Shop and Establishment Act Registration- Introduction

A ‘Shop and Establishment Registration’ or popularly known as ‘Trade license’ in many States and ‘Gumasta License’ in Maharashtra. Shops and Commercial Establishments Act 1958 was enacted to regulate the working hours, weekly/monthly off, payment of wages, terms and condition of employment, holidays, leave etc. of persons employed in shops, commercial establishments. Trade license issuing authority varies state to state, therefore Rules and Regulations of Trade license varies state to state as per State Shops and Establishment act or some other specific Act to regulate Shops and Establishments within the state and its process and documentation also varies slightly. Every employer shall within 30 days from the date on which the establishment, commence its work shall file statement together with fees to the Chief Inspector of the area concerned. In some state period for Registering may differ state to state.

Municipal Corporation or Local Authority is the concern department in the state/Locality to issue Trade License. Every state has its own Shop and Establishment Act (“Act”). However, the general provisions of the Act are the same in all states. The Shop and Establishment Act is regulated by the Labor Department of the respective states. The Act regulates all the shops and commercial establishments operating within the state. The respective states issue the registrations under the Act, and thus it slightly differs from one state to another state.

Shops are generally defined under the Act as the premises where the selling of goods take place either by retail or wholesale or where services are rendered to customers. It includes offices, godowns, storerooms and warehouses used in connection with the trade or business. Commercial establishments are generally defined as a commercial, banking, trading or insurance establishment or administrative service in which persons are employed for office work. It includes a hotel, boarding or eating house, restaurant, cafe, theatre, or other public entertainment or amusement places. However, factories and industries are not covered by the Act and are regulated by the Factories Act, 1948 and Industries (Development and Regulation) Act 1951.

The shops and commercial establishments covered under the Act must mandatorily apply for registration under the respective state Act. All establishments and business, including the people working and maintaining a business from home, must obtain a Shop and Establishment Registration Certificate or Shop License (“Certificate”) under the Act. The proprietors who run a business from home without having any physical store or premises are also required to obtain this Certificate. The proprietors of e-commerce business or online business, or online stores and establishment must register under this Act and obtain the Certificate. Every shop and commercial establishment should register itself under the Act within 30 days of commencement of business.

The Certificate or the Shop License acts as a basic registration/license for the business. This Certificate is produced for obtaining many other business licenses and registrations. It serves as proof of the incorporation of commercial establishment or shops. It is also useful when the proprietor of the business wants to obtain a loan or create a current bank account for the business. Most banks will ask for this Certificate for opening a current bank account.

The different categories of trade license under Shop and Establishment Act.

Hotels, Restaurants, Canteen, Food stall, Bakeries, the sale of vegetables and meat etc.

Small and large scale manufacturing factories, cyber café etc.

Garment shop, Salon, Beauty Parlour, Medical Store, Dry Cleaner, SPA, Gift Shop, etc

Regulations under the Shop and Establishment Act

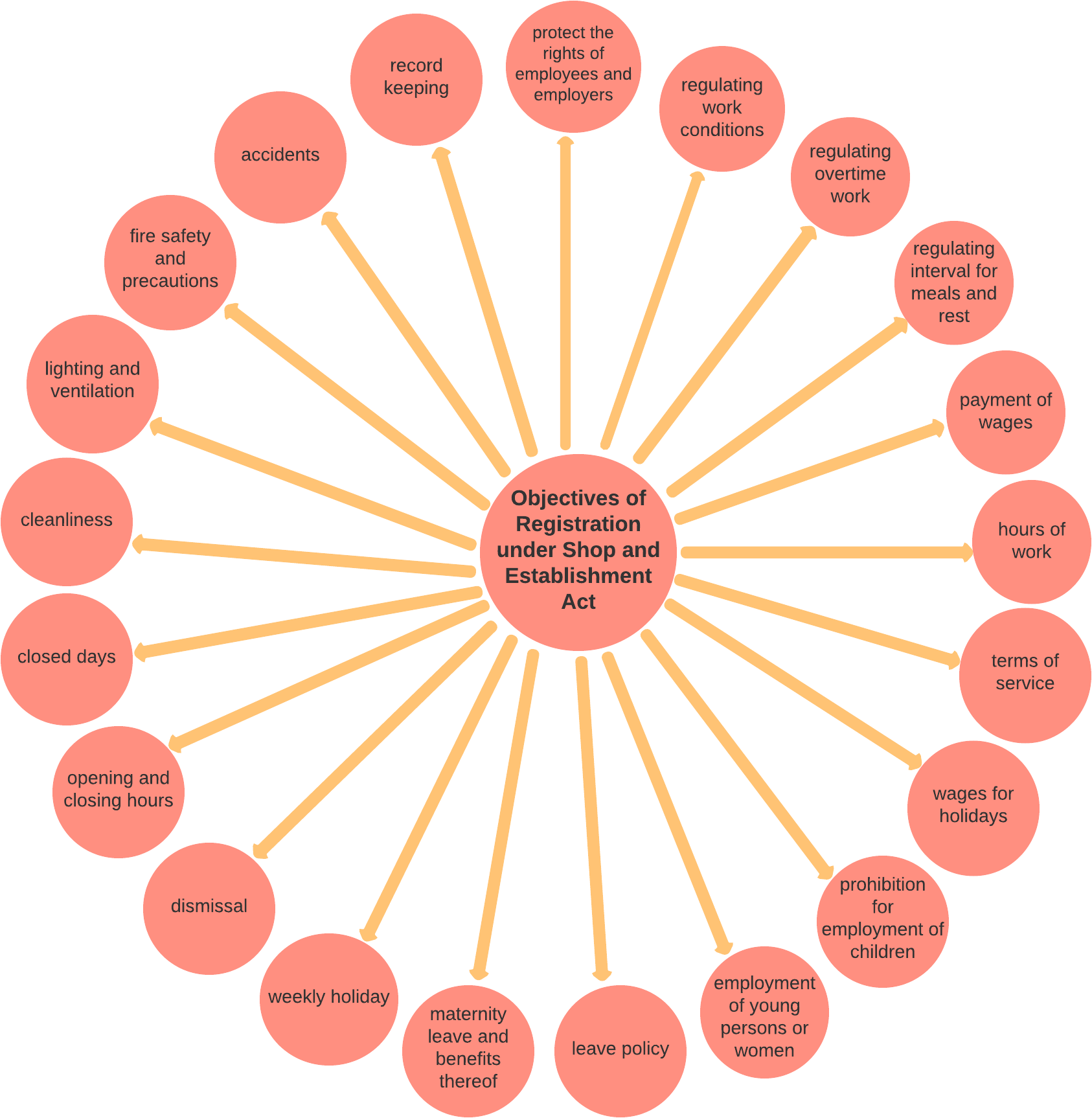

The Shop and Establishment Act is regulated by the Department of Labor and regulates premises wherein any trade, business or profession is carried out. The act not only regulates the working of commercial establishments but also societies, charitable trusts, printing establishments, educational institutions run for gain and premises in which banking, insurance, stock or share brokerage. This act regulates areas such as working hours, rest interval for employees, opening and closing hours, closed days, national and religious holidays, overtime work, rules for employment of children, annual leave, maternity leave, sickness and casual leave, etc., The Act is designed to regulate the payment of wages, hours of work, leave, holidays, terms of service and other work conditions of people employed in the shop and commercial establishments. Shop– According to the Act, Shop is a place that sells goods or services to the customer. It can also include offices, storerooms, warehouses or go-downs. Establishment– an Establishment engulfs all residential hotels, restaurants, theatres, commercial establishments, and other amusement for public entertainment. The Act, among other things, regulates the following matters-

- Hours of work, annual leave, weekly holidays, Close days.

- Payment of wages and compensation, Wages for holidays.

- Time and conditions of payment of wages

- Deductions from wages

- Leave policy

- Prohibition of employment of children

- Prohibition of employment of children.

