Sole Proprietorship Registration in India

Sole Proprietorship is a business managed by a single person that is “one-man organization where a single individual owns, manages and controls the business.” It is not mandatory to work ‘alone’ if you are in sole proprietorship—it is possible for the sole proprietor to hire other people for help in work. Only appropriate or proper licensing to conduct a business and registration of business name if it differs from the sole proprietorship is required.It does not require a registration as such. There is no government registration needed in order to start a sole proprietorship business in India. You don't have to go to an online registration portal and fill up a form or submit any documents. One of the primary benefits is ease of formation, since a government registration is not required. There are no fees to be paid for starting a one-man business on your own, and there is no government regulatory paperwork and compliance to be fulfilled. There are no minimum capital investment requirements, and the proprietor has full control and ownership stake.

However, you do need to open a current account with a bank in the name of the business. A current account in turn requires that you have a specified location from which you are doing business. The bank will ask you to submit at least two documents as proof of business location in the form of government registrations such as shop act license, service tax, GST, etc. A sole proprietorship, also known as the sole trader or simply a proprietorship, is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business. Sole Proprietorship examples include small businesses, such as a single person art studio, a local grocery, or an IT consultation service. The moment you start offering goods and services to others, you form a Sole Proprietorship. It's that simple. Any person who wants to start a business with less investment can opt for this type of business form.A sole proprietorship is the most common form of a business entity where one person is the owner and is personally liable for all the debts and liabilities of the business. It is the simplest form of an entity with minimal compliance procedures.

Once you begin conducting business on your own, you're a sole proprietorship. There is little in the way of paperwork or bureaucracy to contend with, and you don't have to report to anyone. But if you decide to expand your company, or want the legal and financial protection not offered by the sole proprietorship model, you need to incorporate your small business. Incorporating may also make it easier to attract potential investors, should you choose to do so.You get to keep whatever profit or income you generate. Furthermore, the tax benefits of sole proprietorship prevent double taxation of the firm. You will file returns and pay taxes only in your personal name. There are no separate income tax returns to be filed and no tax to be paid by the firm.

There are only two things you need to do for starting a sole proprietorship business in India.

1.Choose a business name.

2.Select a location as the place of doing business

First step starts with just opening a current account to ensure safe payments in the proprietorship’s name. Hence, generating a current account is considered to be the groundwork for starting this type of business.

Benefits of Starting a Sole Proprietorship

The Owner has overall control and claims the ownership stake

- spared of government amenability and supervisory paperwork.

Requires no minimum capital investment

- It is cost-effective as there no fees to pay during the initiation of the process.

The profit solely belongs to the proprietor

- Primary establishment is easy as there is no need for registration

The tax assistances avert double taxation and No separate tax for the firm

- The owner is accountable only to file an annual tax return and pay tax as an individual

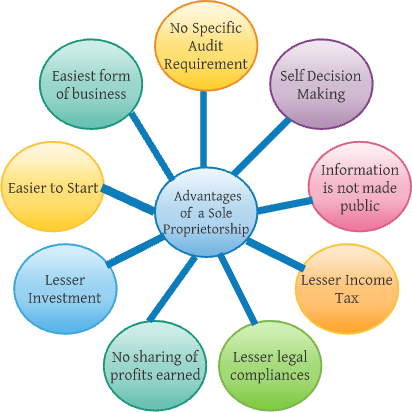

Advantages of a Sole Proprietorship

Easiest form of business

Various shops in our locality carrying out small business operations are Sole Proprietorships. They do not involve any complexities and can be handled by a single person in a comfortable manner.

Easier to start

Sole Proprietorships do not require mandatory registrations under any law. They only require registrations or licenses specific to the nature of business. So, any person can start his/her business easily with a trade name of his/her choice. Any trade name can be used in case it does not clash with any brand name. The name does not require any approval from registry.

Lesser investment

Sole Proprietorships can be started with a very minimal amount of investment at the initial phase. So, it is a great opportunity for those who want to set up a business with low funds as no minimum capital is prescribed for starting a Proprietorship.

