Trade Receivables Discounting System (TReDS) - An Introduction

The RBI launched the Trade Receivables Discounting System in 2018. Small businesses may benefit from the platform today more than ever before.

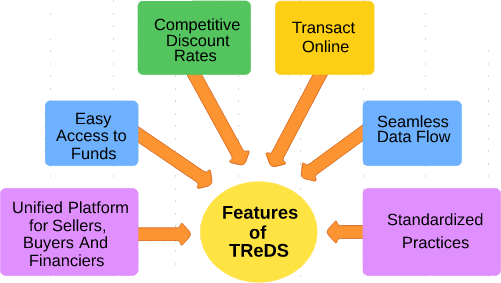

Trade Receivables Discounting System (TReDs) is a Reserve Bank of India initiative to ensure timely payments to the suppliers (MSME Suppliers) which qualify as micro, small and medium enterprises (MSMEs) under the Micro, Small and Medium Enterprises Development Act, 2006. It is a digital platform for MSME Suppliers to auction/discount their trade receivables at competitive rates through online bidding.

It brings together the MSME Suppliers, Buyers (i.e. Corporates, Government Departments and Public Sector Undertakings) and Financiers (i.e. Banks, NBFCs and Financial Institutions) for facilitating uploading, accepting, discounting, trading and settlement of invoices/bills of exchange of MSME Supplier. The process involves uploading a valid invoice by the MSME Supplier on the TReDs Platform, and validation and approval of the invoice by the Buyer. Upon approval, various Financiers start to bid on the invoice at discounted rates. The MSME Supplier can exercise its discretion while accepting the bid and, upon acceptance, the payment is processed, and the MSME Supplier's account is credited with the discounted amount.

Micro, Small and Medium Enterprises (MSMEs) represent a significant part of the Indian economy and are one of the strongest drivers of economic development, innovation and employment.

Despite this sector’s vast potential, certain challenges are hampering its rapid growth. One of the challenges faced by MSMEs is the delayed payment from corporate buyers leading to a shortage of working capital for their regular business operations.

To address the financing related issues faced by MSMEs in India, RBI in 2014 introduced the concept of TReDS, a mechanism of trade receivables financing for MSMEs on a secure digital platform.

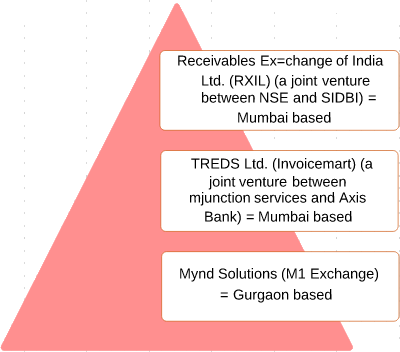

Three platforms were granted licenses by RBI to operate on the TReDS mechanism in 2017, including Mynd Solutions’ M1Xchange, Invoice mart (a joint venture between mjunction services and Axis Bank), and RXIL (a joint venture between NSE and SIDBI) on which registration can be made:

Facilitate immediate payment to MSMEs

The Ministry of Micro, Small and Medium Enterprises (MSME Ministry) vide its Notification (MSME Notification) bearing S.O. 5621(E) dated November 02, 2018 has mandated all companies (Large Corporates) registered under the Companies Act, 2013 with a turnover of more than 500 Crore (Rupees Five Hundred Crore) as per the last available audited financial statements and all Central Public Sector Enterprises (CPSEs) to get themselves registered on the TReDs Platform to ensure cash liquidity for MSME Suppliers.

There is no timeline prescribed under the MSME Notification for the Large Corporates and/or CPSEs to get onboard on the TReDs Platform. However, the Ministry of Corporate Affairs (MCA) has requested the Institute of Company Secretaries of India (ICSI) to seek a report on compliance with the MSME Notification from the Company Secretaries of the Large Corporates. Accordingly, MCA has casted an obligation on the Company Secretaries, upon registration of the Large Corporates on TReDS Platform, to report the compliance to ICSI in the format prescribed by them.

MSME Ministry has designated the Registrar of Companies (ROC) in each State to act as the competent authority to monitor the compliance of the MSME Notification by the Large Corporates and CPSEs under its jurisdiction. Recently, different jurisdictional ROCs have issued notices to various companies to comply with the requirement prescribed under the MSME Notification, on the basis of total income reflected in their last audited financial statements rather than turnover. Total income is often considered as a synonym for turnover. However, 'Turnover' is a defined term under the Companies Act, 2013 to mean the gross amount of revenue recognized in the profit and loss account from the sale, supply, or distribution of goods or on account of services rendered, or both, by a company during a financial year.

As turnover is a qualifying criterion for mandatory registration on TReDs Platform by Large Corporates, the companies whose turnover is below the threshold limit of 500 Crore (Rupees Five Hundred Crore) and have received the notice from the ROC for compliance with the MSME Notification on the basis of total income, can approach their jurisdictional ROCs to clarify the non-applicability of MSME Notification by giving a reference to the definition of 'Turnover' provided under the Companies Act, 2013.

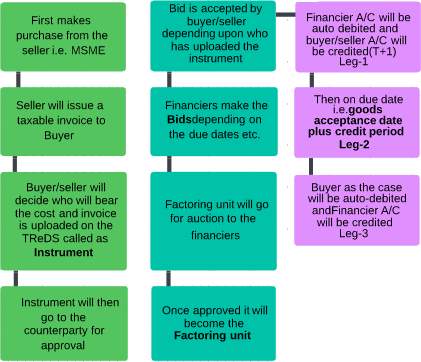

TReDS is designed to facilitate immediate payment to MSMEs for the goods and services supplied by them through bill discounting, thus enabling the smooth flow of working capital. Once a seller uploads an invoice on the platform, it goes to the buyer for acceptance.

Once the buyer accepts, the invoice (then called a factoring unit) goes to auction and financial institutions can quote various discounting rates. The amount will get credited to the seller the next working day. Later, the buyer will repay the financier.

TReDS platform operators are authorized by RBI under the Payment and Settlement Systems Act, 2007. At present, there are three authorized operators.Government agencies including PSUs are major buyers from MSMEs. Hence, if government agencies get on board on the TReDS, it will fulfill the dual purpose of easy working capital to MSME suppliers as well as signaling to the private sector to use the platform.

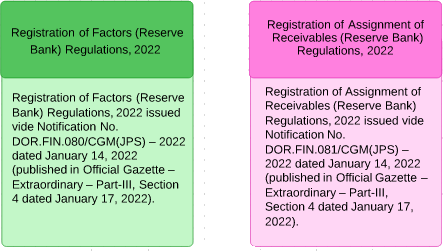

The Union government has directed its PSUs to use the TReDS platform to ensure that MSME have faster channels for realization of their dues from PSUs.Government of India has amended the Factoring Regulation Act, 2011 (the Act) which widens the scope of companies that can undertake factoring business. The Act permits Trade Receivables Discounting System (TReDS) to file the particulars of assignment of receivables transactions with the Central Registry on behalf of the Factors for operational efficiency. Further, the Act empowers the Reserve Bank of India to make regulations prescribing the manner of grant of certificate of registration and for prescribing the manner of filing of assignment of receivables transactions by TReDS on behalf of the Factors.

In exercise of the powers conferred under the Act, the Bank has issued the following regulations:

Under the provisions of the regulations mentioned above, all existing non-deposit taking NBFC-Investment and Credit Companies (NBFC-ICCs) with asset size of 1,000 crore & above will be permitted to undertake factoring business subject to satisfaction of certain conditions. This will increase the number of NBFCs eligible to undertake factoring business significantly from 7 to 182. Other NBFC-ICCs can also undertake factoring business by registering as NBFC-Factor. Eligible companies may apply to the Reserve Bank for seeking registration under the Act. Further, in respect of trade receivables financed through a Trade Receivables Discounting System (TReDS), the particulars of assignment of receivables shall be filed with the Central Registry on behalf of the Factors by the TReDS concerned within 10 days.

The Central Government issued the instruction that every company registered under the Companies Act, 2013 and having turnover of more than Rs. 500 Crore and all Central Public Sector Enterprises (CPSE) shall be required to get themselves onboarded on the Trade Receivables Discounting System Platform (TReDS) setup by Reserve Bank of India.

Registrar of Companies (ROC) in each state for companies and Department of Public Enterprises for CPSEs shall be competent authority to implement and monitor the above instruction and ROC further instruct the Institute of Company Secretaries of India (ICSI) and In this regard, the Institute has received a communication from Ministry of Corporate Affairs (MCA) to advise Company Secretaries of such companies to ensure registration of such companies on the TReDS platform at the earliest and confirm compliance.

Furnishing of information about the payment to MSME suppliers

Every Company who get supplies of goods and services from MSME and whose payment to MSME supplier exceeds 45 days from the date of acceptance or the date of deemed acceptance of the goods or services shall submit a half yearly return to the MCA stating the following:

- the amount of payment due; and

- reasons of the delay;

For implementation the above MCA has come out with an order {Specified Companies (Furnishing of information about payment to micro and small enterprise suppliers) Order, 2019} issued on 22nd January, 2019, wherein specified company shall file details of all outstanding dues and reason of the delay in MSME Form I within thirty days from the date from 22nd January, 2019.

| Type of Return | Time of Return | Period for which return is to be filed | Due Date of Filing MSME Form I |

| Initial Return | One time return | Micro or small enterprises suppliers existing on 22nd January, 2019 | 21st February, 2019 |

| Subsequent Return in each year | Half Yearly | April to September | 31st October |

| Half Yearly | October to March | 30th April |

Important Terminologies

Specified Companies: All companies, who get supplies of goods or services from micro and small enterprises and whose payments to micro and small enterprise suppliers exceed forty five days from the date of acceptance or the date of deemed acceptance of the goods or services.

