference data elements and their values that pertain to that particular product, or to find UPI codes that relate to specific reference data elements and their values. UPI service provider(s) operate and maintain the reference data library, and assign o UPI codes.

Some examples of reference data stored in the UPI reference data library include the following:

Asset class

Currency pair

Delivery type

Instrument type

Option style

Option type

Return, pricing method or payout trigger

Underlying asset type

Underlier ID

Underlier ID source

Technical Guidance for the UPI

The UPI Technical Guidance was published by CPMI and IOSCO on 28 September 2017 as technical guidance to authorities.

The UPI Technical Guidance covers the:

The ROC, in its capacity of IGB, is now in charge of a number of responsibilities spelled out in the UPI Governance Arrangements (FSB, October 2019) and now included in the ROC Charter (see also Mandate of the ROC), including updates or changes to the UPI Technical Guidance as necessary. Updated versions of the UPI Technical Guidance may be available among the ROC's publications.

ISO 17442 standard

ISO 17442 standard- The International Organization for Standardization (ISO) 17442 standard defines a set of attributes or legal entity reference data that are the most essential elements of identification. The Legal Entity Identifier (LEI) code itself is neutral, with no embedded intelligence or country codes that could create unnecessary complexity for users.The ISO 17442 standard specifies the minimum reference data, which must be supplied for each LEI. This data is usually referred as Level 1 Data - Who is who:

Level 2 Data - Who owns whom?

Its aim is to identify mother- daughter relationships among corporate structure.

The Derivatives Service Bureau (DSB)

The Derivatives Service Bureau (DSB) Ltd, a subsidiary of Association of National Numbering Agencies (ANNA), is a global numbering agency for OTC derivatives serving the needs of market participants through the allocation of International Securities Identification Numbers (ISINs), the Classification of Financial Instruments (CFI) and Financial Instrument Short Name (FISN), all globally recognized and adopted ISO standards for identifying, classifying and describing financial instruments. In May 2019, the FSB designated the DSB as the service provider for the future UPI system. As the sole issuer of UPI codes, DSB will also perform the function of operator of the UPI reference data library. In the third quarter of 2022, the DSB expects to start issuing UPIs for OTC derivatives to enable global regulatory authorities to aggregate data on OTC derivatives transactions to help assess systemic risk. The Critical Data Elements other than UTI and UPI (CDE) The Critical Data Elements other that than UTI and UPI (CDE) include data elements of an OTC derivative transaction reported to TRs and important to aggregation by authorities. Setting a standardized definition, format and allowable values provides better understanding on the contents of the transaction and will provide transparency for all OTC derivative transactions. The CDE include data elements related to:

The CDE should be included within the ISO 20022 data dictionary and maintained by ISO. An ISO 20022-compliant message for CDE has been developed and submitted into the ISO process and is currently under review by ISO 20022.

Technical Guidance for CDE

The Technical Guidance for critical OTC derivatives data elements (other than UTI and UPI) was published by CPMI and IOSCO on 9 April 2018 as technical guidance to authorities. It provides harmonized definitions, formats and allowable for the CDE to be used by the authorities when implementing their OTC transactions reporting requirements. To meet their own reporting requirements, some jurisdiction may also require additional information, which may not be included in the Technical Guidance. Finally, although the mandate for CPMI and IOSCO to harmonize CDEs was for OTC derivatives only, some authorities may wish to implement the Technical Guidance for non-OTC derivative transactions as well.

The ROC, in its capacity of IGB, is now in charge of a number of responsibilities spelled out in the Governance Arrangements for critical OTC derivatives data elements (other than UTI and UPI) (CPMI-IOSCO, October 2019) and now included in the ROC Charter. These include updates or changes to the CDE Technical Guidance as necessary.

MiFID regulation | MiFID II LEI

MiFID is the Markets in Financial Instruments Directive. Applicable across the European Union since November 2007. Being a cornerstone of the European Union’s regulation of financial markets looking to improve their competitiveness by generating a single market for investment services and activities, and to guarantee a high degree of systematized protection for investors in financial instruments. MiFID sets out (as stated on European Securities and Market Authority).

MiFID II and MiFIR (The Markets in Financial Instruments Regulation accompanying the European Union’s second Markets in Financial Instruments Directive or Mifid II) will help to ensure unbiased, securer and more efficient markets, whilst facilitating more transparency for all participants. The advanced reporting requirements and tests and tests expand the information available, and reduce the use of dark pools and over-the-counter trading. High-frequency-trading rules will force a strict set of organizational requirements on investment firms and trading venues. Whilst the provision regulating the non-discriminatory access to central counterparties (CCPs), trading venues and benchmarks increase competition.

The protection of investors is reinforced through the introduction of the new requirements on product governance, as well as independent investment advice, the extensions of existing rules to structured deposits, also improvement of requirements in several areas, including the responsibility of management bodies, information inducements, reporting to clients, cross-selling, remuneration of staff, and best execution.

vLEI

Ubisecure is an accredited LEI issuer (otherwise known as a Legal Operating Unit or LOU). As of the 29th of March, they’ve announced support for the Global LEI Foundation’s (GLEIF) verifiable LEI, called vLEI. Being the number one Customer IAM (CIAM) provider in the Nordics and a leading provider of Identity-as-a-Service (IDaaS) solutions through Europe, Ubisecure’s goal has always been to make the complex identity and security challenges of organizations simpler when building applications.

