MSME Registration in India

MSME stands for micro, small and medium enterprises, which was introduced in agreement with the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 by the Government of India. MSMEs are critical contributors to the country's socio-economic development. Thus they are the backbone of any economy and are engines of economic growth promoting equitable development for all. The role of MSME in Indian economy is important, as the MSMEs are key contributors to the socio-economic development of the country. The initiative of MSME started functioning in 2006 to create a competitive environment and encourage small businesses to ensure speedy development and boost the economy.

The Micro Small and Medium Enterprises (MSMEs) were classified as per the MSME Act-2006 solely based on their investment. However, this definition was broadened by the Finance Minister Nirmala Sitharaman in 2020 and a composite criterion was introduced. Turnover was also added to the definition. The updated classification of MSMEs is given below.

The MSMEs are categorized into manufacturing sectors and service sectors. The sectors are classified as per the investment, annual turnover and investment. Below is the classification of the micro, small and medium enterprises.

| Criteria | Micro Enterprises | Small Enterprises | Medium Enterprises |

| Investment | Less than ₹ 1 Cr | Less than ₹ 10 Cr | Less than ₹ 50 Cr |

| Annual turnover | Less than ₹ 5 Cr | Less than ₹ 50 Cr | Less than ₹ 250 Cr |

Therefore, to support and promote MSMEs, the Indian government offers various subsidies, schemes and incentives through the MSMED Act. A registration under the MSMED Act is required to avail the benefits of the same from the central or state government and the banking sector. This registration is known as the MSME registration.

Micro, small and medium sized enterprises in both the manufacturing and service sector can obtain MSME Registration under the MSMED Act. Though the MSME registration is not statutory, it is beneficial for business at it provides a range of benefits such as eligibility for lower rates of interest, excise exemption schemes, tax subsidies, power tariff subsidies, capital investment subsidies and other support.

MSME registration is not a statutory requirement. However, the MSME registration process in India has been conceptualized to provide maximum benefits to all types of enterprises. After registration, any enterprise becomes qualified to reap the benefits offered under the MSMED Act. Some of the benefits from Central Government include easy sanction of bank loans (priority sector lending), lower rates of interest, excise exemption scheme, exemption under certain tax laws and statutory support.

The state government and union territories also have complied with their own package of facilities and incentives for MSMEs. Some of the benefits provided by the state government for MSMEs include the development of specialized industrial estates, tax subsidies, power tariff subsidies, capital investment subsidies and other support.

Both the centre and the state, whether under law or otherwise, target their incentives and support packages generally to units registered with them. Banking laws, excise law and the direct taxes law have incorporated the word MSME in their exemption notifications. Therefore, the registration certificate issued by the registering authority is seen as proof of being MSME and is required to avail the benefits sanctioned for MSMEs. Some of them are detailed below.

- Interest rate reduction for loans

- Collateral free loans from banks

- Beneficial reservation policies in the manufacturing/ production sector

- Ease of obtaining licenses, registrations and approvals.

- Eligibility for CLCSS (credit linked capital subsidy scheme)

- International trade fair special consideration

- Government security deposit waiver (helpful while participating in tenders)

- Stamp duty and registration fees waiver

- ISO certification fees reimbursement

- Direct tax laws rules exemption

- Interest rate exemption on OD

- NSIC performance and credit rating fees subsidy

- Patent registration subsidy

- Barcode registration subsidy

- IPS subsidy eligibility

- Electricity bills concession

Benefits of Registering a Credit Co-operative society

MSME Registration provides to you right to get avail benefits under the MSME Scheme of the government’s. One of the outstanding advantages of registration is that the Government will include your company or business in the Central and State Government schemes so one must get the complete advantage of the schemes. It will lead into superior awareness about the much-arrived schemes and complete transparency of the government working process. Numerous benchmark benefits include simple ingress to various government subsidies and bank loans, ability to apply for different Government’s beneficial schemes and clarity in various laws such as excise, banking direct taxes and much more. Below are the some important MSME Scheme Benefits under the Registration:-

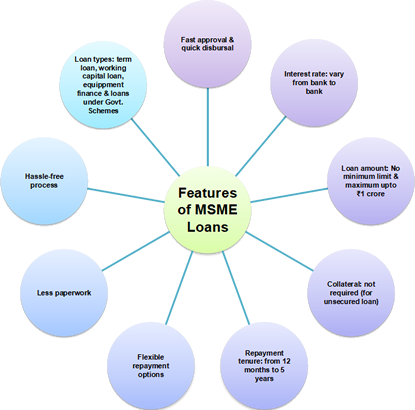

Cheaper bank loans: All the businesses which are registered under the MSME can avail the benefits regarding the bank loans. Banks provide the collateral free loans where your property is not pledge with the Banks. Government and SIDBI both create a separate legal entity which work to implement this scheme on the all small and medium business enterprises.

Enterprises with MSME Certificate have a benefit of 1% exemption on the interest rate on Overdraft.

Note: Many benefits of MSME Registration depend upon the category under which it is registered.

Easy access to credit: PM Modi has introduced the Mudhra Loan scheme, which provides loans to MSME / SSI without collaterals.

PM Modi has introduced the Mudhra Loan scheme, which provides loans to MSME / SSI without collaterals.

Quicker approvals from state and central government bodies: Business registered under MSME are given higher preference in terms of government license and certification.

Tax rebates: MSME / SSI registered businesses enjoy multiple income taxes and capital gains tax subsidies from the government.

Cheaper infrastructure: Charges are lower for MSME registered company for facilities such as electricity and GST exemptions. In fact, other business services such as patents are also cheaper for MSMEs.

Concession in the Electricity Bills: All the small enterprise which has MSME Udyog aadhar Certificate can avail the concession in the electricity bills in the particular areas.

Access to tenders:

There are multiple government tenders which are open only to MSMEs to promote small business participation in the India.MSME registration helps to acquire government tenders easily as Udyam Registration Portal is integrated with Government e-Marketplace and various other State Government portals which give easy access to their marketplace and e-tenders.

Preference in the Government Tenders: MSME certified enterprises are preferred in the government tenders during the bid. So this is one of the most important advantages to win the big tenders.

Reservation Benefits: Government also amend the industrial act where every small business which is registered under the MSME can avail this scheme where you can increase your production of the goods and employment opportunities in the country.

Easy to open business bank account or any other license registration: MSME Registration Certificate treat as legal entity proof of the business so you can easily open a current bank account or mentioned your registration while making another license like GST Registration etc.

Participate in the International Trade Fairs: Participate in the International Trade Fairs – All the small business have to expand their business across the India or on international level which is required to exposure and support from the government. Governments provide benefits to participate and special consideration in the international and national trade fairs which is organized by the MSME Department.

Octroi Benefits under MSME: Small enterprise have to pay the octroi on the goods and services which is delivered by them so its increase the unnecessary cost sometime. In this scheme government provides the refund of the octroi which is imposed on the goods and services.

Stamp Duty and Registration Charges Waived off: Previously all the enterprise which are expand their business in the IT Park or SEZ they avail the benefits under the Stamp Act but now all the small enterprise also can avail these benefits.

Exemption under the Income Tax as Direct tax: Exemption under the Income Tax as Direct tax – All the small business which are doing some really innovative or towards the society improvement then they can take the benefits of the income tax in the initial years. Even under the startup India scheme same benefits are introduced by the government. As mentioned in the government scheme, the businesses registered under MSME get a direct exemption of income tax for the first year of business, depending on its activities. It offers a major relief for enterprises from detailed bookkeeping habits and complex auditing processes.

Get Reimbursement under the Bar Code Registration: Small Enterprise have required lot of the mandatory register to run their product based business so all the manufacturing units required the barcode registration. Under this scheme you are eligible for the subsidy under the bar code registration. Barcodes are essential to keep track of goods in the entire process of supply and chain management.

Various Subsidies on the NSIC Performance and Credit Rating : Under this scheme all the small enterprise can avail the benefits of the subsidy on various expenses through NSIC Performance.

Industrial Promotion Subsidy: Under this scheme government wants to promote the small enterprise so they provide benefits regarding industrial promotion in terms of subsidy.

Protection in the Delay- Payments from Buyers : This is most common problem for the small business. Buyers always delay in the payments to the small business but under this scheme all the enterprise are protected and can file case against the buyer & settlement of the dispute in the minimum time.