Date of Acceptance:

- the day of the actual delivery of goods or the rendering of services; or

- where any objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier;

Date Of Deemed Acceptance: where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services;

- Notification S.O. 368(E) dated 22nd January, 2019 issued by MCA

- Notification No. S.O. 5621(E).- dated 02.11.2018 issued by Ministry of MSME

- Notification No. S.O. 5622(E).- dated 02.11.2018 issued by Ministry of MSME

The Reserve Bank of India (RBI) announced the guidelines for setting up and operating the Trade Receivables Discounting System (TReDS). TReDs is a scheme for setting up and operating the institutional mechanism to facilitate the financing of trade receivables of micro, small and medium enterprises (MSMEs) from corporate and other buyers, including government departments and public sector undertakings (PSUs) through multiple financiers.

The guidelines outline the requirements and the basic tenets of operating the TReDS, including the system participants, their roles, transaction process flow, settlement process, etc., besides indicating the eligibility criteria for entities desirous of setting up and operating such a system. The activities of the system will have to adhere to legal and regulatory requirements in vogue.The TReDS will be an authorized payment system and will also be subject to the oversight of the Reserve Bank of India under the Payment and Settlement Systems (PSS) Act, 2007.

The general guidelines as well as the application format for any non-bank entity to seek authorization under the PSS Act for operating a payment system are available at http://rbidocs.rbi.org.in/rdocs/Publications/PDFs/86707.pdf. Entities meeting the eligibility criteria as outlined in the Guidelines and desirous of setting up the TReDS, may apply in the prescribed format to the Chief General Manager, Department of Payment and Settlement Systems, Reserve Bank of India, 14th Floor, Central Office Building, Shahid Bhagat Singh Marg, Mumbai–400001. Applications will be accepted till the close of business on February 13, 2015.

Background- Evolution of TReDS

MSMEs are the back bone of Indian Economy and despite the important role played by them in country’s overall economic growth, continue to face constraints in obtaining adequate finance, particularly in terms of their ability to convert their trade receivables into liquid funds. MSME sector faces the problem of delayed payment mainly due to their dependency on their buyers within corporate and other sectors, including government departments/undertakings. They are often unable to take up the problem of delayed payments through appropriate institutional setup created for the purpose. In order to address this pan-India issue through setting up of an institutional mechanism for financing trade receivables, the Reserve Bank of India had published a concept paper on “Micro, Small & Medium Enterprises (MSME) Factoring-Trade Receivables Exchange” in March 2014.

The Concept for setting up of electronic bill factoring Exchange was recommended by Financial Sector Reforms (FSR) Committee in 2008 in their report “Hundred Small Steps”.

Based on the FSR Committee recommendations, SIDBI in collaboration with NSE had taken the initiative to set up an E-discounting platform to support financing of MSME receivables. The platform was named as NTREES (Trade Receivables Engine for E-discounting, Prefix ‘N’ stands for NSE and Suffix ‘S’ stands for SIDBI). The NTREES platform was based on the reverse factoring model, where credit exposure was taken by large Purchaser / Corporates, who offered the invoices drawn by its MSME suppliers for discounting and SIDBI as the Financier discounted the same and credited the proceeds to MSME bank accounts through RTGS. The platform was based on the Mexican model (National Financiers – NAFIN) for bidding of MSME receivables.

TReDS Evolution

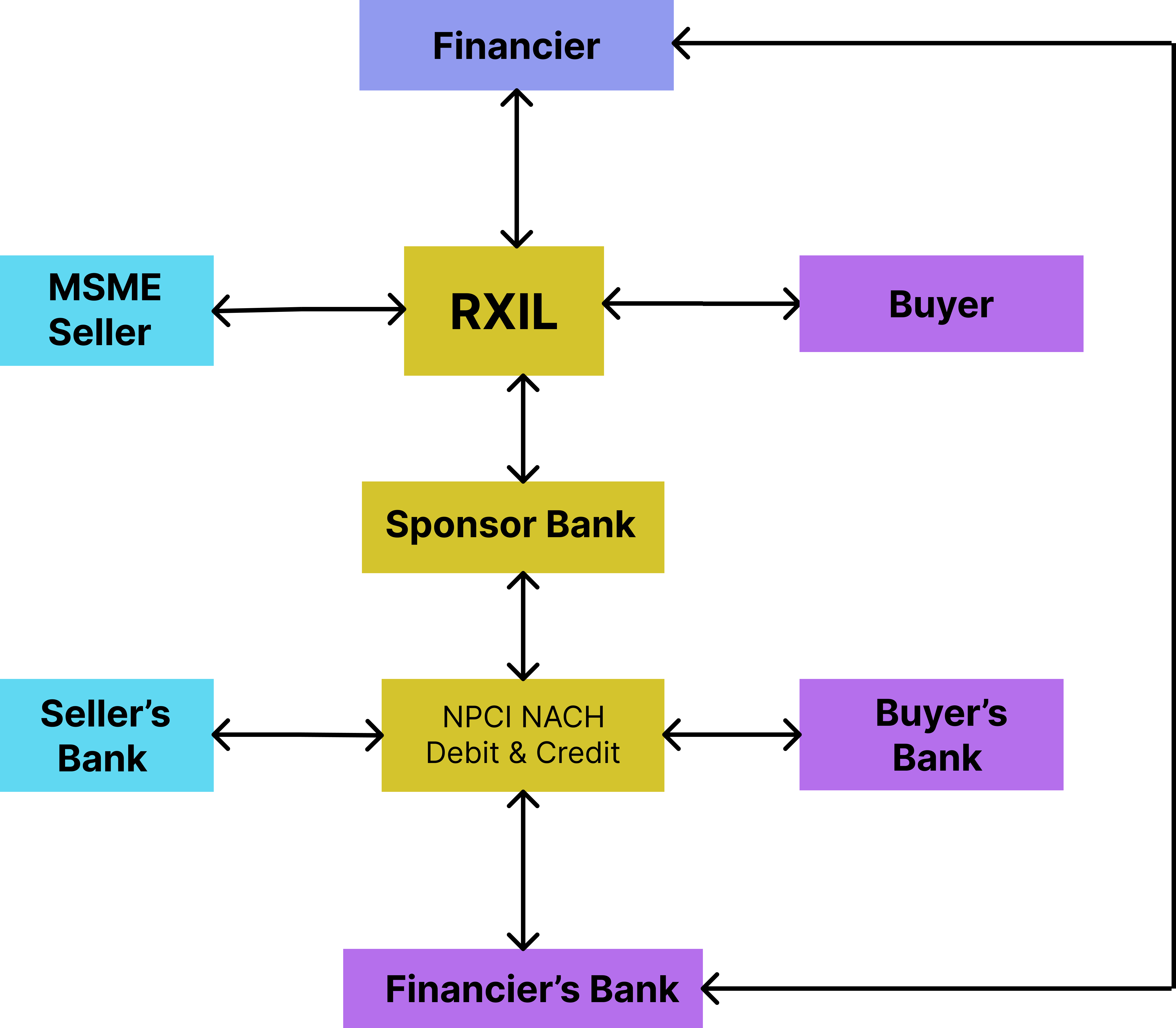

RBI on December 3, 2014 issued guidelines on Trade Receivable e-Discounting System (TReDS). Pursuant to the TReDS guidelines, RBI, on December 2, 2015 granted in-principle approval to SIDBI and NSICL for setting and operating TReDS as per the said guidelines issued under the Payment and Settlement System (PSS) Act, 2007. Adhering to the conditions given in the in-principle letter, separate entity – RECEIVABLES EXCHANGE OF INDIA LTD (RXIL) was incorporated as a joint venture by SIDBI and NSE. The platform was named as “TREDS”.

The scheme for setting up and operating the institutional mechanism for facilitating the financing of trade receivables of MSMEs from corporate and other buyers, including Government Departments and Public Sector Undertakings (PSUs), through multiple financiers is known as Trade Receivables Discounting System (TReDS).

What is TReDS?

The scheme for setting up and operating the institutional mechanism for facilitating the financing of trade receivables of MSMEs from corporate and other buyers, including Government Departments and Public Sector Undertakings (PSUs), through multiple financiers will be known as Trade Receivables Discounting System (TReDS).

The TReDS will facilitate the discounting of both invoices as well as bills of exchange. Further, as the underlying entities are the same (MSMEs and corporate and other buyers, including Government Departments and PSUs), the TReDS could deal with both receivables factoring as well as reverse factoring so that higher transaction volumes come into the system and facilitate better pricing. The transactions processed under TReDS will be “without recourse” to the MSMEs.

TReDS is an electronic platform that allows auctioning of trade receivable. The process is also commonly known as ‘bills discounting’, a financier (typically a bank) buying a bill (trade receivable) from a seller of goods before it’s due or before the buyer credits the value of the bill. In other words, a seller gets credit against a bill which is due to him at a later date. The discount is the interest paid to the financier.