No sharing of Profits earned

Sole Proprietor is the only person who operates and manages the whole business, so 100% of the profits belong to him/her. No one else is entitled to a share in the profits earned.

Lesser legal compliances

Since Sole Proprietorships are not governed by any specific law, the legal compliances are minimal. They do not have a pre-defined Certificate of Incorporation or Registration Certificate. So, the compliances depend upon registrations or licenses taken by a particular sole proprietorship. For example, if a sole proprietorship registers itself under GST law, then it will have to comply with the GST return filing, etc. There is no such requirement of uploading the Annual report or other reports on the MCA website.

Lesser income tax

Since the Sole Proprietorship involves only a Sole proprietor, hence no separate tax is required to be paid by it. Sole proprietor and the Sole Proprietorship are same for the purpose of calculation of tax liability. The assets and liabilities of the Sole Proprietorship are the assets and liabilities of the Sole Proprietor. Sole proprietor is required to file his/her normal return and show the profits earned in the business in that return itself. Separate return is not required for the Sole Proprietorship firm. Also, the tax is calculated at income tax slab rates applicable to an individual. Other tax liabilities like GST will depend upon the nature of business.

Information is not made public

Unlike Companies, Limited Liability Partnerships, etc. where financial statements and audit reports are made public for the users through MCA (Ministry of Corporate Affairs) portal, the financial reports of Sole Proprietorships remain in private hands. Even, the list of all proprietorships is not readily available with the Government officials.

Self decision making

- Since the Sole Proprietorship is managed and operated single handed, there is no chance of conflict of ideas or decisions. Sole Proprietors has the right to do whatever he/she thinks is correct for the business.

- To close the proprietorship, there is nothing which you have to do specifically. Pay all statutory dues like Income tax, GST etc. and surrender all the registrations taken in the name of the firm. The closing proprietorship is easier in comparison to other forms of business.

No specific audit requirement

Sole Proprietorship is not required to get its accounts audited each financial year under any specific law. The audit will depend upon the nature of business and the threshold turnover limits specified for the conduct of the audit. Like, a tax audit is required if the turnover/sales exceed ₹ 1 crores and for professional services, the audit is required if receipts exceed ₹50 lakh. Similarly, GST audit is required if the turnover exceeds ₹ 2 crores.

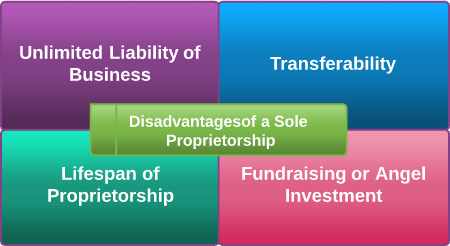

Disadvantages of a Sole Proprietorship

Unlimited Liability of Business

A proprietor is personally liable for all the future liabilities of the proprietorship firm, which can occur due to constant losses in the business. To pay off debt or obligation of the business, the proprietor has to sell his personal assets, like the house, jewellery etc. or face insolvency proceedings in his name. Frankly, this is a very serious demerit, and to overcome this, you may incorporate a One Person Company.

Transferability

Since all the tax registrations like GST, Income Tax and Import Export Code are linked with the PAN Number of the proprietor; hence in case you wish to transfer the business to someone else then it can’t be transferred as a going concern. In other words, the business as such is not transferable.

Lifespan of Proprietorship

The existence of a proprietorship firm is tied with the life of the proprietor. On the demise of the proprietor, the firm also comes to an end. The remaining assets or liabilities are then transferred to the legal heirs as per law by the court of law.

Fundraising or Angel Investment

The proprietorship firm does not have the ability to raise equity fund from angel investors or the venture capital firms. The banks, NBFC and other financial institutions also do not favor financing of a proprietorship firm.

Disadvantages of a Sole Proprietorship

Recommended For - Small traders and manufactureres

Ease of Accoomodating Investment - Impossible

Limited Liability Protection - No

Tax Advantages - Minimal

Perpetual Existence - No

Statutory Compliances - Minimal

Procedure to register as a sole proprietorship

Applying for PAN. If you already have one this step is not required.