Reduction in rate of the Interest by the major banks : Under this scheme all the major banks have some policy regarding the bank loan for the MSME which are following –

- 1. 40% of the total advances must go to micro and small enterprises involved which are in manufacturing having investment in plant and machinery up to ₹10 lakh and for service enterprises having investment in equipment up to ₹4 lakh.

- 2. 20% of the total advance to micro and small enterprises should go to manufacturing enterprises that have above ₹10 lakh till ₹ 25 lakh investment in the plant and machinery and for service enterprises that have investments in equipment above ₹ 4 lakh

- 3. To simplify, 60% of the advances must go to micro enterprises.

Get Capital Subsidy : Under this scheme all the enterprise got the 15% capital subsidy so they can purchase the plan and machinery for the same.

Security Deposit Waived off : Small Enterprise have very small amount of the working capital to run their business but in the some registration they have to deposit the security money so under this scheme it has been waived off for the MSME registration enterprises.

Got the benefits in ISO Certificate : Small enterprise while apply for the big projects, they have to show their credibility which required the ISO Certification. In this scheme you got the subsidy for the ISO Certification.

Get the Subsidy on the Patent Registration :

There are lot of the innovative small firms which are doing some innovative things & required a patent registration which is really expensive. Under this scheme you got the 50% waived off in the patent government registration fee.

Note: National Patent Application is provided with one-time support of up to ₹ 25,000.

Tax Benefits :

The Corporate Tax has been reduced to 5% (instead of 30%, it is 25% now). This is available for those companies which have a turnover of ₹50 Crore.

The timeframe for the minimum alternative tax is increased by 15 years.

The presumptive tax has been reduced by 2% for companies which have a turnover of ₹2 Crore.

There is a One Time Settlement Fee for non-paid amounts of MSME.

Excise Exemption : The Government of India has exempted payment of the excise duty for MSME holders whose value of turnover did not exceed ₹ 1.5 Crore on the first day in the financial year.

However; the benefit of excise exemption is only for those goods which are sold or purchased under the brand name of its manufacturer.

For example – Excise Duty of 10% is levied on ready-made and Made-up articles for MSME holders.

Note : After GST came into being, the limit is decreased to ₹20 Lakh and ₹10 Lakh in the Special Category States.

Concessions on Intellectual Property : MSME holders or Start-ups can get a refund of up to 80% from the Government on the patent application. The government also grants a sanction of ₹ 2 Lakh for filing an International Patent application.

The individual/company gets a rebate of 50% on trademark filing if they possess an MSME Certificate.

Benefits from State Government :

Most of the states offer different schemes or services to promote small businesses. Exemption of Sales tax, credit facilities, developed sites for warehouse construction, hire/purchase of machinery and electricity bill concession.

Benefits from Central Government : To support MSME holders, the Central Government of India has announced different schemes to provide credit support to them.

Credit Guarantee Scheme : A trust named Credit Guarantee Fund Trust for Micro and Small Enterprise (CGTMSE) is established for individuals to provide a collateral free loan of up to ₹ 50 Lakhs. This scheme also includes.

- . The one-time availability for loans in North-eastern regions is reduced from 1.5% to 0.75%.

- . Promoting women entrepreneurship.

- . Loans of up to ₹ 5 Lakhs for micro-enterprises.

- . The guarantee cover is increased from 75% to 80%.

- . The rate of subsidy for MSME is 15%.

- . The upper limit of the loan provided is ₹ 1 Crore.

ISO 9000/ISO 14001 Certification Reimbursement Scheme : This scheme provides an incentive to all those small scale business/industries that have ISO 9000/ISO 14001/HACCP certifications. These incentives are meant for technological up-gradation, quality and environment management.

Almost 75% of the acquiring charges (certifications) are refunded which subject to a maximum of ₹ 75,000 in each case.

Micro & Small Enterprises Cluster Development Programme (MSE-CDP) : This scheme focuses on enhancing productivity and improving the availability of different services to medium and small enterprises. The assistance is provided on-

- . Infrastructure Development (Government Contribution 60%)

- . Diagnostic Study (Maximum cost ₹ 2.50 Lakh)

- . Soft Intervention (Government Contribution 75%)

- . Setting Common Facility Centre (Government Contribution 70%)

A separate council Micro and Small Enterprises Facilitation Council is established for timely resolution of disputes with the customers.

15% subsidy of CLCSS : Credit Linked CGSTI Subsidy Scheme (CLCSS) is a scheme of The Ministry of Micro, Small, Medium Enterprises (MSME) for technological upgradation of the businesses. The government of India launched the scheme in October-2000, and it offers a 15% subsidy which can not go beyond ₹15 lakhs. The maximum limit of loans for subsidy’s calculation under the scheme is ₹100 lakhs.

Following industries can avail benefits of CLCSS:

- . Bio-tech Industry

- . Drugs and Pharmaceuticals

- . Common Effluent Treatment Plant

- . Food Processing (Ice-cream included)

- . Rubber Processing including vehicle Tyre

- . Dyes and Intermediates

- .Industry based on Medicinal and Aromatic plants

- . Corrugated Boxes

- . Plastic Molded / Extruded Products and Parts/ Components

- . Poultry Hatchery & Cattle Feed Industry

Where MSME Registration has been registered with the government

Micro, small and medium sized enterprises in both the manufacturing and service sector can obtain MSME Registration under the MSMED Act. Though the MSME registration is not statutory, it is beneficial for business at it provides a range of benefits such as eligibility for lower rates of interest, excise exemption schemes, tax subsidies, power tariff subsidies, capital investment subsidies and other support.

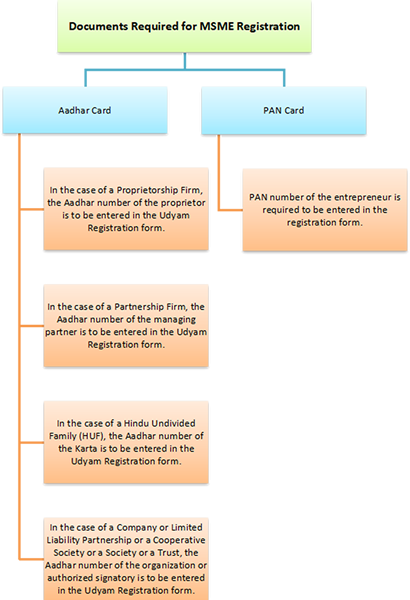

Documents Required for the MSME Registration

- a) Aadhar Card Copy – Aadhar is the mandatory now for the MSME Registration Online. Without Aadhar card you can’t register for the MSME Registration. In the case of the private limited company registration or partnership etc. Partners aadhar card is worked because there is no Aadhar card on company name.

- b) Mobile Number linking with the Aadhar card – MSME Registration is online so you have to required to link your mobile number with the Aadhar card. If number is not linked with the Aadhar card then you have to required the alternative documents like pan card copy etc.

Characteristics of the MSME/Udyam registration

MSME/Udyog registration has been replaced with the Udyam Registration. If any micro, small and medium industries want to start any business; they need to do the registration with MSME/Udyam Registration. This registration with MSME/Udyam Registration is completely online. This facility provides the business with a lot of benefits and subsidies.

For registration under the Udyam registration, an Aadhaar card is compulsory. In case an applicant is other than the proprietor, the Aadhaar card of the partner and the director will be required.

An existing and new business can apply for MSME/Udyam Registration, provided the existing unit is functioning and meets the threshold limits for registration. UAM Registration has to be re-registered for Udyam registration to avail the benefits of MSME.

There is no expiry of the Udyam Registration Certificate. As long as the entity is ethical and financially healthy there will be no expiry of the certificate. The Udyam Registration has lifetime validity unless cancelled.

MSME covers only manufacturing and service industries. Trading companies are not covered by the scheme. MSME is to support startups with subsidies and benefits, trading companies are just like middlemen, a link between manufacturer and customer.

The MSME/Udyam Registration Certificate is for a single entity irrespective of multiple branches or plants. However, information about multiple branches or plants must be furnished.

Documents Required for MSME Registration

The Udyam registration process is entirely online and does not require the uploading of any documents. However, before applying for Udyam Registration, the proprietor or owner of the enterprise is required to have the following documents:-

Other Documents Required for MSME Registration

The documents required for registration depend on the kind of entity that wishes to register for the MSME certificate. In general, documents like address proof of the business, sales and purchase bills are required.

Business Address proof:- In case the proprietor owns the premise, a property tax receipt, lease deed, allotment letter or possession letter will be required. No other document needs to be submitted if there is a municipal license in the name of the proprietor or the business, or any of the partners or directors of the business.