- Prohibition of employing women and young persons in the night shift.

- Enforcement and Inspection.

- Interval for rest.

- Opening and closing hours.

- Record keeping by the employers.

- Dismissal provisions.

- Interval for rest and meals

- Cleanliness

- Precautions against fire

- Accidents

- Record keeping

The Shop and Establishment Act in India is promulgated by the state and may slightly differ from state to state. However, as per the Act, all shops and commercial establishments operating within each state are covered by the respective Shop & Establishments Act.

The Ministry of Home Affairs (MHA) has exempted certain shops (registered under the Shops and Establishment Act) from the lockdown restrictions. However, shops in single brand and multi-brand malls and cigarette and liquor shops have not been exempted.

The Shop and Establishment Act is applicable nationwide, and all the commercial establishments, such as the hotels, and eateries, amusement parks, theatres, and other entertainment houses, as well as any other such public amusement places, come under the purview of the Act. The definition of a ‘Commercial Establishment’, as given in the Act is:

- Any commercial sector, such as banking, trading or insurance establishments

- Any establishment where individuals are employed or engaged to do office work or provide service

- The hotels, eateries and boarding houses or a smaller café or refreshment house

- Amusement and entertainment places such as theatres and cinema halls or amusement parks

All such above mentioned commercial establishments come under the Act and need to adhere to the norms and regulations set by the Act for the treatment of their employees. The exceptions to the Act vary in the States and each State has given a list of shops and establishments act that come into the Act, and who require the registrations under the Act to run their business in the State.

Shop and Establishment Act License

Any shop or commercial establishment that commences operation must apply to the Chief Inspector for a Shop and Establishment Act License within the prescribed time. The application for a license in the prescribed form must contain the name of the employer, address of the establishment, name of the establishment, category of the establishment, number of employees and other relevant details as requested. On submission of the application and review by the Chief Inspector, the shop or commercial establishment will be registered and a registration certificate will be issued to the occupier. The registration certificate must be prominently displayed at the shop or commercial establishment and renewed periodically, as per the act. In case the shop or establishment would like to close down the business, the occupier should notify the Chief Inspector in writing within fifteen days of the closing. The Chief Inspector after reviewing the request for closure can remove the shop or commercial establishment from the register and cancel the registration certificate.

Under the Shop and Establishment Act, every business has to seek approval from Department of Labor and keep up-to-date registers regarding details of employment, fines, deductions and advances, salary and holidays. The requirements may vary from state to state. Files related to annual holidays and number of employees need to be submitted to the office of the Municipal Corporation annually further no Regular return is needs to be filed under this Act. As it is subject to periodic inspections/visits by concerned Government officials, one must keep the below-mentioned records ready for verification during such visits.

- Hiring particulars

- Credit reductions

- Payments to workers

- Employee leave records

- Declaration for non-employment of child labor ( any child below the age of 14 years)

The Shop and Establishment Act in India is promulgated by the state and may slightly differ from state to state. However, as per the Act, all shops and commercial establishments operating within each state are covered by the respective Shop & Establishments Act.

The objective is to secure uniform benefits for employees working in different establishments, from shops, commercial establishments and residential hotels to restaurants, theatres and other places of public amusement or entertainment. Whether a business is big or small, if you choose to register your shop under a Shop and Establishment act, then you need to visit the website or the State government office to complete the Registration Formality in a Method prescribed by the State Government. Every Indian state has enacted certain rules and regulations with regard to conditions of work. Every shop and establishment needs to register itself compulsorily under this Act within 30 days of commencement of work. As this is such a basic license, many other licenses require this as proof of a commercial business. For example, most banks will require you to furnish it if you want to open a current account. To get this license, you would need to provide the PAN card of the business owner or the business itself, a copy of the rental agreement or sale deed, and details of all the employees. Premises governed by the Act are shops, commercial establishments, residential hotels, clubs, restaurants, eating houses, theaters and other places of public amusement or entertainment etc. except those who falls under Factories Act 1948.

This registration is compulsory for every business place of work except those who falls under Factories Act 1948. It is a state regulation and each state has separate shop & establishment regulation.

Documents Required for Shop & Establishment Registration- Photograph of the Shop or Establishment at the entrance with Name Board in local language

- Certificate of Incorporation, MOA & AOA of Company / LLP Agreement of the Company or LLP

- Copy of PAN card

- List of Directors or Partners and their ID & Address proof

- Copy of Board Resolution or Partners Consent

- Address proof of Company/LLP/Partnership/Proprietorship

- Details of all the employees if any.

- Other document required to be attached -depends on the type of the establishment-

- A proprietary firm needs to give an undertaking,

- A partnership firm would have to additionally attach the deed or partnership, etc.

Key Amendments as on May 1, 2019

| S.No | Subject Matter | Old act | New Act |

|---|---|---|---|

| 1 | Applicability | The Old Act was applicable to all the establishments, irrespective of the number of workers employed. | The New Act applies to establishments employing 10 or more workers. However, establishments with less than 10 workers are required to intimate the facilitator (in whose jurisdiction the business is located) regarding certain details about their businesses. The provisions of the New Act will not apply to establishments already having valid registration under the Old Act, until the expiry of their registration. |

| 2 | Definition of "employer" | The definition included a person owning or having ultimate control over the affairs of an establishment. | The definition under the Old Act has been elaborated to specifically include a partner of a firm (where the employer is a firm) or a director of a company (where the employer is a company). |

| 3 | Definition of "establishment" | The definition of the term "establishment" was covered under two heads, which were "establishment" and "commercial establishment". | The New Act prescribes a comprehensive definition in respect of an "establishment", which includes the business of banking, insurance, brokerage, and the establishments of medical practitioners, architects, engineers, accountants, tax consultants or any technical or professional consultants, along with shops, hotels and restaurants. |

| 4 | Definition of "employee" | The definition included persons wholly or principally employed, whether directly or through any agency, and included an apprentice. | The definition of the term "employee" has been replaced by the term "worker", which includes a person employed (including through an outsourcing agency) to do any manual, unskilled, skilled, technical, operational or clerical work, but does not include an apprentice. |

| 5 | Cancellation of the registration certificate | There was no provision pertaining to the cancellation of the registration certificate. | The labor department has the power to cancel the registration certificate and remove an establishment from the register of establishments, if such an establishment is found to have obtained its registration through misrepresentation or suppression of material facts, or by submitting forged or false documents. |

| 6 | Leaves and holidays | The Old Act prescribed the following: • 4 days of paid festival holidays in a calendar year; • 1 day off in a week; • 21 days of privilege leave for employees who have worked for 240 days or more in a calendar year; • 7 days of sick leave and 7 days of casual leave | In terms of the New Act, workers are allowed the following: • 8 days of paid festival holidays in a calendar year; • 1 day off in a week, even if the shop or establishment is kept open on all days in a week; • Privilege leave at the rate of 1 day for every 20 days of work, provided the worker has worked for more than 240 days in a previous calendar year; • 7 days of sick leave and 7 days of casual leave |

| 7 | Welfare provisions (including crèche facilities) | The Old Act contained provisions relating to cleanliness, ventilation, lighting and first aid. | In addition to prescribing obligations for the employer with respect to the health and safety of workers, the New Act prescribes that every shop or establishment, which employs 30 or more women workers, should maintain a suitable room as a crèche for the children of such workers. A group of establishments can also provide a common crèche within a radius of 1 kilometer (approximately 0.62 miles), subject to the conditions which are prescribed by the labor department. Where there are 100 or more workers engaged in an establishment, employers are also required to maintain a canteen. |

| 8 | Discrimination against women employees | The Old Act had no specific provision in relation to discrimination against women employees. | The New Act states that no woman worker will be: • discriminated against in matters of recruitment, training, transfers, promotion or wages; and are required to or allowed to work in any establishment except between the hours of 6 a.m. and 9 p.m., unless the labor department is satisfied with the safety and transportation measures implemented by the organization, and issues an order allowing women to work during night shifts. |