The next step is to name the business.

There is no formal registration required, but the next step is to open a bank account in the name of the business.

Register for GST if your turnover exceeds ₹ 40 lakh. One can also get a shop and Establishment registeration done.

You can also register as a small and medium Enterprise (SME) under MSME Act, though not mandatory, It is beneficial to be registered under the same.

You can also register as a small and medium Enterprise (SME) under MSME Act, though not mandatory, It is beneficial to be registered under the same.

Register for GST if your turnover exceeds ₹ 40 lakh. One can also get a shop and Establishment registeration done.

Checklist of Items for a Sole Proprietorship Registration

- A certificate/license issued by Municipal authorities under the Shop & Establishment Act.

- The license issued by Registering Authorities like the Certificate of Practice is issued by the Institute of Chartered Accountants of India.

- The registration/licensing document is issued in the name of the proprietary concern by the Central Government or the State Government Authority/ Department, etc.

- The banks may also accept the IEC (Importer Exporter Code) issued to the proprietary concern by the office of the DGFT as an identity document for opening of the bank account etc.

- Complete Income Tax return (not just the acknowledgement) in the name of the sole proprietor where the firm’s income is reflected, duly authenticated and acknowledged by the Income Tax Authorities,

- The utility bills such as electricity, water, and the landline telephone bills in the name of the proprietary concern,

- Issue of GST Registration/Certificate.

Any 2 of the documents can be submitted for the Bank Account opening along with the Identity and Address proof of the proprietor.

Proprietorship Firm Compliances depending on their types

Income Tax Return Filing

- Due date for filing of return by sole proprietorship business where it is required to get its accounts audited under the income-tax Act is September 30th of the assesssment year.

- Income tax return filing wherein the audit is not necessary, due date of filing of an income tax return for sole proprietorship firm is 31st July.

- Taxpayer must confirm the actual TDS/Self-Assessment/ Advance Tax paid with the downloaded from 26AS. If any discrepancy is found, suitable corrective action should be taken to reconcile it.

- ITR 3 Form is applicable in case of a proprietorship who is carrying out a proprietary business or profession.

- Form ITR-4 is applicable in case of resident sole proprietorship having income from a business or profession and who has opted for the presumptive taxation scheme as per Section 44AD, Section 44ADA and Section 44AE of the Income Tax Act, 1961.

Income Tax Audit

- A tax audit is mandatory for Sole proprietorship firms if the turnover or gross recepits in the financial year exceeds ₹ 1 crore.

- In case of a professional income, the audit is mandatory if gross recepits in the financial year exceeds ₹ 50 lakhs.

- In such person is opting for the Presumptive Taxation Scheme, a tax audit becomes mandatory if the person declares taxable income below the limits prescribed under the presumptive tax scheme.

- In case of failure to audit the books of account, the taxpayer shall be liable for a penalty of 0.5% of total sales/ turnover/ gross receipts or ₹ 1,50,000 whichever is lower, except for any reasonable cause.

- If the sole proprietor has loss in any financial year, the same can be carried forward to the subsequent year(s) and be set-off against positive income. It is important to note that filing of an income tax return before the due date is a mandatory requirement to be eligible for carry forward of previous years losses and set off against the current year taxable income.

GST Registration

- If the current supply of goods or service is over ₹ 40 lakh, you need to get a GST Registration (if your business operates exclusively in the North Eastern states, ₹ 20 lakh) within 30 days of business incorporation.

- Anyone supplying goods or services to another state, need to apply for GST regardless of turnover.

- Even online service provider serving customers in another State will instantly attract GST registration.

- Once a Person gets registered under GST, it becomes necessary to file GST returns monthly, quarterly or yearly depending upon the types of GST returns.

- Return filing is mandatory under GST. Even if there is no transaction, you must file a Nil return. You cannot file a return if you do not file previous month/quarter's return. Hence, late filing of GST return will have a cascading effect leading to heavy fines and penalty.