In case of a rented premise, an NOC (no objection certificate) and rent receipt is required from the landlord. Further, an electricity or water bill (showing usage of utilities and ownership of the property) needs to be submitted.

Company documents:-

In-case the entity is a company, a copy of the ‘MoA’ (Memorandum of Association) and ‘AoA’ (Articles of Association) along with the certificate of incorporation needs to be submitted. A general meeting resolution copy authorizing one of the directors as the signatory also needs to be submitted.

In-case of partnership firms, the partnership deed needs to be submitted and if it’s registered partnership firm, the copy of the registration certificate also needs to be submitted.

Apart from these documents Company registration proof: Photocopy of sale bill and photocopy of purchase bill (of raw material).

Licenses and bills:- Apart from the above mentioned mandatory documents, there are some documents which need to be submitted on demand like the purchase bills and receipts related to the installation of the plant and machinery. If applicable, a copy of the industrial certificate obtained by the proprietor also needs to be submitted.

Hence Photocopy of an industrial license and bills of purchasing machinery and installations are required.

In addition to it, one has to file its personal details of the kind of the industry they want to run and some of the respective documents as mentioned below:

- 1. Aadhaar Number

- 2. Name of Applicant

- 3. Social Category

- 4. Gender

- 5. Name of Enterprise / Business.

- 6. Type of Organization you are opting for.

- 7. Your PAN number.

- 8. Location of Plant you are setting up in a place.

- 9. Current office Address

- 10. Mobile Number.

- 11. Your E- Mail ID.

- 12. Date of Commencement of Business.

- 13. Bank Account Number.

- 14. Bank IFS Code.

- 15. Main Business Activity of Enterprise

- 16. NIC 2 Digit Code.(National Industrial Classification Code)

- 17. Additional details about Business.

- 18. Number of employees

- 19. Investment in Plant & Machinery / Equipment

- 20. Attachment of your scan copy of Aadhaar card

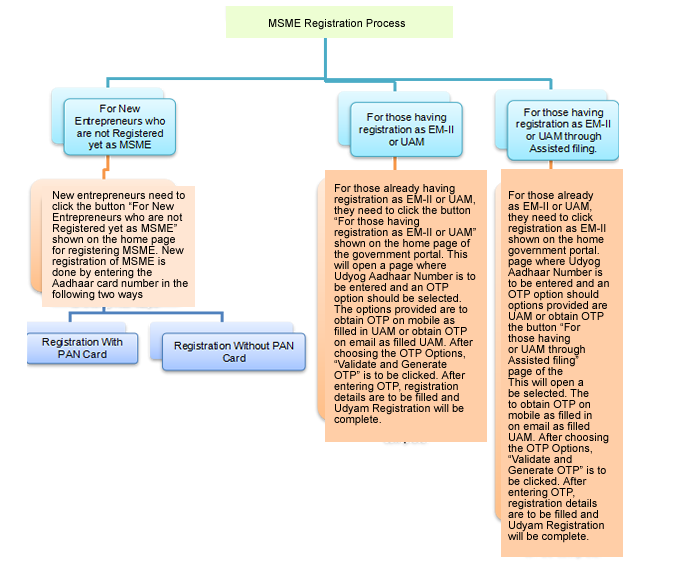

MSME Registration Process

MSME registration is to be done in the government portal of udyamregistration.gov.in. The registration of MSMEs can be done under the following two categories in the portal –

- For New Entrepreneurs who are not Registered yet as MSME and

- For those having registration as EM-II or UAM and for those having registration as EM-II or UAM through Assisted filing.

Aadhaar Card is the only document required for MSME registration. MSME registration is fully online and no proof of documents is required. PAN and GST linked details on investment and turnover of enterprises will be taken automatically by the Udyam Registration Portal from the Government databases. The Udyam Registration Portal is fully integrated with Income Tax and GSTIN systems. PAN and GSTIN number is mandatory from 01.04.2021 for registration. Registration without PAN and GSTIN can be done now but have to be updated with PAN number and GSTIN number within 01/04/2021 for avoiding suspension of registration. Those who have EM-II or UAM registration or any other registration issued by any authority under the Ministry of MSME, will have to re-register themselves in this Portal.

Registration with PAN Card

When clicked on the “For New Entrepreneurs who are not registered yet as MSME” button on the homepage of the government portal, it opens the page for registration and asks to enter the Aadhaar number of the entity and the name of the entrepreneur. After entering these details, “Validate and Generate OTP Button” is to be clicked. Once, this button is clicked and OTP is received and entered, the PAN Verification page opens. If the entrepreneur has a PAN Card, the portal gets the PAN details from the government databases and automatically fills details on the page. The ITR details are to be filled by the entrepreneur. Once PAN details are entered, a message appears as “Udyam Registration has already been done through this PAN” and the entrepreneur needs to click the “Validate PAN” button. After verification of PAN, the Udyam Registration box will appear and the entrepreneurs need to fill the personal details and details of the plant or industry. Once the details are filled, the “Submit and Get Final OTP” button is clicked, the MSME is registered and a message of successful registration with reference number will appear. After verification of registration, which may take a few days, the Udyam Registration Certificate is issued.

On the home page of the Government portal.click on the "For New Entrepreneurs who are not registered yet as "MSME".

It opens the page for registrationand asks to enter the Aadhaar number and the name of the entrepreneur

After that click on "Validate and Generate OTP Button"

Once,this button clicked and OTP is received and entered, the PAN Verification page opens

If the entrepreneur has a PAN card, the portal get the PAN details from the government databases and automatically fills details on the page.

The ITR details are to be filled by the entrepreneur.

Once PAN Details are entered, a message appears as"Udyam Registration has already been done through this PAN" and the entrepreneurs needs to click the "validate PAN" button

After verification of PAN, the udyam registration box appear and the entrepreneurs need to fil the personal details and detalils of plant or industry.

Once the detals are filled,"the submit and get final OTP" button is clicked the MSME is registered and a message of successful registration with reference number will appear. After verification of registration, which may take a few days,the Udyam Registration cerificate is issued.

Registration without PAN Card

The button “For New Entrepreneurs who are not registered yet as MSME” is to be clicked on the homepage of the government portal. It opens the page for registration and asks to enter the Aadhaar number and the name of the entrepreneur. After entering these details, “Validate and Generate OTP Button” is to be clicked. Once, this button is clicked and OTP is received and entered, the PAN Verification page opens. If the entrepreneur does not have a PAN Card, the “No” option under the heading “Do you have PAN?” is to be clicked and then the “Next” button. After the “Next” button is clicked, the Udyam Registration page opens where the entrepreneur should enter his personal details and plant or industry details. Once the details are filled, “Final Submit” is clicked and a thank you message will appear with the registration number. After getting the PAN and GSTIN, it needs to be updated on the portal within 01/04/2021 to avoid suspension of Udyam Registration.

On the home page of the Government portal.click on the "For New Entrepreneurs who are not registered yet as "MSME".

It opens the page for registrationand asks to enter the Aadhaar number and the name of the entrepreneur

After that click on "Validate and Generate OTP Button"

Once,this button clicked and OTP is received and entered, the PAN Verification page opens

If the entrepreneur doess not have a PAN card, the "NO" option under the heading."Do you have PAN?" is to be clicked and the "NEXT" Button.

After tne "NEXT" buton IS clicked, the Udyam Registration page opens where the entrpreneur shoud enter his personal details and plant or industry details.

Once the Details are filled "final submit" is clicked and a thank you message will appear with the registration number.

After getting the PAN and GSTIN, it need to be updated on the portal within 01/04/2021 to avoid suspension of Udyam Resistration.

MSME Returns

FORM MSME-1 Furnishing return with ROC in respect of outstanding payments to Micro or Small Enterprise. MCA wide order dated 22nd January, 2019 directed all companies, who get supplies of goods or services from micro and small enterprises and whose payments to micro and small enterprise suppliers exceed forty five days from the date of acceptance or the date of deemed acceptance of the goods or services as per the provisions of section 9 of the Micro, Small and Medium Enterprises Development Act,2006 (27 of 2006)(hereafter referred to as “Specified Companies”),shall submit a half yearly return to the Ministry of Corporate Affairs stating the following: (a) The amount of payment due; and (b) The reasons of the delay; Every specified company shall file in MSME Form I details of all outstanding dues to Micro or small enterprises suppliers existing on the date of notification of this order i.e. 22nd January, 2019 within thirty days from the date of deployed on MCA 21 portal.(i.e. within 30 days from the 1st may, 2019) Every specified company shall file a return as per MSME-1,by 31st October for the period from April to September and by 30th April for the period from October to March. MSME-1 FORM is required to file two times in the month of May, 2019:

- Initial Return for the amount outstanding as on 22nd January, 2019

- Half Yearly Return for the amount outstanding as on 31st March, 2019.

