Incorporation of Nidhi Company

A company incorporated to cultivate the habit of saving amidst its members or shareholders falls under Nidhi Company. The dictionary meaning of the term Nidhi is ‘treasure’. However, in the Indian financial sector, it a mutual benefit society which gets notified by the Central Government. Nidhi companies can solely take a deposit from their members and lend to their members only. Nidhi Companies are also known as Permanent Fund, Benefit Fund, Mutual Benefit Fund ad Mutual Benefit Company.

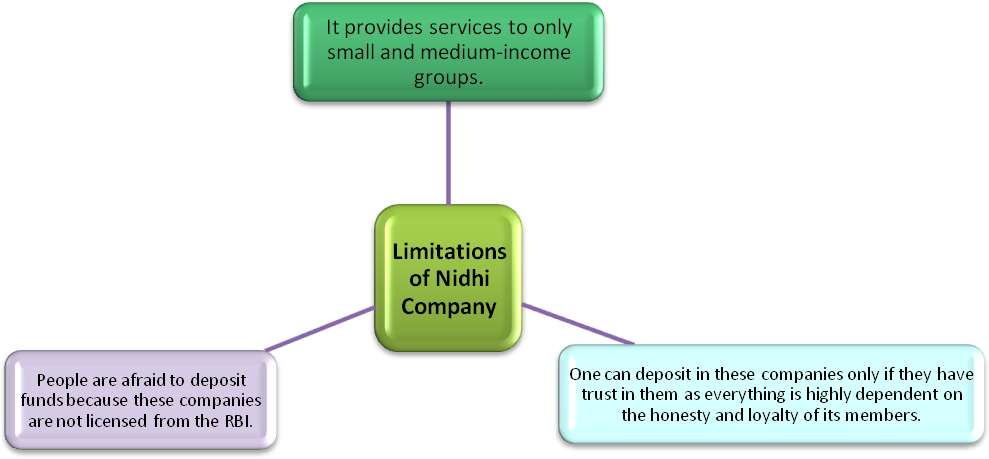

RBI regulates the matters of a Nidhi Company in regards to its deposit acceptance activities. Nidhi Company is one of the forms of Non-Banking Financial Company (NBFC) which do not require RBI approval. Despite being an NBFC, a Nidhi company has exempted from the core provisions of the RBI Act, 2013 because it works for the welfare of its members. The incorporation of Nidhi Company is a lengthy procedure for which one needs to meet the eligibility criteria.

Nidhi Company is not governed by the RBI but by the Central Government and hence the Central Government has introduced the Nidhi Company rules 2014 in order to better govern the company in a more transparent manner.

In order to form Nidhi Company in India, you have to incorporate a Public Limited Company under the ‘Company Act, 2013’, with a minimum paid-up equity share capital is ₹ 5 Lac. A minimum of 3 directors and 7 shareholders are required to start a Nidhi Company incorporation process. After being incorporated as a Nidhi Company, it shall comply with all the provisions and restrictions applicable under Companies Act 2013 as well as Nidhi Rule 2014.

Key Features

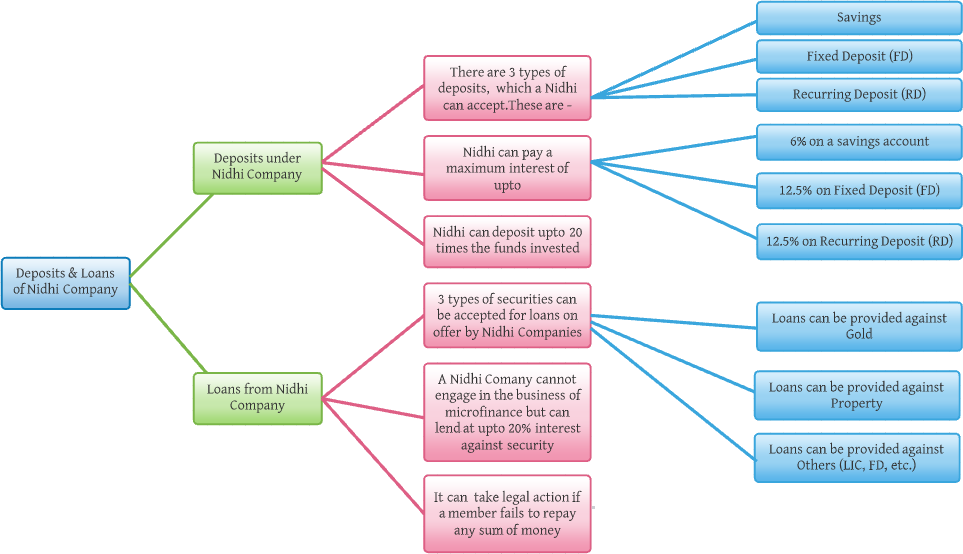

- It is not entitled to perform either a “vehicle finance business or microfinance business” in India.

- Within 12 months of registration, the number of members must be at least 200.

- A maximum interest rate of 20% p.a. (calculated by the reducing balance method) can be charged.

- The maximum rate of interest that can be offered on savings deposit account shall not exceed 2% above the rate offered by Nationalised Banks.

- Nidhi Company can accept FD, RD & savings and can earn an interest of 12.5% currently on FD & RD.

- The rate of interest that can be offered on Fixed and Recurring Deposits shall not exceed the maximum rate of interest prescribed by RBI for the NBFCs to be offered on deposits. The maximum limit for the rate of interest for NBFCs is also applicable to the Nidhi companies.

- Its operations must be limited to the district level for the first 3 Years. After completion of 3 years, 3 offices can be set up within the same district. For expansion out of the district, prior approval from the “Regulator Director” is required.

- It can only give loans against security. These securities may be Gold, Property, Fixed Deposits, Government Securities, or Life Insurance Certificates.

- Unencumbered deposits (Deposits which aren’t offered as securities for any purpose) should not be less than 10 % of outstanding deposits.

- Filing of Annual Accounts, Audit, and Tax Returns, in the proper format, is compulsory.

Benefits of Nidhi Company

Its easy for Nidhi Company to get funding or borrow capital from or lend money to group members.