As per RBI TReDS guidelines, only MSMEs can participate as sellers, while banks, non-banking financial companies and factoring companies are permitted as financiers.

How Does the System of TReDS Work?

A seller has to upload the invoice on the platform. It then goes to the buyer for acceptance. Once the buyer accepts, the invoice becomes a factoring unit. The factoring unit then goes to auction. The financiers then enter their discounting (finance) rate. The seller or buyer, whoever is bearing the interest (financing) cost, gets to accept the final bid. TReDS(Trade receivable Discounting System) is an electronic platform that allows businesses to auction trade receivables such as invoices, and the platform serves as a transparent and quick medium for the MSME vendors to avail funds at cheaper rates through banks and factoring companies. In this, a business owner can sell a bill (invoice) to a financier ( a bank or another financial institution) which is due to be a paid at a future date. So, in other words, they get credit (funds) on the basis of the invoice and start working with other client without any cash flow problems.

Process of bill discounting on a TReDS platform – Factoring

There is a step- by step process in this system:

- Supplier supplies the goods or services

- Supplier logs in on the platform and uploads the invoice for Receivables

- Buyer verifies and approves the invoice

- The invoice is converted into Factoring Units for bidding

- Financiers bid against the Factoring units

- Supplier accepts the most Favorable bid

- Platform generates settlement instructions for debiting the financier and crediting the Supplier

- Platform settlement instructions for debiting the buyer crediting the financier

Note:

- Market timings of Auction are 9 a.m. to 9 p.m. every day.

- Cut Off time is 4.00 p.m. if before it bid accepted then the settlement will be T+1 after the cut off time the settlement will be T+2 (Bid Acceptance Date + 2 working days).

- If the factoring unit is not accepted by anyone on TReDS portal for auction then buyer will pay directly to seller outside the portal.

- Costs involved in financing are Interest Cost paid by buyer/seller as may be decided by them mutually.

Note:

All the companies with a turnover of more than 500 crore and all Central Public Sector Enterprises shall be required to get themselves on-boarded on the TReDS Platform. {The Central Government under the power conferred by Section 9 of the Micro, Small and Medium Enterprises Development Act, 2006 on 2nd November, 2018 issued the above instruction}

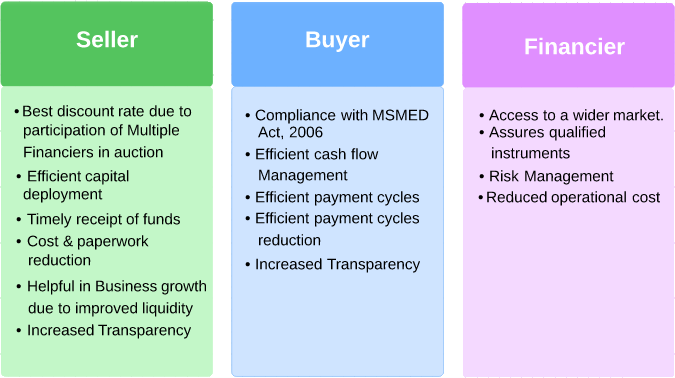

Benefit of Registration

Key Benefits for MSMEs from TReDS

TReDS helps a supplier to realize payment against an invoice raised to a buyer, through a financier at discounted rates, in significantly less number of days as compared to the buyer company’s regular credit period timelines. Here are some of the key benefits of TReDS for MSMEs

Get easy and quick working capital at much cheaper interest rates as compared to business loans i.e. ability to convert trade receivables into liquid funds

Enjoy collateral-free quick finance with one time documentation

Get paid for your invoices next day after acceptance of discounted amount. Allows MSMEs to post their receivables on the system and get them financed.

Obtain off-balance sheet finance, the amount does not reflects as a loan in your balance book.

Maintain a regular cash flow and grow your business

Puts greater discipline on corporates to pay their dues on time.

Corporates enjoy savings on procurement cost through improved negotiation of financing term for its vendors.

Financiers, on the other hand have an opportunity to build PSL asset portfolio.

Registration Process

Registering your business is one of the finest methods to ensure that the government pays attention to your working capital needs. You can register for free on the new Udyam portal or TReDS.Factoring (where the supplier pays the interest) is still not popular in India because major corporations continue to abuse their stranglehold over small enterprises, delaying payment for months.

As a result, registration ensures that payments are made on time and that larger firms are not bullied.Banks and other financial institutions will compete to take over the supplier’s receivables (the MSME). Rather than reflecting the creditworthiness of the MSME, the interest rate will reflect the creditworthiness of the large corporation on whom the invoice is raised.On a specific day and time, the settlement file reveals how much a financier must pay an MSME seller and how much a buyer owes the financier, ensuring credit discipline.

- RXIL (Receivables Exchange Of India Ltd) a Joint Venture of SIDBI and NSE is authorized Entity for handling the TReDS Platform.

- ON TReDS PLATFORM maintained by RXIL following one time process is to be followed

- Click on Register and fillup the following details for creation of USER ID

(1). Name

(2). Constitution Type

(3). PAN Number

(4). Registration As: Buyer/Seller/Financier

(5). Authorized Person’s Name

(6). Authorized Person’s PAN and any Address Proof issued by Central or State Govt.

(7). Mobile No. and Email ID

(8). Comments about Entity and Its Objects

- Once the Details submitted, the USER is activated to fill the online application.

- The USER ID created is valid for 30 days.

- After Login make the Online application with requisite Documents

- Documents:

(1). Application Form

(2). Bank Confirmation Letter

(3). Mandate form for debiting the designated bank account (applicable for Financiers and Buyers)

(4). KYC documents of the applicant entity, promoters, administrator (Admin User), authorized signatories etc.

(5). Other applicable documents - Execute the Master Agreement

- Submit the printed signed application and self-attested / attested documents to RXIL.

- RXIL will verify the information provided in the application and documents and will confirm the same to the applicant.

- Pay the Non-Refundable Registration Fee at the time of registration. In addition to the Registration Fee, the participants will have to pay an Annual Fee by 30th day of April every year. RXIL reserves right to withhold transaction rights of entities which have not remitted fees.

- atisfactory completion of the process RXIL to initiate activation process for the applicant to use the TReDS platform.

- The status can be tracked by visiting the status tracker page of the online registration module. Further Email Alerts / Notifications are also sent at various stages of registration.

How to Register?

For MSME Sellers:

- Click on “ Register” button on RXIL website

- Fill up the Application form

- Upload all Attested documents of Entity and Individuals

- Review of the uploaded documents and registration form by RXIL executive

- Template Activation by RXIL executive

- Uploading the templates with entity Seal/Stamp and signatures of Authorized official/s

- Payment of one time registration fee as applicable

- Completion of Registration by RXIL executive

- Despatch of all original documents to RXIL after receiving Login ID and Password of the TReDS platform

- Visit by RXIL nominated executive for Original Seen & Verified (OSV) and Onsite verification

For Buyers & Financiers:

- Obtain on-boarding kit from RXIL executive on email

- Fill up the forms with Sign and Stamp of Authorized Official/s

- Collecting self-attested KYC documents (Proof of Identity) & (Proof of Address) of all individuals mentioned in the form

- Submission of scanned copies of the above documents on email to RXIL executive

- Providing NACH Auto Debit Mandate of the Designated Account

- Lodging the NACH Auto Debit Mandate on NPCI by RXIL executive

- Scrutiny of all above (Steps 2,3,4,5) by RXIL executive

- Feeding the data into the system by RXIL executive

- Payment of one time registration fee as applicable

- Completion of Registration by RXIL executive

- Despatch of all original documents to RXIL after receiving Login ID and Password of TReDS platform

- Visit by RXIL nominated executive for Original Seen & Verified (OSV) and Onsite verification

What is the eligibility criterion for MSMEs to join the TReDS platform as a Seller?

The eligibility criteria for MSME enterprises to join the TReDS platform as Sellers are given below:

Manufacturing Enterprises and Enterprises rendering Services

| Investment in Plant and Machinery or Equipment | |

| Micro | Not more than 1 crore and Annual Turnover ; not more than 5 crore |

| Small | Not more than 10 crore and Annual Turnover ; not more than 50 crore |

| Medium | Not more than 50 crore and Annual Turnover ; not more than 250 crore |

How TReDS works?

Generally, the following steps are followed while financing/discounting through TReDS:

- Uploading of invoices/bills and creation of factoring units on TReDS platform by the MSME sellers (in case of factoring) or the buyer (in case of reverse factoring). A Factoring Unit (FU) contains the necessary details of the invoice in digital format.

- Acceptance of the FU by the counterparty – buyer or the seller, as the case may be

- Bidding by financiers against the FU

- Selection of best bid by the seller or the buyer, as the case may be

- Payment by the financier (of the selected bid) to the MSME seller at the agreed rate of financing / discounting.