The Global LEI Foundation (GLEIF) is leading the way in implementing an entirely digitized LEI service to enable instant, global, automated identity verification. Having a cryptographically verifiable LEI would optimize processes and strengthen different sectors like healthcare, telecom, financial services and more. Digital certificates (electronic documents issued by a Certificate Authority) haven’t completely solved the digital identity case. The information contained within is often outdated, and revocation has always been an issue. Furthermore, individual countries often have their own schema, meaning that a digital certificate issued in one country might not be usable by the owner in another country or context. The effect of this came to light during the 2008 global financial crisis. From this grew out the realizations that digital certificates do not facilitate the mission that is by GLEIF, which is to develop a verifiable credential and cryptographically secure chain of trust where each business worldwide should have only one global identity. GLEIF is now inviting stakeholders from across the global economy to partake in a cross-industry development program to create an ecosystem and credential governance framework and the technical infrastructure for a verifiable LEI (vLEI) – a digitally verifiable credential containing the LEI. The vLEI will create a cryptographically secure chain that puts back the former manual processes required to access and confirm an entity’s LEI data

vLEI will give legal entities, government organizations and organizations worldwide the ability to use non-reputable identification data pertaining to their legal status, ownership structure and authorized representatives in their business activities.

Need for Legal Entity Identifier

As global trade increased at an exponential rate in the 1900's, a need arose for transparency in transactions, a means of increasing trust in who you are dealing with, especially cross borders. There was no common identifier applicable to all legal entities across various industries, from companies, to funds and even Governments. This is why LEI codes are required.

When capital markets and banking went digital, there was a need for a common identifier again. This caused a lot of hassle with regards to identity in regulating the corporate world and financial markets. Companies owned companies that were owned by other companies and it caused a lot of confusion around who owned who, and it made it very hard in some cases to find out who you exactly were dealing with. This was the cause for many famous fraud cases and made it easy to disguise 'black' money between organizations.

This also made it difficult for banks and other institutions to onboard new clients as KYC practices were relying on old and unconsolidated data.Registry information can be hard to access and needed to be collected into a single database. Lacking a reliable, trustworthy identifier it could become laborious and costly to onboard new clients and confirm identity (it is now estimated in research conducted by McKinsey that the LEI could save banks up to 2-4 billion Dollars annually in KYC processes).

Any entity that is considered a legal entity may complete a Legal Entity Identifier application- A Limited Company, an association, a trust, a charity anything that is recognized by law to be an organization. However, in order to enhance transparency in the global financial ecosystem some forms of legal entities are required by regulation to have LEI (Legal Entity Identifier). The LEI requirement is a feature in many EU and Global regulations. Often times the LEI identifier system is used in regulatory reporting so that regulators may have an easy way of identifying counterparties to transactions. Companies that have mandatory LEI requirements are all financial intermediaries, funds and trusts, banking institutions and financial institutions, any legal entity that is listed on a stock exchange or that issues debt, securities or equity. LEI codes are required if your legal entity falls into (but not limited to) one of the following classifications:

Type of Legal Entity that can apply for a Legal Entity Identifier

A Legal Entity number may be obtained for any of the following ‘Legal Entities’:

- Registered Companies* and Registered Subsidiaries*

- Non Profits

- Sole Proprietors (Having a distinct identity within a business register)

- International Branch offices (The Head Office must already have an LEI)**

- Funds and Trusts

*As a general rule, a Business Registry will usually bestow a status of “Good Standing” to a business which maintains accurate information within the registry and completes any annual filing requirements.

A Legal Entity does not have to be in Good Standing to be issued with a Legal Entity Identifier, but must be Active. i.e. Legal Entities which have been struck off, merged, withdrawn or de-registered will be unable to receive or renew their identifier number.

** A branch office within an alternative jurisdiction/state, but still within the same country as the head office is not eligible as only one LEI per country can currently be issued.

Who may not apply for a Legal Entity Identifier?The LEI may not be requested by any of the following:

These entity types should all utilize the code of their parent or Head Office organization.

LEIs issued by LOUs are added to the LEI Index daily. An LEI Lookup accesses the organization’s associated LEI Data Record – including a historical record of:

- Company name(s)

- Legal and HQ address and country

- The local business registry used to register the organization

- The corroboration level (e.g. how the LOU verified the organization details)

- The LEI Issuer

Anyone can access and search the LEI index (entity identifier database) on the GLEIF website using the web-based LEI search tool.

Small self-administered pension schemes (SSAS) to obtain LEI numbersSSAS fall under MIFID II LEI requirements. SSAS trustees or investment firms managing the pension scheme are responsible for obtaining LEI. If you are either a trustee, asset manager, or an investment firm, Rapid LEI can help you easily manage LEIs in a single account.

Type of Legal Entity that can apply for a Legal Entity Identifier

Rapid LEI is a service provided by Ubisecure. Ubisecure is a Local Operating Unit (LOU) accredited by the GLEIF. Rapid LEI works closely with Registration Agents (RA) and Validation Agents (VA) – organizations approved by the GLEIF to register LEIs in partnership with an accredited LOU.