No Minimum Share Capital Requirement

Easy to Manage

No External Involvement in Management

Relaxation in Compliances

Easy Transfer of Ownership

Low Rates of Interest

Secured Investments

Clear Objectives for easy donations and loans

Exemptions and Privileges under Companies Act,2013

Lease intervention of R.B.I

Scope of Business to Nidhi Companies

Deposits

| Period | Minimum period of 6 Months (except Recurring deposits which shall be for a minimum period of 12 Months) and a maximum period of 60 months. |

| Saving Account Deposits | Maximum balance in a savings deposit account qualifying for interest shall not exceed ₹1,00,000 at any point of time and the rate of interest shall not exceed 2% above the rate of interest payable on savings bank account by nationalised banks. |

| Term Deposits | A Nidhi may offer interest on fixed and recurring deposits at a rate not exceeding the maximum rate of interest prescribed by the Reserve Bank of India which the Non- Banking Financial Companies can pay on their public deposits (12.5%). |

| Repayment Period | A Nidhi Company:

|

| Repayment in case of death | In case of death of depositor, it shall be repaid to the surviving depositor or nominee or legal heir with interest upto the date of repayment without any reduction in the interest rate. |

Loans

| Ceiling Limit for Loans |

|

|||||||||||||||

| Ceiling Limit for Loans in case of Loss | Where a Nidhi has not made profits continuously in the three preceding financial years, it shall not make any fresh loans exceeding 50% of the maximum amounts of loans specified in clauses (a), (b), (c) or (d). | |||||||||||||||

| Default in Repayment | A member who has defaulted in repayment of loan shall not be eligible for further loan (Repayment period not exceeding One Year) | |||||||||||||||

| Loan against Gold, Silver and Jewellery | Loan sanctioned would be upto 80% of the value of the Gold, Silver and Jewellery. | |||||||||||||||

| Loans Against Immovable Property | Total loans against immovable property [excluding mortgage loans granted on the security of property by registered mortgage, being a registered mortgage under section 69 of the Transfer of Property Act, 1882 (IV of 1882)] shall not exceed 50% of the overall loan outstanding on the date of approval by the board. Individual loan shall not exceed 50% of the value of property offered as security and the period of repayment of such loan shall not exceed seven years. |

|||||||||||||||

| Loan against fixed deposit receipts, national savings Certificates, other government securities and insurance Policies | Such securities duly discharged shall be pledged & maturity date of such securities shall not fall beyond the loan period or one year whichever is earlier: Provided further that in the case of loan against fixed deposits, the period of loan shall not exceed the unexpired period of the fixed deposits. | |||||||||||||||

| Interest on loan | The rate of interest shall not exceed 7.5% above the highest rate of interest offered on deposits calculated on reducing balance method. Nidhi shall charge the same rate of interest on the borrowers in respect of the same class of loans. | |||||||||||||||

| Locker Facility | Nidhis which have adhered to all the provisions of these rules & may provide locker facilities on rent to its members subject to the rental income from such facilities not exceeding 25% of the gross income. |

Salient features of Nidhi Companies

Directors

- The Director shall be a member of Nidhi.

- The Director of a Nidhi shall hold office for a term up to ten consecutive years on the Board of Nidhi.

- The Director shall be eligible for re-appointment only after the expiration of two years of ceasing to be a Director.

- Where the tenure of any Director in any case had already been extended by the Central Government, it shall terminate on expiry of such extended tenure.

- The person to be appointed as a Director shall comply with the requirements of sub-section

- Rule 17 of Nidhi Rules 2014 of Section 152 of the Act and shall not have been disqualified from appointment as provided in section 164 of the Act.

Dividend

A Nidhi shall not declare dividend exceeding 25% or such higher amount as may be specifically approved by the Regional Director for reasons to be recorded in writing and further subject to the following conditions, namely:

- an equal amount is transferred to General Reserve;

- there has been no default in repayment of matured deposits and interest; and

- it has complied with all the rules as applicable to Nidhis.

Auditor

No Nidhi shall appoint or re-appoint an individual as auditor for more than one term of five consecutive years.No Nidhi shall appoint or re-appoint an audit firm as auditor for more than two terms of five consecutive years :

Provided that an auditor (whether an individual or an audit firm) shall be eligible for subsequent appointment after the expiration of two years from the completion of his or its term:

Explanation: For the purposes of this proviso:

- in case of an auditor (whether an individual or audit firm), the period for which he or it has been holding office as auditor prior to the commencement of these rules shall be taken into account in calculating the period of five consecutive years or ten consecutive years, as the case may be;

- appointment includes re-appointmen

Auditor’s Certificate

The Auditor of the company shall furnish a certificate every year to the effect that the company has complied with all the provisions contained in the rules and such certificate shall be annexed to the audit report and in case of non-compliance, he shall specifically state the rules which have not been complied with.

Prudential norms

- Every Nidhi shall adhere to the prudential norms for revenue recognition and classification of assets in respect of mortgage loans or jewel loans as contained hereunder.

- Income including interest or any other charges on non-performing assets shall be recognised only when it is actually realised and any such income recognised before the asset became non-performing and which remains unrealised in a year shall be reversed in the profit and loss account of the immediately succeeding year.

- (a) In respect of mortgage loans, the classification of assets and the provisioning required shall be as under:

(i) Standard Asset-No provision

(ii) Sub-standard Asset-10% of the aggregate outstanding amount

(iii) Doubtful Asset (NPA for 2-3 years)-25% of the aggregate outstanding amount

(iv) Loss Asset-100% of the aggregate outstanding amount

Filing of Half Yearly Return

Every company covered under rule 2 shall file half yearly return with the Registrar in Form NDH-3 along with such fee as provided in Companies (Registration Offices and Fees) Rules, 2014 within 30 days from the conclusion of each half year duly certified by a company secretary in practice or chartered accountant in practice or cost accountant in practice.

Power to enforce compliance

- For the purposes of enforcing compliance with these rules, the Registrar of companies may call for such information or returns from Nidhi as he deems necessary and may engage the services of Chartered Accountants, Company Secretaries in Practice, Cost Accountants, or any firm thereof from time to time for assisting him in the discharge of his duties.