- Payment by the buyer to the financier on the due date

Participants

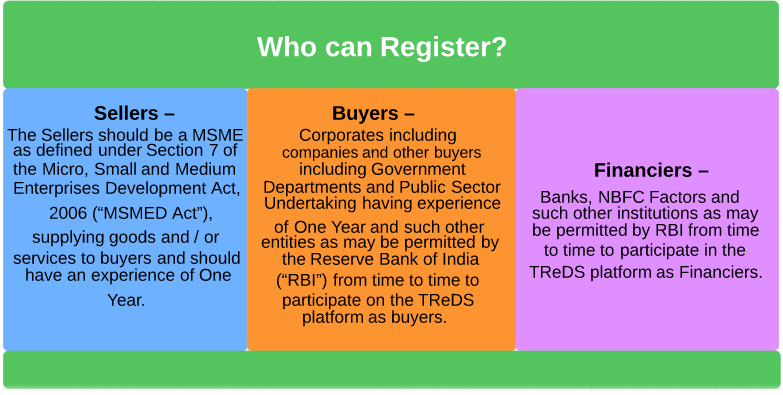

The eligible entities who can participate in the TReDS platform are MSME Seller, Buyer (Corporates, Government Departments, PSUs and any other entity) and Financier (Banks, NBFC – Factors and other financial institutions permitted by RBI).

| Participants | Eligibility |

| Sellers | MSME entities as per the definition of the Micro, Small and Medium Enterprises Development Act, 2006 (“MSMED Act”) |

| Buyers | Corporates including companies and other buyers including Government Departments and Public Sector Undertakings and such other entities as may be permitted by the Reserve Bank of India (RBI) |

| Financiers | Banks, NBFC Factors, Financial Institutions and such other institutions as may be permitted by RBI from time to time |

On-boarding:

- Entity Creation: Register with RXIL and execute Master Agreement.

- Entity Verification: RXIL undertakes verification and due diligence

- Onboarding Fees: Entity pays the Registration Fees.

Factoring Unit:

- Pre-Requisites:

(a). Establish Buyer & Seller relationship

(b). Financier defines limit on Buyer - Uploading Of Invoice: Seller/Buyer uploads the tax invoice with minimum balance tenor of 15 days, which have not been financed from any other source on the TReDS Platform

- Acceptance: Counter Party accepts the invoice and Invoice will be converted in to Factoring Unit

Auction:

- Bid Offering: Financiers (with defined limits on Buyers) bid on Tax Invoices

- Bid Acceptance: Cost Bearer (Seller) accepts the best Bid in the Auction

- Obligation: RXIL generates LEG1 Obligation i.e. Financier to Seller

Settlement:

- LEG 1 (T-1): Debit the Financier and Credit the Seller and Register Factoring Unit with CERSAI

- LEG 2 (Due Date): Debit the Buyer & Credit the Financier and Satisfy the Factoring Unit from CERSAI

- LEG 3 (Unfinanced Or Failed): In this case Settle between Buyer and Seller

Criteria for Establishing and Operating the TReDS

Entities interested in developing and operating the TReDS must meet the following requirements.

- Budgetary requirements

- The TReDS’ minimum paid-up equity capital will be Rs. 25 crore because it will not be authorized to take on any credit risk.

- Foreign ownership of the TReDS will be governed by the current foreign investment policy.

- Entities other than the promoters will be prohibited from owning more than 10% of the TReDS’ equity capital.

- Due diligence on the part of the promoters

Organizations and their promoters/promoter groups must be “fit and suitable” to serve as TReDS, as defined by the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009. The RBI will judge the applicants’ ‘fit and appropriate’ status based on their previous track record of sound credentials and integrity, as well as their financial soundness and a track record of at least five years of running their businesses. Other regulators and enforcement and investigative agencies, such as the Income Tax Department, the CBI, the Enforcement Directorate, and the Securities and Exchange Board of India, may, if necessary, request feedback on the candidates.

- Capabilities in terms of technology

The TReDS should have a strong technological base to support its operations. As a result, the TReDS should at the very least meet the following technological requirements.

- TReDS must be able to provide an electronic platform to all participants.

- The TReDS must have a proper Business Continuity Plan (BCP), which includes a disaster recovery site and an online surveillance capability that monitors positions, prices, and volumes in real-time to prevent system manipulation.

- The TReDS must have a proper Business Continuity Plan (BCP), which includes a disaster recovery site and an online surveillance capability that monitors positions, prices, and volumes in real-time to prevent system manipulation.

The TReDS may also undertake some random audits to ensure that the factoring units uploaded on the exchange are authentic & based on genuine underlying transactions involving the sale of goods or services.

TReDS would put in place a standardized mechanism / process for on-boarding of buyers and sellers on the TReDS. This one-time on-boarding process will require the entities to submit all KYC related documents to the TReDS, along with resolutions / documents specific to authorized personnel of the buyer, and the MSME seller. Such authorized personnel would be provided with IDs / Passwords for TReDS authorizations (multi-level). Indemnity in favor of TReDS, if required, may also be given if it is made part of the standardized on-boarding process.

The KYC documentation and its process may be standardized and disclosed to all stakeholders by TReDS. As it requires confirmation of the banker of the MSME seller / buyer, as the case may be, the KYC documentation may be synchronous with the documentation / verification done by the banks in adherence to the extant regulatory requirements.

There would be a one-time agreement drawn up amongst the participants in the TReDS. The Master Agreement may also clearly indicate that any legal proceedings to be initiated by one entity against another, if at all, will be outside the purview of TReDS.This agreement should clearly capture the following aspects:

- The buyer’s (corporates and other buyers including government departments and PSUs as the case may be) obligation to pay on the due date once the factoring unit is accepted online.

- No recourse to disputes with respect to quality of goods or otherwise.

- No set offs to be allowed.

Challenges in the adoption of TReDS

- The Ministry of Micro, Small and Medium Enterprises vide its Notification dated 02.11.2018 has mandated all companies with a turnover of more than Rs. 500 crore and all Central Public Sector Enterprises, to get themselves onboarded on the TReDS platform. Despite the mandate of the Government that all CPSEs sign up on the TReDS Platforms to improve the cash flows of MSMEs, many have yet to comply with the mandate. Only 177 of the 255 CPSEs had registered on the TReDS platform to date.

- Big corporate houses are not comfortable with uploading invoices on online platforms. Being a transparent system, these corporates are not appreciating the fact that they are required to ensure the settlement of the MSME invoices within the prescribed period of 45 days from the date of acceptance of goods or services rendered by the MSME. This is especially true in the case of PSUs, which have a track record for payment delays. Between the three platforms, volumes generated by PSUs are not more than about 7-8%.

- As per the Report on Impact of COVID-19 Pandemic on MSME Sector and Mitigation Strategy Adopted to Counter It, it was observed that MSMEs do not publish their invoices on the TReDS platform despite having the registration due to unsaid pressure from corporate (buyers). Further, it was seen that corporate (buyers) do not approve the published invoices of MSMEs on the TReDS platform, which defies the sole purpose of the platform, as Banks cannot fund such invoices.

To increase its adoption, there is a need to spread awareness around the value proposition of the TReDS platforms amongst MSMEs and Corporates

The identity of MSME suppliers are a source of concern for large corporations. Because large firms are hesitant to file invoices online for fear of their competitors discovering their MSME suppliers, the Reserve Bank of India and the government may need to rethink the Trade Receivables e-Discounting System.

Businesses should also be concerned about the fact that, because TReDS is a transparent system, they must settle supplier invoices within 45 days of receiving goods or services.According to a senior banker familiar with TReDs developments, the Receivables Exchange of India (RXIL), an embryonic platform for discounting trade receivables of micro, small, and medium businesses (MSMEs), looks to be having teething problems.

RXIL, India’s first TReDS platform, started in January 2017. SIDBI, in partnership with NSE and three banks, developed the platform (SBI, ICICI Bank and YES Bank). TReDS is an online electronic institutional system that allows MSMEs to borrow money from a range of lenders to finance their trade receivables.

The TReDS platform enables MSME sellers to use an auction mechanism to discount invoices/bills of exchange against big companies, such as government departments and public sector entities, assuring the prompt realization of trade receivables at market rates.A number of financiers are in attendance at the auction. It addresses MSMEs’ twin issues of prompt receivables encashing and the removal of credit risk.

There are two concerns limiting TReDS’ full-fledged take-off.” For one thing, many companies believe that their competitors will be able to figure out where they source their materials. Two, firms often prefer to give lengthier credit terms to suppliers and will not recover receivables within 45 days.Many organizations have warned their MSME buyers that they will not take bills on the site. RXIL has already waived the registration fee and transaction fees on its platform twice, from January 6 to April 30, 2017, and May 1 to June 30, 2017.

Over the last 3 years, TReDS has emerged as a next-generation ecosystem for MSME enterprises to finance their receivables at competitive rates and thereby overcoming the challenge of delayed payments. TReDS has tremendous potential to solve the MSME woes relating to working capital management.

Factoring Regulation- Legal Framework

Survival of business depends on smooth operations, precisely the need for liquidation of funds. Focusing on the same issue, India for the very first time adopted a consolidated legal framework to be known as Factoring Regulation Act, 2011 (‘Act’) governing the factoring transactions in the country. The basics of factoring transaction can be understood with a simple instance of a sale-purchase transaction, wherein the seller upon delivering his goods demands the payment but the buyer may or may not pay within the stipulated time. To remove this contingency, it became necessary to adopt the bill discounting method as a defined framework.

Thus, the Act is introduced to address the issues about payments and liquidity in the business of Micro, Small, and Medium Enterprises (MSMEs). Post the introduction of the said Act, there have been many changes in the industry, technology, and innovations, for which the Factoring Regulation (Amendment) Act, 2021 (‘Amendment Act’) has been passed by the Parliament.