- The registration Certificate once granted is permanent unless surrendered, cancelled, suspended, or revoked

MSME / SSI REgistration

- MSME registration is the procedure to get your firm registered under MSME development Act for SME benefits.

- To avail the benefits offered by the Ministry of MSME, a sole proprietor has an added advantage of getting a unique identity for his business which is also considered as Sole Proprietorship Registration.

- The tax holiday for startups has been extended up to 31st March 2022.

- MSME certificate is valid as long as the enterprise is functioning. However, a provisional MSME certificate is valid for 5 years.

- Enterprises registered under MSMEs are eligible for various benefits from the Government of India, Reserve Bank of India (RBI), etc. This includes subsidies, incentives, credit facilities from banks, and protection against delayed payments by buyers of goods/services and it provides a lot of benefits in terms of taxation, setting up the business, credit facilities, loans etc.

FSSAI Registration

- In Case Proprietor Is Doing Business Of Food And Related Articles, Obtaining a license can provide the food business with legal benefits, build goodwill, ensure food safety, create consumer awareness, and assist in business expansion. Also it helps regulate, manufacture, storage, distribution and sale of import food.

- It includes three types of registration-

- Basic registration: It includes business having turnover up to ₹12 lakh in a year

- State license: business having turnover between ₹12 lakh to ₹20 crores in a year comes under state license

- Central license: business having turnover above ₹20 crores comes under central license, any business doing export and import also come under central license

IEC Registration

- All the Sole Proprietors who are engaged in Import and Export of goods require to register the Import Export Code. IE code has lifetime validity. Importers are not allowed to proceed without this code and exporters can’t take benefit of exports from DGFT, customs, Export Promotion Council, if they don’t have this code.

- IEC does not require the filing of any returns, once allotted.Even for export transactions, there isn’t any requirement for filing any returns with DGFT.

- IEC is not mandatory for all traders who are registered under GST. In all such cases, the PAN of the trader shall be construed as new IEC code for the purpose of import and export.

- Import Export Code (IEC) isn’t required to be taken in case the goods exported or imported is for personal purposes and isn’t used for any commercial purpose.

- Export/ Import done by the Government of India Departments and Ministries, Notified Charitable institutions need not require getting Import Export Code.

Shop and Establishment registration

- The Shop and Establishment Act registration regulates hours of work, payment of wages, leave, holidays, terms of service and other conditions of work of persons employed in shops, commercial establishments, establishments for public entertainment or amusement and other establishments and to provide for certain matters connected therewith and to secure uniform benefits for employees working in different establishments, from shops, commercial establishments and residential hotels to restaurants, theatres and other places of public amusement or entertainment,whether a business is small or big, within 30 days of commencement of work.

- This registration is compulsory for every business place of work except those who falls under Factories Act 1948. It is a state regulation and each state has separate shop & establishment regulation.

- Each state have a DIC Department which creates the policy in the respective state for the all small business. On the basis of Shop License Registration Certificate you can easily avail the government benefits.

Intellectual Property Rights Registration

- Intellectual Property Rights (IP Rights) are like any other property rights which are intangible in nature. The IP Rights usually give the creator an exclusive right over the use of his/her creation for a certain period of time.

- Every startup uses trade name, brand, logo, advertisements, inventions, designs, products, or a website, in which it possesses valuable IP Rights.

- protection of intellectual property helps to improve the valuation of its business, to generate better goodwill, to protect its competitive advantage, to use intellectual property as a marketing edge and to use the IP Rights as a potential revenue stream through licensing

Patents, Designs & Trade Marks Registration

- In Case You Want that no one can use your business Name take Trademark Registration. Trademarks means any words, symbols, logos, slogans, product packaging or design that identify the goods or services from a particular source.If a person is using a similar mark for similar or related goods or services or is using a well-known mark, the other person can file a suit against that person for violation of the IP rights irrespective of the fact that the trademark is registered or not.