- In respect of any Nidhi which has violated these rules or has failed to function in terms of the Memorandum and Articles of Association, the Central Government may appoint a Special Officer to take over the management of Nidhi and such Special Officer shall function as per the guidelines given by Central Government:

Provided that an opportunity of being heard shall be given to the concerned Nidhi by the Central Government before appointing any Special Officer.

Compliance with rule 3A by certain Nidhis

- Every company referred to in clause (b) of rule 2 and every Nidhi incorporated under the Act, before the commencement of Nidhi (Amendment) Rules, 2019, shall also get itself declared (Form NDH-4) as such in accordance with rule 3A within a period of one year from the date of its incorporation or within a period of nine months from the date of commencement of Nidhi (Amendment) Rules, 2019, whichever is later:

- Provided that in case a company does not comply with the requirements of this rule, it shall not be allowed to file Form No. SH-7 (Notice to Registrar of any alteration of share capital) and Form PAS-3 (Return of Allotment)

Companies declared as Nidhis under previous company law to file Form NDH-4

- Every company referred in clause (a) of rule 2 shall file Form NDH-4 along with fees as per the Companies (Registration Offices and Fees) Rules, 2014 for updating its status:

- Provided that no fees shall be charged under this rule for filing Form NDH-4, in case it is filed within six month of the commencement ofNidhi (Amendment) Rules, 2019:

- Provided further that, in case a company does not comply with the requirements of this rule, it shall not be allowed to file Form No. SH-7 (Notice to Registrar of any alteration of share capital) and Form PAS-3 (Return of Allotment).

Penalty for non-compliance

If a company contravenes any of the provisions of the rules prescribed herein, the company and every officer of the company who is in default shall be punishable with fine which may extend to five thousand rupees, and where the contravention is a continuing one, with a further fine which may extend to five hundred rupees for every day after the first during which the contravention continues.

Branches by Nidhi company

- A Nidhi may open branches only if it has earned net profits after tax continuously during the preceding 3 financial years.

- Within the district, the company may open up to 3 branches only.

- If it proposes to open more than 3 branches within the district or any branch outside the district, it shall obtain prior permission of the Regional Director and intimation requires being provided to the Registrar about the opening of every branch within 30 days of such opening

- No Nidhi shall open branches or collection centers or offices or deposit centers, or by whatever name called outside the State where its registered office is situated.

- Unless financial statement and annual return are filed with the Registrar, the branches or collection centers or offices or deposit centers will be opened.

Closure of Branch by Nidhi Company

A Nidhi shall not close any branch unless

- It publishes an advertisement in a newspaper in vernacular language in the place where it carries on business at least 30 days prior to such closure

- At least 30 days from the date of which advertisement was published informing the public about such closure; fixes a copy of such advertisement or a notice informing such closure of the branch on the notice board of Nidhi for a period of.

- Gives intimation to the Registrar within 30 days of such closure.

Annual returns required to fill by Nidhi Company

- Nidhi requires to file a return of statutory compliances in Form NDH – 1 along with such fee as prescribed with the Registrar duly certified by a Company Secretary in practice or a Chartered Accountant in practice or a Cost Accountant in practice within 90 days from the closure of the first financial year after its incorporation and where applicable, the second financial year.

- In case if the company fails in complying with the above criteria, then it shall within90 days from the close of the 1stfinancial year, apply to the Regional Director in Form NDH -2 along with fee for extension of time and the Regional Director may consider the application and pass orders within 30 days of the receipt of the application.

- In case of failure, the Nidhi shall not accept any further deposits from the commencement of the second financial year till it complies with the provisions besides being liable for penal consequences provided in the Act.

- Every company covered under rule 2 shall file half yearly return with the Registrar in Form NDH-3 along with such fee within 30 days from the conclusion of each ½ year duly certified by a company secretary in practice or chartered accountant in practice or cost accountant in practice

Share capital and allotment

Rule 7 provides that every Nidhi shall issue equity shares of the nominal value of not less than ₹ 10/- each. This requirement shall not apply to a company which has been declared as a Nidhi company. Provided that this requirement shall not apply to a company referred below:

- According to Section 620A(1)of Companies Act, 1956 every company which had been declared as a Nidhi or Mutual Benefits;

- Every company functioning on the lines of a Nidhi company or Mutual benefit society but has either not applied for or has applied for and is awaiting notification to be a Nidhi or Mutual Benefit Society under Section 620A(1)of Companies Act, 1956;

- No service charge shall be levied for the issue of shares.

- Every Nidhi shall allot to each deposit holder at least a minimum of 10 equity shares or shares equivalent to ₹100/-.

- A savings account holder and a recurring deposit account holder shall at least 10 equity shares of ₹ 10/-.

Advantages to forming a Nidhi Company

Separate Entity

Nidhi Company is a separate legal entity that can acquire assets and incur debts in its own name.

Liability is Limited

Liability of Directors and shareholders of the Nidhi Company is limited in case the company suffer from any loss and faces, financial distress in the course of its business activity, the personal assets of any of the Directors or members are not at risk of being seized by banks, creditors, and government.

Fewer Regulations

"Nidhi" Companies are governed under the Nidhi Rules, 2014. The Central Government is the regulating authority, which controls its ativities and operations. Guidelines imposed by the RBI on "Nidhis" are very few.

Better Credibility

"Nidhis" companies enjoy better credibility as opposed to any other member-based organizations like Trusts, cooperative societies or NGOs.

Better Option for Savings

The main purpose of a Nidhi Company's incorporation is to encourage the habit of saving among the members of the Company. This is how it achieves the other goal of its registration of being mutually beneficial. The Nidhi Companies are to "lend and borrow money" to and from its shareholders/members only.

Easy Access of Public Funds

The loans from the Nidhi Company come at a cheaper rate than loans from banks and other NBFCs, for its shareholders. And the process of obtaining the loan and customized services are much more conveient and quicker.

Ease of Fund

Nidhi Company is the safest and the cheapest way of inviting deposits from the general public. you just need to take them as registered members.

Micro Banking

Nidhis provide banking services to the remote and rural public of india which still is based in far-off locations and is, hence, devoid of accessing finance from national banks and NBFCs.