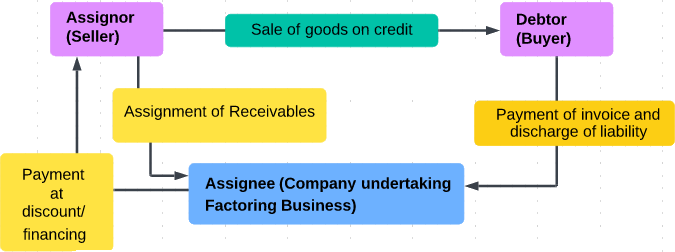

Concept of Factoring Transaction

Understanding a factoring transaction in the simplest sense, let’s say there is a seller ‘A’ and a buyer ‘B’, A sells certain goods to B for which an invoice is generated for 1,00,000. The payment is to be made by B within 30 days, although A needs the payment urgently. The option with A is to visit a bank/ financer and receive the amount against the said invoice immediately at a certain discount and B will pay the amount against that invoice directly to the bank/financier.

This simple concept of a factoring transaction is recognized under the Act and it granted the opportunity to MSMEs for ease in liquidation and/or immediate financing. The Act further granted an opportunity to Banks and Non-banking financial companies (NBFCs) to act as financiers under the factoring transaction, which is governed by the Reserve Bank of India (RBI).

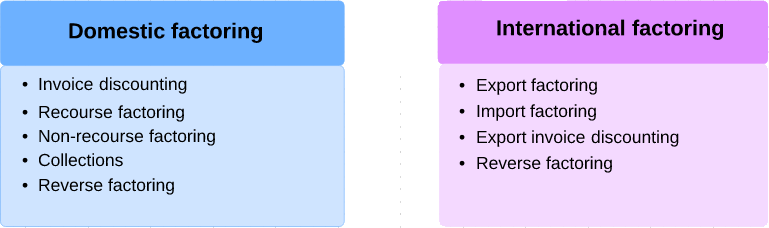

Types of Factoring Transactions

Factoring Business

Factoring as defined by Standing Committee

As noted by the Standing Committee, Factoring can be defined as a transaction where an entity (MSME) ‘sells’ its receivables (dues from a customer) to a third party (a ‘factor’ like a bank or NBFC) for immediate funds (partial or full).

Parties involved in a Factoring Transaction Primarily, it is pertinent to understand that there are three Parties defined under the said Act which are involved in a factoring transaction,

being the Assignor, Assignee, and Debtor—

- Assignor (Seller) - Owner of receivable

- Assignee (Company undertaking Factoring Business) - Factor in whose favour receivable is transferred

- Debtor (Buyer) - Person liable to assignor to pay the receivable whether existing, accruing, future, conditional, or contingent

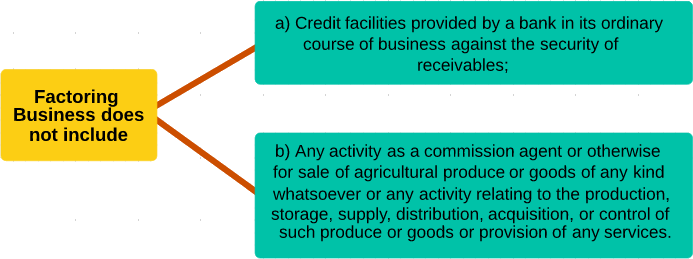

Factoring Business defined under the Amendment Act

The scope of earlier definition of Factoring Business has been enhanced under the Amendment Act, which is now aligned with international standards and can be simplified in the following manner —

| What is the Business? | Business of Acquisition |

| What is being acquired? | Receivable (Invoice due by Buyer) |

| How it is being acquired? | By way of Assignment |

| From whom it is acquired? | Assignor (Seller) |

Upon such acquisition, the Assignor can avail two facilities from the Assignee —

- Consideration for collection of such receivable from Debtor (Buyer); or

- Financing, by way of making loans or advances or otherwise against the assignment of receivables.

Receivables defined under the Amendment Act

The term Receivables, in general, refers to a bill/ invoice, but under the Amendment Act, Receivables are defined as follows —

- Money owed by a debtor and not yet paid to the assignor for goods or services; and

- Includes payment of any sum, by whatever name called, are required to be paid for the toll or the use of any infrastructure facility or services.

Further, the receivables can include any debt which may be present, future, conditional or contingent, such amount as is outstanding from the buyer to the seller. This type of receivable is eligible to be assigned by the seller in favor of the Debtor (financier/ factor).

Factors and its Registration

Definition of Factor

Factor basically means the Financier/ Assignor and the Act provided specific types of factors to act as financiers which limit the number, involved in a factoring transaction, thereby not meeting object of the Act. Therefore, by virtue of the Amendment Act, the scope of the term Factor is widened, accordingly, the following entities are included in the definition of Factors—

- Banks (Exempted from Registration)

- Statutory Corporations (Exempted from Registration)

- NBFCs (Obtain registration under Section 3 of the Act from RBI)

- Companies (Obtain registration under Section 3 of the Act from RBI)

The major change in this regard to be noted is that earlier, only NBFC-Factors could undertake the Factoring Business who comply with the Principal Business Criteria i.e. its financial assets are in the factoring business and income from the factoring business should both be more than 50% (of the gross assets/net income) or more than a threshold as notified by the RBI. Whereas post the Amendment Act, there is no such requirement of principal business and any NBFC can obtain registration from RBI to undertake the Factoring Business.

Registration of Factor

NBFCs and Companies are mandatorily required to obtain a registration certificate from the RBI to carry on the factoring business as per the regulations issued by the said authority. Further, the Banks and Statutory Corporations that act as a Factor are required to follow the rules and regulations and directions or guidelines issued by RBI. The registration of Companies and NBFCs intending to undertake factoring business are required to obtain registration under the Master Direction – Non-Banking Financial Company –Non-Systemically Important Non-Deposit taking Company (Reserve Bank) Directions, 2016. Whereas, there may be certain amendments by RBI in the said Master Direction concerning the Principal Business Criteria and other provisions as RBI may deem fit.

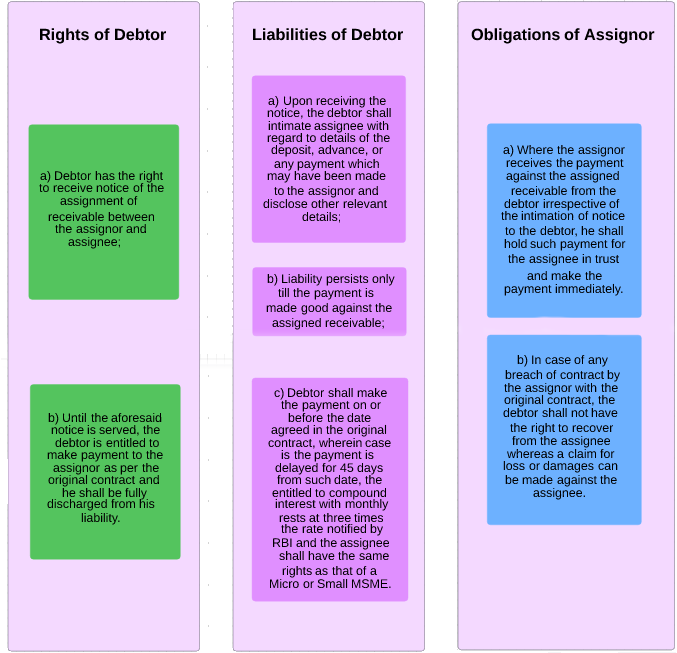

Assignment of Receivables

Agreement for Assignment

The assignment of receivables may be undertaken by entering into an agreement in writing, such agreement shall be between the assignor (seller) and assignee (factor/ financier). Further, the points of consideration post the entering into Agreement shall be as follows—

- Disclose any defenses and right of set-off against the receivable available to the debtor;

- Where debtor or factor are established outside India, the provisions of Foreign Exchange Management Act, 1999 laid down by RBI shall be complied with;

- Upon execution of the agreement, all rights, remedies, and any security interest created over any property to secure the due receivable shall vest exclusively with the assignee;

- Effect of such assignment shall give the absolute right to recover the receivable and exercise all rights and remedies as may be available to assignor including but not limited to damages;

- Where an assignment of receivables is a part of any security for repayment of the loan (advanced by a bank or other creditor) and same is disclosed to the assignee then the consideration against such assignment shall be paid to the said bank or creditor.

Intimation to Debtor and Discharge of Liability

- To demand payment of receivable from the debtor (buyer), it is mandatory to send the notice of assignment by the assignor or assignee with express authority (by assignor);

- Upon receiving the notice, the debtor shall make the payment to the assignee in the discharge of the obligation as specified in the said notice in the manner specified therein;

- Wherein case, no notice has been given to the debtor and the payment is made to the assignor then the same shall be held in trust by the assignor for the assignee and which shall be paid to the assignee.