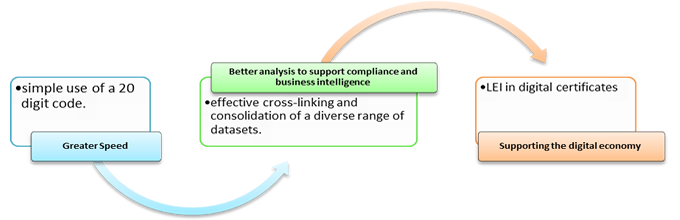

What is the future for LEIs?Identifier usage is driven by various local and global regulations, as well as new payment standards like ISO 20022 in the Digital Certificate standard ISO 17422.

Being an accredited Legal Identity Identifier issuer is core to Ubisecure’s mission. At present the main focus on developing services to automate the interactions & assurances within the three identity domains: individuals, organizations & things.

The Ubisecure Identity Platform is used in nationwide solutions to enable the use of strong identity, secure identity data and improve customer experience. LEIs are the best good solution to solving the issues associated with the less standardized, and less mature organizations domain to improve KYC, digital assurance and more. The Ubisecure Identity Platform and Identity APIs open many new use cases for LEIs as the central identifier to how organizations can interact and trust each other, assign rights to represent, and be trusted by their customers. Innovations are detailed in the Marketplace, including the new ‘Sign in with RapidLEI‘service that asserts organization identity, affiliation and representation rights to counterparties.

Benefits are there to having a Legal Entity Identifier number

By having an LEI number, your international recognition and trading credibility is increased immediately. Investors, customers and potential stakeholders can locate your essential LEI data in real time. Likewise, you can benefit from the added layer of security that comes from knowing exactly who you are dealing with. Having LEI can ensure your business is compliant with the 184 international regulations mandating the use of a Legal Entity Identifier around the world. The LEI can help to streamline on boarding for financial institutions, who are even now becoming LEI Validation Agents in order to have LEIs issued to new clients quickly and efficiently. If your organization has an International Securities Identification Number (ISIN), you can now link you LEI and ISIN codes in a process known as LEI to ISIN Mapping. Benefits of having LEI:

Guarantees your existence as a legally registered entity-Verified authoritative information about all parties involved in a transaction

Internationally compliant to LEI mandates-Smooth data validation efforts in the payments lifecycle and Create efficiency in transaction chains, reducing costs through interoperability

International business passport-Improve operational processes by simplifying risk management

Faster onboarding experience with Financial Institutions-Streamline onboarding and Know Your Customer (KYC)

LEI Certificate available-It can help show your customers who you are, and that you are a real entity successfully registered to the LEI database increasing your international credibility. It can be make international trading much easier, and builds the trust relationship with your customer, investor or suppliers. Eliminate duplication of processes so full customer due diligence (CDD) is not repeated and KYC and Anti Money Laundering checks are more reliable.

Increased transparency in financial markets-Provide insight to who owns whom in a corporate structure.

Brand identity secured-Reduce barriers to entry for legal entity identification.

Regulatory reporting requirements-Help firms fight fraud and economic crime.

Available to include in Digital Certificates-Facilitate information sharing with corresponding banking services by using a standardised format

Legal Entity Identifier Application Process

A Legal Entity Identifier or LEI Code is a 20 digit alpha-numeric code that helps identify a legal entity on a global database. Each entity is assigned a unique code in order to help identify it in a number of different business use cases such as transaction reporting, KYC checks, proof of company registration or identity. Having an LEI code is usually required by regulation and it is a compliance requirement in many countries and industries. For example in securities trading the SFTR regulation requires both the seller and issuer to report LEI during the process. Likewise, CSDR stipulates that Central Securities Depositories are required to report on transactions that have occurred, and will need to identify market participants by way of LEI.

Documents required for LEI Registration-Legal Entity Identifier - Check List- In order to apply for your Legal Entity Identifier you will be required to provide the following:

- Registered company name

- Legally registered address

- Company Registration Number

- Company Form e.g. Limited Company, Public Company, LLC etc

- Name of legal person responsible of entity e.g. Director, CEO

- A document to confirm the above e.g. Certificate of Incumbency. Any one of the following will be accepted as part of the LEI application:

- Certificate of Incumbency

- Articles of Association / Memorandum of Association

- Certificate of Incorporation

- Registry Extract or official filing

- Power of Attorney (PoA) or legal letter

- Power of Attorney (PoA) or legal letter

In order to obtain a Legal Entity Identifier all information must be checked for data quality control purposes. Before all LEIs are issued the data is cross checked with the local companies’ registry and documentation provided. This ensures that the LEI is a reliable source of data and is one of the most important factors behind the LEI. The LEI is an Open Data System. In order to ensure an Open Data System contains high quality data it should to be sourced from a trusted registry. GLEIF have outlined over 650+ company registries from which a legal entity can have its data confirmed. An LEI code is a unique identifier that offers accurate data about a company by searching for them on the LEI index. A companies LEI record will contain public data such as their name, address, where they are registered, and whether they are a branch, or owned by another 'parent' company.

In order to validate and confirm this information, it must be cross checked with the local company’s registry listing. For example a company in the UK will usually be registered with the Companies House and in the USA with the Secretary of State. This listing will be used to confirm LE-RD (Legal Entity Reference Data).

LE-RD (Legal Entity Reference Data) - In order to ensure any Open Data System contains high quality, reliable data it needs to be obtained from a trusted source. With regards to the LEI, the data in question is LE-RD which is commonly referred to as Level 1 data. Level 1 Data provides simple, business card information about a legal entity. It is of paramount importance that as we migrate from a national business 'ID' to a global one, that the transition is seamless and this new global identifier is accurate and reliable for the end user. GLEIF have outlined over 650+ company registries from which a legal entity can have its data confirmed.