Simple Processing

Borrowing and lending to known persons, belonging to the same group, is much less complicated than dealing with banks, where the procedure is impersonal and fixed.

Low Capital Requirements

Ministry of Corporate Affairs(MCA) commands the minimum capital requirement of ₹ 5 lakhs for the incorporation of a "Nidhi" and, within 1-year, the capital has to be raised to at least ₹ 10 lakhs.

Fulfiling the needs of Lower & Middle-income groups

Nidhi Companies play an important role in meeting the needs of lower and middle-income groups by providing them financial help without complex formalities and documentation.

Easier Eligible

People getting minimum wages and belonging to lower strata are usually unable to take loans from traditional banks because of their high eligibility critria. For them, Nidhi Company is a good option to obtain finance because of fewer conditions.

Perpetual Existence

Death or departure of any members is not going to affect a Nidhi Company as it has perpetual existence. Perpetual succession allows the Nidhi Company to continue till the time it gets dissolved legally.

Single Regulatory Body

After the Amendment in Companies Act 2013, Nidhi Companies are overseas by Nidhi Company Rules.

Easy Registration Process

You don't need to take any license from RBI. You just have to incorporate your company as a public limited one with the MCA.

Ease of Management

In Nidhi Company, bringing changes is not a matter of worry and concern, unlike other NBFCs.

It acts as a "Better credit Co-operative Society"

Nidhi Company is a close substitute for credit co-operative society. And, therefore, more preferred by the small financer. Once a Nidhi company has been registered, the members can avail of all the benefits of a credit co-opearative society.

No External Involvement

Nidhi Companies take funds from their members and further provides loans to their members only. All transactions are done within this group only. So, no external factors are affecting the working of these companies. The investors/members themselves oversee the operations of the company.

Activities Prohibited In a Nidhi Company

No Nidhi shall

carry on the business of chit fund, hire purchase finance, leasing finance, insurance or acquisition of securities issued by any body corporate;

issue preference shares, debentures or any other debt instrument by any name or in any form whatsoever;

open any current account with its members;

accept deposits from or lend to any person, other than its members;

pledge any of the assets lodged by its members as security;

take deposits from or lend money to any body corporate; Issue or cause to be issued any advertisement in any form for soliciting deposits.

pay any brokerage or incentive for mobilising deposits from members or for deployment of funds or for granting loans.

Acquire other company by way of control, share purchase, composition of the Board of Directors etc.

Carry on any business other than borrowing or lending in its own name. Enter into any partnership arrangement in its borrowing or lending activities.

Membership

A Nidhi shall not admit a body corporate or trust as a member.

Except as otherwise permitted under these rules, every Nidhi shall ensure that its membership is not reduced to less than two hundred members at any time.

A minor shall not be admitted as a member of Nidhi:Provided that deposits may be accepted in the name of a minor, if they are made by the natural or legal guardian who is a member of Nidhi.

Net Owned Funds

The amount representing the proceeds of issue of preference shares shall not be included for calculating Net Owned Funds.

Scope of Business to Nidhi Companies

Deposits |

|

| Period | Minimum period of 6 Months (except Recurring deposits which shall be for a minimum period of 12 Months) and a maximum period of 60 months. |

| Saving Account Deposits | Maximum balance in a savings deposit account qualifying for interest shall not exceed ₹1,00,000 at any point of time and the rate of interest shall not exceed 2% above the rate of interest payable on savings bank account by nationalised banks. |

| Term Deposits | A Nidhi may offer interest on fixed and recurring deposits at a rate not exceeding the maximum rate of interest prescribed by the Reserve Bank of India which the Non- Banking Financial Companies can pay on their public deposits (12.5%). |

| Repayment Period | A Nidhi Company:

|

| Repayment in case of death | In case of death of depositor, it shall be repaid to the surviving depositor or nominee or legal heir with interest upto the date of repayment without any reduction in the interest rate. |

| Un-encumbered term deposits |

Un-encumbered term deposits means unhindered by creditor claims or liens.Every Nidhi shall invest and continue to keep invested, in unencumbered term deposits with a Scheduled commercial bank (other than a co-operative bank or a regional rural bank), or post office deposits in its own name an amount which should be minimum 10% of the deposits outstanding at the close of business on the last working day of the second preceding month: Provided that in cases of unforeseen commitments, temporary withdrawal may be permitted with the prior approval of the Regional Director for the purpose of repayment to depositors, subject to such conditions and time limit which may be specified by the Regional Director to ensure restoration of the prescribed limit of 10%. Amount of deposits shall be calculated on the basis of the last audited annual financial statements. |

Loans |

||||||||||||||||

| Ceiling Limit for Loans |

|

|||||||||||||||

| Ceiling Limit for Loans in case of Loss | Where a Nidhi has not made profits continuously in thethree preceding financial years, it shall not make anyfresh loans exceeding 50% of the maximum amounts ofloans specified in clauses (a), (b), (c) or (d). | |||||||||||||||

| Default in Repayment | A member who has defaulted in repayment of loan shall not be eligible for further loan (Repayment period not exceeding One Year) | |||||||||||||||

| Loan against Gold, Silver and Jewellery | Loan sanctioned would be Upto 80% of the value of the Gold, Silver and Jewellery. | |||||||||||||||

| Loans Against Immovable Property | • Total loans against immovable property [excluding mortgage loans granted on the security of property by registered mortgage, being a registered mortgage under section 69 of the Transfer of Property Act, 1882 (IV of 1882)] shall not exceed 50% of the overall loan outstanding on the date of approval by the board. Individual loan shall not exceed 50% of the value of property offered as security and the period of repayment of such loan shall not exceed seven years. | |||||||||||||||

| Loan against fixed deposit receipts, national savings Certificates, other government securities and insurance Policies | Such securities duly discharged shall be pledged & maturity date of such securities shall not fall beyond the loan period or one year whichever is earlier: Provided further that in the case of loan against fixed deposits, the period of loan shall not exceed the unexpired period of the fixed deposits. |

|||||||||||||||

| Interest on loan | The rate of interest shall not exceed 7.5% above the highest rate of interest offered on deposits calculated on reducing balance method. Nidhi shall charge the same rate of interest on the borrowers in respect of the same class of loans. | |||||||||||||||

| Locker Facility | Nidhis which have adhered to all the provisions of these rules & may provide locker facilities on rent to its members subject tothe rental income from such facilities not exceeding 25% ofthe gross income. |