Rights and Obligations of Parties

Method of Factoring Transaction

A factoring transaction is generally a manual process and after the introduction of the Act, it was undertaken in a traditional physical manner, whereas in 2014 RBI released a concept paper on an electronic mechanism to undertake these transactions through exchange portals, and later in 2017, RBI introduced Guidelines pertaining to setup of Trade Receivables Discounting System (TReDs). Since, the introduction of these guidelines, there has been an increase in the setup of the TReDS online platform to undertake the factoring transaction through online platforms. Presently, three entities RXIL, M1xchange, and Invoicemart are running the TReDS platform and recently BSE has also received in-principle approval from RBI to set up the TReDS platform.

Trade Receivables Discounting System

TReDS as defined under the Amendment Act TReDS mean a payment system authorized by the Reserve Bank under section 7 of the Payment and Settlement Systems Act, 2007 to facilitate the financing of trade receivables. Under the said Section, RBI had issued Guidelines in 2017 to ensure compliance with the TReDS platform; however, most likely a new master direction/ regulation may be issued by RBI shortly.

TReDS as defined by RBI TReDS is an electronic platform for facilitating the financing / discounting of trade receivables of Micro, Small, and Medium Enterprises (MSMEs) through multiple financiers.

Participants

- MSME sellers, corporate and other buyers, including the Government Departments and PSUs, and financiers (both banks and NBFC factors).

Activity on Platform

- Facilitating uploading, accepting, discounting, trading, and settlement of the invoices/bills of MSMEs.

Definition of Factoring Unit

- A standard nomenclature is used in the TReDS for an invoice or a bill on the system. Factoring Units may be created either by the MSME seller (in the case of factoring) or by corporate and other buyers, including Government Departments and PSUs, (in case of reverse factoring) as the case may be.

Process flow and procedure

- Adopt a mechanism as detailed in Guidelines

- Facilitate discounting of factoring units by the financiers resulting in an inflow of funds to the MSME with a final payment of the factoring unit being made by the buyer to the financier on the due date

- Further enable discounting / re-discounting of the discounted factoring units by the financiers, thus resulting in its assignment in favour of other financiers

- TReDS platform shall undertake the following —

- Uploading of invoices/bills and creation of factoring units by the MSME sellers

- Acceptance of invoices/bills by the corporate and other buyers, including the Government Departments and PSUs, within a specified time limit;

- Discounting, rating, and re-discounting of factoring units;

- Sending of notifications at each stage to the relevant parties to the transaction; reporting and MIS requirements; and

- Generation and submission of settlement of obligations.

- n the case of reverse factoring, the buyer could also create factoring units based on the documents uploaded by the MSME seller.

Other responsibilities of TReDs

- Undertake random audits of the factoring units uploaded on the exchange

- Standardized process of on-boarding buyers and sellers for submitting KYC documents, resolutions, and/ or any other specific documents and an indemnity

- There would be a one-time agreement drawn up amongst the participants in the TReDS:

- Master agreement between the financier and the TReDS

- Master agreement between the buyers and the TReDS

- Master agreement between the MSME sellers and the TReDS

- In the case of financing based on invoices, an assignment agreement would need to be executed between the MSME seller and the financier.

- The TReDS will be in the custody of all the agreements.

Registration as TReDS

An entity may be registered with RBI to set up and operate TReDS if it fulfills the following criteria—

(a). Financial Criteria

- minimum paid-up equity capital shall be Rs. 25 crore;

- foreign shareholding as per the extant foreign investment policy;

- entities, other than the promoters, will not be permitted to have a shareholding over 10 percent of the equity capital;

- overall financial strength of the promoters/entity;

(b). Due diligence of promoters

- entities and their promoters/promoter groups as defined in the SEBI (Issue of Capital & Disclosure Requirements) Regulations, 2009 should be ‘fit and proper;

- RBI would assess the ‘fit and proper’ status of the applicants based on their record of sound credentials and integrity;

- financial soundness and track record of at least 5 years in running their businesses.

(c). Technological capability

- sound technological basis to support its operations;

- provide an electronic platform for all the participants;

- information about bills/ invoices, discounting and quotes shall be disseminated by the TReDS on a real-time basis, supported by a robust MIS system;

- suitable Business Continuity Plan (BCP) including a disaster recovery site;

- online surveillance capability which monitors positions, prices, and volumes in real-time to check system manipulation.

Registration on CERSAI

Under the Amendment Act, where any trade receivables are financed through TReDS, the details of the said transaction shall be filed with the Central Registry (Setup under Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002) by TReDS on behalf of the factor.

Opportunities for the Parties

| S. No. | Party | Opportunities |

| 1. | MSMEs* | (a). Register on the TReDS platform for ease in liquidity of funds in capacity of a seller (b). Either receive consideration or financing from the Financiers/ Factors registered on the platform against an outstanding invoice |

| 2. | NBFCs** | (a). Obtain registration from RBI to be registered on the TReDS platform even where your principal business is not of factoring (b). Better and hassle-free bidding process can be availed on the TReDS platform |

| 3. | Companies | (a). Other companies who are not registered as NBFC may also act as Financier/ Factor upon receiving registration from RBI as per the required criteria (b). b.Tech-based companies interested in setting up a TReDs platform, upon meeting the eligibility criteria register with RBI and obtain approval |

Currently, entities with a turnover of INR 500 Crore are mandatory to be registered on the TReDS platform. **Currently, there are only 7 NBFC-Factors who undertake the business of financing, whereas now on uplifting the criteria of principal business, it has opened gates for a wide no. of NBFCs. XI.

Registration of assignments of receivables transactions

In exercise of the powers conferred by section 19 (1A) read with Section 31A of the Factoring Regulation Act, 2011 (12 of 2012), the Reserve Bank of India, hereby makes the following regulations pertaining to the manner of filing of particulars of transactions with the Central Registry by a Trade Receivable Discounting System (TReDS) on behalf of Factors.

- Where any trade receivables are financed through a Trade Receivables Discounting System (TReDS); the concerned TReDS on behalf of the Factor shall, within a period of ten days, from the date of such assignment or satisfaction thereof, as the case may be, file with the Central Registry the particulars of-

(a). Assignment of receivables in favor of a Factor in Form I, which shall be authenticated by the authorized person using a valid electronic signature.

(b). Satisfaction of any assignment of receivables on full realization of the receivables in Form II, which shall be authenticated by the authorized person using a valid electronic signature. - If the particulars referred in the sub-regulation (1) are not filed within the period specified therein, the Central Registrar may, on being satisfied on an application made in this behalf stating the reasons for the delay, allow the said particulars to be filed within such additional time not exceeding ten days as he may specify, upon payment of the fee as prescribed by GoI in Registration of Assignment of Receivables Rules, 2012, as amended from time to time.

- Every Form for registration of any transaction relating to assignment of receivables or satisfaction of receivables on realization shall be accompanied by the fee, as prescribed by Government of India (GoI) in Registration of Assignment of Receivables Rules, 2012, as amended from time to time, to be paid to the Central Registrar in the manner as may be specified by the Central Registrar from time to time.

Settlement process

Critical to the operations of the TReDS is the mechanism that ensures timely settlement of funds between the member financiers and the MSME sellers (when the factoring unit is financed) and the subsequent settlement of funds between the member buyers and the respective financiers on due date of the factoring unit. In order to ensure a smooth process of such payments, the TReDS would be required to:

- Trigger settlement between financier and MSME for accepted bids - In respect of all factoring units financed on a given day, the TReDS will generate the payment obligations of all financiers on T+2 basis and send the file for settlement in any of the existing payment system as agreed among the system participants. The TReDS would have to put in place a separate recourse mechanism to handle settlement failures in respective payment systems.

- Trigger settlement between the buyer and the ultimate financier on due date - the TReDS would generate the payment obligations file and send the same for settlement on due date to the relevant payment system.

The TReDS will generate the settlement files and send the same to existing payment systems for actual payment of funds. This would ensure that the inter-bank settlement (between the bankers representing member MSMEs, buyers and the financiers) will take place and defaults, if any, by the buyers will be handled by the buyer’s bank and will not be the responsibility of the TReDS. Hence, the settlement process ensures payments to relevant recipients on due date, thus, facilitating the smooth operations on the TReDS. However, it would not entail a guaranteed settlement by the TReDS.

The TReDS would be required to put in place a mechanism for bankers to report defaults in payments by buyers. The TReDS would also need to ensure adequate arbitration and grievances redressal mechanism is in place.

Illustrative Outline of Process flow under TReDS

- Corporate and other buyers, including Government Departments and Public Sector Undertakings, send purchase order to MSME seller (outside the purview of the TReDS).

- MSME seller delivers the goods along with an invoice. There may or may not be an accepted bill of exchange depending on the trade practice between the buyer and the seller (outside the purview of the TReDS).

- Thereafter, on the basis of either an invoice or a bill of exchange, the MSME seller creates a ‘factoring unit’ (which would be a standard nomenclature used in the TReDS for an invoice or a bill on the system) on TReDS. Subsequently, the buyer also logs on to TReDS and flags this factoring unit as ‘accepted’. In case of reverse factoring, this process of creation of factoring unit could be initiated by the buyer.

- Supporting documents evidencing movement of goods etc. may also be hosted by the MSME seller on the TReDS in accordance with the standard list or check-list of acceptable documents indicated in the TReDS.

- The TReDS will standardise the time window available for buyers to ‘accept’ the factoring units, which may vary based on the underlying document – an invoice or bill of exchange.