If you are a UK company registered with the Companies House, they provide a public searchable database of UK entities, along with basic documentation and a list of current and past Directors. This means the company information can be confirmed very quickly, and we often are able to register LEIs for UK entities in a matter of minute. There are some national companies’ registries that have strict rules around providing company data, or registries that are hard to make contact with. In these cases we may request that the LEI applicant provide some registry documentation in order to allow LOU Rapid LEI confirm the data provided while filling out the online LEI registration form.

Once the entity information has been provided, it has to be checked to ensure it is fully correct. There are a number of documents which can be accepted as official registry data and used to corroborate the LEI data. This means that the document should primarily confirm the legally registered entity name, current address, name of primary stakeholders (e.g. Director, CEO).

Level II Data-If you are reporting parental information, you will be required to confirm the existence of this relationship by providing consolidated accounts. A company annual report or consolidated will only be accepted as evidence of the relationship.

Letter of Authorization (LoA)If you are applying for LEI on behalf of another legal entity, client or employer you may be required to provide a Letter of Authorization signed by the company authorized signatory, which is usually the Director. In order to transfer and renew LEI which is currently being managed at another LEI service provider, you will also be required to provide LoA. This will facilitate assessment of aggregate borrowing by corporate groups, and monitoring of the financial profile of an entity/group. This requirement will be implemented in a calibrated, but time-bound manner. Necessary instructions will be issued by end-October 2017.

New LEI regulation for payments in India

LEI were introduced in India by the Reserve Bank in a phased manner for participants in over the counter (OTC) derivative and non-derivative markets and large corporate borrowers. The banks shall advise their existing large corporate borrowers having total exposures of ₹ 50 crore and above to obtain LEI as per the schedule. Borrowers who do not obtain LEI as per the schedule are not to be granted renewal / enhancement of credit facilities. A separate roadmap for borrowers having exposure between ₹ 5 crore and upto ₹ 50 crore would be issued in due course. Banks should encourage large borrowers to obtain LEI for their parent entity as well as all subsidiaries and associates.

Entities can obtain LEI from any of the Local Operating Units (LOUs) accredited by the Global Legal Entity Identifier Foundation (GLEIF) – the entity tasked to support the implementation and use of LEI. In India, LEI code may be obtained from Legal Entity Identifier India Ltd (LEIIL), a subsidiary of the Clearing Corporation of India Limited (CCIL), which has been recognized by the Reserve Bank as issuer of LEI under the Payment and Settlement Systems Act, 2007 and is accredited by the GLEIF as the Local Operating Unit (LOU) in India for issuance and management of LEI.

The rules, procedure and documentation requirements may be ascertained from LEIIL. After obtaining LEI code, banks shall also ensure that borrowers renew the codes as per GLEIF guidelines. These directions are issued under Section 21 and Section 35(A) of the Banking Regulation Act, 1949 - It has been decided to require banks to make it mandatory for corporate borrowers having aggregate fund-based and non-fund based exposure of ₹ 5 crore and above from any bank to obtain Legal Entity Identifier (LEI) registration and capture the same in the Central Repository of Information on Large Credits (CRILC).

| Total Exposure to Scheduled Commercial Banks | To be completed by |

|---|---|

| ₹ 1000 crore and above | Mar 31, 2018 |

| Between ₹ 500 crore and ₹ 1000 crore | Jun 30, 2018 |

| Between ₹ 100 crore and ₹ 500 crore | Mar 31, 2019 |

| Between ₹ 50 crore and ₹ 100 crore | Dec 31, 2019 |

| Phase | Net Worth of Entities | Proposed deadline | Proposed deadline |

|---|---|---|---|

| Phase I | above Rs.10000 million | April 30, 2019 | December 31, 2019 |

| Phase II | between Rs.2000 million and Rs 10000 million | August 31, 2019 | December 31, 2019 |

| Phase III | up to Rs.2000 million | March 31 2020 | September 30 2020 |

New LEI regulation for payments in India

It is now mandatory that the LEI system be adopted for all payment transactions of value ₹50 crore and above, handled by entities using the Reserve Bank’s Centralized Payment Systems viz. Real-Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT). Issued under Section 10 (2) read with Section 18 of Payment and Settlement Systems Act, 2007 (Act 51 of 2007) and will be effective from April 1, 2021.

As per Reserve Bank of India-ApplicabilityEntities can obtain LEI from any of the Local Operating Units (LOUs) All members, other than private individuals, transacting in the markets regulated by RBI will need to obtain the LEI in the given schedule below:

- Government securities market

- Money market -markets for any instrument with a maturity of one year or less)

- Non derivative forex markets (settlement of instruments before the spot date)

- All Eligible Participants in the OTC Derivative markets

- Large Corporate Borrowers

- All Eligible Participants in Non- Derivative Market

Banks are now required to ask for LEI from all large corporate borrowers. RBI has implemented a schedule to enforce the regulation in a phased manner. If the large corporate borrowers fail to provide LEI, its credit facilities will not be neither renewed nor new credit offered. If the entity fails to receive LEI before the due date, they cannot transact in these financial markets.

RBI also motivates to require LEI from the partner entities, parent entities and subsidiaries of the large corporate borrowers.