Comparison in Nidhi, Micro Finance & Society

| Points | Nidhi Company Registration | NBFC Registration India (Micro finance) | Society Registration in India |

| Minimum capital | ₹5 Lakh/- | ₹5 Crore/- | Differs state to state |

| Person Required | 7 Person | 2 Person | 15 Person |

| RBI Approval | Not Required | Mandatory | Not applicable |

| Area of operation | District level | PAN India | Applicable district |

| Ownership | Held by shareholders | Held by shareholders | Decided by elections |

| Ideal for | If you are a beginner | Experienced | Moderate Experience |

Eligibility Criteria to Register as Nidhi Company at a glance

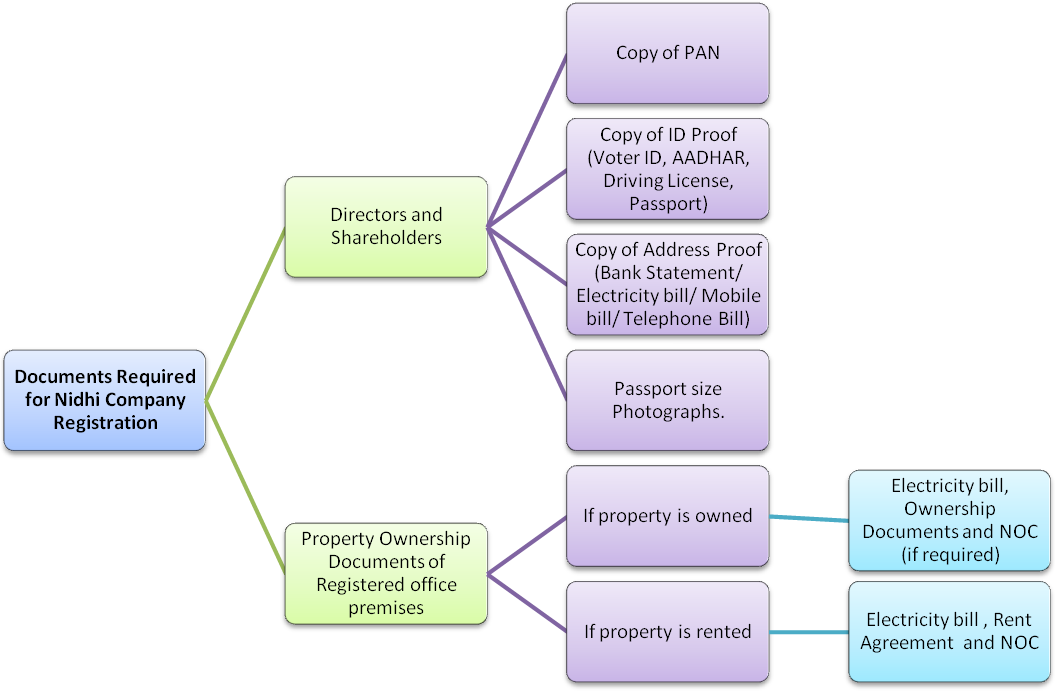

*The Nidhi Company must have a registered office located in India

*Documents such as bank statement or electricity bill should not be older than 2 months.

| S.No. | Features | Before Registration | After Registration |

| 1 | Minimum Shareholders | 7 | 200 |

| 2 | Directors | 3 | |

| 3 | Minimum Capital | ₹ 5 Lakh | ₹ 10 Lakh |

| 4 | Net Owned Fund | Minimum ₹ 10 Lakh | |

| 5 | Net Owned Fund to Deposit Ratio | 1:20 |

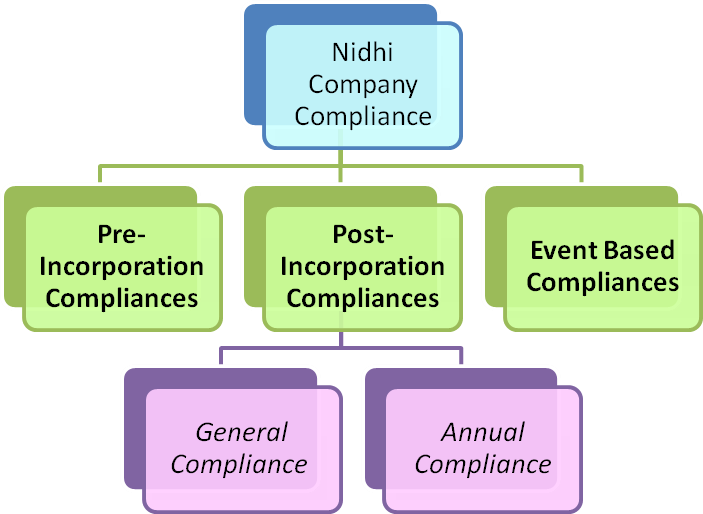

Reasons why the compliances of Nidhi Company are important

To generate accurate insights about the performance and working of the company

Every company which is registered under Companies Act, 2013 has to mandatory file the required compliances for the smooth operations of the business.

Being a Public Company, Nidhi Company has to safeguard the interests of the stakeholders.

Pre-Incorporation Compliances of Nidhi Company

The objective of a Nidhi should be crystal clear

- Primarily the object must be to foster the habit of thrift and savings among its members.

- Secondly, the company must receive and lend deposits to its members for mutual benefits.

A company must be a “public company” first, before incorporating as a Nidhi. At the time of incorporation, a company shall not issue any preference shares. In case a company has issued preference shares before the incorporation process. Then those shares must get redeemed as per the terms of the issue.

A Nidhi is Incorporate similar to a Public Limited Company therefore following criteria shall meet before in-corporation: –

- Company minimum seven members are required out of which three must be the directors of the company

- A minimum paid up capital of ₹5 lakh is required to set up a Nidhi Company.