Important Definition

1. Specified Companies mean all companies, who get supplies of goods or services from micro and small enterprisesand whose payments to micro and small enterprise suppliers exceed forty five days from the date of acceptance or the date of deemed acceptance of the goods or services as per the provisions of section 9 of the Micro, Small and Medium Enterprises Development Act, 2006.

Note: MSME-1 is not applicable to Medium Enterprises.

2. Micro & Small Enterprises above means any class or classes of enterprises (including companies, Partnership firm, Association of Person, Hindu Undivided family, Co-operative Society, Proprietorship Firm, other entities etc) shall be :

| Classification | Ceiling on Investment in Plant and Machinery (in INR) for enterprises engaged in or production, processing or preservation of goods | Ceiling on Investment in Plant and Machinery (in INR) for enterprises engaged in or production, processing or preservation of goods |

|---|---|---|

| Micro | Below ₹ 25 lakhs | Below ₹ 10 lakhs |

| Small | More than ₹25 lakh but does not exceed ₹ 5 crore | More than ₹25 lakh but does not exceed ₹ 5 crore |

3. Day of Acceptance means:

- (a)The day of the actual delivery of goods or the rendering of services; or

- (b)Where any objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier.

4.Day of Deemed Acceptance meansday of the actual delivery of goods or the rendering of services, where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services.

Procedure for filing MSME Return

Details to Be Furnished In MSME-1:- Name of supplier

- PAN of supplier

- Amount due against the supplies of goods or services

- Date from which the amount is due

- Reason of delay in payment of the amount due

- Firstly identify your MSME registered suppliers and ask for their registration certificate.

- If there are any such suppliers who are registered under MSME Act and if the payments to them are due for more than 45 days from the date of acceptance of the goods and services, then details of such suppliers shall be furnished in Form MSME-1.

If any company fails to file MSME-1 within 30 days or knowingly furnishes any information or statistics which is incorrect or incomplete in any material respect, the company shall be punishable with fine which may extend to twenty-five thousand rupeesand every officer of the company who is in default, shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than twenty-five thousand rupees but which may extend to three lakh rupees, or with both.

MSME schemes launched by the Government are:

Technology and Quality upgradation scheme:

Registering in this scheme will help the micro, small and medium enterprises to use energy efficient technololgies (EETs) in manufacturing units so as to reduce the cost of production and adopt a clean development mechanism.

Grievance monitoring system:

Registering under this scheme is beneficial in terms of getting the complaints the business owners addressed. In this, the busniess owners can check the status of their complaints, open them if they are not satisfied with the outcome.

Incubation

This scheme helps innovators with the implementation of their new design,ideas or products. This scheme provides finnnancial assistance for setting up'Business Incubators'. This scheme promotes new ideas,designs,products etc.,

Credit linked capital subsidy scheme:

Under this scheme new technology is provided to the business owners to replace their old and obsolete technolugy. A capital subsidy is given to the business to upgrade and have better means to do their business. These small, micro and medium enterprises can directly approach the banks for their subsidies.

New MSME Act and its Effect on the Payment Cycle under the New GST Returns

The Micro, Small and Medium Enterprises Development Act (MSMED), 2006 was enacted to support the creation and development of MSMEs. It also enhances their ability to compete with other domestic and larger foreign counterparts. The recently implemented new GST return filing system brought with it many changes aimed at simplifying the process of filing returns.

Background of the New GST Return Filing SystemOne of the main changes that the new system brings is the increase in the turnover limit for classification of taxpayers for filing frequency:

- Small taxpayers: Having aggregate turnover up to ₹5 crores in the preceding year;

- Large taxpayers: Having aggregate turnover above ₹5 crores in the preceding year;

All MSMEs fall under the small taxpayer category. The new GST return system allows small taxpayers to choose quarterly filing of returns, whereas the large taxpayers must file returns only on a monthly basis. Further, registered buyers can take the input tax credit (ITC) inANX-2 only on the basis of invoices uploaded by their suppliers in their corresponding ANX-1.

Background of the MSMED Act, 2006The MSMED Act, 2006 specifies 45 day credit period for the recipient of any goods or services to pay to the MSME supplier. It is included to protect the interest of the MSME business. The Ministry of Micro, Small & Medium Enterprises (MSME) launched MSME Samadhaan on 30 October 2017. It was launched to empower micro and small entrepreneurs across the country. It enables them to directly register their cases about delayed payments by Central Ministries/ Departments/ CPSEs/ State Governments.

- The issue arises when MSME taxpayers, who opt for quarterly filing of returns, make a supply to large taxpayers. The same is presented as follows:

- The MSME can declare the details relating to this supply anytime in the three months of the relevant quarter by the 11th of the month following the quarter.

- The recipient of the supply, on the other hand, being a large taxpayer, will claim ITC and file GST returns on a monthly basis.

- The recipient will want to ensure that the MSME supplier declares the invoice details on GST portal for such supply on a timely basis. Thereby, he can avail the ITC only after the MSME uploads the invoices.

- As a result, the recipient may choose to hold back payment of either the tax portion of the invoice or the entire invoice itself to such MSME supplier, until he declares the same on the portal.

- However, the MSMED Act does not allow the recipient to hold back the payment beyond 45 days.

- It discourages the large taxpayers from dealing with the MSMEs until they change the filing frequency to monthly or upload invoices on a monthly basis since it might create working capital issues for an MSME due to a delayed or potential non-availability of ITC.

- MSMEs may face additional compliance cost to maintain a system for uploading invoices regularly on a monthly basis rather than on a quarterly basis.

- It obligates the MSME to opt for a monthly return filing system, thus defeating the objective of the new return system to simplify the return filing process.

On 23 August 2019, the Hon’ble Finance Minister Nirmala Sitharaman has announced many measures to boost the economy. One of them is the intention to allow GSTN to partner with the Trade Receivables Discounting System (TReDS)

TReDS is an existing platform specially created for MSMEs to sell/discount their trade receivables. This helps the MSME free up working capital faster. The TReDS platform allows for bidding of discount rates that ensure that the MSME gets the best discounting price in the market. The partnership with GSTN helps authenticate the invoice raised by the MSME since GSTN can confirm the existence of the receivable subsequent to entering the relevant details on its portal. This would incline the MSME to file its GST returns sooner to be able to sell its receivables. The quarterly return filing option does help to ease the burden of compliance on the MSME. However, choosing to file monthly returns makes it more attractive for large taxpayers to deal with the MSME. While the payment cycle problem faced by the large taxpayers in dealing with the MSMEs isn’t fully addressed, it does appear to be a step in the right direction.

Various MSME Schemes of the Central Government

Various MSME Schemes of the Central Government

| S.No | SME Division Schem | Related Scheme | Description | Nature of assistance | Who can apply? | How to apply? |

|---|---|---|---|---|---|---|

| 1 | Scheme for 'Providing financial assistance on International Cooperation' | International Cooperation Scheme | The scheme covers the following activities: (a)Deputation of MSME business delegations to other countries for exploring new areas of technology infusion/ upgradation, facilitating joint ventures, improving market of MSMEs products, foreign Collaborations, etc. (b)Participation by Indian MSMEs in international exhibitions, trade fairs and buyer-seller meets in foreign countries as well as in India, in which there is international participation. Holding international conferences and seminars on topics and themes of interest to the MSME. | IC scheme provides financial assistance of up to 95% of airfare and space rent of entrepreneurs. Assistance is provided on the basis of size and type of the enterprise. It also provides assistance for common expenses of delegation like freight & insurance, local transport, secretarial/ communication services, printing of common catalogue, etc.3 | (a)State/ Central Government Organizations; (b)Industry/ Enterprise Associations; and (c)Registered Societies/ Trusts and Organizations associated with promotion and development of MSMEs. | Apply online or else can send applications for seeking financial assistance, in the prescribed to the Director (International Cooperation), Ministry of MSME, Udyog Bhavan, New Delhi - 110011 |