| 9 | Wages for overtime | The Old Act prescribed that all employees (other than those working at residential hotels or restaurants) will be entitled to wages for overtime, at the rate of 1.5 times their ordinary wages, in case they work for more than 9 hours a day or for more than 48 hours a week. | The New Act states that every worker who is required to work beyond 9 hours a day or 48 hours a week will be entitled to wages at the rate of 2 times his or her ordinary wages for such overtime work. The total number of overtime hours cannot exceed 125 hours in 3 months. |

| 10 | Opening and closing hours of the establishment | Under the Old Act, there was no specific provision with respect to keep establishments open 24/7. | Any shop or establishment situated in, on, or around municipal corporation areas, hospital premises, national highways, railway platforms, petrol pumps and state roadways bus station premises may be kept open for 24 hours, as long as the establishments comply with requirements relating to working hours, weekly offs, leave and holidays, spread-over and overtime. Other shops and establishments may be kept open throughout the year, except between 11 p.m. and 6 a.m., as long as the employers comply with requirements relating to working hours, weekly offs, leave and holidays, spread-over and overtime. |

| 11 | Penalties | The maximum penalty prescribed under the Old Act for any contravention was ₹750 (approximately USD 10). However, in certain cases of continuous violation, penalties could extend to ₹ 10 (approximately USD 0.10) for every day of such violation. | The New Act prescribes a penalty of up to ₹50,000 (approximately USD 716), and if the contravention leads to any accident causing injury or death of a worker, the contravention shall be punishable with a fine ranging from ₹25,000 (approximately USD 358) to ₹ 50,000 (approximately USD 716) and/or with imprisonment of up |

Key Amendments as on May 1, 2019

The New Act is based on the model legislation, known as the Model Shops and Establishment (Regulation of Employment and Condition of Services) Act, 2016. This is a progressive move and should go a long way in increasing the ease of doing business but at the same time, penalties under the New Act have been increased substantially to ensure they are an effective deterrent. As importantly, the New Act has no provision relating to any notice of termination of service. Further, since the Old Act stands repealed pursuant to the introduction of the New Act, any existing employment contract harmonious with the New Act will be considered as if it were issued under the New Act, unless specifically superseded by any regulation or order under the New Act. It is laudable that there are specific provisions relating to women workers, including prohibiting discrimination against them, and the requirement of a crèche facility. That being said, it may be noted that the New Act states that every establishment where 30 or more women workers are employed is required to maintain a room as a crèche. This requirement appears to contradict the 2017 amendments to the Maternity Benefit Act, 1961, under which every establishment with 50 or more employees is required to provide a crèche facility. In addition to this, the rules under the New Act are yet to be notified.

Each shop or business required a legal entity proof like proprietorship firm or partnership firm etc. a legal entity proof which gives the right for doing the business in your area or state for the same.

Applicable if you are opening a shop or commercial establishment.

Approval from Department of Labor. Various registers giving details of employment, fines, deductions and advances, salary, holidays, etc. Files related to annual holidays, number of employees need to be submitted at the Office of the Municipal Corporation annually.

Every banks is required a legal entity proof to open a current bank account. Each shop & Establishment has to open a separate bank account for the daily transactions as per the RBI Compliance. So on the basis of the shop certificate you can easily open a current business bank account.

State government and local municipality conduct regular inspection visits for checking the proper working of shops and establishments along with license as well. If you have the Shop Act license, then you can quickly get over the inspections every time.

Each state have a DIC Department which creates the policy in the respective state for the all small business. On the basis of Shop License Registration Certificate you can easily avail the government benefits.

In few states the renewals are also done on annual basis.

Benefits of the Shop & Establishment Registration

Provides legal status to an establishment

Ease of opening a current bank account

Ensures peace between employer and employee

Offers better pay and holiday policy

Restricts unethical business practices

Promotes growth and expansion

Establishes brand image in the market

Process for Obtaining Shop and Establishment Registration

The procedure for obtaining the Shop and Establishment Registration Certificate differs from state to state. It can be obtained online or offline. For obtaining the registration certificate online, the proprietor or owner of the shop or business must log into the respective State Labor Department website. The proprietor or owner must fill the application form for the registration under the Shop and Establishment Act, upload the documents and pay the prescribed fees. The prescribed fees differ from state to state. Once the registration form is approved, the registration certificate will be issued online to the proprietor or owner of the business.

For obtaining the registration certificate offline, the registration application is to be filled and submitted to the Chief Inspector of the concerned area along with the prescribed fees. The Chief Inspector will issue the registration certificate to the owner or proprietor after being satisfied with the correctness of the application. The registration application form contains the details relating to the name of the employer and establishment, address and category of the establishment, number of employees and other relevant details as required. The registration application needs to be renewed before the expiry of the period of registration. The validity of the Shop and Establishment Certificate differs from state to state. Some states provide the Certificate valid for a lifetime, while other states provide the Certificate valid for one to five years. The fee might vary, the process, the amount of time to deliver the certificate, the inspector in-charge, and so on will vary depending on each state.

- Almost within 30 days from the date of commencement of any business, the employer of the shop/commercial establishment should send an application to the inspector in-charge.

- The application should be in the agreed form. Moreover, the employer should submit it along with the prescribed fees. The application form should contain the following details:

- Name of the employer

- Name of the establishment

- Address of the establishment

- The category which it belongs to

- Number of employees working

- The date on which the establishment started work

- The Labor Department of each State produces the shop and establishment act process and the registration takes place.

- The local district labor officers normally take charge as the inspector in-charge under this act. However, they are the ones who will grant the shop and establishment registration certificate.

- The fee for the whole process varies on how many workers are on employment in that particular organization/business.

- The inspector in-charge will review the application, once the occupier applies. If the application has all the necessary details and if the details satisfy the inspector in-charge, then the registration of the shop and establishment will be successful and the occupier will get a registration certificate.

- Prominently, the registration certificate must be displayed at the establishment and also remember to renew the license periodically.

- However, the employer has to notify the inspector in-charge if there is a plan to close down the business.

- In case if the employer is sure to close, then the employer has to submit writing within 15 days of closing. The inspector will then cancel the registration provided under the Shops and Establishment Act. Therefore, they will remove its name from the register.

- However, make sure to intimate any changes of information to the inspector within 15 days from the date on which such changes take place if you have missed telling at the time of registration. After all verification, the inspector in-charge will make necessary changes and will issue a fresh registration certificate if required.

Procedure for registration

Log On

You would first need to log on to the state provided website of the respective states and select the registering procedure as an individual or an organization.

Enter login:

log in using the Id given at the time of registration. Fill your details in the application submitted.

Submit application:

Request a renewal of license using the Application ID. Re-upload all your documents as requested.

The documentation required

Pay Fees:

The registration and renewal fee of the Shop& Establishment License varies from state to state.

Checking Status:

The moment the payment is made,application status changes to ‘Under Scrutiny’ which will change to ‘Completed’ once it is approved, until then, keep checking. It usually takes at least a week for it to happen.

Download Certificate

Once it’s done, you will see the certificate on your screen. You may ‘Download Certificate’, from there.

Renewal of Shops & Establishment License

Labor Reforms in recent times due to Labor Codes

In India, the labor acts would fall under concurrent list which means both central government and state government could make laws on it. There were more than hundred acts in various states which were governing the labor laws and at the same time there were more than 40 acts which were governed by the central government, due to which the labor compliances in the nation turned out very complex. To resolve all this complexity a Labor Commission was formed in Year 1999 to which they submitted their report in year 2002 and recommended that the then current labor laws are very old and outdate and need an immediate reform. Agreeing to it, the then central government agreed to come up with the four labor codes. However many Governments came in power since then, but those four labor codes were passed recently in year 2019 and 2020. The major changes in Industrial Relations Code relates to number of workers. If there are 300 or more than 300 workers in an establishment then it has to compulsorily make rules and regulations on 1) Workers Classification 2) Wage Rates 3) Holidays and 4) Paydays. These regulations are also called Standing orders. Earlier this limit was 100 workers. Next change from this code is, if in any establishment there is activity related to Closure, Retrenchment or Layoff, in which there are more than 300 workers, then it has to obtain prior permission from government.