Meaning of Legal Entity Identifier

A legal entity is an organization or company that has legal rights and responsibilities, including tax filings. The Legal Entity Identifier (LEI) is a 20-digit reference number used to uniquely identify parties in financial transactions worldwide, based on the ISO 17442 standard developed by the International Organization for Standardization (ISO). The code was introduced as a critical measure to better the quality and precision of financial data systems for better risk management post the Global Financial Crisis. So it’s essentially a business passport, which identifies your company and makes it possible to check if your counterpart is who they’re claiming to be. LEI will be assigned on application from the legal entity and after due validation of data. For an organization, LEI will be

- Used as a means of identification for a financial entity

- Facilitate transaction reporting to Trade Repositories

- Ensure compliance with regulatory requirements

LEI consist of 20 characters and will be issued to each company once:

- The first 4 characters are unique to the LOU which has issued the LEI.

- The 5th and 6th characters are the same – 0 for every company.

- The following 12 characters consist of letters and numbers and are unique for each company

- The final 2 characters are known as the checking characters.

The entity-specific part of the code is there for a reason and is structured with the following information-

- The official name of the legal entity

- The registered headquarters address of the legal entity

- The country of legal formation

- The date of the first LEI assignment

- The date of the last update of the LEI

- The date of expiry, if applicable

Meaning of Legal Entity Identifier

This is a 20-digit unique code that is issued to any company wanting to conduct financial transactions and trade or borrow money as a corporate borrower in India. The LEI code contains information about the organization’s ownership and structure and is meant to enhance transparency in the financial marketplace. You can order LEI registration from any local operating unit or from a Registration Agent. There is a fee attached when issuing Legal Identifier Codes and an annual maintenance fee must be paid when renewing the code.

An LEI code search will reveal crucial information based on the ownership structure of the entity. As such, it can be used to establish ‘who is who’ and ‘who owns whom.’ Hence essentially, an LEI search will provide you with access to a global directory of participants that exist within the financial market.

How to buy shares in India for beginners?

- Since it is not possible to directly visit the stock exchange and buy or sell stocks/shares like any other commodity on the market, it becomes necessary to hire the services of brokers.Brokers can be licensed individuals, registered companies and even online agencies accredited by Securities and Exchanges Board of India (SEBI-the board which regulates and administers the shares market), who are the professionals authorized to buy and sell on the stock markets. You can also approach various broking companies which are licensed to trade and deal in securities in the stock markets. Brokers would help you fill a form and would require items and documents like passport size photographs, proof of residential address and also a valid proof of identity.

- The next step on would then be to open two types of accounts for you. One of the accounts is a trading account and the second is called a Demat account. The difference in these types of accounts is that a trading account is basically concerned with on how to buy shares, while a Demat account is meant to hold the stocks or shares.

It is impossible to hold shares in physical form or to simply store stocks physically, so these stocks have to be converted to a Dematerialized or Demat state. This specialized account stores the shares you have acquired from the markets through your brokers in your name. Also, the sale of your stocks will be from this account and it will reflect in your Demat account statements that you get at regular intervals.

On the other hand, buying and selling of shares you intend to acquire or sell will however require a Trading account.. Both the Demat and Trading accounts will be opened simultaneously as they are both important requirements in knowing how to buy shares in India for.

The primary purpose of a PAN card is for checkmating financial transactions carried out by individuals. PAN is a 10-digit alphanumeric number issued by the Income Tax Authorities under the supervision of Central Board of Direct Taxes (CBDT). It is a unique key which is assigned to an individual and is mandatory for taxation purposes.

Buying and selling of shares in India takes place in two exchanges namely:Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) only. Beginners interested in learning on how to buy shares in India need to specify the particular exchange to their brokers, as the prices of shares at the two exchanges usually differ.

For professional guidance on how to buy/sell shares in India, you need to inform your broker about what quantity of which share you wish to buy and most importantly, at which price. If you use an online broker helping with buying shares in India, you can also place your order via their customer care lines, so that when the share reaches that price, your broker will make the transaction on your behalf. The same applies to selling of shares. Your sell order will be processed by your broker when the share eventually attains that price.The buy and sell orders are valid for a specific period, usually less than 48 hours. If the buy or sell price is not reached within that time frame, the order is cancelled and you’ll need to place a new order.

Types of Shares traded in stock exchanges in India

Equity shares-Also called ordinary shares, majority of the types of shares in India traded on the stock exchanges are equity shares. Equity shares are offered at different face values and owners of equity shares are entitled to dividends, voting rights and other benefits as shareholders.

Shares with Differential Voting Rights-More popularly called DVRs, these types of shares in India offer voting rights that may not be the same as those of equity shareholders. As compared to equity shares, shares with DVRs are often traded at lower values – most times, they could be just 10% of the voting rights of regular equity shareholders. However,DVRs are types of shares in India that tend to attract higher dividends

Preference Shares-These types of shares in are named so because owners of preference shares usually have rights to dividends ahead of ordinary shareholders. For preference shares, a fixed dividend is declared annually, whereas in equity shares, dividends are declared based on the profits of the company.