| 2 | Scheme for providing establishment of new institutions (EDIs), strengthening the infrastructure for EDIs under ATI scheme | Assistance to Training Institutions scheme | The assistance shall be provided to training institutions in the form of capital grant for creation/strengthening of infrastructure and programme support for conducting entrepreneurship development and skill development programmes. | Maximum assistance for creation or strengthening of infrastructure will be ₹150 lakhs on matching basis, not exceeding 50% of project cost. However, for the North Eastern region (including Sikkim), Andaman & Nicobar and Lakshadweep, maximum assistance on matching basis would be ₹ 270 lakhs or 90% of project cost, whichever is less. Maximum assistance per trainee per hour for entrepreneurship development and skill development programmes is ₹50 (₹60 for NER, A&N and Lakshadweep) | Any State/ Union Territory Government, Training Institutions, NGOs and other development agencies can apply for assistance for creation or strengthening of infrastructure. Training institutions who wish to conduct training programmes under the scheme will have to enroll themselves with any of the three national level EDIs of the Ministry viz, NIESBUD, Noida; IIE Guwahati and ni- MSME, Hyderabad. | Organizations who wish to apply for assistance for creation or strengthening of infrastructure may send their applications to the Director (EDI), Ministry of Micro, Small and Medium Enterprises, Udyog Bhawan, Rafi Marg, New Delhi - 110 107. Training institutions who wish to conduct training programmes or persons who wish to enroll for training programmes under the scheme may visit http://msmetraining.gov.in/ approach any of the three EDIs mentioned. |

| 3 | Marketing support under the Marketing Assistance scheme | Marketing Assistance Scheme | The assistance is provided for following activities: A.Organizing exhibitions abroad and participation in international exhibitions/ trade fairs B.Co-sponsoring of exhibitions organized by other Organizations/ industry associations/ agencies Organizing buyer-seller meets, intensive campaigns and marketing promotion events | Financial assistance of up to 95% of the airfare and space rent of entrepreneurs. Assistance is provided on the basis of size and type of the enterprise. Financial assistance for co-sponsoring would be limited to 40% of the net expenditure, subject to a maximum amount of ₹ 5 lakh. | MSMEs, Industry Associations and other organizations related to the MSME sector | The applications/ proposals for seeking assistance under the scheme shall be submitted to the nearest office of National Small Industries Corporation, with full details and justification. |

Development Commissioner (DC-MSME)

| S.No | Related Scheme | Description | Nature of assistance | Who can apply? | How to apply? |

|---|---|---|---|---|---|

| 1 | Credit Guarantee Scheme | Ministry of Micro, Small and Medium Enterprises, GoI and Small Industries Development Bank of India (SIDBI), established a Trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to implement Credit Guarantee Fund Scheme for Micro and Small Enterprises. The corpus of CGTMSE is being contributed by GoI and SIDBI. | For individuals: Collateral free loans up to a limit of ₹ 50 lakhs - for individual MSEs | Both existing and new enterprises are eligible to be covered under the scheme.Both existing and new enterprises are eligible to be covered under the scheme. | Candidates meeting eligibility criteria may approach Banks/ Financial Institutions, which are eligible under the scheme, are scheduled commercial banks and select Regional Rural Banks. |

| 2 | Credit Linked Capital Subsidy Scheme for Technology Upgradation | Technology up-gradation would ordinarily mean induction of state of- the-art or near state-of-the-art technology. In varying mosaic of technology obtaining in more than 7,500 products in Indian small scale sector, technology up-gradation would mean a significant step up from present technology level to a substantially higher one involving improved productivity, and/or improvement in quality of products and/or improved environmental conditions including work environment for the unit. It includes installation of improved packaging techniques as well as anti-pollution measures and energy conservation machinery. Further, units in need of introducing, facilities for in-house testing and on-line quality control would qualify for assistance, as the same is a case of technology upgradation. Replacement of existing equipment/technology with same equipment/ technology will not qualify for subsidy under this scheme, nor would scheme be applicable to units upgrading with second hand machinery. | The revised scheme aims at facilitating technology up-gradation by providing 15% up-front capital subsidy to SSI units, including tiny, khadi, village and coir industrial units, on institutional finance availed of by them for induction of well established and improved technologies in specified sub-sectors/products approved under the scheme. Revised CLCSS has been amended as follows: (a)Ceiling on loans under scheme has been raised from ₹ 40 lakh to ₹ 1 crore (b)Rate of subsidy has been enhanced from 12% to 15% (c)Admissible capital subsidy is calculated with reference to purchase price of plant and machinery, instead of term loan disbursed to beneficiary unit (d)Practice of categorization of SSI units in different slabs on the basis of their present investment for determining eligible subsidy has been done away with; and (e)Operation of scheme has been extended upto 31 st March, 2007. The above revisions/ amendments are effective from September 29, 2005. | Eligible beneficiaries include sole proprietorships, partnerships, cooperative societies, and private and public limited companies in the SSI sector. Priority shall be given to women entrepreneurs. | Candidates meeting eligibility criteria may all scheduled commercial banks, scheduled cooperative banks [including urban cooperative banks co-opted by SIDBI under Technological Upgradation Fund Scheme (TUFS) of Ministry of Textiles], Regional Rural Banks (RRBs), State Financial Corporations (SFCs) and North Eastern Development Financial Institution (NEDFi) are eligible as PLI under this scheme after they execute a General Agreement (GA) with any of nodal agencies, i.e., Small Industries Development Bank of India (SIDBI) and National Bank for Agriculture and Rural Development (NABARD). |

| 3 | ISO 9000/ISO 14001 Certification Reimbursement Scheme | Small scale sector has emerged as dynamic and vibrant and making significant contribution to industrial production, export and employment generation. The process of economic liberalization and market reforms has opened up Indian small scale sector to global competition. In order to enhance the competitive strength of small scale sector, Government introduced an incentive scheme for their technological up-gradation/ quality improvement and environment management. The scheme provides incentive to those small scale/ancillary undertaking who have acquired ISO 9000/ISO 14001/HACCP certifications. The scheme enlarged so as to include reimbursement of expenses for acquiring ISO 14001 certification. | Scheme envisages reimbursement of charges of acquiring ISO- 9000/ISO-14001/HACCP certifications to the extent of 75% of expenditure subject to a maximum of ₹ 75,000 in each case. | Permanent Registered Micro Small Enterprises (MSEs) units are eligible to avail incentive scheme. Scheme is applicable to those MSEs/ ancillary/ tiny/ SSSBE units who have already acquired ISO- 9000/ISO-14001/ HACCP certification. | Formats of application & required documents together with "Check list" are enclosed. Small & micro units with EM No. are required to submit their application duly completed to their local Director, MSME-DI addresses given in following websites : www.dcmsme.gov.in |

| 4 | Micro & Small Enterprises Cluster Development Programme (MSE-CDP) | Ministry of Micro, Small and Medium Enterprises (MSME), Government of India (GoI) has adopted cluster development approach as a key strategy for enhancing productivity and competitiveness as well as capacity building of Micro and Small Enterprises (MSEs) and their collectives in the country. Clustering of units also enables providers of various services to them, including banks and credit agencies, to provide their services more economically, thus reducing costs and improving availability of services for these enterprises. Objectives of the scheme: i.Support sustainability and growth of MSEs by addressing common issues such as improvement of technology, skills and quality, market access, access to capital, etc. ii.Build capacity of MSEs for common supportive action through formation of self help groups, consortia, upgradation of associations, etc. iii.To create/upgrade infrastructural facilities in the new/existing industrial areas/clusters of MSEs. To set up common facility centres (for testing, training centre, raw material depot, effluent treatment, complementing production processes, etc). | Diagnostic study Soft intervention Setting up of Common Facility Centres (CFCs) Infrastructure development (Up-gradation/New) Cost of project and Govt. of India assistance: •Diagnostic study - Maximum cost ₹ 2.50 lakhs. •Soft interventions - Maximum cost of project ₹ 25.00 lakh, with GoI contribution of 75% (90% for special category States and for clusters with more than 50% women/ micro/ village/ SC/ST units). •Hard interventions i.e., setting up of CFCs – maximum eligible project cost of ₹15.00 crore with GoI contribution of 70% (90% for special category States and for clusters with more than 50% women/ micro/ village/ SC/ST units). Infrastructure development in the new/existing industrial estates/ areas. Maximum eligible project cost ₹10.00 crore, with GoI contribution of 60% (80% for special category States and for clusters with more than 50% women/micro/SC/ST units) | Industrial association/ Consortium, Clusters | Online applications are only considered with effect from 01-04-2012. Hard copy of applications needs to be sent through State Governments or their autonomous bodies or field institutes of Ministry of MSME i.e., MSME-DIs. The proposals are approved by Steering Committee of MSE-CDP.n |