This Code also talks about that, if any employee/worker has to go on strike then it has to give the establishment a 14 days prior notice, before strike or lock-out and this notice would be valid for maximum of 60 days. In this code there are few changes made for Trade unions as well. If in any establishment there is more than one trade union, then it would be provided with Sole Negotiating union only when at least 51% of the employees are members to it. Earlier this requirement was of 75%. Code on Social Security, 2020 Substitutes Nine labor laws viz.; The Employees Compensation Act, 1923, The Employees State Insurance Act, 1948, The Employees Provident Fund and Miscellaneous Provision Act, 1952, The Employees Exchange (Compulsory Notification of Vacancies) Act, 1959, The Maternity Benefit Act, 1961, The Payment of Gratuity Act, 1972, The Cine Workers Welfare Fund Act, 1981, The Building and Other Construction Workers Cess Act, 1996 and The Unorganized Workers Social Security Act, 2008. This code brings out a concept of universal social security for the very first time, which includes organized workers as well as unorganized workers. Various provisions are made for comprehensive social security to workers of unorganized sectors as well.

This code speaks about that Government should from time to time formulate and notify suitable welfare schemes relating to provident fund, employment injury benefit, housing, educational schemes for children and further more.

In this code the definition of employees has been expanded to include more workers like, interstate migrant workers, gig workers, platform workers, film industry workers and further more. After this code came, the gratuity period for working journalists has been now reduced from five years to three years. Code on Occupational Safety, Health and Working Conditions, 2020 Substitutes thirteen labor laws viz.; Factories Act, 1948, Dock Workers Act, 1986, Contract Labor Act, 1970, Inter-State Migrant Workers Act, 1979 and Nine other Acts. Apart from regulating employment, the main focus of this code is to regulate health, safety and working conditions. The definition of factory has been expanded, if in any establishment where there are more than 20 workers where power aid is used or where in the number of workers is more than 40 but there is no use of power aid, then it would come within the definition of a Factory. The earlier limit on manpower limit on hazardous working conditions has now been removed. This code has now become compulsory on contractors who employees more than 50 workers. Under this code the daily work limit cannot be more than eight hours.

Under this code, now a woman can work in any establishment. It would be the responsibility of the employer to provide adequate safeguard in hazardous conditions. Both Central and State government has to maintain a record of inter-state migrant workers. For this the government is planning to soon come up with a portal. Worker earning till Eighteen Thousand Indian Rupees would be called by inter-state migrant workers and can obtain various benefits.

Other Key Amendments due to the Labor Codes

- For applicability of Chapter V-B regarding “pre-condition of permission from the Appropriate Government, notices, compensation for lay-off, retrenchment, and closure”, the minimum number of workmen in the industrial establishment is increased from 100 to 300 workmen.

- In case of retrenchment or closure, in addition to the prescribed compensation of 15 day’s wage for each completed year of service, an amount equivalent to his three month’s average pay shall also be paid

- In case of retrenchment, the workman has been given compensation corresponding to fifteen days’ average pay for every completed year of continuous service or any part thereof in excess of six months; or an amount equivalent to his three months’ average pay, whichever is higher.

- For the purpose of recognition of the trade union, the threshold membership of the trade union has been increased from 15% to 30%.

- For the purpose of application of the Factories Act, the minimum number of workers has been increased from 10 to 20 in case of factories working with the aid of power; and from 20 to 40 workers for factories without the aid of power.

- For taking cognizance of any offence under the Act by the Court, previous sanction in writing by the State Government is mandatory, along with complaint by an inspector.

- Provision has been made for compounding of any offence punishable under this Act with fine only, and committed for the first time.

- The minimum number of workmen in establishment or with contractor is increased from 20 to 50.

- No dispute between the workman and his employer connected with or arising out of discharge, dismissal, retrenchment or termination will be treated as an industrial dispute if any such dispute is not raised in conciliation proceeding within a period of three years from the date of such discharge, dismissal, retrenchment or termination.

- A male adult worker has been allowed to work in a factory for more than 48 hours in a week subject to the following:-

- The total number of hours of work in any day will not exceed twelve;

- The spread over, inclusive of intervals for rest, will not exceed thirteen hours in any one day;

- The total number of hours of work in any week, including overtime, shall not exceed sixty;

- No worker will be allowed to work overtime, for more than seven days at a stretch and the total number of hours of overtime work in any quarter shall not exceed one hundred and twenty five;

- Such overtime work shall not be made compulsory or obligatory for any

- The State Government may, by order, specify conditions for ensuring safety or women who are required or allowed to work in any factory or manufacturing process between the hours of 8 P.M. and 6 A.M.

- Entitlement, regarding ‘Annual leave with wages’, for the worker who has worked for a period of 180 days or more in a factory during a calendar year.

- Provision of deemed registration if the registering officer fails to pass an order either granting or refusing or objecting to grant or amend the registration within a period of 30 days after submission of an application complete in all respects.

- Provision of duly licensed if the registering officer fails to pass an order either granting or refusing or objecting to grant or renew or amend the registration within a period of 30 days after submission of an application complete in all respects

- The State Government, by notification, may exclude cost on purchase and transportation of plant and machinery to be used in a factory and such other costs from the cost of construction incurred by an employer.

- An employer aggrieved by an order of assessment made under Section 5 or by an order imposing penalty under Section 9, may appeal to the appellate authority against the said order in such manner as prescribed.

- The registration deemed to be duly granted, if no adverse order is passed within the prescribed time from the date of submission of application.

- An officer can compound any offence punishable with fine under these Acts committed for the first time or after expiry of two years’ period of the previous offence, on realization of composition fee as prescribed.

- Exempt from maintaining multiple registers and submission of multiple returns under Certain Labor Laws.

- The State Government, by order, notify forms for maintaining registers and records and furnishing returns by an employer/establishments in lieu of the forms prescribed under the said 13 Acts.

- A Single Annual Online Integrated Return can be filed by employers for 14 Acts. Allow all the shops/ Establishment/Factories to submit consolidated annual returns in lieu of multiple returns under various labor laws

- Five services such as approval of drawings, registration and licensing under the Factories Act, 1948; registration of boilers under the Boilers Act, 1923; grant of registration certificate under Odisha Shops and Commercial Establishment Act, 1956; and grant of registration certificates to Establishments under Contract Labor (R&A) Act, 1970 have been rolled out through e-Biz portal for on line delivery of services.

- Fifty services under various statutes enforced by the Factories and Boilers and the Labor Directorate are being automated for Ease of Doing Business.

- The Government has introduced “Self-Certification Scheme” under various Labor Laws, vide it is to liberalize the enforcement of Labor Laws under the concept of Self-Regulatory Mechanism without compromising the safety, health, social security and welfare of the workers. It also gives some exemption to ‘New Start-Ups’.

Conclusion

- The two important things that were discussed very frequently which were 1) Labor Reforms and 2) Ease of Doing Business and both these things are some where interrelated, as from time to time if you bring reforms in labor laws the ease of doing business will itself boost and jump upwards

- It would be a huge task for both the State and Central Government to cope up with the new labor codes. As per these codes, now the employers will change their policies and infrastructure then unorganized workers, who were neglected till date, will get the basic security and results in business growth. Now with time only we will get to know that how effective and beneficial these new changes will be to the employees, employers and to Economy in general Labor laws would act as catalyst after the reform process is completed with passage of time.