- The words “Nidhi Limited” must be used as part of name of Nidhi Company.

- A minor, trust or a body corporate is not allowed to become a member of a Nidhi Company.

- Nidhi Company cannot accept deposits of more than 20% of the net owned funds.

- Nidhi Company cannot open its branches if it has not earned any profit after tax (PAT) for regular three years consecutively.

- Rate of interest on the loan cannot be more than 7.5% above the highest rate of interest which are offered on deposits.

- No preference shares shall be issued.If preference shares had already been issued by a Nidhi Company before the commencement of this Act, such preference shares are to be redeemed in accordance with the terms of the issue of such shares.

Nidhi Company Incorporation Process

Obtain DSC-Digital Signature Certificate in electronic format from Government Recognized Certifying Agencies for the directors and shareholder of the company, who is required to sign the e-form for registration before filing incorporation application for the company. Photo, ID and Address proof is required along with DSC application form for issuance of DSC.

Obtain Director Identification Number (DIN) issued by ROC by applying for DIN- (in Form DIN 3 in existing company or directly with SPICe INC 32 upto 3 directors) DIR 2– To be filed by all the directors of the company, declaration as per rule 5 & 6 of Nidhi rules 2014 – also to be signed by all the subscribers. An application is filed along with ID and address proof duly attested by CS/CMA/CA.

Obtain Name Approval Certificate in RUN Form (Reserve Unique Name) or directly apply with SPICe INC 32 -in both cases 2 chances are given with one Resubmission (RSUB). It is mandatory to add ‘Nidhi Limited‘ to the name. Names should not be too general like Finance Nidhi Limited, Money Nidhi Limited etc. An approved name by CRC is valid for a period of 20 days

Enlist the Company's constitution in Memorandum of Association (MOA) in e-(MOA) and Articles Of Association (AOA) in e-(AOA) directly with SPICe INC 32. Application for registration/incorporation of public limited company is made to Registrar of Companies (ROC) along Memorandum and Article of Associations, declaration, affidavits etc. INC 9– To be filed by all the subscribers to MoA. Minimum Seven persons are required for incorporation of Nidhi limited company

To get the Company Identification Number -(CIN) address for the Registered Office and NOC from the landlord is required Apply for PAN and TAN with SPICe INC 32

Deposit Capital amount within 2 months from the date of incorporation & raise capital to atleast ₹10 lakhs before your first balance sheet filing, appoint auditor, make 200 members by the first balance sheet filing, print all Nidhi forms.Adhere to Prudential norms as prescribed under Rule 20 of the Nidhi Rules, 2014.

Current Bank Account To Be Opened In Company's Name immediately & Declaration of Commencement of Business in Form 20A Within 180 days of incorporation

Application for Goods and Services Tax Identification Number(GSTIN), Employees State Insurance Corporation Registration(ESIC) plus Employees Provident Fund Organization(EPFO) registration(AGILE-PRO) IN Form INC 35 who exceed the threshold limit of turnover or profits have to oblige GST rules.

Get the Certificate Of Incorporation -(COI) issued by ROC with the PAN & TAN

Get the Certificate Of Incorporation -(COI) issued by ROC with the PAN & TAN

Get the Certificate Of Incorporation -(COI) issued by ROC with the PAN & TAN

Application for Goods and Services Tax Identification Number(GSTIN), Employees State Insurance Corporation Registration(ESIC) plus Employees Provident Fund Organization(EPFO) registration(AGILE-PRO) IN Form INC 35 who exceed the threshold limit of turnover or profits have to oblige GST rules.

Current Bank Account To Be Opened In Company's Name immediately & Declaration of Commencement of Business in Form 20A Within 180 days of incorporation

Deposit Capital amount within 2 months from the date of incorporation & raise capital to atleast ₹10 lakhs before your first balance sheet filing, appoint auditor, make 200 members by the first balance sheet filing, print all Nidhi forms.Adhere to Prudential norms as prescribed under Rule 20 of the Nidhi Rules, 2014.

General Compliances

- Within one year of incorporation, a Nidhi Company must increase its members to at least 200

- Ratio of net owned funds to the deposits must not exceed 1:20

- Net Owned fund of the Nidhi Company must be ₹ 10 lakh or more. Net owned funds = Equity share capital + free reserves (-) accumulated losses (-) intangible assets(-)deferred revenue expenditure(i.e. revenue that has not yet been earned by the products/services delivered to the customer and is receivable from the same which might be written off over a period of few years.)

- Deposits should not be less than 10% of the outstanding deposits as per Rule 14 of the Nidhi Company Rules, 2014

- Maintaining Statutory Registers and Books of Accounts

- Convening Statutory Meetings from time to time

Annual Compliances

| Form No. | Compliance | Due Date |

| NDH-1 |

This form is used to file Return of Statutory compliance which includes details regarding company’s members, loans, deposits, reserves etc. for the complete financial year E-Form GNL-2 Form for submission of documents with the Registrar. |

Within 90 days from the closure of the first financial year after incorporation along with fees.Duly certified by PCA/PCS/CMA |

| NDH-2 |

This form is used for filing application for extension of time. E-Form RD-1 Applications made to Regional Director. |

It must be filed with the Regional Director within 90 days of the closure of financial year.The Regional Director may extend the period upto one year from the date of receipt of application. |

| NDH-3 |

This form is used for filing Half yearly return with the Registrar of Companies (ROC) E-Form GNL-2 Form for submission of documents with the Registrar. Note this form contains the details of Number of Members admitted during the half year, number of members ceased to be members and total number of members as on the date, Loan granted by Nidhi company along against the particular security and Deposits accepted by the Nidhi company form its members. |

Within 30 days from the end of each half year along with prescribed fees. It must be duly certified by a practising chartered account, or company secretary or cost accountant |

| NDH-4 |

Form for filing application for declaration as Nidhi Company and for updating of status by Nidhis Note- Failure to file form NDH-4, Companies shall not be allowed to file Form No.SH-7 (Notice to Registrar of any alteration of share capital) and Form PAS-3 (Return of Allotment). |

|

| AOC-4 | Filing of financial statements and other related documents with the ROC | Within 30 days of the conclusion of the Annual General Meeting |

| MGT-7 | Annual Return | Within 60 days of the conclusion of the Annual General Meeting |

| ITR-6 | Return of Income Tax | By 30th September of every year |

Event Based Compliances of Nidhi Company

The third category of compliances of Nidhi Company which are called Event based Compliances. These compliances are required to be filed only once at the time of the registration of the Nidhi Company. Such compliances denote any changes in the company which are to be done. However, they are not required to file repeatedly.