Open LEI system

Information accuracy and reliability are the foundation of trade, and any shortcoming affects everything from the ability to process transactions to the capacity to discern systematic risk automatically. The open LEI system solves this problem by providing permanent, IP-free, unique identifiers for all entities who undertake financial transactions. Anyone can access the open LEI data that includes:

- Registered and trading names

- Company type (e.g. Fund, Trust, Limited Liability Company)

- Registered address (es)

- Company registration number

- Parent company information

- Subsidiary company information

The global open and available LEI database can be accessed by LEI Search, a user-friendly interface to the Legal Entity Identifier (LEI) system. It is publicly available with updates provided on a daily basis. The LEI Search interface triumphs former time-consuming background checks, allowing to systematically browse the GLEIF database and can be easily integrated into your know your customer (KYC) process. The Legal Entity Identifier information needs to be updated every 12 months.

If you are a Limited Company or Sole Trader in India, it might be that you don’t need LEI by law. You may still decide to obtain a code before you need it, however, especially if you are engaged in any cross border activity, as LEI is quickly being adopted as a global standard.

As of July 2020, LEI Register has introduced a new option for customers in India- the LEI Register’s Official LEI Certificate. It is available as a PDF file as well as A4 paper document (sent as a mail, delivered within 7 working days). LEI Certificate is a document displaying your company information based on a Legal Entity Identifier (LEI) that is an international standard (ISO 17442) and is endorsed by G20 countries. LEI aim to standardize information regarding legal entities around the globe. LEI Register has trustworthy information on all companies with valid LEI-s around the world. The information is checked and renewed every year. To download the LEI Certificate, you need to choose it in the checkout page of LEI Registration/ LEI Renewal process. You will receive the certificate as a downloadable email file. The PDF Certificate price starts at ₹890.

The certificate can be sent via e-mail to their on-boarding team or upload it to your bank account or trader’s platform to make the LEI identification process more seamless.

| Years | LEI | LEI Certificate + Tag | Certificate hard copy |

|---|---|---|---|

| 1 | ₹3990 | +₹890 | +₹990 |

| 3 | ₹9990 | +₹1690 | +₹990 |

| 5 | ₹14900 | +₹2490 | +₹2490 |

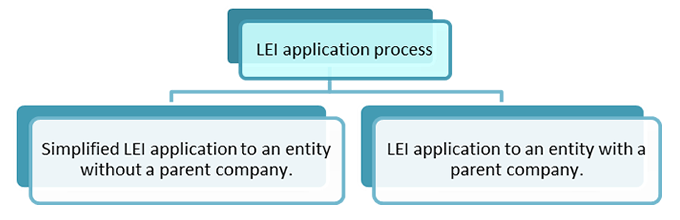

How to Obtain a Legal Entity Identifier Number in India?

Obtaining a Legal Entity Identifier (LEI) is easy. Simply follow the steps described below and your LEI number will be sent to you within 1-24 hours.

Step 1: Fill in the LEI application form-

In order to apply for a new LEI number, you’ll first need to fill in the blanks in the LEI number registration application form along with Documents to prove the registration of the company. Please upload the documents to prove the registration of the company. For example, GST Certificate, IEC details, Udyog Aadhaar, Memorandum.

Step 2: Data Validation-Choose LEI registration period. You may choose between a one, three- or five-year registration periods by clicking on the appropriate one. You can pay by credit card or PayPal and your LEI application will be processed as soon as the payment has been submitted.

Step 3: Confirmation-After receiving the confirmation certificate within 1-24 hours, you can check your LEI number validity on our LEI search page by simply typing in your LEI number or company name.

How to Obtain a Legal Entity Identifier Number in India?

LEI application to an entity with a parent company

Step 1: Fill in the LEI application form-order to apply for a new LEI number, you’ll first need to fill in the blanks in the LEI number registration application form along with Documents to prove the registration of the company. Please upload the documents to prove the registration of the company. For example, GST Certificate, IEC details, Udyog Aadhaar, Memorandum.

State the address of the parent company and the shareholding pattern of the parent company along with consolidated accounts. A company annual report or consolidated will only be accepted as evidence of the relationship. Additional information needed is: parent company name, address, accounting period, documents to prove the registration of the parent company and the date when the mother-daughter relationship first started in addition to consolidated financial statements to prove the relationship. It is also required to mention that whether the parent company ultimate consolidation parent or not. If not then, additional information needed is: ultimate parent company name, address, accounting period, documents to prove the registration of the ultimate company and the date when the mother-daughter relationship first started along with consolidated financial statements to prove the relationship.

Step 2: Data Validation-Choose LEI registration period. You may choose between a one, three- or five-year registration periods by clicking on the appropriate one. You can pay by credit card or PayPal and your LEI application will be processed as soon as the payment has been submitted..

Step 3: Confirmation-After receiving the confirmation certificate within 1-24 hours, you can check your LEI number validity on our LEI search page by simply typing in your LEI number or company name.

New Legal Entity Identifier (LEI) Regulations for Insurers and Loaners

As advised by the Financial Stability Development Council, Sub-Committee (FSDC-SC), new Legal Entity Identifier regulations are going to apply.

- All insurers shall obtain LEI as of July 31st for reasons mentioned above.

- All insurers shall inform their corporate borrowers with total exposures of ₹50 crore and more to obtain LEI and provide it to them on or before June 30th, if they haven’t done so already.

- Borrowers, who do not obtain LEI by June 30th, 2020, will no longer be granted renewal/ enhancement of credit facilities by insurers.

- New loan proposals will not be sanctioned by the insurers without valid LEI information.

- Insurers have to keep records of their borrowers’ LEI codes and specify while reporting the transactions executed with such corporate borrowers.