| 5 | Micro Finance ProgrammeMicro Finance Programme | Government launched a Scheme of Micro Finance Programme and tied up with existing programme of SIDBI by way of contributing towards security deposits required from the MFIs/NGOs to get loan from SIDBI. The scheme is being operated in underserved States and underserved pockets/ districts of other States. | Government of India provides funds for Micro Finance Programme to SIDBI, which is called ‘Portfolio Risk Fund’ (PRF). At present SIDBI takes fixed deposit equal to 10% of loan amount. The share of MFIs/NGOs is 2.5% of loan amount (i.e., 25% of security deposit) and balance 7.5% (i.e., 75% of security deposit) is adjusted from funds provided by the Government of India. | MFIs/NGO | Submit the proposal in prescribed form to SIDBI |

| 6 | MSME Market Development Assistance (MDA) | As part of comprehensive policy package for MSMEs, MSMEMDA scheme has been announced with a view to increase participation of representatives of participating units, the provision of MSME-MDA scheme has been modified recently. MDA is offered in three forms as mentioned below: Participation in the international exhibitions/fairs - For registered small & micro manufacturing enterprises with DI/DIC. Financial assistance for using Global Standards (GS1) in barcoding - Recognized importance of barcoding and avail financial assistance through Office of DC (MSME). Purchase and Price Preference Policy - This is administered through Single Point Registration Scheme of NSIC. Under this, 358 items are reserved for exclusive purchase from MSME by Central Government. Other facilities include tender documents free of cost, exemption from earnest money and security deposit and 15% price preference in Central Government purchases - for individual MSMEs. | The scheme offers funding upto 75% in respect of to and fro air fare for participation by MSME entrepreneurs in overseas fairs/trade delegations. The scheme also provide for funding for producing publicity material (upto 25% of costs)-Sector specific studies (upto ₹2 lakhs) and for contesting anti-dumping cases (50% upto ₹1 lakh) - for individual MSMEs & associations. | Individual MSMEs & industry associations | Candidates meeting eligibility criteria may send their application to office of DC (MSME) through concerned MSME‐DIs |

| 7 | National Awards (for individual MSEs)) | Micro, Small & Medium Enterprises (MSMEs) in India have seen a vast development. MSMEs have registered tremendous growth as also progress in terms of quality production, exports, innovation, product development and import substitution, very much beyond expected objectives of setting up MSMEs. Entrepreneurial efforts have made it possible to produce number of items, which hitherto were imported. In quite a few cases new variants so produced are having additional attributes than their original versions and are capable of solving a multitude of user problems. This all has become possible owing to ambitions and visionary spirit of entrepreneurs of MSMEs Ministry of Micro, Small and Medium Enterprises with a view to recognizing efforts and contribution of MSMEs gives National Award annually to selected entrepreneurs and enterprises under the scheme of National Award. | 1. Outstanding efforts in Entrepreneurship in Micro, Small & Medium Enterprises (MSMEs)

|

Deserving entrepreneurs managing Micro, Small and Medium Enterprises Having permanent SSI registration/ have filed Entrepreneurs Memorandum Part-II with authorities notified. MSMEs should have been in continuous production/ servicing at least during last three years. | Eligible enterprises send nominations in prescribed proforma/ downloaded only on prescribed form to Director, MSME-DI of the State where their MSMEs is registered/have filed Entrepreneurs Memorandum (EM). |

National Manufacturing Competitiveness Programme (NMCP) Schemes

DC-MSME Schemes under National Manufacturing Competitiveness Programme

| S.No | Related Scheme | Description | Nature of assistance | Who can apply? | How to apply? |

|---|---|---|---|---|---|

| 1 | National Manufacturing Competitiveness Programme (NMCP)National Manufacturing Competitiveness Programme (NMCP) | National Manufacturing Competitiveness Council (NMCC) has finalized a five-year national manufacturing programme. Ten schemes have been drawn up including schemes for promotion of ICT, mini tool room, design clinics and marketing support for SMEs. Implementation will be in PPP model, and financing will be tied up. Under this plan following schemes are being implemented. 1 Marketing support/ Assistance to MSMEs (Bar Code) 2 Support for entrepreneurial and managerial development of SMEs through incubators 3 Enabling manufacturing sector to be competitive through Quality Management Standard & Quality Tech. Tools (QMS/QTT) 4 Building awareness on Intellectual Property Rights (IPR) for MSME 5 (a) Lean manufacturing competitiveness scheme for MSMEs (b) Compendium of success stories. 6 (a) Design clinic scheme for design expertise to MSMEs manufacturing sector (DESIGN) (b) Case studies of design projects under design clinic scheme for MSMEs 7 Marketing assistance & technology up-gradation scheme in MSMEs. 8 Technology and quality up-gradation support to MSMEs 9 Promotion of ICT in Indian manufacturing sector (ICT) | Varies for each scheme. The reader is requested to refer following website: http://www.dcmsme.gov.in/schemes/nmcp_scm.htm. | MSMEs | Submit the proposal in prescribed form given in the DC (MSME) |

| 2 | i). Marketing Support/ Assistance to MSMEs (Bar Code) | To provide financial assistance to Micro and Small Enterprises (MSEs) to enhance their marketing competitiveness. Under this scheme MSEs are encouraged and motivated for use of barcodes through seminars and reimbursement of registration fees. | Reimbursement of registration fee (one time and recurring for 3 years) for bar coding. Financial assistance for reimbursement of 75% of one-time registration fee (Under SSI-MDA Scheme) w.e.f., 1st January, 2002 and 75% of annual recurring fee for first three years (Under NMCP Scheme) w.e.f., 1st June, 2007 paid by MSEs to GS1 India for using of Bar Coding. | The Scheme is applicable to those MSEs with EM-II registration and registration with GS1 India for use of barcode. | Once got registration for use of bar code for product (http://www.gs1india.org/), take following steps for reimbursement of fee Fill prescribed application form for claiming reimbursement on Bar Code Application form along with formats for supporting documents may be collected from Director, MSME-DI or can be downloaded from http://www.dcmsme.gov.in/ Application form with required documents is to be submitted to office of MSME-DI Address of MSME-DI is given on the website: http://www.dcmsme.gov.in/MSMEDO/ DCmsmeaddress.html |

| 3 | ii). Support for Entrepreneurial and Managerial Development of SMEs | The objective of the scheme is to provide early stage funding for nurturing innovative business ideas (new indigenous technology, processes, products, procedure, etc.) which could be commercialized in a year. Under this scheme financial assistance is provided for setting up of business incubators.. | Funding support for setting up of ‘Business Incubators (BI)’. The cost may vary between ₹4-8 lakh for each incubatee / idea, subject to overall ceiling of ₹ 62.5 lakh for each BI. Items @ per BI (a) Upgradation of infrastructure ₹2.50 lakhs (b) Orientation/ Training ₹ 1.28 lakhs (c) Administrative expenses ₹0.22 lakh Thus the total assistance per BI - ₹ 66.50 lakhs | Any individual or MSME having innovative idea near commercialization can apply to the host institution (e.g., IITs, NITs, Technical Colleges, Research institutes, etc.). See list of host institutions at http://www.dcmsme.gov.in/schemes/Institutions_Detail.pdf Any technical institution (as given in EOI) which wants to become host institution can apply to office of Development Commissioner – MSME (DC-MSME) or their nearest MSMEDIs, for funding support. | The scheme is based on Request for proposal (RFP)/Expression of Interest (EOI) and application by the technical institution, which wants to be host institution, can be made by it, once an RFP is released. - Any individual or MSME can apply directly to their nearest host institution, a list of host institution is given on the Website http://www.dcmsme.gov.in/schemes/Institutions_Detail.pdf |