- Any changes in the name of the company, if required

- Any change in the registered office address of the company

- Change in the objects of the company

- Change in the capital structure of the company. For example: Increase in authorised capital of the company

- Appointment of Director and Auditor

- Resignation of Director and Auditor

- Transfer of shares

- Appointment of the Key Managerial Personnel

- Increase in the authorised capital of the company.

Conclusion

A Nidhi Company is categorised under the Non-Banking Financial Company or NBFC, which does not involve the Reserve Bank of India (RBI) license. Section 406 of the Companies Act, 2013 acknowledges a Nidhi Company and is managed and controlled by the Ministry of Corporate Affairs. Their primary fundamental business is borrowing and lending money between its members. Nidhi companies are allowed to take a deposit from and lend to the members only. Nidhi Company is based on the concept of the ‘Principle of Mutuality’ or ‘ParasparaSahaya’. Entities who wish to operate a lending business with low funds investment can opt for Nidhi Company. A Nidhi Company functions for the common benefit of all its members and shareholders. Section 406 of the Companies Act, 2013 and Nidhi Rules, 2014 prescribes some major compliance for a Nidhi Company. Nidhi Companies are easy to operate as there is less involvement of RBI. Still, they have to follow the compliances set up for them by the Companies Act, 2013 and the Nidhi Rules, 2014. Not following the compliances can subject to hefty penalties. Section 406 of the Companies Act of 2013 and the Companies (Nidhi Companies) Rules of 2014 comprises of all the provisions which are in relation to the “incorporation and governance of the Nidhi Companies in India”. The guidelines and directives for the Nidhi Companies are also issued by the RBI. These are mainly related to financial activities and investments by companies including the NBFCs. Because of “Nidhi Companies” being engaged in the business of deposits and loans by its members only, certain exemptions have been provided to these companies, by the RBI. The interest charged on the loans under a Nidhi Company is quite reasonable. The purposes these are sought for, includes, manufacturing/renovation of houses or child’s education, etc. The loans are provided against security only.

The deposits under Nidhis do not earn much interest as compared to deposits in the organized banking sector. All lending and borrowing of the Nidhi Companies is done by its members, exclusively. Hence, such companies are also referred to as Mutual Benefit Societies because they work for the mutual benefit and welfare of all members. If you are looking to start a business in financing or loans in India, then Nidhi Company is the best option for it.

Important Points to Note

- It cannot carry any of the following transactions: leasing finance, insurance, chit fund, hire purchase finance, or acquisition of securities issued by any corporation

- A Nidhi Company is not entitled to issue preference shares, debentures, or any other debt instruments in any form.

- It cannot accept deposits from or give loans to any external individual or corporation

- It is not allowed to perform vehicle finance business & microfinance business in India

- Within 12 months of registration, a minimum of 200 members has to be added.

- A maximum interest rate of 20% p.a. can be charged, by following the reducing balance method

- A Nidhi Company can only give loans against security. These securities may be Gold, Property, and FD & LIC.

- Unencumbered deposits (Deposits not offered as securities for any purpose) should be more than 10 % of outstanding deposits.

- Filing of Annual Accounts, Audit, and Tax returns are compulsory

Frequently Asked Questions

- 1. What are the minimum requirements to register a Nidhi Company?

-

- A Minimum of Seven members is required to start a Nidhi Company out of which three members must be directors of the Company, However, it should acquire a minimum of 200 members within one year of commencement.

- Unencumbered term deposit must be 10% or higher of the outstanding deposits

- The ratio of net owned funds to deposits should not be more than 1:20, where 10% of the total deposits are in fixed deposit account of a nationalized bank.

- A place of business in India must be provided as a registered office address.

- 2. What are the minimum requirements towards Capital?

-

A Minimum of ₹5 Lakh is required as the equity shares capital to start a Nidhi Company. This entire amount has to be paid up. However, within one year of registration, the net owned funds should be ₹10 lakh or more. This includes equity share capital and free reserve and excludes accumulated losses as well as intangible assets.

- 3. Whether Loan can be providing to non-members?

-

The principle of mutual benefit has been to pool the savings from members and lend only to members and never have dealing

- 4. Who can become members of Nidhi Companies?

-

Members are only individuals. Bodies Corporate or Trusts are never to be admitted as Members

- 5. Whether a person can be director of Nidhi Company without holding any share capital?

-

The Director shall be a member of Nidhi. Therefore, it is mandatory for director of Nidhi Company to hold shares.

- 6. What is minimum nominal value of shares for Nidhi Company?

-

Every Nidhi shall issue equity shares of the nominal value of not less than ten rupees each.

- 7. What is requirement of minimum shareholding for deposit holder?

-

Every Nidhi shall allot to each deposit holder at least a minimum of ten equity shares or shares equivalent to one hundred rupees.

- 8.What is maximum limit upto which a Nidhi can declare dividend?

-

Nidhi shall not declare dividend exceeding twenty five per cent or such higher amount as may be specifically approved by the Regional Director for reasons to be recorded in writing.

- 9. What is the requirement of DSC (Digital Signature Certificate)?

-

- DSC is provided in the form of token issued by Certified Authorities and is a substitute of Physical Signature and enable the owner to sign documents digitally

- Company incorporation is a complete online process and all the forms required to be filed for incorporation of company are required to be signed digitally with the help of DSC of the Directors

- Company Sarthi helps its clients in the issuance of DSC

- 10. What is the requirement of Documents for DSC issuance?

-

- Self-attested Documents and Details required are :

- Duly filled and Signed Application Form

- Copy of PAN Card

- Copy of Aadhaar Card

- Passport size Photograph

- Valid and active Mobile Number and e-Mail id

- On submission of above documents with the DSC Authority partner, applicant will receive the OTP on the given Mobile and e-Mail ID and thereafter applicant has to complete Mobile and Video verification

- 11. What is the eligibility to become a Director in Company?