Insurers have to keep records of their borrowers’ LEI codes and specify while reporting the transactions executed with such corporate borrowers.

Legal Entity Identifiers in Crypto-currency & block chainWhile crypto currency transactions are publicly recorded, users are known only by their crypto currency “addresses,” which cannot be traced back to users’ real-world identity. As such, crypto currency transactions are more transparent than cash but more anonymous than other forms of online payment. They are “Virtual Currencies and Beyond, Initial Considerations”. Anonymity in crypto currency transactions is also an issue when it comes to tax evasion..

Block chain currencies that are completely anonymous seem to have grown in popularity on the dark web and criminal marketplace that has paved the way for money laundering, terrorism finance and other shady transactions.

Legal Entity Identifiers can help with the organization identity layer and because LEI is just a 20-digit code, they contain no personal data. When it comes to digital transactions on the Crypto-currency or block chain, LEIs can provide peace of mind for business entity identification as the banking sector could set-up processes to check transactions in the LEI database.

If the financial institution or entities maintain a database of transactions, then it is possible that LEI can lead to entity identification and person identification in transactions. It would mean that the time it takes to trace a transaction is greatly reduced too. The only solution to this problem is that if we put a transaction on a distributed network of many “peers”, then it would become very hard for a hacker to change or alter that data because they would have to alter it on each peer.

Legal Entity Identifiers go some part of the way to solve that challenge. It doesn’t mean that we’re giving away our data or freedoms. Instead, identity data will give more credibility/transparency to the crypto currency system and each transaction behind it. Whether or not the network is centralized, identities can still preserve the network’s independence and credibility because it will make life for the cybercriminals harder.

Legal Entity Identifiers in Know Your Customer (KYC)Banks, insurers, creditors and more are increasingly demanding (thanks to the global drive in KYC regulation) that customers provide due diligence information to ensure they are who they say they are. KYC regulation is now expanding into other industries such as not-for-profit. KYC typically involves:

- Customer identification through collection of personal information.

- Screening of data against global watch lists.

- Determination of risk for customer to commit money laundering, terrorist finance, or identity theft.

- Creation and assessment of a customer profile.

- Monitoring transactions against a customer’s expected behavior profile.

According to UK Government website, identity checking consists of 5 parts:

(‘strength’)

- detect-get evidence of the claimed identity

(‘validity’)

- respond-check the evidence is genuine or valid

(‘activity’)

- Recovery-check the claimed identity has existed over time

(‘identity fraud’)

- Identity-check if the claimed identity is at high risk of identity fraud

(‘verification’)

- Access Management-check that the identity belongs to the person who’s claiming it

Adopting LEIs for each client transaction can save time, gain transparency and streamline on boarding. This is because the LEI database is open, up-to-date and contains all the information needed to identify an organization thereby save time and money in manual verification and checking. For instance, in a business loan application, e-KYC could check and verify a business with LEI in minutes and a

Legal Entity Identifiers in Digital Certificates

Digital certificates are hugely important in encrypting the internet. Whether it’s for encrypting a website and adding the ‘S’ to HTTPS or it’s encrypting and signing a digital document like a PDF, digital certificates are everywhere. Up until now, they have solved some great security challenges on the internet by encrypting networks and communication channels. However, as we know, encryption is not always enough. You can keep information encrypted but if you’re sending it to a criminal then encrypting it does nothing. As an example, imagine visiting an online shop. The shop is encrypted and so you feel safe enough to buy something and you enter your credit card information. Later, you realize the shop itself was merely a phishing site and you’ve actually sent your sensitive information to a cybercriminal. This is a regular occurrence on the internet today.

It’s not enough to know your information is protected. Today, we need to know who is on the receiving end of that information and be sure that we can trust them. HTTPS websites used to have the option of adding identity to the certificates but it was far too easy to get one if you were a cybercriminal and the people doing the vetting were the same people selling the certificates so there wasn’t much motivation to improve the process. Even code signing certificates (used to protect us from malicious apps) were being obtained by cybercriminals to sign apps that would infect our computers and phones.

Any organization trading on the financial market today has to have LEI and declare on that the LEI their parent and subsidiary companies. This database of LEIs is open and accessible to the public who can read and challenge the data. LEIs are obtained from independent Local Operating Units managed by the GLEIF. The power of a third-party identification system is huge and can be relied upon now for global financial reporting to comply with regulations like MiFID II, EMIR and MiFIR. Going beyond trade reporting, LEIs have already been dubbed as a new tool to help save the Know Your Customer (KYC) and other due diligence processes in on boarding a customer. Using LEIs in digital certificates could increase the efficiency of this system even further.

Right now the identity vetting in the Qualified Certificate is done by a certificate authority and is not available on an open database. It’s also possible to change company details without the certificate details changing. This can create areas of vulnerability that a hacker can exploit. Legal Entity Identifiers are not yet integrated with all types of digital certificates but you can obtain an SSL/TLS Certificate with a LEI and a Digital Signing Certificate with a LEI. A good use case for digital signing is B2B transactions that involve paper based document signing such as contracts and agreements. An organization looking to take these workflows online and make them paperless would benefit from having the additional security of LEI Numbers attached to the certificate that is doing the encrypting and signing of the document.

This LEI number can be checked against the on boarding data and reduce friction and time associated with transactions between two parties.