- The TReDS may have either a single or two separate modules for transactions with invoices and transactions with Bills of Exchange, if so required. In either case, all transactions routed through TReDS will, in effect, deal with factoring units irrespective of whether they represent an invoice or a bill or exchange.

- Factoring units may be created in each module as required. Each such unit will have the same sanctity and enforceability as allowed for physical instruments under the “Factoring Regulation Act, 2011” or under the “Negotiable Instruments Act, 1881”

- The standard format / features of the ‘factoring unit’ will be decided by the TReDS – it could be the entire bill/invoice amount or an amount after adjustment of tax / interest etc. as per existing market practice and as adopted as part of the TReDS procedure. However, each factoring unit will represent a confirmed obligation of the corporate and other buyers, including Government Departments and PSUs, and will carry the following relevant details – details of the seller and the buyer, issue date (could be the date of acceptance), due date, tenor (due date – issue date), balance tenor (due date – current date), amount due, unique identification number generated by the TReDS, account details of seller for financier’s reference (for credit at the time of financing), account details of buyer for financier’s reference (for debit on the due date), the underlying commodity (or service if enabled).

- The TReDS should be able to facilitate filtering of factoring units (by financiers or respective sellers / buyers) on any of the above parameters. In view of the expected high volumes to be processed under TReDS, this would provide the necessary flexibility of operations to the stakeholders.

- The buyer’s bank and account details form an integral feature of the factoring unit. The creation of a factoring unit on TReDS shall result in automatic generation of a notice / advice to the buyer’s bank informing them of such units.

- These factoring units will be available for financing by any of the financiers registered on the system. The all-in-cost quoted by the financier will be available on the TReDS. This price can only be viewed by the MSME seller and not available for other financiers.

- There will be a window period provided for financiers to quote their bids against factoring units. Financiers will be free to determine the time-validity of their bid price. Once accepted by the MSME seller, there will be no option for financiers to revise their bids quoted online.

- The MSME seller is free to accept any of the bids and the financier will receive the necessary intimation. Financiers will finance the balance tenor on the factoring unit.

- Once a bid is accepted, the factoring unit will get tagged as “financed” and the funds will be credited to the seller’s account by the financier on T+2 basis (T being the date of bid acceptance). The actual settlement of such funds will be as outlined under the Settlement section.

- Once an accepted factoring unit has been financed by a financier, notice would be sent to buyer’s bank as well as seller’s bank. While the buyer’s bank would use this information to ensure availability of funds and also handle thedirect debit to the buyer’s account on the due date in favour of the financier (based on the settlement obligations generated by the TReDS), the seller’s bank will use this input to adjust against the working capital of the MSME seller, as necessary (the TReDS procedures may, if necessary, also indicate that the proceeds of the accepted and financed factoring units will be remitted to the existing working capital / cash credit account of the MSME seller). If agreed by members, the TReDS may also provide the option to members, whereby the financiers would take direct exposure against the buyers rather than through their bankers.

- On the due date, the financier will have to receive funds from the buyer. The TReDS will send due notifications to the buyers and their banks advising them of payments due. The actual settlement of such funds will be as outlined under the Settlement section.

- Non-payment by the buyer on the due date to their banker should tantamount to a default by the buyer (and be reported as such as per regulatory procedures prescribed from time to time) and enable the banker to proceed against the buyer. Any action initiated in this regard, will be strictly nonrecourse with respect to the MSME sellers and outside the purview of the TReDS.

- These instruments may be rated by the TReDS on the basis of external rating of the buyer, its credit history, the nature of the underlying instrument (invoice or bill of exchange), previous instances of delays or defaults by the buyer with respect to transactions on TReDS, etc.

- The rated instruments may then be further transacted / discounted amongst the financiers in the secondary segment.

- Similar to the primary segment, any successful trade in the secondary segment will also automatically result in a direct debit authority being enabled by the buyer’s bank in favor of the financier (based on the settlement obligations generated by the TReDS). In parallel, it will also generate a ‘notice of assignment’ intimating the buyer to make the payment to the new financier.

- In the event that a factoring unit remains unfinanced, the buyer will pay the MSME seller outside of the TReDS.

In order to meet the requirements of various stakeholders, the TReDS should ensure to provide various types of MIS reports including intimation of total receivables position, financed and unfinanced (to sellers); intimation of outstanding position, financed and unfinanced with details of beneficiaries and beneficiary accounts to be credited (for buyers); total financed position for financiers; etc. Similarly, data on unfinanced factoring units in the market should also be made available by the TReDS. The system should also generate due date reminders to relevant parties, notifications to be issued to bankers when a factoring unit is financed, notifications to be issued to buyers once a factoring unit related to their transaction is traded in the secondary segment, etc.

Background of the MSMED Act, 2006

The MSMED Act, 2006 specifies 45 day credit period for the recipient of any goods or services to pay to the MSME supplier. It is included to protect the interest of the MSME business. The Ministry of Micro, Small & Medium Enterprises (MSME) launched MSME Samadhaan on 30 October 2017. It was launched to empower micro and small entrepreneurs across the country. It enables them to directly register their cases about delayed payments by Central Ministries/Departments/CPSEs/State Governments.

The Payment Cycle Problem

The issue arises when MSME taxpayers, who opt for quarterly filing of returns, make a supply to large taxpayers. The same is presented as follows:

- The MSME can declare the details relating to this supply anytime in the three months of the relevant quarter by the 11th of the month following the quarter.

- The recipient of the supply, on the other hand, being a large taxpayer, will claim ITC and file GST returns on a monthly basis.

- The recipient will want to ensure that the MSME supplier declares the invoice details on GST portal for such supply on a timely basis. Thereby, he can avail the ITC only after the MSME uploads the invoices.

- As a result, the recipient may choose to hold back payment of either the tax portion of the invoice or the entire invoice itself to such MSME supplier, until he declares the same on the portal.

- However, the MSMED Act does not allow the recipient to hold back the payment beyond 45 days.

- It discourages the large taxpayers from dealing with the MSMEs until they change the filing frequency to monthly or upload invoices on a monthly basis since it might create working capital issues for an MSME due to a delayed or potential non-availability of ITC.

- MSMEs may face additional compliance cost to maintain a system for uploading invoices regularly on a monthly basis rather than on a quarterly basis.

- It obligates the MSME to opt for a monthly return filing system, thus defeating the objective of the new return system to simplify the return filing process.

Solution offered & Conclusion

On 23 August 2019, the Hon’ble Finance Minister Nirmala Sitharaman has announced many measures to boost the economy. One of them is the intention to allow GSTN to partner with the Trade Receivables Discounting System (TReDS).

TReDS is an existing platform specially created for MSMEs to sell/discount their trade receivables. This helps the MSME free up working capital faster. The TReDS platform allows for bidding of discount rates that ensure that the MSME gets the best discounting price in the market. The partnership with GSTN helps authenticate the invoice raised by the MSME since GSTN can confirm the existence of the receivable subsequent to entering the relevant details on its portal. This would incline the MSME to file its GST returns sooner to be able to sell its receivables.The quarterly return filing option does help to ease the burden of compliance on the MSME. However, choosing to file monthly returns makes it more attractive for large taxpayers to deal with the MSME. While the payment cycle problem faced by the large taxpayers in dealing with the MSMEs isn’t fully addressed, it does appear to be a step in the right direction.

TReDS Architecture

Which complaints/ grievances will be covered under this Mechanism?

Only complaints/ grievances pertaining to RXIL TReDS platform will be covered under this Mechanism and the following will not be part of the Mechanism:

- Any complaint/ grievance/ disagreement/ dispute between the seller and the buyer - including in relation to any goods or services provided by the Seller to the Buyer

- Non-performance of any respective obligations of the seller or the buyer in relation to any transactions undertaken on the TReDS platform

- Non-performance of any respective obligations between the buyer and the financier

- All such disputes or proceedings should be resolved outside the TReDS platform without any reference or recourse to RXIL.

What are the contact details for addressing complaints/ grievances relating to RXIL TReDS platform?

The grievances can be sent to:

- Nodal Officer, Receivables Exchange of India Limited

- I-Think Techno Campus, 701- 702, 7th floor, Supremus,Kanjurmarg East,Mumbai,

- Maharashtra 400042

- Tel No. 022 6903 3000

- Email id: grievance@rxil.in

What are the mandatory details required for lodging investor’s complaint/ grievance?

- name of the complainant

- area of complaint

- specific instances of the cause of grievance / complaint

What is the procedure for filing the complaint / grievance?

Party registered on RXIL platform having complaint/ grievance shall submit the grievance to RXIL Nodal Officer through email/ written letter.

Auto response email quoting unique ticket number will be sent to the complainant. In case of written complaint, acknowledgement will be sent within five (5) working days of receipt by quoting unique ticket number.

Action will be initiated immediately to have the grievance resolved within a maximum period of three weeks.

In case of dissatisfaction, the complainant can escalate the grievance to Chief Operating Officer (COO) of the Company for further action / resolution. The escalated complaints will be redressed by the COO within a period of five (5) working days.

Conclusion

The entire regime of Factoring Regulation has taken a massive shift, under which MSMEs liquidation issues may be resolved more effectively as the existing TReDS are constantly performing well in the market. In a short period, if new TReDS platforms might be set up, more MSMEs are registered and more NBFCs act as Factors/ Financiers in this enhanced and transparent regime, the objective of the Act does not seem too far. RBI with enhanced power to make regulations about registration requirements, filing requirements and other matters may introduce a revolutionary regulation that will change the framework of the financial market in India.