| 4 | iii). Scheme for "Enabling Manufacturing Sector be Competitive through Quality Management Standards and Quality Technology Tools" | The objective of the scheme is to sensitize and encourage MSEs to understand and adopt latest Quality Management Standards (QMS) and Quality Technology Tools (QTT). | Funding support for introduction of appropriate course modules in technical institutions -Funding support for conducting ‘QMS awareness’ workshops (applicant – expert organization or industry associations) -Funding support for conducting Competition watch (Cwatch), study and analysis -Funding support for introduction QMS and QTT tools in selected MSMEs (applicant – expert organization or industry association) -Participation in International Study Mission (MSEs as selected by Monitoring and Advisory committee) - A total contribution of ₹ 425 lakhs per year will be done by GoI for introduction of course material, training the trainer, awareness workshop and other activities -Funding support of ₹1.25 lakhs per programme will be provided for conducting awareness program. -Under C-watch GoI contribution of ₹2.5 lakh for professional study on threatened product. GoI contribution of ₹7.5 lakh for technical exposure visit GoI contribution of ₹2.5 lakhs for procurement of samples GoI contribution of ₹ 5 lakhs for product development GoI contribution of ₹1.5 lakhs for popularization of improved products -GoI contribution of ₹ 2.5 lakh/unit for covering costs of diagnostic study and for implementation of Quality Technology Tools/Quality Management Standards (25 - 50% cost will be paid by participating units) - GoI contribution of ₹2.5 lakh per SME for international visit. (25% and 50% cost to be collected by micro and small organizations respectively | Expert organizations like Quality Council of India (QCI), National Recruitment Board for Personnel and Training, Consultancy Development Corporation, National Productivity Council, Standardization Testing & Quality Certification (STQC, a Society under Ministry of IT), IIQM (Indian Institute of Quality Management), Industry Associations that have taken active interest in QMS/QTT, Technical Institutions, Engineering Colleges, Tool Rooms and similar bodies, etc., MSEs | MSEs or Clusters may contact office of DC (MSME). DC office will finalize MSME clusters for conducting the Awareness Programme on Quality Management Standards and Quality Technology Tools (QMS/QTT). |

| 5 | iv. Building Awareness on Intellectual Property Rights (IPR) | The objective of the scheme is to enhance awareness of MSME about Intellectual Property Rights (IPRs) to take measure for the protecting their ideas and business strategies. Effective utilization of IPR tools by MSMEs would also assist them in technology upgradation and enhancing competitiveness | Funding support for - Conducting awareness/ Sensitization programmes on IPR (Applicants – MSME organizations and expert agencies) - Conducting pilot studies for selected clusters/Groups of industries (Applicants – MSME organizations competent agencies and expert agencies) - Funding support for conducting Interactive Seminars/Workshops (Applicants – MSME organizations and expert agencies) - Funding support for conducting specialized training on IPR (Applicants – Expert agencies) - Funding support for Assistance for Grant on Patent/GI Registration (Applicants – MSME units and MSME organizations) - Funding support for setting up of ‘IP Facilitation Centre for MSME (Applicants – MSME organizations and IPR facilitating agencies) - Funding support for organizing interaction with International Agencies (Applicants – MSME organizations and IPR facilitating agencies) - GoI assistance of ₹1 lakh per awareness programme will be provided - GoI assistance of ₹2.5 lakh per pilot study will be provided - GoI assistance of ₹2 lakh per programme of interactive seminar will be provided - GoI assistance of ₹6 lakh per short term training programme and ₹45 lakh per long term training programme will be provided - Registered Indian MSME will be provided one-time financial support limited up to ₹25,000 for on grant of domestic patent and ₹ 2.00 lakh for foreign patent. For registering under Geographical Indications of Goods Act, one time financial support will be limited up to ₹1.00 lakh. - GoI will provide a total financial support up to ₹65.00 lakh each for establishing IP facilitation centres, which will include one-time grant of ₹45.00 lakh and ₹18.00 lakh as recurring expenses for 3 years, ₹2 lakhs will be provided as miscellaneous charges - Government of India will provide financial support up to ₹5.00 lakh and ₹7.50 per event for domestic intervention and International Exchange Programme respectively | Registered MSME Units - MSME organizations - like industry association, societies, cooperatives, firms, trusts, NGOs, institutions and universities with a track record of assisting MSMEs - Competent agencies - like consultancy organizations, research institutes, individual experts or agencies having sound technical and financial capabilities to conduct pilot studies with at least five years of previous experience - Expert agencies - like TIFAC, Patent Facilitation Centre, NRDC, Indian Patent Office, Registrar of Trademark, Registrar of Geographical Indication, D.B.T., Registrar of Copyright, MoHRD, NIIPM, IITs, Law Schools, Patent Attorneys, individual IPR expert, WIPO, EU-TIDP, USPTO, KIPO/KIPA, IIFT, DIT, MoEF, Ministry of MSME, DSIR and other such bodies - Quasi-Government or Government Aided bodies - Private units provided it is sponsored by MSME Industry Associations | Application forms for each of the components are given with scheme guidelines (http://www.dcmsme.gov.in/schemes/IPR10.pdf ) , one can download application form from there and send it to nearest MSME-DI. |

| 6 | v. Lean Manufacturing Competitiveness Scheme for MSMEs | The objective of the scheme is to enhance the manufacturing competitiveness of MSMEs through the application of various Lean Manufacturing (LM) techniques. | Financial assistance for implementation of Lean Manufacturing techniques primarily cost of Lean Manufacturing consultant.(80% by GoI and 20% by beneficiaries) Lean manufacturing consultants will raise bills for services provided to SPV, SPV will pay first installment of 20% to LMC and will get it reimbursed by NMIU; funds will be transferred to NMIU by GoI. The payment to LMC by SPV would be on a milestone basis in 5 tranches of 20% each. | Scheme is open to all Micro, Small and Medium Manufacturing Enterprises. The units should be registered with DIC (EM-II) or with any other agency (Professional body, association, Government agency, department, etc). The units are required to form a MC ideally of 10 units (minimum 6) by signing among themselves a Memorandum of Understanding (MoU) to participate in the scheme. | A group of SMEs can apply for the scheme, hence either a recognized SPV can apply or a mini cluster can be formed by a group of 10 or more units - The SPV can apply to the National Monitoring and Implementing Unit (National Productivity Council for the Scheme) in the given format - The approval is given in two steps, first is in-principal approval and final approval is given once the criteria of in-principal approval are fulfilled. |

| 7 | vi). Design Clinic Scheme for design expertise to MSMEs manufacturing sector (DESIGN) | The objective of the scheme is to increase competitiveness of MSMEs through design and hence spread awareness on importance of design and its learning. | Funding support for ‘Design Awareness’ workshops & seminars Funding support for implementing ‘Design’ projects GoI contribution of ₹60,000 per seminar and 75% subject to a maximum of ₹3 lakhs per workshop 60% of the total approved project cost or ₹9 lakhs, whichever is less, in case of a individual MSME or a group of not more than three MSME applicants 60% of the total approved project cost or ₹15 lakhs, whichever is less, in case of a group of four or more MSME applicants 40% to be contributed by the applicant MSME(s) in both cases. | - Expert agencies (industries associations, technical institutions or other appropriate bodies) for conducting seminars and workshops - MSMEs or group of MSMEs as prime applicants - Academic institutes/design company/design consultants, etc., as co-applicants along with a designated MSME (prime applicant) - Individual (e.g., design students) as co-applicants in collaboration with the academic institution and MSME (prime applicant) | - For conducting workshop and seminar, expert agencies can directly apply to design clinic centers. - For design projects application can be made by MSMEs without a design company or along with design consultant/ academic institution, by submitting proposal to Design Clinic Center or through internet. - Apply online at http://www.designclinicsmsme.org/ or Download form from www.dcmsme.gov.in/schemes | 8 | vii). Marketing Assistance & Technology Up-gradation Scheme | Marketing Assistance and Technology Upgradation scheme is a GoI initiative for adoption of modern marketing techniques by MSMEs consistent with the requirement of global market. The scheme is divided into eight subcomponents and GoI assistance is available in various proportions. | - Funding support for conducting awareness on new packaging technologies (applicant as mentioned in EOI) - Cluster based studies on packaging status and need for up-gradation (gap analysis) (applicant as mentioned in EOI) - Unit based intervention for packaging requirement (pilot). (Applicant as mentioned in EOI) - Funding support for conducting skill up-gradation/ Development programmes for modern marketing techniques. (Applicant as mentioned in EOI) - Funding support for conducting trade competition studies. (Applicant as mentioned in EOI) - Funding support to MSMEs belonging to North-Eastern Region for participation in marketing events. (For North East–Region MSMEs) - Enabling participation of MSMEs in State/District level local Exhibitions/Trade fairs and provide funding support (reimbursement) (Registered MSMEs) - Funding support (in the form of reimbursement) to MSMEs for adopting Corporate Governance Practices. (Registered MSMEs) - Funding support for setting up of marketing hubs - Reimbursement to ISO 18000/ISO 22000/ISO 27000 certification for MSMEs. - GoI assistance of ₹0.50 lakh per programme (GoI:unit :: 80:20) - per awareness programme - GoI assistance of ₹10 lakh (GoI:unit :: 80:20) – for cluster based study on packaging. - GoI assistance of ₹9 lakh (GoI:unit :: 80:20) for a group of 10 units towards unit based interventions for packaging requirements in clusters - GoI assistance of ₹6 lakh (GoI: unit :: 80:20) per cluster for skill up-gradation programmes - GoI assistance of ₹8 lakh (GoI:unit :: 80:20) per trade competition study - Reimbursement up to ₹75,000 per unit (north–east ) for space charge, to and fro and transport charges - The total reimbursement upto ₹30,000 per unit for SC/ST/ Women/Physically Handicapped entrepreneurs, and ₹20,000 per person for other MSME units for participation in state and district level trade fairs. - Reimbursement up to 50% of total expenditure subject to maximum ₹45,000 per MSME unit for adopting corporate government practices - Funding support of ₹ 30 lakhs (GoI) for marketing hubs, plus ₹ 5 lakhs (GoI) for furniture, IT, etc., and recurring expenses of ₹15 lakhs (80% GoI, 20% private units) for 2 years - One time reimbursement of expenditure to the extent of 75% subject to a maximum of ₹1 lakh in each case for acquiring ISO | -Competent agency as mentioned in the EOI guidelines, MSMEs, industry associations, NGOs. | For participation of MSMEs in State/District level trade fair - SSC supported by office of DC (MSME) will identify and approve manufacturing MSME clusters/units for participating in State/ District level local Exhibitions/Trade Fairs on the basis of responses received through MSME-DIs, Industries Associations, and NGOs - Applicant MSME unit will submit its claim along with required documents to local MSME-DI office for reimbursement in prescribed format For adopting Corporate Governance Practices. - Office of DC-MSME will identify MSME units for participating in this activity on the basis of request received through MSME-DIs, Industries Associations, and NGOs - The applicant MSME unit will submit claim along with required documents to the local MSME-DI office for reimbursement in prescribed format For Reimbursement of Certification - The application form is given along with the scheme guidelines, (http://www.dcmsme.gov.in/schemes/MarkAssis.pdf) fill application form and send it to Regional MSME-DI along with supporting documents. |