- At present, it is cumbersome to be an entrepreneur due to this vicious web of old labor laws which make compliance practically difficult. It is easy to seek employment rather doing own business and becoming a job creator. The codes provide for ‘one labor return, one license and one registration’ to smoothen compliance.

- The major challenge in labor reforms is to facilitate employment growth while protecting workers’ rights. Key debates relate to the coverage of small firms, deciding thresholds for prior permission for retrenchment, strengthening labor enforcement, allowing flexible forms of labor, and promoting collective bargaining.

- Further, with the passage of time, labor laws need an overhaul to ensure simplification and updatation, along with provisions which can capture the needs of emerging forms of labor (e.g., gig work).

Delhi Shops and Establishments Act

The Shop and Establishment Act has been enacted by various State Governments to regulate the conditions of work of employees in shops, commercial undertakings, restaurants, etc., all commercial establishments must abide by The Weekly Holiday Act, 1942 enacted by the Central Government which governs the grant of holidays. However, there is no specific Central Government Act which comprehensively governs hours of work, payment of wages, health and safety in commercial establishments. To bridge this gap, state Governments have enacted a Shop and Establishment Act to help regulate the conduct of commercial establishments within their jurisdiction. The Delhi Shops and Establishments Act, applied to all shops, establishments and commercial establishments operating within the State of Delhi.

The Delhi Shops and Establishments Act defines a “shop” as:“”shop” means any premises where goods are sold either by retail or wholesale or where services are rendered to customers and includes an office, a store-room, godown, warehouse or workhouse or workplace, whether in the same premises or otherwise, used in or in connection with such trade or business but does not include a factory or a commercial establishment.”

The Delhi Shops and Establishments Act defines an “establishment” as:“”establishment” means a shop, a commercial establishment, residential hotel, restaurant, eating-house, theatre or other places of public amusement or entertainment to which this Act applies and includes such other establishment as Government may, by notification in the Official Gazette, declare to be an establishment for the purpose of this Act.”

“”commercial establishment” means any premises wherein any trade, business or profession or any work in connection with, or incidental or ancillary thereto is carried on and includes a society registered under the Societies Registration Act, 1860 (21 of 1860), and charitable or other trust, whether registered or not, which carries on any business, trade or profession or work in connection with, or incidental or ancillary thereto, journalistic and printing establishments, contractors and auditors establishments, quarries and mines not governed by the Mines Act, 1952 (35 of 1952), educational or other institutions run for private gain, and premises in which business of banking, insurance, stocks and shares, brokerage or produce exchange is carried on but does not include a shop or a factory registered under the Factories Act, 1948 (43 of 1948), or theatres, cinemas, restaurants, eating houses, residential hotels, clubs or other places of public amusements or entertainment.”

All shops, establishments and commercial establishments commencing operations in the State of Delhi must apply for Delhi Shops and Establishments Act Registration within 90 days of commencing operations. The application form must contain information in the prescribed format and include:

- The name of the employer and the manager, if any;

- The postal address of the establishment;

- The name, if any, of the establishment,

- The category of the establishment, i.e., whether it is a shop, commercial establishment, residential hotel, restaurant, eating house, theatre or other places of public amusement or entertainment;

- The number of employees working about the business of the establishment;

As per the Delhi Shops and Establishments Act, it states that no adult requires working for more than nine hours on any day or 48 hours in any week. For any work in excess of nine hours on any day or more than 48 hours in any week, must pay them overtime wages. Further, the period of work of an adult employee must be so fixed that no period of continuous work shall exceed five hours and that no employee shall be required or allowed to work for more than five hours before he had an interval for rest and meals of at least half an hour.

Employment of Child, Young Person or WomanIn the State of Delhi, no child shall be required or allowed to work whether as an employee or otherwise, in any establishment notwithstanding that such child is a member of the family of the employer. Also, it does not permit young person to work about the business or an establishment for more than six hours a day.

Holiday for Shops and Establishments in DelhiEvery employee working for a shop or establishment in Delhi should be allowed at least twenty-four consecutive hours of rest (weekly holiday or close day) every week. In addition to the close day, every shop and commercial establishment shall remain closed on three of the National holidays each year as the Government notification in the Official Gazette.

Procedure for Registration under Delhi Shops and Establishments Act

To register a shop or an establishment online forms are (Form A) available on website of Department of Labour, Government of Delhi. Also, while filing the form reference should be made to The Delhi Shops and Establishments Rules, 1954.

The owner of the shop shall send a statement to the Chief Inspector in Delhi in Form “A” together with prescribed fee paid in cash, within 90 days.

On receipt of the statement and the prescribed fees, the Chief Inspector will carry out verification and on being satisfied about the correctness of the statement, register the establishment and will issue the Registration Certificate to the owner of shop or commercial establishment In Delhi.

The Ministry of Corporate Affairs, under Easy of Doing Business has "developed a single window facility for incorporation of a new company and other different services including issuance of PAN, TAN, ESIC No, Bank Account, Professional Tax registration, GSTIN etc. on "SPICE+" portal.

Now, Government of Delhi vide notification no.PA/Addl.LC/Lab/2021/1859 has directed that Ministry Of Corporate Affairs "SPICE+" portal is now integrated with the registration portal of "Delhi Shops & Establishments" and any new company seeking registration under the Delhi Shops And Establishments Act, 1954 should be done on the "SPICE +" portal. However, any such subsequent registration for different branch offices of an establishment under the Act can be done on Delhi Shops & Establishment registration portal i.e. https://labourcis.nic.in. Hence, employer of a new company intending to register its establishments in Delhi under The Delhi Shops and Establishments Act, 1954, may register directly on the "SPICE+" portal with effect from 28th May, 2021.

Procedure to cancel Shops and Establishment License:In case of cancelling the license registration

- The prescribed form for the cancellation of application should be filled in fully and coherently.

- The same should be applied within 10 days of actual closure of the establishment.

- The registration number of the establishment should be mentioned on the cancellation form including the name, business address and other relevant information.

- The reason for cancellation of the license must be mentioned in the application form.

- Make sure the reasons cited for cancellation are valid.

- Finally a copy of paid legal dues of employee(s) should be attached.

An Act to amend and consolidate the law relating to the regulation of hours of work, payment of wages, leave, holidays, terms of service and other conditions of work of persons employed in shops, commercial establishments, establishments for public entertainment or amusement and other establishments and to provide for certain matters connected therewith

- This Act may be called the Delhi Shops and Establishments Act, 1954.

- It extends to the whole of Union Territory of Delhi.

- It. shall come into force on such date as Government may, by notification in the Official Gazette, appoint in this behalf.

- It shall apply in the first instance only to the municipal areas, Notified Areas and Cantonment limits of Delhi, New Delhi, Shahdara, Civil lines, Mehrauli, Red Fort and Delhi Cantonment but Government may, 2(by notification in the Official Gazette), direct that it shall come into force in any other local area or areas or shall apply to such shops or establishment or class of shops and establishments in such other areas as may be specified in the notification.

- The Act came into force w.e.f 1.2.55 vide Notification No. F. 23(5)/51 L. dated 17.1.55.

- Subs. by Act 6 of 1955.