The linking of the Trade Electronic Receivables Discounting System (TReDS) to the GST Network (GSTN) is expected to increase the usability of the platform, remove the problem of fake bills, and give a huge fillip to a market that has the potential to reach 20,000 crore.

Chartered Accountants can play a very vital role in bringing system of TReDS by streamlining overall accounting system and GST System of such MSME thereby resulting into Growth of MSME and adequate financing thereby increasing productivity.

Frequently Asked Questions

- 1. What is TReDS?

-

It is an electronic platform that allows auctioning of trade receivable. The process is also commonly known as ‘bills discounting’, a financier (typically a bank) buying a bill (trade receivable) from a seller of goods before it’s due or before the buyer credits the value of the bill. In other words, a seller gets credit against a bill which is due to him at a later date. The discount is the interest paid to the financier.

- 2. Who are the various stakeholders in the ecosystem?

-

Seller, say, for instance, a garment manufacturer or an automobile spare parts manufacturer; buyer, say, for instance, a big retailer like Pantaloons or D-Mart or a bike manufacturer like Honda or Bajaj; financier, mostly a bank or a factoring company which gives an advance to the seller against a bill due to him from the buyer; and discounting platform provider. As per RBI TReDS guidelines, only MSMEs can participate as sellers, while banks, non-banking financial companies and factoring companies are permitted as financiers.

- 3. How does the system work?

-

A seller has to upload the invoice on the platform. It then goes to the buyer for acceptance. Once the buyer accepts, the invoice becomes a factoring unit. The factoring unit then goes to auction. The financiers then enter their discounting (finance) rate. The seller or buyer, whoever is bearing the interest (financing) cost, gets to accept the final bid. TReDs then settle the trade by debiting the financier and paying the seller. The amount gets credited the next working day into the seller’s designated bank account through an electronic payment mode. The second leg of the settlement is when the financier makes the repayment and the amount is repaid to the financier.

- 4. What are the discounting rates?

-

The financiers can’t bid below marginal cost of funds-based lending rate (MCLR) rate set by the RBI. Typically, for buyers with good credit ratings, financiers bid near the MCLR rate. The spread widens depending upon the buyers' credit rating.

- 5. Who are the discounting platform providers in the country?

-

RBI has given license to three entities and they are governed by the Payment and Settlement Systems Act. These are Receivables Exchange of India (RXIL), which is a joint-venture between National Stock Exchange and SIDBI; A Treds, a joint-venture between Axis Bank and Mjunction Services; and Mynd Solution. RXIL was the first one to go live on January 9.

- 6. How are the volumes on these platforms?

-

The concept is still at a very nascent stage and all the three players are trying to empanel more corporates and financiers in order to succeed.

- 7. What are the teething issues faced by the platforms?

-

All the transactions undertaken on the TReDS have to be registered with the Central Registry of Securitization and Asset Reconstruction and Security Interest of India. The registration charge goes up to ₹750, which discourages small-ticket sellers from using the platform. Also, TReDS providers want the KYC (know your customer) related regulations to be streamlined. Further, they want more players to be allowed as financiers. Currently, only banks and certain NBFCs are allowed to be financiers. Experts say even other participants like High Net worth Individuals should be allowed to act as a financier to expand the market.

- 8. What is an Instrument on TReDS Platform?

-

Instrument is nothing but invoice details and scanned invoice uploaded either by the Seller or Buyer reflecting the underlying trade receivables of MSME Sellers. Only the Tax Invoice is accepted as a valid invoice.

- 9. What all supporting Documents need to be uploaded for creating an Instrument?

-

Only tax invoice is mandatory. Other supporting documents like Good Receipt Note, Lorry Receipt / Freight Delivery Document or Credit/Debit Note are optional.

- 10. What type of Invoices can be uploaded on TReDS Platform?

-

Only Tax invoice for Manufacturing and Service activity with minimum balance tenor of 15 days, which have not been financed from any other source and not encumbered, can be uploaded on the TReDS platform.

- 11. What if Buyer is not registered on TReDS Platform?

-

Both Buyer and the Seller must be registered on the TReDS platform for financing / factoring of trade receivables of the MSME Seller. As mentioned earlier, the counterparty needs to provide acceptance for the invoice as per the RBI TReDS guidelines. If a Buyer is not registered on the TReDS platform, the Seller may reach out to the Buyer to get registered on the TReDS platform or it can pass on the contact details of the Buyer to RXIL team. RXIL team will then reach out to the Buyer to get it registered on the TReDS platform.

- 12. Who bears the Interest Cost?

-

TReDS platform provides the flexibility for either the Seller or the Buyer to bear the interest cost. The interest obligation for financing of factoring units is accordingly calculated by the TReDS platform.

- 13. What is Factoring Unit?

-

On acceptance of the instrument (comprising of invoice details and scanned invoice) by the counterparty, the instrument becomes a Factoring Unit. Only accepted instruments enter into an auction.

- 14. What is Marketing Timing of Auction of Factoring Units?

-

The Auction Market where the Financiers can enter bids shall be open from 9:00 AM to 9:00 PM every day.

- 15. What is cut-off time to accept the Bid?

-

The participant having the right to accept the bid can accept the bids any time during the day. The cut-off time for acceptance of bid is 4:00 PM for T+1 (Bid acceptance date + 1 working day) Settlement. Any bid accepted after the cut-off time shall be settled on T+2 (Bid acceptance date + 2 working days) basis.

- 16. Is financing of factoring unit guaranteed on TReDS Platform?

-

No. The financing of factoring units is not guaranteed on the TReDS platform. The same shall depend on offering of bids by the Financiers, acceptance of bids by the cost bearer and settlement of obligation by the participants (Financiers for Leg 1 and Buyers for Leg 2).

- 17. How will Buyer repay the Obligation?

-

The Buyer shall provide debit mandate to RXIL at the time of registration. The designated bank account of the Buyer on TReDS platform will be auto-debited for the purpose of crediting the obligations to the designated bank account of the Financier. The Buyer shall repay the obligation to the financier on the due date of the factored invoice which shall be goods acceptance date plus credit period. If the due date falls on a holiday, the obligations need to be settled on the preceding working day.

- 18. What happens if the repayment from Buyer to Financier fails?

-

Non-payment by the Buyer on the due date to the Financier is tantamount to a default by the Buyer. The transaction is marked as Failed in the TReDS platform. The Buyer is required to settle directly with the Financier.

- 19. What are the Parties in the TReDS mechanism?

-

There are basically three parties:

- Sellers

- Buyers

- Financiers

- 20. What is Factoring & Reverse Factoring?

-

Factoring means the process where seller initiates the process of financing of trade receivables. Reverse Factoring means the process where buyer initiates the process of financing of trade receivables.

- 21. What is Instruments under TReDS terminology?

-

It is the invoice details and scanned invoice uploaded either by seller or buyer. Invoice shall be a Tax invoice.

- 22. Along with Instrument other documents are required to be filed?

-

No, there is no such condition to upload other document with the Instrument.

- 23. Does Invoice need to be accepted by counterparty?

-

Yes, As per RBI Guidelines it is mandatory that in case seller uploads invoice it needs to be accepted by the buyer, while in case of buyer uploading the invoice seller must accept the invoice for factoring.

- 24. What is Buyer-Seller Link?

-

This link helps in establishing relation between Buyer & Sellers on portal. This link drives the entire processing of transaction on portal including counterparty approval.

- 25. What is the Cap Rate?

-

It is the maximum rate acceptable to the seller/buyer (whoever is the interest cost bearer) for financing of the trade receivables of MSME seller.

Both Seller and the Buyer can define the Cap Rate for financing / factoring of trade receivables on the TReDS platform. If the Seller is the cost bearer then the Cap Rate defined by the Seller then the Seller’s Cap Rate will be taken into account. If the Buyer is the cost bearer then Buyer’s Cap Rate will be taken into account.

Buyer can define only one cap rate; while the Seller can define Cap Rate for each Buyer. - 26. Mention Step by Step process of deployment on the Portal.

-

- First of all decide out of 3 which one to choose.

- Thereafter have a preliminary meeting with its officials to have an overview of documentation part.

- Make memorandum for Board meeting a long with specimen Board resolution.

- Through board resolution decided the authorized official and Administrator.

- Thereafter execute all necessary documents through these officials.

- Execute master agreement, KYC of both above officials, KYC of entity (Co.), Stamp paper of proper value.

- Then hand over the documents to officials for necessary actions i.e. deployment on TReDS portal.

- 27. How will be the payment mechanism on the portal?

-

Once the bid is accepted by Buyer/Seller whosoever bear the cost the financier bank will be auto debited. On Final date the Banker A/c of Buyer will be auto-debited.

Note:- Market timings of Auction are 9 a.m. to 9 p.m. every day.

- Cut Off time is 4.00 p.m. if before it bid accepted then the settlement will be T+1 after the cut off time the settlement will be T+2 (Bid Acceptance Date + 2 working days).

- If the factoring unit is not accepted by anyone on TReDS portal for auction then buyer will pay directly to seller outside the portal.

- Costs involved in financing are Interest Cost paid by buyer/seller as may be decided by them mutually.