| 9 | viii). Technology and Quality Up-gradation Support to MSMEs | The scheme advocates use of energy efficient technologies in manufacturing units so as to reduce cost of production and adopt clean development mechanism. | - Capacity building of MSME clusters for Energy Efficiency/Clean Development and related technologies (Applicant - awareness programme and model DPRs by expert agencies as mentioned in EOI, energy audits, DPRs and EET projects by expert agencies, associations or MSMEs) - Implementation of Energy Efficient Technologies (EET) in MSME units (Applicant - registered MSME unit, to be implemented by SIDBI) - Setting up of Carbon Credit Aggregation Centers (Association, technical institutions and ESCOs) - Encouraging MSMEs to acquire product certification/licenses from National/International bodies - Funding support of 75% for awareness programme subject to maximum of ₹75,000 per awareness programme. - 75% of actual expenditure for cluster level energy audit and preparation of model DPR - 50% of actual expenditure subject to maximum ₹1.5 lakh per DPR towards preparation of subsequent detailed project reports (DPRs) for individual MSMEs on EET projects. - 25% of the project cost will be provided as subsidy by Government of India, balance amount is to be funded through loan from SIDBI/ banks/ financial institutions. The minimum contribution as required by the funding agency will have to be made by MSME unit. - 75% of the actual expenditure, subject to a maximum ₹15 lakh for establishing Carbon Credit Accreditation Centers - 75% subsidy is provided to MSME manufacturing units towards licensing of product to National/International standards. The maximum GoI assistance allowed per MSME is ₹1.5 lakh for obtaining product licensing/ marking to National Standards and ₹2.0 lakh for obtaining product licensing/ Marking to international standards./td> | -Expert organizations like PCRA, BEE, TERI, IITs, NITs, etc. -State Govt. agencies like MITCON, GEDA, etc. Cluster/Industry based associations of MSMEs NGOs and Technical Institutions | Obtain product certification from National Standardization Bodies (like BIS, BEE, etc.) or International Product Certifications (CE, UL, ANSI, etc.) - For reimbursement of fees forward application in the specified format (given in annexure-IV of scheme guidelines), to MSME-DI concerned, along with required documents |

NSIC (National Small Industries Corporation) Schemes

| S.No | Related Scheme | Description | Nature of assistance | Who can apply? | How to apply? | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Performance and Credit Rating Scheme | An independent, trusted third party opinion on capabilities and credit-worthiness of SSIs - Availability of credit at attractive interest - Recognition in global trade - Prompt sanctions of credit from banks and financial institutions - Subsidized rating fee structure for SSIs - Facilitate vendors/buyers in capability and capacity assessment of SSIs - Enable SSIs to ascertain the strengths and weaknesses of their existing operations and take corrective measures. Salient features - A combination of credit and performance factors including operations, finance, business and management risk - Uniform rating scale for all empanelled rating agencies. - SSIs have the liberty to choose among the empanelled Rating Agencies. - Turn-over based fee structure - Partial reimbursement of rating fee through NSIC. |

|

Any enterprise registered in India as a micro or small enterprise is eligible to apply | Any micro or small enterprise wishing to apply for rating will have to fill up the prescribed application form and submit the same to nearest branch of NSIC or to the rating agency chosen by it. Or through empanelled rating agencies: CARE, CRISIL, India Ratings, ICRA, ONICRA, SMERA, Dun & Bradstreet (D&B), SMERA | ||||||||||

| 2 | Bank Credit Facilitation Scheme | To meet the credit requirements of MSME units NSIC has entered into a Memorandum of Understanding with various nationalized and private sector banks. Through syndication with these banks, NSIC arranges for credit support (fund or non-fund based limits) from banks without any cost to MSMEs. Furthermore MSMEs can upgrade their competence in terms of business and technologies by getting rated through independent, renowned and professional rating agencies empanelled with NSIC. MSE’s which get rated under NSIC-Performance and Credit Rating Scheme not only has a liberty to get rated from any one of rating agencies of its preference but it also invariably increases their creditability in business and help them in getting timely credit from banks at liberal rates of interest. | All documentations pertaining to completion and submission of a credit proposal to banks shall be undertaken by NSIC thereby saving cost and time to MSME. | MSME Entrepreneurs | Please visit hobts@nsic.co.in to download loan application forms from banks under Bank Credit Facilitation Scheme of the website address of the banks. | ||||||||||

| 3 | Raw Material Assistance Scheme | Scheme aims at helping MSEs by way of financing purchase of raw material (both indigenous & imported). This gives an opportunity to MSEs to focus better on manufacturing quality products. |

|

Entrepreneurs | Entrepreneurs can download and apply on prescribed application forms and along with application processing fee to submit to Regional & Branch Offices. | ||||||||||

| 4 | Single Point Registration | Government is single largest buyer of a variety of goods. With a view to increase share of purchases from small-scale sector, Government Stores Purchase Programme was launched. NSIC registers Micro & Small Enterprises (MSEs) under Single Point Registration scheme (SPRS) for participation in Government purchases. | The units registered are eligible to get benefits: - Issue of tender sets free of cost - Exemption from payment of Earnest Money Deposit (EMD) - In tender participating MSEs quoting price within price band of L1+15% allowed to supply a portion upto 20% of requirement by bringing down their price to L1 price where L1 is non-MSEs. - Every Central Ministries/ Departments/ PSUs shall set an annual goal of minimum 20% of total annual purchases of products or services produced or rendered by MSEs. Out of annual requirement of 20% procurement from MSEs, 4% is earmarked for units owned by Schedule Caste /Schedule Tribes. - In addition to the above, 358 items are also reserved for exclusive purchase from SSI sector. | Micro & Small Enterprises which are registered with the Director of Industries (DI)/District Industries Centre (DIC) as manufacturing/service enterprises or having acknowledgement of Entrepreneurs Memorandum (EM Part-II) are eligible for registration with NSIC under its Single Point Registration Scheme (SPRS). - Micro & Small Enterprises who have already commenced their commercial production but not completed one year of existence. Provisional Registration Certificate can be issued to such Micro & Small Enterprises under Single Point Registration scheme with monitory limit of ₹5.00 lakhs which shall be valid for the period of one year only from the date of issue after levying the registration fee and obtaining the requisite documents. | Micro & Small Enterprises shall have to apply either on-line on website www.nsicspronline.com or on prescribed application form to concerned Zonal/ Branch Office of NSIC. The application form containing terms & conditions are available free of cost. | ||||||||||