2. Definitions. – – In this Act, unless the context otherwise requires: -

- “Adult” means a person who has completed his eighteenth year of age; 1[(1A) “Apprentice” means a person, who is employed, whether on payment of wages or not, for the purpose of being trained in any trade, craft or employment in any establishment;]

- “Child” means a person who has not completed his twelfth year of age;

- “Close day” means the day of the week on which a shop or commercial establishment remains closed

- “Closing hour” means the hour at which a shop or commercial establishment closes;

- 5. “Commercial establishment” means any premises wherein any trade, business or profession or any work in connection with, or incidental or ancillary thereto, is carried on and includes a society registered under the Societies Registration Act, 1860 (XXI of 1860) and charitable or other trust, whether registered or not, which carries on any business, trade or profession or work in connection with or incidental or ancillary thereto, journalistic and painting establishments, contractors and auditors establishments, quarries and mines not governed by the Mines Act, 1952 (XXXV of 1952), educational or other institution run for private gain and premises in which business of banking, insurance, stocks and shares, brokerage or produce exchange is carried on, but does not include a shop or a factory registered under the Factories Act, 1948 (LXIII of 1948), or theatres, cinemas, restaurants, eating houses, residential hotels, clubs or other places of public amusement or entertainment;

- (6) “Day” means a period of twenty-four hours beginning at mid-night; Provided that in the case of an employee whose hours of work extend beyond midnight, day means the period of twenty-four hours beginning when such employment commences irrespective of midnight:

- (7) “Employee” means a person wholly or principally employed, whether directly or otherwise, and whether for wages, (payable on permanent, periodical, contract, piece-rate or commission basis) or other consideration, about the business of an establishment and includes an apprentice and any person employed in a factory but not governed by the Factories Act, 1948 (LXIII of 1948), and for the purpose of any matter regulated by this Act, also includes a person discharged or dismissed whose claims have not been settled in accordance with this Act;]

- (8) “Employer” means the owner of any establishment about the business of which persons are employed, and where the business of such establishment is not directly managed by the owner, means the manager, agent, or representative of such owner in the said business; (9) “Establishment” means a shop, a commercial establishment, residential hotel, restaurant, eating house, theatre or other places of public amusement or entertainment to which this Act applies and includes such other establishments as Government may, by notification in the Official Gazette, declare to be an establishment for the purposes of this Act;

- (10)“Factory” means a factory as declared or registered under the Factories Act, 1948 (LXIII of 1948);

- (11)“Family” means the husband, wife, son, daughter, father, mother, brother, sister or grand-son of an employer, living with and wholly dependent on such employer;

- (12)“Government” means the Chief Commissioner, Delhi;

- (13)“Holiday” means a day on which an establishment shall remain closed, or on which an employee shall be given a holiday under the provisions of the Act;

- (14) “Hours of work” or “working hours” mean the time during which the persons employed are at the disposal of the employer exclusive of any interval allowed for rest and meals and “hours worked” has a corresponding meaning;

- (15) “Inspector” means an Inspector appointed under section 36 of the Act;

- (16)“Leave” means leave as provided for under this Act;

- (17) “Occupier” means a person owning or having charge or control of the establishment and includes the manager, agent of representative of such occupier;

- (18) “Opening hour” means the hour at which 4[a shop or commercial establishment] opens for the service of a customer;

- (19)“Prescribed” means prescribed by rules made under this Act;

- (20)“Register of Establishments” means a register maintained for the registration of establishment under this Act;

- (21)“Registration Certificate” means a certificate showing the registration of an establishment;

- (22) “Religious festival” means any festival, which the Government may by notification in the Official Gazette declare to be a religious festival for the purposes of this Act;

- Ins. by Act 33 of 1970.

- Subs. by Act 33 of 1970.

- Now, Lt. Governor of Delhi (Author’s Comments).

- Subs. by Central Act 21 of 1961.

- (23)“Residential hotel” means any premises in which business is carried on for the supply of dwelling accommodation and meals on payment of a sum of money by a traveler or any member of the public or a class of the public and includes a club;

- (24)“Restaurant” or “eating-house” means any premises in which is carried on wholly or principally the business of the supply of meals or refreshment to the public or a class of the public for consumption on the premises;

- (25)“Retail trade or business” includes the business of a barber or hair-dresser, the sale of refreshment of intoxicating liquors, and retail sales by auction;

- (26)“Schedule” means a schedule appended to this Act;

- (27)“Shop” means any premises where goods are sold, either by retail or wholesale or where services are rendered to customers, and includes an office, a store-room, godown, warehouse or workhouse or work place, whether in the same premises or otherwise, used in or in connection with such trade or business but does not include a factory or commercial establishment;

- (28)“Spread over” means the period between the commencement and the termination of the work of an employee on any day;

- (29) “Summer” means the period covering the months of April, May, June, July, August and September;

- (30) “Wages” means wages as defined in section 2 of the Minimum Wages Act, 1948 (XI of 1948);

Nothing in this Act shall affect any rights or privileges which an employee in any establishment is entitled to at the date this Act comes into force, under any other law, contract, custom or usage applicable to such establishment or an award, settlement or agreement binding on the employer and the employee in such establishment, if such rights or privileges are more favorable to him than those to which he would be entitled under this Act.

4. Exemptions. -Notwithstanding anything contained in this Act, the provisions of this Act mentioned in the third column of the Schedule shall not apply to the establishment, employees and other persons mentioned against them in the second column of the said Schedule: Provided that the Government may, by notification published in the Official Gazette, add to, omit or alter any of the entries of the said Schedule, and on the publication of such notifications the entries in either column of the said Schedule shall be deemed to be amended accordingly.

*5. Registration of establishments -1- Within the period specified in sub-section (5), the occupier of every establishment shall send to the Chief Inspector a statement in a prescribed form, together with such fees as may be prescribed, containing--

a) The name of the employer and the manager, if any;

b) The postal address of the establishment;

c) The name, if any, of the establishment,

d) The category of the establishment, i.e., whether it is a shop, commercial establishment, residential hotel, restaurant, eating house, theatre or other place of Public amusement or entertainment;

e)The number of employees working about the business of the establishment; and

f) Such other particulars as may the fees, the Chief Inspector shall, on being satisfied

(2) On receipt of the statement and the fees, the Chief Inspector shall, on being satisfied about the correctness of the statement, register the establishment in the Register of Establishment in such manner as may be prescribed and shall issue, in a prescribed form, a registration certificate to the occupier.

The registration certificate shall be shall be prominently displayed at the establishment and shall be renewed at such intervals as may be prescribed in this respect.

(4) In the event of any doubt or difference of opinion between an occupier and the Chief Inspector as to the category to which an establishment should belong, the chief Inspector shall refer the matter to the Government which shall after such enquiry, as it may think proper, decide the category of each establishment and the decision thereto, shall be final for the purpose of this Act.

(5) Within ninety days from the date mentioned in column 2 below in respect of the establishment mentioned in column 1, the statement together with fees shall be sent to the Chief Inspector under sub-section(1).

| Establishments | Date from which the period of 90 days is to commence |

|---|---|

| 1. Establishment existing in municipal areas, notified areas & cantonment limits of Delhi, New Delhi, Shahdara, Civil Lines, Mehrauli, Red Fort and Delhi Cantonment to which the Act is applicable on the date on which the Act comes into force. | i. The date on which this Act comes into force |

| 2. Establishment existing in local areas in which this Act is brought into force by notification under sub-section (4) of section1 on the date on which the Act has been made applicable by notification. | ii. The date on which this Act comes into force in the local areas concerned |

| 3. New establishment in areas mentioned in clauses (i) and (ii) of this sub-section. | iii. The date on which the establishment commences its work |

* Delhi Administration had decided to do away with the registration of shops/commercial establishments in the Union Territory of Delhi and is approaching the Government of India to amend Section (5), (6) and (7) of the Delhi Shops and Establishments Act, 1954. Till the Act is amended the requirement of registration/renewal/amendment has been kept in abeyance.

a. Manner of registering establishments and form of registration certificate:-On receipt of the statement and the fees prescribed in Rule 3, the Chief Inspector shall, on being satisfied about the correctness of the statement, register the establishment in appropriate part of the Register of Establishments in Form "B" and shall issue a registration certificate in Form 'C' to the occupier of the establishment.

b. Renewal of Registration Certificate.- A Registration Certificate shall be renewed at an interval of every 1[twenty one years] 2[on payment of fee prescribed in column 4 of Schedule I.]

- Every application for renewal shall be made in Form 'L' within 30 days of the expiry of the Registration Certificate originally granted or subsequently renewed.