- In Case You Want to work of Writing, Artistic, Literature take Copyright Registration.Copyright means a legal right of an author/artist/originator to commercially exploit his original work which has been expressed in a tangible form and prevents such work from being copied or reproduced without his/their consent.the duration of copyright is the lifetime of the author or artist, and 60 years counted from the year following the death of the author/artist/originator.

- Patent is a monopoly given to the inventor on his invention to commercial use and exploit that invention in the market. In India, the term of the patent is for 20 years. The patent is renewed every year from the date of patent.

Income Tax Compliances of Sole Proprietorship Firm

Presumptive taxation scheme is designed to help ease the compliance burden of small businesses by assuming a set profit margin on the total income of the business or profession. The computation of taxable income under this scheme is tabulated below:

| Section | Computation of taxable income | Maximum turnover limit /criteria |

|---|---|---|

| Section 44AD (Businesses) | Payment received in cash shall be charged at 8% of gross turnover and electronic receipts shall be charged at 6% of gross turnover during the year. A higher income can be declared | Turnover up to ₹ 2 crores in a year |

| Section 44ADA (Professionals) | 50% of gross receipts. A higher income of more than 50% can be declared | Annual receipts up to ₹ 50 lakhs in a year |

| Section 44AE (Transporters) | ₹ 7,500 per vehicle per month or part thereof based on the duration for which the vehicle was owned by the person during the year | Upto 10 goods vehicles owned during the year |

If the sole proprietor fails to furnish a return of income within the prescribed due date, an interest on tax dues and late fee becomes applicable as per section 234F of the Income Tax Act 1961. Fee for default in furnishing return of income will be as follows:

- ₹ 5,000 if return is furnished on or before the 31st day of December of the assessment year after due date.

- ₹ 10,000 in any other case

However late filing fee shall not exceed ₹1,000 if the total income of assessee does not exceed ₹5 lakh.

Tax Rate of a proprietor being a resident in India

| Total Income Slabs in ₹ | When the proprietor is less than 60 years of age | When the proprietor is of the age of 60 years or more but less than 80 years | When the proprietor is of the age of 80 years or more |

|---|---|---|---|

| Up to 2,50,000 | Nil | Nil | Nil |

| 2,50,001 to 3,00,000 | 5% | Nil | Nil |

| 3,00,001 to 5,00,000 | 5% | 5% | Nil |

| 5,00,001 to 10,00,000 | 20% | 20% | 20% |

| Above 10,00,000 | 30% | 30% | 30% |

- Rate of Surcharge : In addition to income tax, individuals are required to pay surcharge at the rate of 10% (If total income exceed ₹ 50 Lakh but does not exceed ₹ 1 crore) and at the rate of 15% (if total income exceed ₹ 1 Crore but does not exceed ₹ 2 crore) and at the rate of 25% (if total income exceed ₹ 2 Crore but does not exceed ₹ 5 crore) and at the rate of 37% (if total income exceed ₹5 Crore )

- Health and Education cess: Health and education cess is payable at the rate of 4% on “income tax and surcharge” irrespective of income.

- Rebate under section 87A: The rebate is available to a resident individual if his total income does not exceed ₹ 5,00,000. The amount of rebate shall be 100% of income-tax or ₹12,500, whichever is less.

MSME /SSI Registration

MSME (Micro, Small and Medium Enterprises) are Enterprises engaged in providing or rendering of services and whose investment in equipment (original cost excluding land and building and furniture, fittings and other items not directly related to the service rendered or as may be notified under the MSMED Act, 2006.

The MSMEs are categorized in manufacturing sectors and service sectors. MSME/Udyam Registration covers only manufacturing and service industries. Trading companies are not covered by the scheme. These two sectors have been further classified based on the investment. The classification has recently been reset based on investment and annual turnover to create a greater scope of growth for the MSMEs. Below is the reset classification of the micro, small and medium enterprises.