-

- Any natural person above the age of 18 years can become the director in the company after procuring Director Identification Number (DIN).

- There are no specific criteria provided in terms of citizenship or residency, a foreign national can also become a director

- 12. What is Director Identification Number (DIN)?

-

- DIN is a unique number assigned by the Ministry of Corporate Affairs to Individuals on whose name the application is made, allowing that individual to become a Director in a Company or Designated Partner in an LLP

- DIN is allowed only once in lifetime and can be used to become a Director in any number of company as per eligibility criteria

- The application of DIN Allotment is now merged with the application for the formation of a company subject to a limit of maximum 3 DIN.

- 13. What is the requirement of Documents for DIN issuance?

-

- Self-attested Documents and Details required are :

- Copy of PAN Card

- Copy of Aadhaar Card

- Passport size Photograph

- Valid and active Mobile Number and e-Mail id

- Proof of Identity of Applicant (Any one)

- Valid Passport

- Driving License

- Voter ID Card

- Proof of Residence of Applicant (Any one not older than 2 months having same address as that in the Proof of Identity)

- Bank Statement

- Electricity bill

- Telephone bill

- Mobile bill

- 14. How to reserve the name of the Company?

-

- Applicant has to give few choices of the name which can be checked at the Company Sarthi for the availability

- On the availability of atleast one name, Company Sarthi inform you of the same and ask you to provide two options of that name and the priority preference

- Company Sarthi also seeks from you the main objects of the company and State in which Registered office will be situated

- Although Company Sarthi follows a rigorous process of checking availability of Name, the registrar may ask to re-submit application with a different name if names applied do not fall under the criteria of uniqueness, relevancy or do not fulfill other requirements

- 15. Does any subscriber have to be physically present for completing the process of Incorporation of the Company?

-

- No, none of the promoters are required to be physically present for completing the process of Incorporation of the Company

- All the forms are filed on the web portal and are digitally signed.

- Also, the required documents can be sent through e-mail or uploaded on our portal for filing.

- 16. What documents are required for registered office of Company?

-

- Business address Proof (Any one not older than 2 Months)

- Electricity Bill

- Pipe Lined Gas Bill

- Telephone Bill

- Mobile Bill

- No Objection Certificate to be obtained from the owner(s) of registered office

- Rent Agreement of the registered office should be provided if property is on rent

- 17. What are the penalties for Non-Compliance?

-

Timely filing of compliances is mandatory for every Nidhi company. Non- Compliance attracts penalty for the Nidhi Bank Operators.

- If the company does not meet the compliance, the organisation and the concerned officers will be fined an amount up to ₹ 5,000.

- In the case of continuation of infringement, the company will be charged a further fine of ₹ 500 per day.

Hence it is important to hire professionals to help in the compliance procedures.

- 18. Why choose Nidhi Company?

-

- These companies are helpful for the lower and middle classes.

- There is no external involvement in management.

- Minimum documents and formalities make things easy for registering a Nidhi Company

- The investment is secured, and there is a low rate of interest.

- There is no requirement of minimum share.

- It becomes easy for Nidhi Company to get funding from group members, and at the same time, lending is also easy.

- There is an easy transfer of ownership.

- Lower rate of interest and secured investment.

- Exemptions and Privileges under Companies Act, 2013

- Stamp Duty and relaxation in Compliances

- 19. What are Nidhi Companies not entitled to do?

-

Nidhi Companies are not entitled to perform the following transactions

- Invite and accept deposits from their own members rather than other members.

- There is no external involvement in management.

- Engage in Chit funds business and leasing finance

- Lotteries

- Going on for any business other than borrowing and lending to its members

- Opening the current account with its members

- Getting into a partnership arrangement to carry lending as well as borrowing activities

- Insurance

- Issuing debentures, preference shares, or some other debt instruments

- Accepting and lending of deposits from corporate

- For mobilization of deposits, pay fee, incentive, and commission

- Pay brokerage amount for granting loans to the members

- Hire-purchase finances.

- 20. Who has got the authority to regulate Nidhi Company?

-

Ministry of Corporate Affairs is the responsible authority for regulating Nidhi Company and is also accountable for Nidhi Company Registration. Provisions of Nidhi Rules, 2014, are being followed for doing all the activities.

- 21. What requirements are to be met to become a Nidhi Company member?

-

To become a member of Nidhi Company, an individual should meet the following requirements

- The member must be over 18 years of age.

- Only an individual is eligible to become a member. No trust or any corporate body can become a member.

- 22. Can a Nidhi Company do microfinance business?

-

Nidhi Companies are not permitted to do microfinance business in India. Only RBI registered NBFC-MFI with a net worth of ₹5 crores can do microfinance business in India.No, Nidhi Company is not allowed to do microfinance business in India because micro finance is a completely different set of business for an NBFC and require more capital to do the same. Hence, Nidhi Company cannot engage itself into micro finance business. Further, since Nidhi Company raise fund from deposits and hence, if it passes the same to member without any security, then there will be great chances of customer default which will ultimately results into bankruptcy of the Nidhi Company.

- 23. How many branches a Nidhi Company can open?

-

A Nidhi Company can open up to 3 branches after three years of continuous profit running of the business. Further, these three branches can be opened within the district only. Further, to open any branch outside the district, you will require the Regional Director (RD) permission.

Also, a Nidhi Company cannot open a branch outside the state.

- 24. What do you mean by Mutual benefit Company and how it is different from Nidhi Company?

-

Mutual Benefit Company is nothing but a Nidhi Company. Mutual benefit is the previous name of the Nidhi Company. After 2013, it was made mandatory to use the name of Nidhi Limited instead of Mutual benefit for registration of Nidhi Company in India.

- 25. Are the deposits with the company safe and secured?

-

Yes, because Government of India/Ministry of Corporate Affairs/RBI has framed the laws/rules to ensure the security and safety of deposits and Nidhi companies must strictly abide by the rules and regulations framed by the Central Government.