- Subs. vide Notification No. 1/1/83 CIS, dated 22.11.83.

- Ins. vide Notification No. F. 13 (218)/54-I&L, dated 23.4.85.

In the event of loss or mutilation of a registration certificate issued under Rule 4 or renewed under Rule 5 above, a duplicate Registration Certificate shall be issued in Form 'C' marked 'Duplicate' on an application made by the occupier of the establishment and on payment of a fee of 4[₹ 3]].

d. Forms of notifying a change and fees.The occupier shall notify to the Chief Inspector in Form 'D' any change in respect of any information contained in part I of his statement prescribed under Rule 3 within fifteen days after the change has taken place. The notice in Form 'D' shall be sent to the Chief Inspector with ,such fee as are prescribed in Schedule II.]

.(6) Change to be communicated to the Chief Inspector. –It shall be the duty of the occupier to notify to the Chief Inspector, on a prescribed form, any change in respect of any information contained in his statement under sub-section (1) of section 5 within 1 month [thirty days after the change has taken place]. The Chief Inspector shall on the receipt of such notice and the prescribed foe and on being satisfied about its correctness make the change in the register of establishments in accordance with, such notice and shall amend the registration certificate, or issue a fresh registration certificate, if necessary.

(7) Closing of establishment to be communicated to the Chief Inspector. –The occupier shall within fifteen days of his closing the establishment, notify to the Chief Inspector in writing accordingly. The Chief Inspector shall, on receiving the information and being satisfied about the nature of closure, remove such establishment from the register of establishments and cancel the registration certificate. Provided that the Chief Inspector may not, if satisfied that the establishment is likely to re-start within a period of six months, remove it from the register of establishments and cancel the registration certificate.

No adult shall be employed or allowed to work about the business of an establishment for more than nine hours on any day or 48 hours in any week and the occupier shall fix the daily periods of work accordingly. Provided that during any period of stock taking or making of accounts or any other purpose as may be prescribed, any adult employee may be allowed or required to work for more than the hours fixed in this section, but not exceeding 54 hours in any week subject to the conditions that the aggregate hours so worked shall not exceed 150 hours in a year. Explanation - For the purpose of calculating the normal hourly wage the day shall be reckoned as consisting of eight hours. Provided that advance intimation of at least three days in this respect has been given in the prescribed manner to the Chief Inspector and that any person employed on overtime shall be entitled to remuneration for such overtime work at twice the rate of his normal remuneration calculated by the hour.

(9) Restriction on double employment. –No person shall work about the business of an establishment or two or more establishments or an establishment and a factory in excess of the period during which he may be lawfully employed under this Act.

10. Interval for rest and meals. -- The period of work of an adult employee in an establishment each day shall be so fixed that no period of continuous work shall exceed five hours and that no employee shall be required or allowed to work for more than five hours before he has had an interval for rest and meals of at least half an hour.

- The time for such interval shall be fixed by the employer and intimated to the Chief Inspector a week before such fixation and shall remain operative for a period of not less than three months.

The periods of work on any day of an adult person shall be so arranged that inclusive of his interval for rest or meals as required under Section 10, they shall not spread over for more than ten and a half hours in any commercial establishment or for more than twelve hours in any shop.

12. Prohibition of employment of children. –No child shall be required or allowed to work whether as an employee or otherwise in any establishment notwithstanding that such child is a member of the family of the employer.

13.Employment of young persons and hours of work.-(1) No young person shall be required or allowed to work about the business of an establishment for more than six hours a day.

(2) No young person shall be employed continuously for more than three and a half hours without an interval of at least half an hour for rest or meals and the spread over shall not exceed eight hours on any day.

14. Young persons and women to work during day time. –No young person or woman shall be allowed, or required to work, whether as an employee or otherwise in any establishment between 9 P.M. and 7 A.M. during the summer season and between 8 P.M. and 8 A.M. during the winter season.

15. Opening and closing hours of shops and commercial establishment. -- No shop or commercial establishment on any day, be opened earlier than such hour or closed later than such hour, as may be fixed by the Government by general or special order made in that behalf. Provided that any customer who was being served or was waiting to be served in any shop or commercial establishment at the closing hour so fixed may be served during the period of fifteen minutes immediately following such hour.

2.Before making an order under sub-section (l), the Government shall hold an inquiry in such manner as may be prescribed.

3.The Government may, for the purposes of this section, fix different opening hours and different closing hours for different classes of shops or commercial establishments or for different areas or for different times of the year.1. Subs. by Central Act 21 of 1961.

16. Close day. -- Every shop and commercial establishment shall remain closed on a close day.

- In addition to the close day every shop and commercial establishment shall remain closed on three of

- The National holidays each year as the Government may 1[by notification in the Official Gazette] specify.

- I. The Government may, by notification in the Official Gazette, specify a close day for the purposes of this section and different days may be specified for different classes of shops or commercial establishments or for different areas.

- II. Notwithstanding anything contained in sub-section (1), the occupier of any shop or a commercial establishment may, open his shop or commercial establishment on a close day, if such a day happens to coincide with a religious festival, “or the Mahurat day”, the day of the commencement of the financial year of the establishment concerned, provided a notice to this effect has been given to the Chief Inspector at least twenty-four hours before the close day and that in lieu thereof the shop or the commercial establishment is closed on either of the two days immediately preceding or following that close day.

(a) Every occupier of a shop or commercial establishment shall, along with Form 'A' furnish intimation regarding the choice of close day in Form 'E' to the Chief Inspector.

[provided that in respect of any shop or commercial establishment which comes into existence on or after the first day of December, 1959, its occupier shall furnish such information in form "E" to the Chief Inspector within thirty days of the date on which shop or commercial establishment comes into existence.]

17. Period of rest (weekly holiday). –Every employee shall be allowed at least twenty-four consecutive hours of rest (weekly holiday) in every week, which shall, in the case of shops and commercial establishments required by this Act to observe a close day, be on the close day.

18. Wages for the holiday. –No deduction shall be made from the wages of any employee on account of the close day under section 16 or a holiday granted under section 17 of this Act. If an employee is employed on a daily wage, he shall nonetheless be paid his daily wage for the holiday and where an employee is paid on piece rates, he shall receive the average of the wages received during the week.

a. Overtime working.-i) Other purposes for which overtime may be worked-An employer may require an adult employee to work overtime subject to the conditions laid down in section 8, for any of the following additional purposes :-

- Seasonal pressure of work;

- Work in pursuance of any custom or usage observed in the establishment;

- Work in pursuance of any custom or usage observed in the establishment;

- Treating of material liable to deterioration, if not treated immediately;

- Work necessitated as a result of any order from Court or any Government authority;

ii) Advance intimation in respect of requiring adult employees to work overtime in an establishment under the 1st proviso to section 8 shall contain the following information:

- The purpose of overtime;

- Date or dates and the probable time or period for which overtime is proposed to be worked;

- Number of the employees required to work overtime.

- Not less than thirty days before making an order under sub section (1) of section 15, the Government shall cause to be published in the Official Gazette a notification that it proposes to make such an order.

- A copy of the notification issued under sub-rule (1) shall be sent to every registered Association and Union representing employees and employers of shops and establishments for their comments. The Labor Advisory Board, if any, for the Union Territory of Delhi, shall also be consulted before making the order.

- After considering the objections or suggestions, if any, of the associations/ unions and the advice tendered by the Labor Advisory Board, the Government may make the order proposed or in such modified form as it may deem fit: Provided that it shall not be necessary to republish proposals before making the order in the modified form: Provided further that if in the opinion of the Administrator, it is necessary in public interest he may reduce the period specified in sub-rule (1) to such an extent as he may deem proper and he may also dispense with procedure laid down in sub-rule (2) and (3).