MSME Classification- Manufacturing Enterprises and Enterprises rendering Services

| Criteria | Micro enterprises | Small enterprises | Medium enterprises |

|---|---|---|---|

| Investment in plant and machinery or equipment | Less than ₹ 1 Cr | Less than ₹ 10 Cr | Less than ₹ 50 Cr |

| Annual turnover | Less than ₹ 5 Cr | Less than ₹ 50 Cr | Less than ₹ 250 Cr |

The reason behind MSME registration being appealing is the wide-ranged benefits. Here are the MSME registration benefits.

- MSME registered enterprises can avail loans at lower interest rates than regular loans. Loans can be availed at an interest rate of as low as 1% to 1.5%.

- MSME certificate holders can enjoy tax exemption under the MSME Act.

- MAT or minimum alternate tax can be extended to 15 years from the regular 10 years.

- MSME registered enterprises gets preference for government-issued license and certificates.

- By getting registered under MSME, the cost of patenting and industry set up reduces due to various rebates and concessions.

- Many government tenders are given to only MSME registered enterprises.

- An MSME gets easy access to credit.

GST Registration

If the current supply of goods is over ₹ 40 lakh, you need to get a GST Registration (if your business operates exclusively in the North Eastern states or Special Category States, ₹ 20 lakh) within 30 days of business incorporation.

All the service providers should obtain GST registration, if the entity’s aggregated annual turnover exceeds ₹20 lakhs per annum in most states and ₹10 lakhs in the Special Category States. However, certain category of persons are required to compulsorily get registered under GST:

- Inter -state suppliers

- Casual Taxable persons

- Persons taxable under the reverse charge basis

- Non-resident taxable persons

- Persons required to deduct TDS under GST

- Persons required to deduct TCS under GST

- Input Service Distributors

- Persons making a sale on behalf of someone else whether as an Agent or Principal.

- Every E-commerce Operator who provides a platform to suppliers to make supply through it.

- Suppliers who supply goods through E-commerce operator who is liable to collect tax at source.

- Online Service Providers providing service from outside India to a non-registered person in India.

| Normal Category States/UT who opted for a new limit of ₹ 40 lakh | Normal Category States who choose status quo | Special Category States/UT who opted for new limit of ₹ 40 lakh | Special Category States/UT who opted for new limit of ₹ 20 lakh |

|---|---|---|---|

| Kerala, Chhattisgarh, Jharkhand, Delhi, Bihar, Maharashtra, Andhra Pradesh, Gujarat, Haryana, Goa, Punjab, Uttar Pradesh, Himachal Pradesh, Karnataka, Madhya Pradesh, Odisha, Rajasthan, Tamil Nadu, West Bengal, Lakshadweep, Dadra and Nagar Haveli and Daman and Diu, Andaman and Nicobar Islands and Chandigarh | Telangana | Jammu and Kashmir, Ladakh and Assam | Puducherry, Meghalaya, Mizoram, Tripura, Manipur, Sikkim, Nagaland, Arunachal Pradesh and Uttarakhand |

Other amendments in the threshold limits under the Composition Scheme

- Changes in the composition scheme: The threshold of annual turnover for composition scheme was increased to ₹ 1.5 crores from 1st April 2019. The taxpayers registered under the scheme have to pay tax quarterly and file returns annually from 1st April 2019. The limit remains unchanged at ₹ 75 lacs for North Eastern states & Uttarakhand.

- Composition scheme was made available to service providers: New scheme introduces a fixed tax rate of 6% with 3% CGST and 3% SGST. Independent service providers, as well as mixed suppliers of goods and services with an annual turnover of up to ₹ 50 lacs in the preceding financial year can opt for this scheme.

Conclusion

It’s easy to start a small business by forming a Sole Proprietorship with minimal complexities. Because of lesser complexities, the sole proprietor can focus on enhancing his/her business rather than focusing on meeting various compliances. It’s a good option for those who want to provide a platform to their business idea and try out something they want to with minimal investment.