Business Bank Account and their Advantages

A business bank account is simply a separate account for all of your business finances and accounting. It’s thought that business owners save time sorting through company expenses and they find it more efficient to do their finances. This really means that you’re able to simplify your accounting processes and ensure that you’re paying the right business tax each month because you’re always paying out expenses from your business account. Additionally, having a business bank account will allow you to access business finance that you’re bank may not allow you to access from a personal account. Things like a business loan, tfor example. You can also access other features such as a personal business banking manager who works with you to support your business growth. Business accounts access online can also provide additional tools to help you manage your business finance that a personal account would not provide. When looking to open a business bank account you should be considering a number of factors.

(Standing Charges)

(Transaction Charges)

Internet Banking

Interest Rates

Business Bank Account and their Advantages

Introductory Offers

Branches

Mobile Only Branches

Opening a business bank account will require certain documentations that banks use to do Know Your Customer and Anti-Money Laundering checks. These required documents are often:

- Proof of address of the company– such as a bank statement or utility bill.

- Business details – registered address, contact details, company’s house registration (only for limited companies or partnerships). You may also be asked for some financial statements.

- If relevant, details of all directors or partners, including name, date of birth, address and National Insurance numbers.

It’s important to note that a sole trader can use a personal account to do business but if you have a registered business you should have a separate bank account. If a bank recognizes that many business transactions are occurring on a personal account they may ask you to open a business account or threaten to close your account.

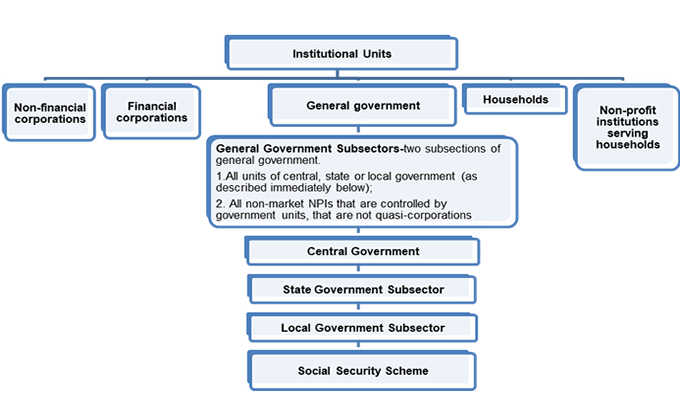

Legal Entity Identifiers for Government Entities

The LEI ROC has stated, at the GLEIS Forum on the 22nd May 2019 that government entities are eligible for a Legal Entity Identifier (LEI) as they are legal entities according to ISO 17442, in the same conditions as other entities i.e. “if they could enter independently into legal contracts, regardless of whether they are incorporated or constituted in some other way”.

They also found that entities that cannot be incorporated such as ministries, agencies and republics are eligible for LEI. It was clarified that these entities should enter a parent entity when applying for LEI where previously this information was not being entered. For this reason, the LEI ROC is looking to create a new item called “general government entities” which could be filled out separately and help to clarify, if there is no parent entity, at least what industry these entities belong to. This shows a small shift in the collection of entity data. The LEI ROC wants to know more about government entities and more accurately reflect the hierarchy of these entities. The LEI ROC has therefore published a public consultation on the subject of adding “general government entities” as a classification item under the Legal Entity Identification application process.

According to ISO 17442, legal entities:“Include, but are not limited to, unique parties that are legally or financially responsible for the performance of financial transactions or have the legal right in their jurisdiction to enter independently into legal contracts, regardless of whether they are incorporated or constituted in some other way.”

The LEI ROC are satisfied for this definition to include government entities that are not incorporated or have a legal personality as long as they enter legal contracts under their jurisdictions laws such as issuing, buying or selling financial assets.

- To avoid duplication and data errors in the Legal Entity Identifier System, the LEI ROC suggests using the identifiers defined in the LEI Common Data File format V2.1.

- Under LEI application procedures today, the definition of a parent (either direct or ultimate) is currently based on accounting consolidation.

The current standards in the Global Legal Entity Identifier System (GLEIS) state that a legal entity can opt out of the collection of its parent’s entities information if there is no parent according to the definition. This could include legal entities whose parent is a natural person, does not prepare financial statements or there is no known person controlling the entity such as a diversified shareholding. This means that under the current definition, government entities can opt out of parent reporting and this is expected to happen in the majority of cases. . There are some organizations which are part or fully state owned and therefore there is a similar relationship. On the other hand, many government entities appear to exist more as soiled entities either on a local or national level and act independently from the levels above and below it, both financially and with accountability within the public sector.

The European Market Infrastructure Regulation (EMIR) and Legal Entity Identifiers (LEIs)

LEIs are mandatory for entity identification of both parties involved in derivative contracts whether financial or non-financial. Information should include the parties that enter, the beneficiary, the booking entity and the clearing member. A report shall use a legal entity identifier to identify

- A beneficiary which is a legal entity

- A broking entity

- A CCP

- A clearing member

- A counterparty which is a legal entity

- A submitting entity.

It is also understood that the LEI needs to add a capability to identify branches under the same legal entity. For example, bank branches which come under one legal entity but may require separate identification for cross-border resolution schemes. The LEI ROC has referred to these as “international branches” and has made some recommendations on the conditions in which an international branch would be able to obtain LEI.

FCA will take pragmatic approach to supervise reporting on Brexit Day