- Every employer or his agent or the manager of any establishment shall fix periods in respect of which wages to the employee shall be payable and such person shall be responsible for the payment to persons employed by him of all wages required to be paid under this Acts

- No wage period, so fixed, shall exceed one month.

- The wages of every employee in any shop or establishment shall be paid on a working day before the expiry of the seventh day of the last day of the wage period in respect of which the wages are payable.

- All wages shall be paid in cash.

- Where the employment of any person is terminated by or on behalf of the employer, the wages earned by him shall be paid before the expiry of the second working day after the day on which his employment is terminated.

- The wages of an employed person shall be paid to him without deduction of any kind except those specified in subsection (2).Explanation. -Every payment made by the employed person to the employer or his agent or the manager shall for the purpose of this Act be deemed to be a deduction from wages.

- Deductions from the wages of an employee shall be of one or more of the following kinds, namely: -

- Fines;

- Deductions for absence from duty;

- Deductions for damage to or loss of goods expressly entrusted to -the employed person for custody, or for loss of money for which he is required to account, where such damage or loss is directly attributable to his neglect or default;

- Deductions for house accommodation supplied by the employer;

- Deductions for such amenities and services supplied by the employer as the Government may by general or special order authorize; Explanation. -The words 'amenities and services' in this clause do not include the supply of tools and protectives required for the purpose of employment.

- Deductions for the recovery of advances or for adjustment of over-payments of wages, provided that such advances do not exceed an amount equal to wages for two calendar months of the employed person and, in no case, shall the monthly installment of deduction exceed one-fourth of the wages earned in that month.

- Deductions of income-tax payable by the employed person;

- Deductions required to be made by order of a Court or other competent authority;

- Deductions for subscription to, and for repayment of advances from, any provident fund to which the Provident Fund Act, 1952 (XIX of 1952) applies or any recognized provident fund as defined in section 2(38) of Income Tax Act, 1961 (43 of 1961) or any provident fund approved in this behalf by the Government during the continuance of such approval;

- Deductions for payment to co-operative societies or to a scheme of insurance approved by the Government.

(3) Any employer desiring to impose a fine on an employed person or to make a deduction for damage or loss caused by him shall explain to him personally and also in writing the act or omission or the damage or loss, in respect of which the fine or deduction is proposed to be imposed or made, and give him an opportunity to offer any explanation in the presence of another person. The amount of the said fine or deduction shall also be intimated to him.

(4) The amount of fine or deduction mentioned in sub-section (3) shall be such as may be specified by the Government. All such deductions and realizations thereof shall be recorded in a register maintained in a form as may be prescribed.

(5) The amount of fine imposed under sub-section (3) shall be utilized in accordance with the directions of the Government.

(6) Nothing in this section shall be deemed to affect the provisions of the Payment of Wages Act, 1936 (IV of 1936).

21.Claims relating to wages. -- The Government may, by notification in the Official Gazette, appoint any Commissioner for Workmen's Compensation Act or other officer with experience as a Judge of a Civil Court or as a Stipendiary Magistrate to be the authority to hear and decide all claims arising out of delayed payment or non-payment of earned wages of an employee employed in any establishment.

- Application for any such claim may be made to the authority appointed under sub-section (1) by the employee himself [or any official of a registered trade union authorized in writing to act on his behalf] or any legal practitioner or the Chief Inspector for a direction under subsection (3). Provided that every such application should be presented within one year from the date on which the claim for such wages has become payable under this Act: Provided further that an application may be admitted after the said period of one year when the applicant satisfies the authority that he had sufficient cause for not making the application within such period.

- When any application under sub-section (2) is entertained, the authority shall hear the applicant and the employer, or give them an opportunity of being heard and after such further enquiry, if any, as it may consider necessary may, without prejudice to any other penalty to which employer may be liable under this Act, direct the payment to the employee of the amount due to him together with the payment of such compensation as the authority may think fit, not exceeding half the amount so due or Rs. 100, whichever is less.

- If the authority hearing any application under this section is satisfied that it was either malicious or vexatious, it may direct that a penalty not exceeding hundred rupees be paid to the employer by the person presenting the application.

- Any amount directed to be paid under this section may be recovered:

- If the authority is a magistrate, by the authority as if it was a fine imposed by the authority as a magistrate, or

- If the authority is not a magistrate, by any magistrate to whom the authority makes application in this behalf, as if it were a fine imposed by such magistrate.

- (6) Every direction of the authority under this section shall be final.

- (7) Every authority appointed under subjection (1) shall have all powers of a Civil Court under the Code of Civil Procedure, 1908 (V of 1908) for the purpose of taking evidence and of enforcing the attendance of witnesses and compelling the production of documents, and every such authority shall be deemed to be a Civil Court for all the purposes of Section 195 and Chapter XXXV of the Code of Criminal Procedure, 1898 (V of1898).

(1) Every person employed in an establishment shall be entitled:

a.After every twelve months', continuous employment, to privilege leave for a total period of not less than fifteen days;

b. In every year, to sickness or casual leave for a total period of not less than twelve days; provided that:

- An employee who has completed a period of four months in continuous employment, shall be entitled to not less than five days privilege leave for every such completed period; and

- (ii) An employee who has completed a period of one month in continuous employment shall be entitled to not less than one day's casual leave for every month. Provided further that a watchman or caretaker who has completed a period of twelve months in continuous employment and to whom the provisions of Section 8, 10, 11, 13 and 17 do not apply by virtue of an exemption granted under Section 4, shall be entitled to not less than thirty days' privilege leave.

(i) Privilege leave to which an employee is entitled under clause (a) of sub-section (1) or under any such law, contract, custom or usage, award, settlement or agreement as is referred to in section 3, or any part of such leave, if not availed of by such employee, shall be added to the privilege leave in respect of any succeeding period to which he is so entitled, so however, the total period of such privilege leave which may be accumulated by such employee shall not at any one time exceed three times the period of privilege leave to which he is entitled after every twelve months' employment under that clause or under such law, contract, custom or usage, award, settlement or agreement.

(ii) Leave admissible under clause (b) of sub-section (1) shall not be accumulated.(2) If an employee entitled to leave under clause (a) of sub-section (1) of this section is discharged by his employer before he has been allowed the leave, or if, having applied for and having been refused the leave, he quits his employment before he has been allowed the leave, the employer shall pay him full wages for the period of leave due to him.

23. Wages during leave. –Every employee shall he paid for the period of his leave at a rate equivalent to the daily average of his wages for the days on which he actually worked during the preceding three months, exclusive of any earnings in respect of overtime but inclusive of dearness allowance.

24. Contracting Out. –Any contract or agreement, whether made before or after the commencement of Delhi Shops and Establishments (Amendment) Act, 1970, whereby an employee relinquishes any right conferred by this Act, shall be null and void in so far as it purports to deprive him of such right.

25. Cleanliness. –The premises of every establishment shall be kept clean and free from effluvia arising from any drain or privy or other nuisance and shall be cleaned at such times and by such methods as may be prescribed. These methods may include lime washing, color washing, painting and disinfecting.

26. Lighting and ventilation. -- The premises of every establishment shall be kept sufficiently lighted and ventilated during all working hours.

- Suitable arrangements shall be made for supply of drinking water to the employees.

If it appears to an Inspector that the premises of any establishment within his jurisdiction are not sufficiently lighted, cleaned or ventilated, he may serve on the employer an order in writing specifying the measures which in his opinion should be adopted and requiring them to be carried out before a date specified in the order. The Government may prescribe standards in respect of any of these matters.

28. Precautions against fire. –In every establishment, except such establishments or class of establishments as may be prescribed, such precautions against fire shall be taken as may be prescribed. No persons shall smoke or use a naked lighter or cause or permit any such light to be used in the immediate vicinity of any inflammable material in any establishment.

29. Accidents. –The provisions of Workmen's Compensation Act, 1923 (VIII of 1923) and of rules made thereunder, shall apply mutatis mutandis to every employee of an establishment.