It is essential for every proprietorship firm, ranging from micro to macro size, to run their business according to legal terms and conditions. For example, if you’re working as an independent writer, developer, contractor, freelancer, photographer or a salesperson, then automatically you’re running proprietorship firm because in all that cases, you’ve to pay your debts. Nonetheless, it is not legally acceptable to run a firm without compliance registrations. Moreover, the utmost advantages of all these legal registrations revolve around.

- Owning a legitimate image

- Competitive market relationships

- Sharp tendency to expand

- Tangible ways for reporting of taxes

- International growth

Frequently Asked Questions

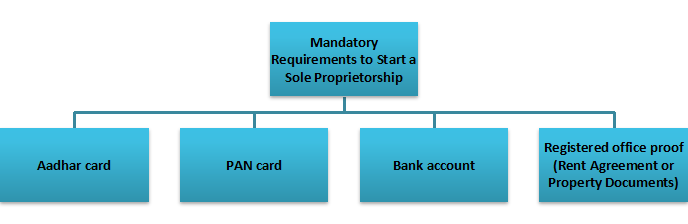

- 1. What are the minimum requirements to register Proprietorship firm?

-

For registering in sole Proprietorship, the following documents are required:

- PAN card of proprietor

- Aadhar Card of proprietor

- Bank Account

- Business address proof

- 2. What are the minimum requirements towards Capital?

-

A proprietorship firm is the most basic form of business entity. It doesn’t have any separate legal identity, it’s quite easy to setup and it doesn’t require any minimum capital. In simple terms, you can start a proprietorship firm with zero capital. Through this post, we are going to tell you how to start your proprietorship firm with zero capital.

- 3. What are options available with sole proprietor to register its business?

-

These firms do not require specific registration. But in order to run the business smoothly, they have an option to get registered under the following:

- GST registration

- MSME registration

- Registration under Shop and Establishment Act

- 4. What all other documents required for the sole proprietorship entities?

-

- License/ Certificate issued by Municipal Authorities

- CST/VAT certificate

- Income tax returns documents

- Certificate issued by Service Tax/ Sales Tax /Professional Tax authorities

- Certificate issued by Food and Drug Control Authorities, Indian Medical Council

- IEC (Importer Exporter Code) issued to the proprietor owner by the office of DGFT

- Utility bills such as water bill, electricity bill and landline telephone bills in the name of the proprietor owner

- 5. Who can start a Sole Proprietorship?

-

Any Indian citizen with a current account in the name of his/her business can start a sole proprietorship. Registration may or may not be required, depending on the type of business that is planned to be established. However, to open a current account, banks typically require a Shops & Establishments Registration.

- Service providers providing services online or offline to clients

- Businesses manufacturing goods

- Traders and merchants selling goods

- 6. What are the Compliances required?

-

- 1. As a sole proprietor, you must file Income Tax Return annually.

- 2. Also, you need to file your GST Return if you are registered under GST.

- 3. A sole proprietor should also deduct TDS and file TDS return if liable for Tax Audit.

- 7. What businesses are commonly run as Sole Proprietorships?

-

Most local businesses are run as sole proprietorships, from grocery stores to fast-food vendors, and even small traders and manufacturers. That doesn’t mean that larger businesses cannot operate as sole proprietorships.

- 8. What if I wish to convert from Sole Proprietorship to Private Limited Company or Partnership?

-

The procedure involved is a little tedious, but it is possible. It is very common for sole proprietors to convert into partnerships or private limited companies at a later stage of their businesses.

- 9. Is it Easy to close the proprietorship firm?

-

As the proprietor and the proprietorship are one and the identical, hence, there is no formality needed for closing a proprietorship firm. In most of the cases, via surrender of the GST certificate and close the current account leads to close a proprietorship.

- 10. Is name of firm secured after proprietorship registration?

-

No, the name of the firm is not secured after proprietorship registration and can be copied by anyone else. For this, proprietor has to apply the trademark registration after the firm’s registration.

- 11. What is the proof of proprietorship registration?

-

Proprietorship firms do not have a certificate of incorporation. Only GST certificate and MSME certificate are being issued that denotes the firm has been registered.